This will be our last edition for the year. We would like to thank you for reading our musings over the past few years. We have rebranded the publication from “The Month Ahead” to “The Navigator” as it appropriately serves as a compass to our asset allocation in the various mandates we manage. We have now reached an audience of 200+ active readers and we hope more will find this weekend afternoon read useful or the least a bit black humour in it.

We end the year by recapping some of the critical calls made throughout the year, both the good and the bad ones. We started the year proclaiming the end of QE as we know it but we are confident that strong and synchronized global growth will offset the potential risk of the tapering in QE (QT as we call it), The Year Ahead 2017: It’s the end of QE as we know it (And I feel fine). The synchronicity of the growth is emanating from buoyant global consumption and also the return of the capex cycle. This view has played out accordingly with past months data indicating a swath of countries that are registering above their 2010-2016 average growth rates in retail sales and capex investments.

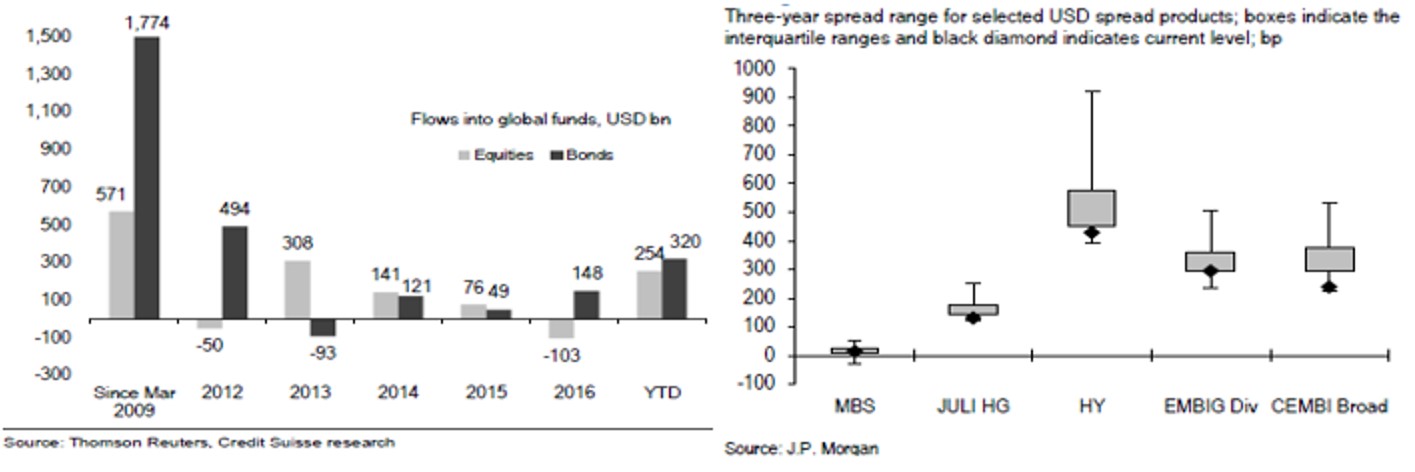

We extended our view to overweight equities over fixed income as valuation was still accommodative for equities but extended for fixed income. We also added to various commodities complexes such as copper and steel producers. Equities have outperformed Fixed Income by 10% year-to-date while copper and steel prices are up 19% and 13% respectively. We reinstated our bullish USD view at the start of the year premising on stronger growth differential of the US vs ROW alongside rising inflation and a more hawkish Fed versus other regions. A terrible wrong call as the Dollar Index fell -8% when the upshot of inflation in the US we were expecting did not materialize and the absence of reflation from the failure of Trumpnomics exacerbated its drop. We advocated a relative value trade overweighing EM debt over EM equities as the specter of protectionism between the US and EM ratchet and uncertainty in US foreign policy prompted the preference for safety in debt instruments than equities while still capturing the growth differential EM had over DM; It’s complicated. That was the costliest strategic mistake for a good part of the next 6 months as EM Equities outperformed EM bonds by 20% and was the best performing region within equities.

As we moved into the half-year mark, all asset prices continued to rally but we witnessed a potentially deadly combination of global growth transitioning from an accelerated growth phase to a stable growth phase while earnings momentum have also started to roll over in April’s Don’t forget to breathe and June’s Clairvoyance. These observations prompted us to reduce our overweight in equities and to hedge for risk-off scenarios by adding long-dated US Treasury in our fixed income portfolio while reducing our commodities trades opting to buy Gold as a defensive hedge. By August, in our And the three bears never saw her again musing, we have altered our longstanding view to be overweight equities bringing down to neutral while raising substantially more cash than we had in a year. We argued that strong global growth in 1H17 will not be replicated and have forecast a slowdown in the pace of growth instead. We have little experience to understand the effect of QT as it draws closer beyond the circumstantial knowledge when the flow of central bankers’ balance sheet turns negative, the concomitant effect is the decline in bonds and equities prices and the theoretical expectation that Fed’s QT will add 15-20bps increase in rates every year on top of its prescribed cumulative 125bps 4-hikes from now till end of 2018. Given our apprehension, we raised more cash to 15-20% of the portfolio. Nonetheless, we acknowledged that markets can go parabolic and built up plenty of irrational exuberances before bear market ensues in The epitaph of QE and his mates. We presented empirical data to show that it doesn’t benefit much in selling ahead of a bear market, assuming one has the prophetic ability to foretell one or selling after a bear market. While we have raised cash, we have added numerous options strategies that will benefit should the market melts up without putting too much capital at risk. It last month’s edition Are we there yet, Minsky? we elucidated the anatomy of a financial crisis according to the economist, Hyman Minsky, and concluded the past years of experimental unorthodox monetary policies and the unintended consequences that came along with have all the hallmarks of a potential financial crisis in the making.

However, we are comforted by two recent developments. First is the willingness of central bankers to delink the unwinding of their balance sheet and the much-needed normalization of interest rates. This new-found confidence in central bankers is critical as it accommodates future policy responses should another crisis erupts global or in local economies. For example, the Fed has begun unwinding its balance sheet last month, if a crisis erupts 12 months later, they would have the ability to pump prime the economy with $600bn they have unwound during this period. Likewise, on interest rates, the Fed has moved away from its zero-bound constrain for a good part post GFC by raising rates from 0% in 2015 to 1.25% now and it anticipated to raise another 125bps to 2.50% by end of 2018. If a crisis evolves, they have the latitude of cutting rates back to 0%. We note that PBOC, Bank of Canada and Bank of England have also rebuilt their policies arsenal by embarking on the dual path of reducing the quantity of money and normalizing cost of money in the past 12 months. However, we are more worried about ECB and BOJ as their policies remain unchanged and we believe they are behind curve in normalizing.

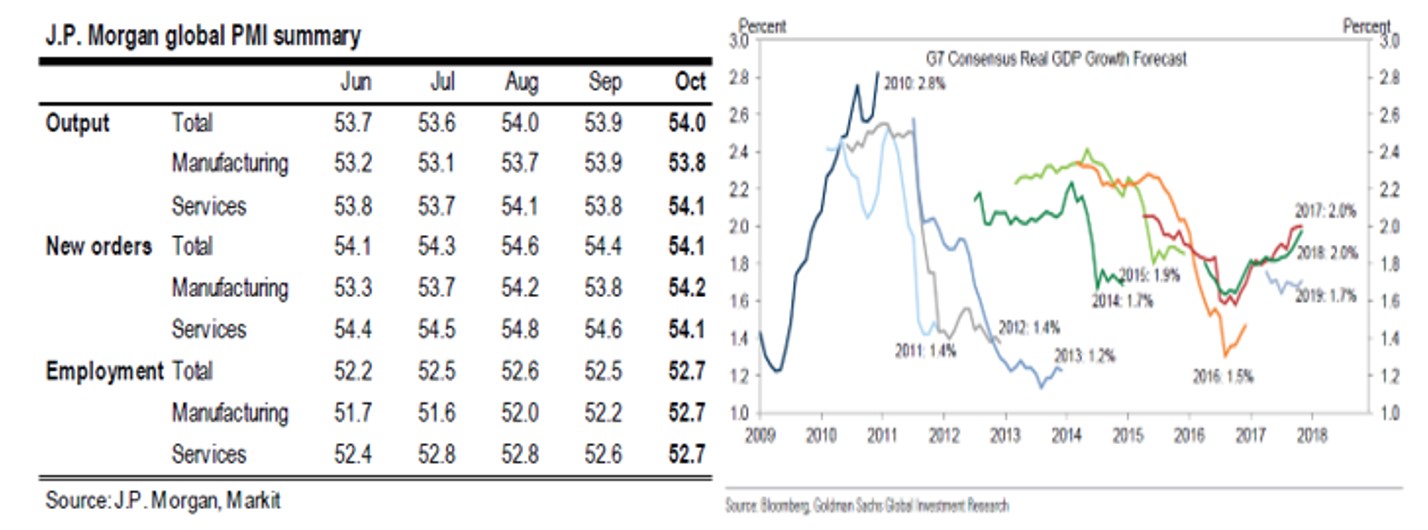

The second development is we are surprised by the momentum of the global economy. Hard and soft data thus far are indicating GDP growth of 3.4% in 2H17 as strong as 1H17 growth debunking our earlier fear of a slower 2H. Critically, a 3.4% global GDP prints in the past 2 halves are a good 20bps above global potential. The latest The J.P. Morgan global all-industry output PMI in October edged up one-tenth to 54.0 in October; a reading that is consistent with 3.2% annualized growth in global GDP for the early part of 2018. On the back these strong than expected data, we are seeing consensus upgrading 2018 GDP forecast noticeably from 3Q17 onwards. The current consensus forecast is for global GDP growth to end 2017 at 3.4% and for 2018 to grow by 3.6%.

A key tenet of this strength lies in the capex recovery. In the last 3 months, JPM latest capex proxy is annualizing 9.3% growth, a pace not seen since 2012. Rising business confidence, higher profits and stock prices underpinned this vigor for corporates to spend. Capex story normally is a multi-quarters story. The importance of capex in driving equity gains stems from the fact that the benefits of investment are felt almost instantaneously and with a multiplied effect to the customers of those firms carrying out the capex. The cost of capex can be depreciated over many years boosting profits of corporates during the early phase. Moreover, capex-driven growth boosts nominal GDP growth much more than wages, allowing revenue growth to outpace cost growth. While the consumers account for c.80% of US and 55-65% of global demand, the vagaries of consumption growth are low, but changes in capex are larger and can alter growth trajectories significantly and are bigger swing factor for equities performances. Capex growth tends to outpace GDP growth during later part of a business cycle. As a rule-of-thumb, business investment tends to grow twice as fast as potential GDP on average in expansions once the economy has reached full employment like where we are now.

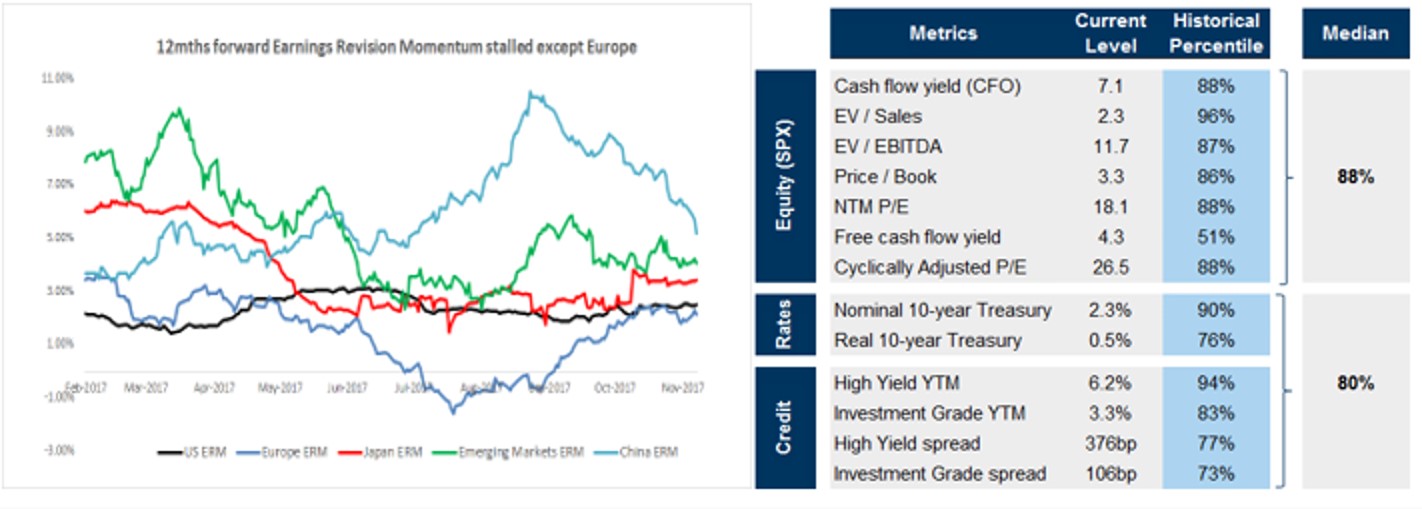

While the economic backdrop has certainly surpassed our expectations, valuation remains a bug bear. Since turning Neutral equities in August, MSCI World Equities have rallied another 5% brining YTD returns of 18%. But with earnings upgrade momentum stalling since 3Q17, except for Europe, it implies asset valuations for equities and even for fixed income has become even more expensive. Equities in the US are now at the 88% percentile of expensive on many metrics, Rates and Credit fare no better as well.

Equities: Upgrade to Overweight but just slight and preferring to use options to participate in the further upside. Yes, valuations are expensive. We are moving away from regional preferences instead opting for sectoral overweights in Technology, Financials and Commodities. These three sectors are experiencing strong earnings revision momentum and are expected to post one of the strongest if not the strongest EPS growth in FY18. They are also late cyclical plays exactly where we are now in the economic cycle. Growth and small-cap strategies are emphasized in the total return mandates we are managing while sustainable dividends, low gearing and rising free cashflow are important in our income mandates.

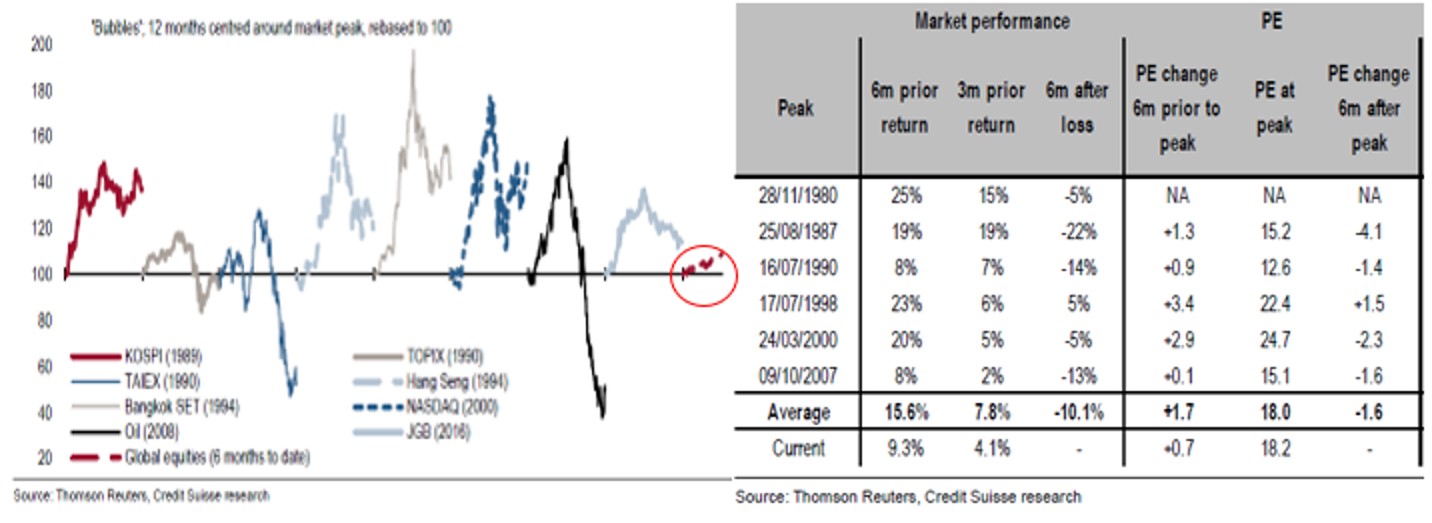

We are also reminded of a few salient points about bear markets chief of which is a career suicide pill calling for one too early. Bull markets tend to peak only after a significant run-up in prices and valuations. We are almost there but not quite yet.

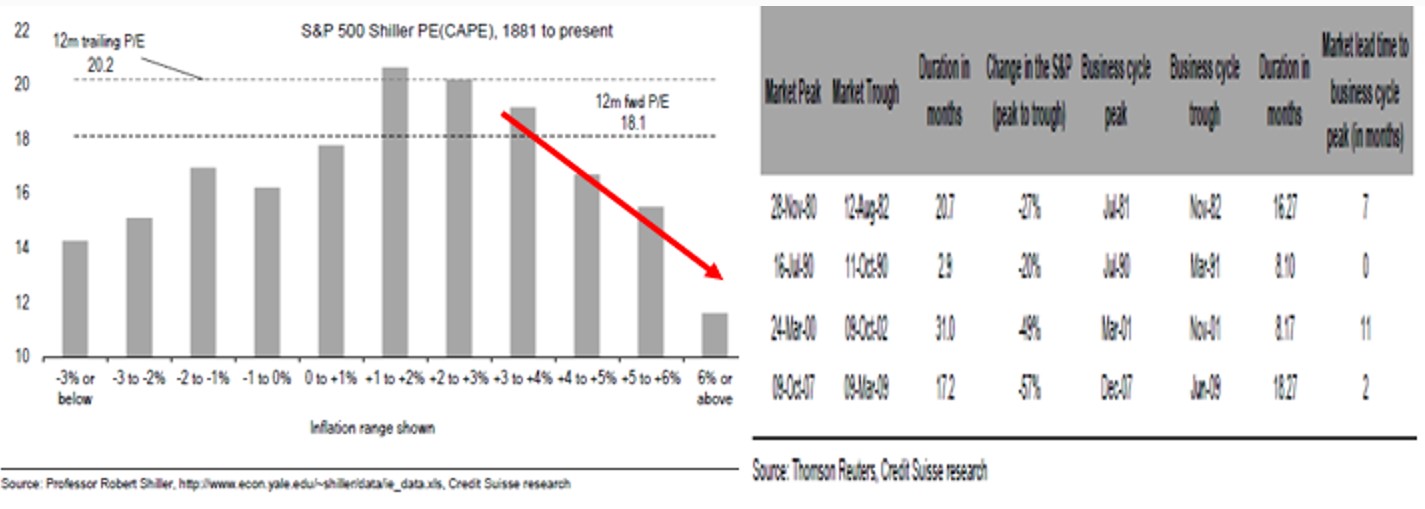

Valuation de-rates only when inflation hits above 3%; we are now less than 2% on core CPI and at 2% overall CPI in the US. Markets tend to peak 4 months ahead of a recession. Latest Fed recession model is indicating only a 8% probability of recession in the next 12 months, way below the 20% level that has marked previous recessions.

Fixed Income: Underweight. We have been built up our case that market is under-estimating inflation and mispricing interest rate risk in the many past editions. Recent strength in data underpins shrinking output gap on both capital resources and labour market and warrants scrutiny in the coming months. If inflation does overshoot as we fear, the implications for bonds are obvious but the deleterious dislocations of bonds because of rising rates will not be confined to bonds only but to all other asset classes including equities. For now, we monitor and remind ourselves the relative positioning is heavier in bonds than equities. We remained committed to absolute return bond managers, managers in capital structure arbitrage, EM credit and preferred securities.

FX: Neutral. Our view that US will have to normalize rates faster than most G7, we remain long USD.

Commodities: Overweight. We are long oil producer, basic materials companies and have increased exposure in a fund manager that specialized in industrial, commodities and discretionary spending.

Alternatives Investments: No change in our preference for long/short equities manager in the US due to expensive valuation, will continue to add/search absolute return managers in fixed income. We are exploring a few non-correlated strategies such as selected real estate PE funds owning to added security of collateral and yield, clearly defined venture capitalists and fund managers that rely solely on AI and big data analytics in their investment decisions.

Cash: Cash is reduced to 10-15%.

Featured Picture/Quote:

When I see the rainbow in the sky, I will always remember the promise that I have made to every living creature. 17 The rainbow will be the sign of that solemn promise.

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.