The recent UEFA Euro 2024 tournament has reminded me that I used to be a hardcore football fan. I grew up watching matches in some of the most popular leagues: the UEFA Champions League, the Italian Series A, and the English Premier League. Subsequently, tennis tournaments caught my attention, and I started following the GOATs (greatest of all time) such as Federer, Nadal or Djokovic. Through the years, although other life pursuits have taken my time away, valuable lessons from football and tennis stay with me and reshape the ways I look at many things in life including investment.

Football and tennis, by nature, strike a stark difference. The former emphasizes teamwork and system while the latter individuality and mentality. Nonetheless, a well-crafted and balanced strategy targeting long-term success arguably forms the foundation for the most established teams or individuals in both sports. Before I delve into the most topical theme in the investment world at this point – “Generative AI”, let me share with you my own “70/30 strategy” inspired by these sports and how I have applied this strategy to investments throughout the years.

Let’s explore the 70/30 strategy through the examples of Novak Djokovic, a living legend in the tennis world, and Real Madrid, the undisputed king of European football:

First of all, these are not hard rules. They are rather a set of guidelines shaped by my own experience, perspectives, the equity market paradigm during my career span, and what has worked best for our clients at Covenant Capital.

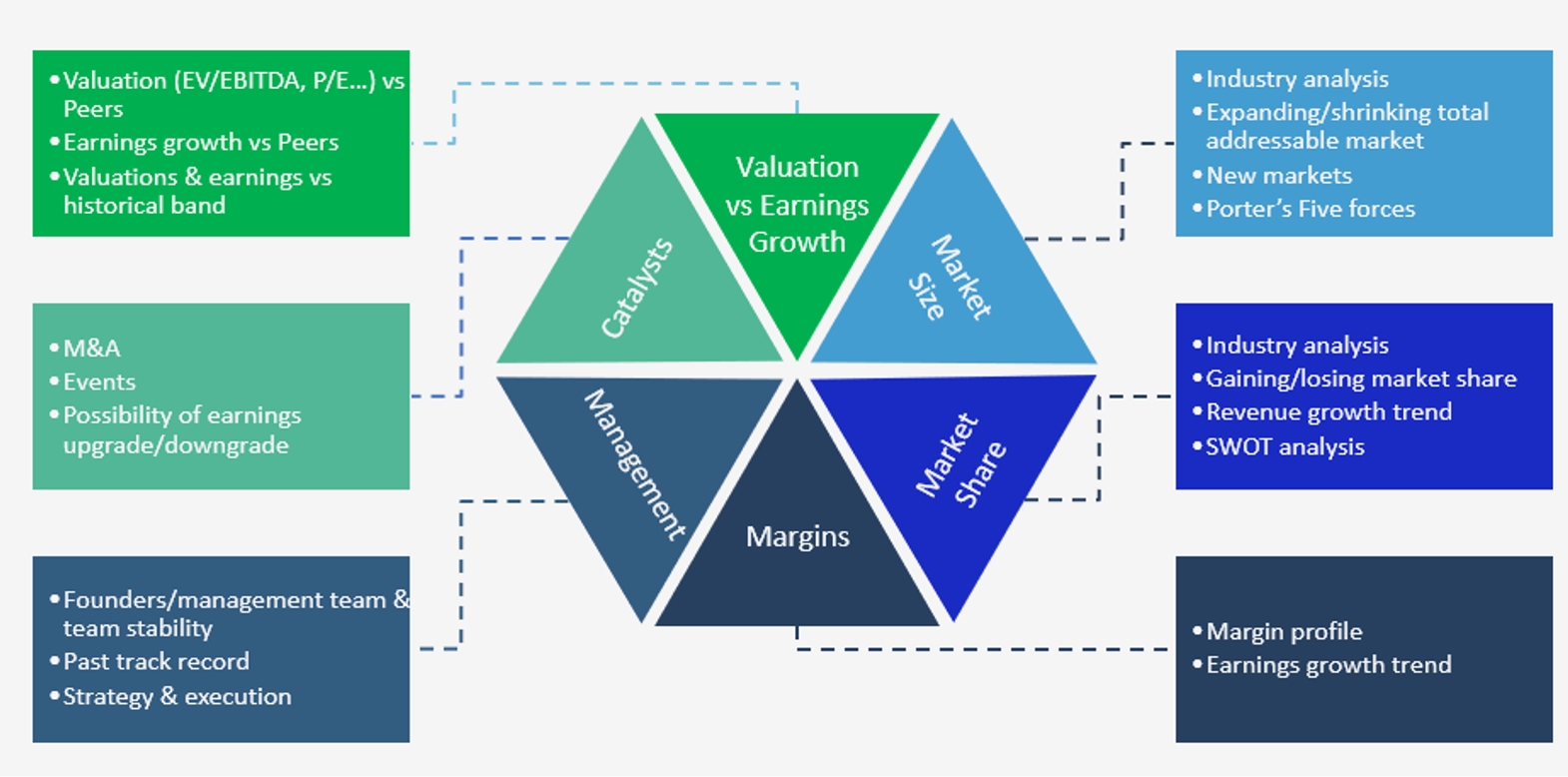

I believe in buying good companies at reasonable prices. The 4M framework looking at companies’ market size, market share, margins, and management helps me to identify outstanding companies in the long run. These companies operate in growing markets (size), gain market shares, improve margins, and are led by exceptional management. Nevertheless, great companies might not equate to great stocks in the shorter term as valuations might be expensive or stocks might fall short of catalysts and growth momentum. When evaluating an investment opportunity, placing 70% of the weight on long-term 4M factors and 30% on short-term valuation/catalyst factors achieves a balanced approach for identifying excellent companies and stocks to own, akin to Real Madrid’s strategy in the football world.

Figure 1. Covenant Capital’s 4M framework

In managing my equity portfolio, I apply a strategy similar to that of Djokovic: a 70% allocation in “core” holdings and a 30% allocation in “satellite and tactical” positions. “Core” holdings consist of high-quality, well-established, and stable companies under the “4M” framework. This part forms the foundation of the portfolio. On the other hand, a 30% “satellite and tactical” allocation allows me to capitalize on emerging & innovative companies in less developed segments and “tactical” macro trades. These trades could potentially enhance the portfolio’s return albeit containing higher risks. However, in a time of need to avoid prolonged drawdowns, cash is raised by reducing “satellite” and “tactical” positions while retaining high conviction “core” stocks.

Excessive allocation to “satellite” and “tactical” trades exposes the portfolio to unnecessarily high volatility and drawdowns in market gyrations and reduces the ability to hold other long-term positions, or worse, forces investors to liquidate them at unfavorable prices. On the flip side, allocating 100% to the “core” strategy can also be detrimental. Without the flexibility provided by “satellite” and “tactical” positions, it can result in missing opportunities in emerging areas and sectors that require certain levels of “leap of faith” at times. Moreover, during rapidly changing market conditions and macro environment, the portfolio might be too rigid to adapt and fail to adjust swiftly enough. Therefore, a balanced 70/30 approach ensures long-term stability, growth potential, and timely response in the short term.

As an equity manager and analyst, an important part of my job is to analyze individual companies and pick stocks. Hence, 70% of resources are dedicated to this task. However, I agree with John Maynard Keynes as he aptly noted: “Markets can remain irrational longer than you can remain solvent”, highlighting the undeniable role of a 30% emphasis on macro-overlay.

First of all, do not fall in love with your stocks, regardless of how strong your conviction may be. Emotional attachment can cloud judgment and hinder objective decision-making. Additionally, the thesis-breaking factors, more often than not, are the macro environment underpinning companies’ businesses which can cause critical flaws in your thesis if overlooked. To mitigate this risk, it is important to continually reassess the potential consequences of these macro factors on individual stocks and the overall portfolio. If these factors alter the long-term stock thesis or persist long enough to impact the portfolio’s sustainability, investors should adjust the size or even exit their positions. The 30% allocation to “satellite & tactical” trades does provide room for maneuver in this case.

For example, 2022 was marked by the most aggressive inflation and rate-rising environment since the hyper-inflation period of the 1970s-1980s. As a result, the traditional stock & bond portfolios suffered one of the worst drawdown years alongside the 1931 great depression and the 1969 recession. Such an environment proves inconducive for most stocks regardless of their long-term prospects. Investors might consider reducing tactical allocation to raise cash and trimming exposure to companies most sensitive to inflation and rates. This balancing act creates a cash buffer against market turbulence, hence protecting against further downside. Moreover, the long-term “core” positions are then less likely to be liquidated under pressure, allowing the overall portfolio to participate in the rebound when the market turns.

Let’s shift gears to dive into the most topical debate – Generative AI and how we think about investing in this theme.

Suffice to say that Generative AI has taken the world by storm since late 2022. Many of us have now been using ChatGPT, Gemini, or some Copilot products on a daily basis to improve the efficiency of our work, learn something new quickly, or get creative. Although AI or artificial intelligence is not new, applications have been confined to corporate and industry levels. ChatGPT and Gen AI have brought accessibility at scale to consumers and internet users.

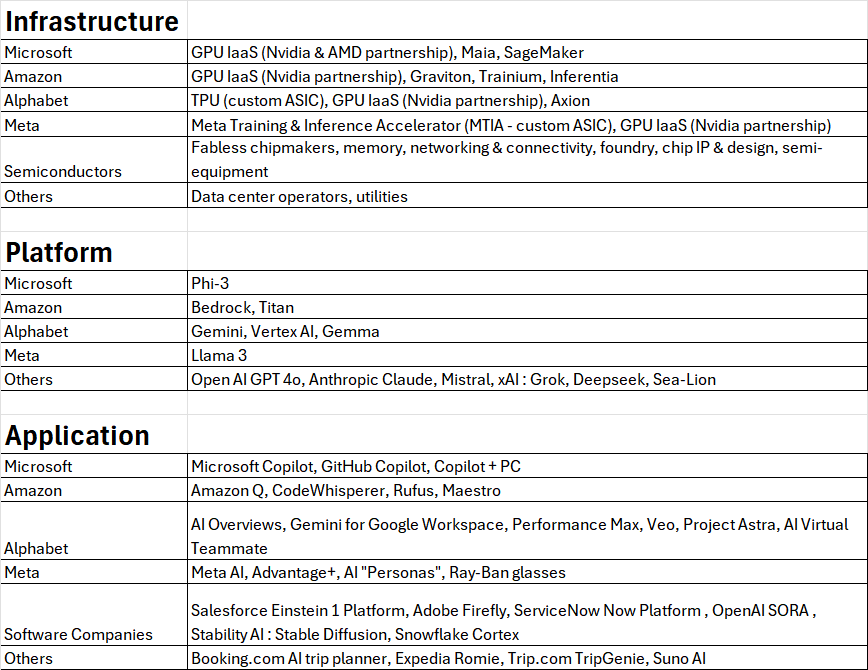

As it has worked in many past technology trends, the “IPA” framework should once again be employed to guide our thinking around Gen AI investment. “IPA” stands for “Infrastructure”, “Platform”, and “Applications”. A technological advancement first starts with infrastructure build-out. Subsequently, the emergence of platforms on top of the infrastructure layer fosters corporates to develop and deploy applications.

For example, in the smartphone evolution, telco companies provided the 3G/4G/5G infrastructure. Following this, various platforms such as iOS and Android emerged. These platforms in turn have enabled the deployment of a myriad of applications that we are using today.

The below table encapsulates the IPA ecosystem of Gen AI:

Figure 2. Generative AI’s IPA framework. Source: Covenant Capital, Goldman Sachs Research.

In the “infrastructure” layer, the hyperscalers (e.g. Microsoft, Amazon, and Alphabet) procure a large number of AI accelerators, memory, networking, and connectivity chips from the semiconductor companies to construct AI servers, data centers, and data campuses. These hyperscalers open up their infrastructure for the likes of OpenAI, Anthropic, Mistral, and Musk’s xAI … to train their LLM (large language models) and create the “platform” layer. Subsequently, software and application developers such as Salesforce, Service Now, OpenAI, and Booking.com … leverage these platforms to develop innovative applications and services, driving further advancements in AI technology and its practical implementations.

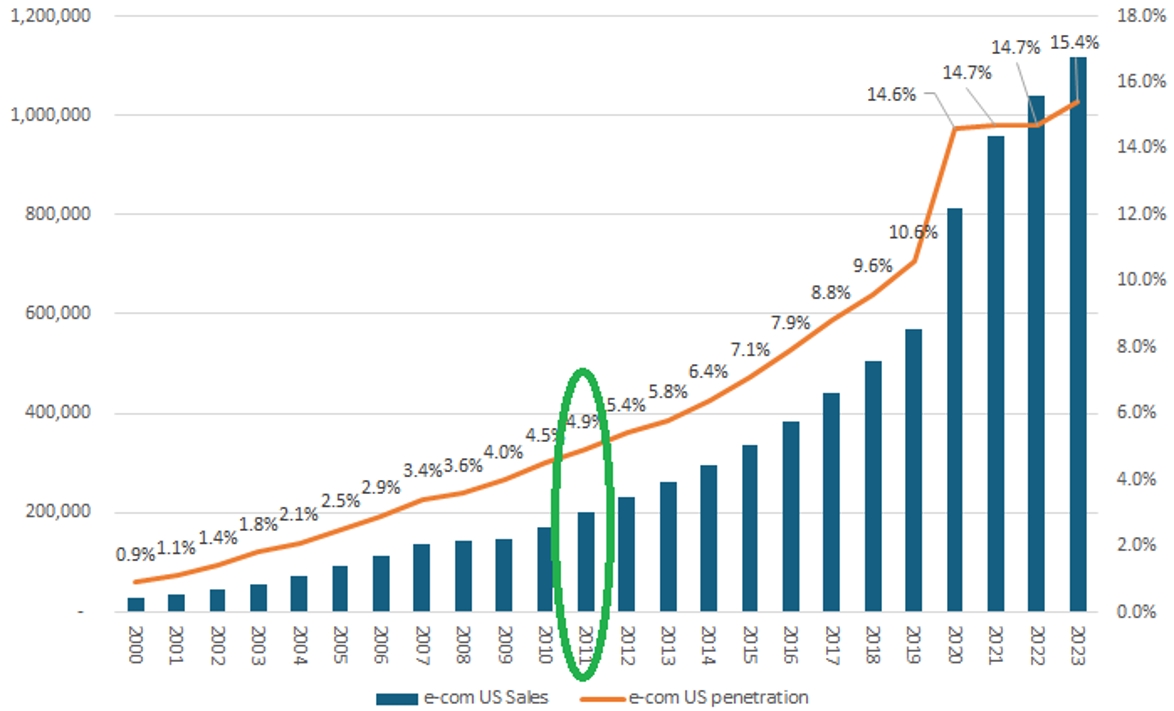

Although users have found great utility in applications such as the ones abovementioned, skepticism about Gen AI’s longevity remains high in the absence of “killer apps”. Killer apps, akin to search and e-commerce in the internet era, social media, and the sharing economy in the smartphone & 5G era, arguably will take years to come to fruition. As of now, we have yet to reach that stage with the Gen AI trend.

For instance, the e-commerce penetration rate only reached ~5% and revenue ~$200bn in the US in 2011, more than a decade after the start of the Internet boom:

Figure 3. US e-commerce revenue (left axis – $mn) and penetration rate (right axis). Source: JP Morgan Research.

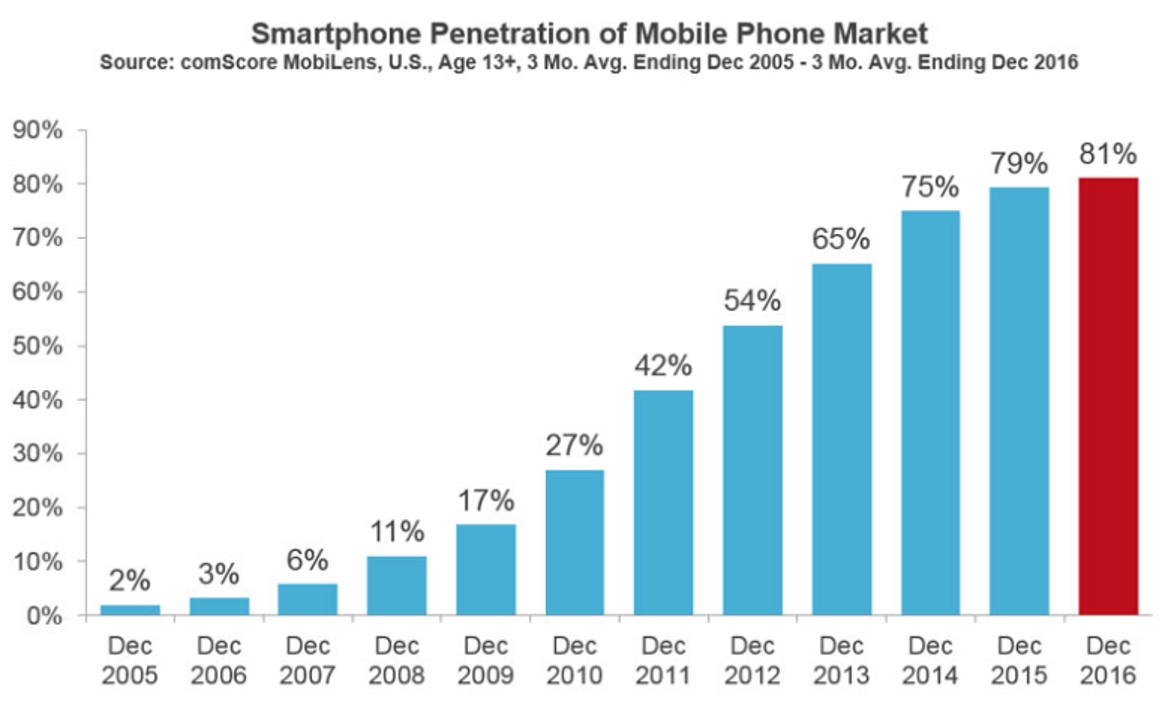

Smartphone technology took 8 years to exceed a 50% penetration rate in the US:

Figure 4. Smartphone penetration rate in the US from 2005. Source: comScore.

We are only in the second year of Gen AI and early infrastructure ramp. As such, the investment should emphasize 70% infrastructure layer vs 30% platform & application layer. That will also mean 70% allocation to the infrastructure enablers such as semiconductors and hyper-scalers vs 30% allocation to software and non-semi stocks. This balance might shift in the future alongside the ecosystem’s maturity stage.

Nonetheless, we have seen adoption picking up and applications spreading into many industries:

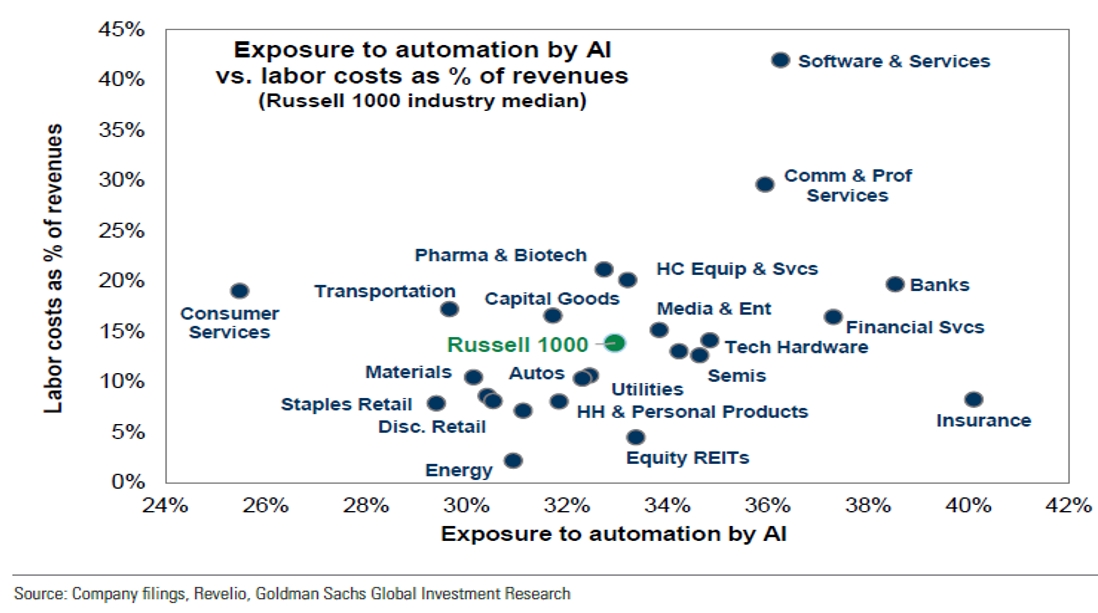

One of the most compelling long-term benefits of Gen AI is its potential for significant productivity enhancement. Goldman Sachs estimates potential labor productivity gain using AI by identifying industries’ labor costs as % of revenues and their exposure to AI automation (figure 5). For instance, the software & services sector is prone to high labor costs and the likelihood of being replaced by AI. Thus, the productivity of companies in this sector will be lifted meaningfully by adopting AI.

Figure 5. Potential productivity gain by adopting AI by sectors. Source: Goldman Sachs Research.

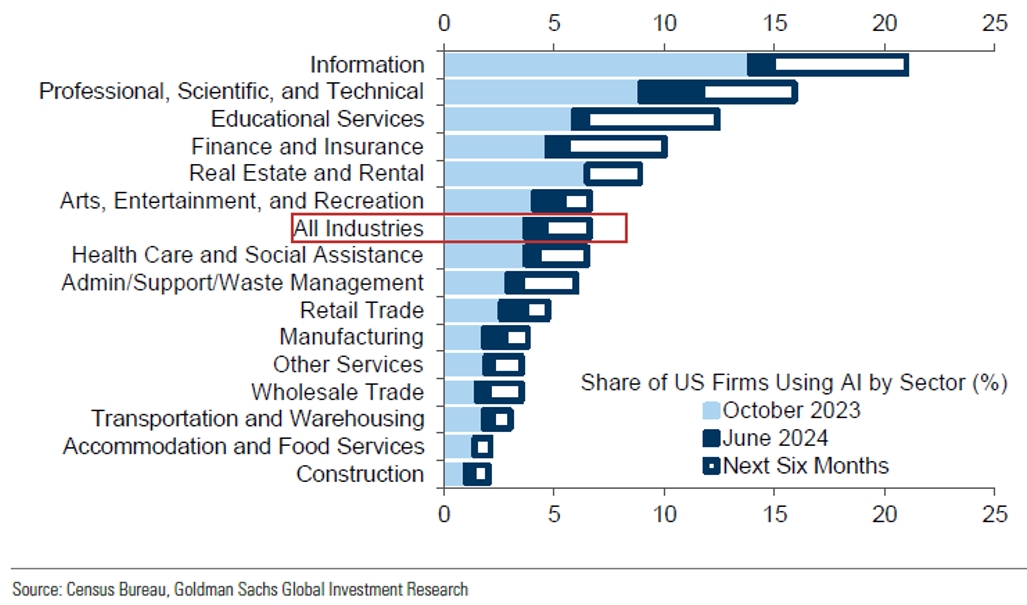

At a 5% adoption rate across industries in the US, we have only touched the tip of the iceberg of what Gen AI can do.

Figure 6. Percentage of US firms are using Gen AI. Source: Goldman Sachs Research.

In every gold rush, our preferred plays have always been the shovel makers who thrive by selling tools and equipment to the gold miners. The Gen AI trend is no exception. As a result, infrastructure enablers such as semiconductor companies are the backbone of our strategy. Within this space, fabless chipmakers (Nvidia, AMD, and Broadcom …), memory (Hynix, Micron, and Samsung), networking & connectivity (Broadcom and Marvell …), and chip IP & design (e.g. ARM) companies that win content and share in AI servers and accelerated computing era are our favored choices. Top-tier foundry (e.g. TSMC) and semi-equipment companies (ASML, Lam Research, and Applied Materials…) will also reap the rewards as well.

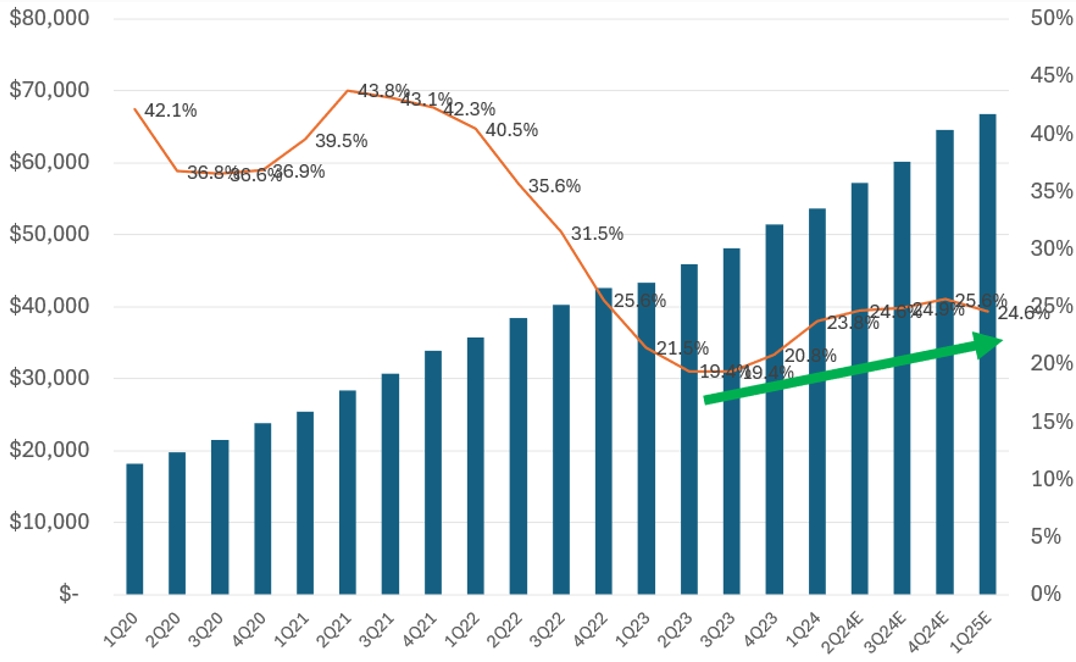

The big-3 hyperscalers are expected to invest a large amount of CapEx into ramping up the Gen AI ecosystem which will continue to bode well for our “shovel makers”. While I will take a stab at concern about their CapEx investment later, it is worth noting that the early monetization of Gen AI “platforms” has helped to propel the hyperscalers’ cloud revenue growth back to above +20% yoy level as per figure 7. In other words, the monetization of the platform layer has started.

Figure 7. Big-3’s quarterly cloud revenue (left axis – $mn) and yoy growth (right axis). Source: Visible Alpha, Covenant Capital.

Is this a good or bad thing that infrastructure build-up is highly concentrated among mega-cap companies? One major issue that plagued the 1990s and 2000s cycles was the large amount of under-utilized capacity resulting from suboptimal investments by numerous smaller-scale companies and ventures. In contrast, the giants in this cycle arguably possess deep pockets, access to capital, and extensive distribution networks to essentially bring this new technology to fruition. Nevertheless, the number of participants will broaden in the future when we transition to the “application” phase.

Are areas such as power utilities and data-center operators good proxies of the Gen AI infrastructure build? Admittedly, they fall outside of my core competence and therefore are not included in the 70% “core” holdings. However, from time to time, these sectors can be excellent additions to the 30% “satellite & tactical” bucket.

Invest, grow, repeat.

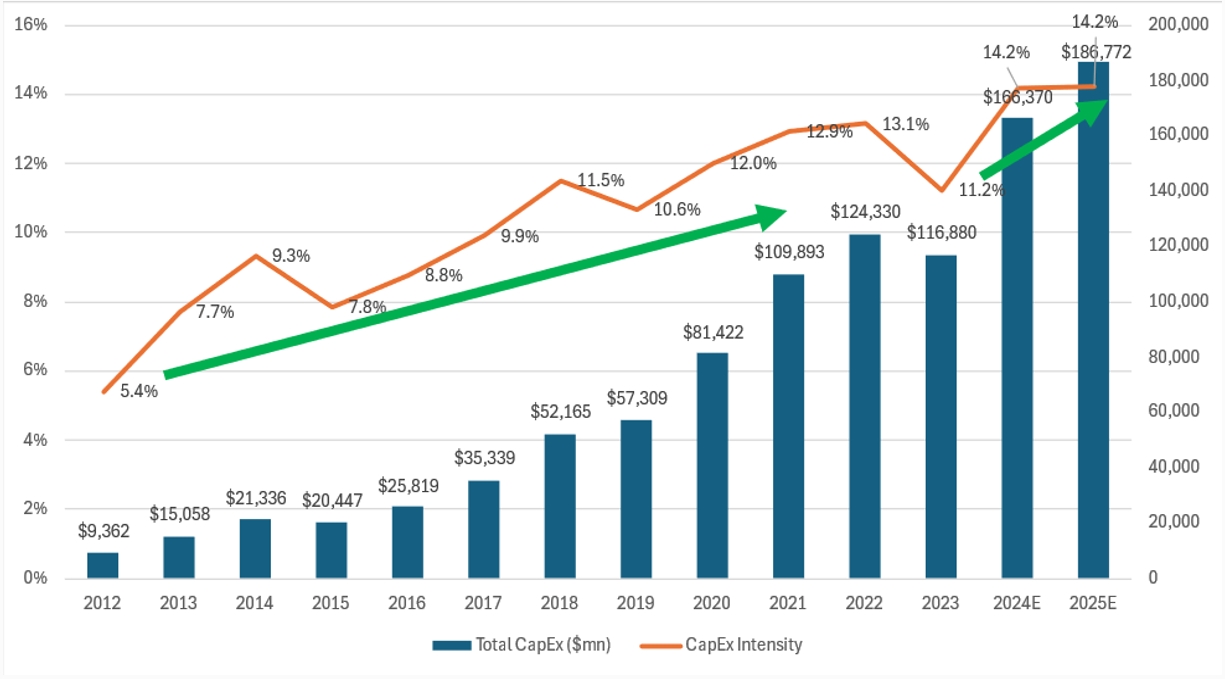

There is a reason why the hyperscalers – Microsoft, Amazon, and Alphabet are among the largest companies in the world: they invest for future growth. The Gen AI cycle is no exception as this big-3 group is expected to invest ~$166bn/$187bn in CapEx in 2024E/2025E respectively. As a result, the CapEx intensity (CapEx/revenue) will reach ~14.2% in these two years. As mentioned earlier, infrastructure enablers have been the main beneficiaries of this CapEx spending from the big-3.

Figure 8. Big-3’s annual CapEx (right axis – $mn) and CapEx intensity (left axis). Source: Visible Alpha, Covenant Capital.

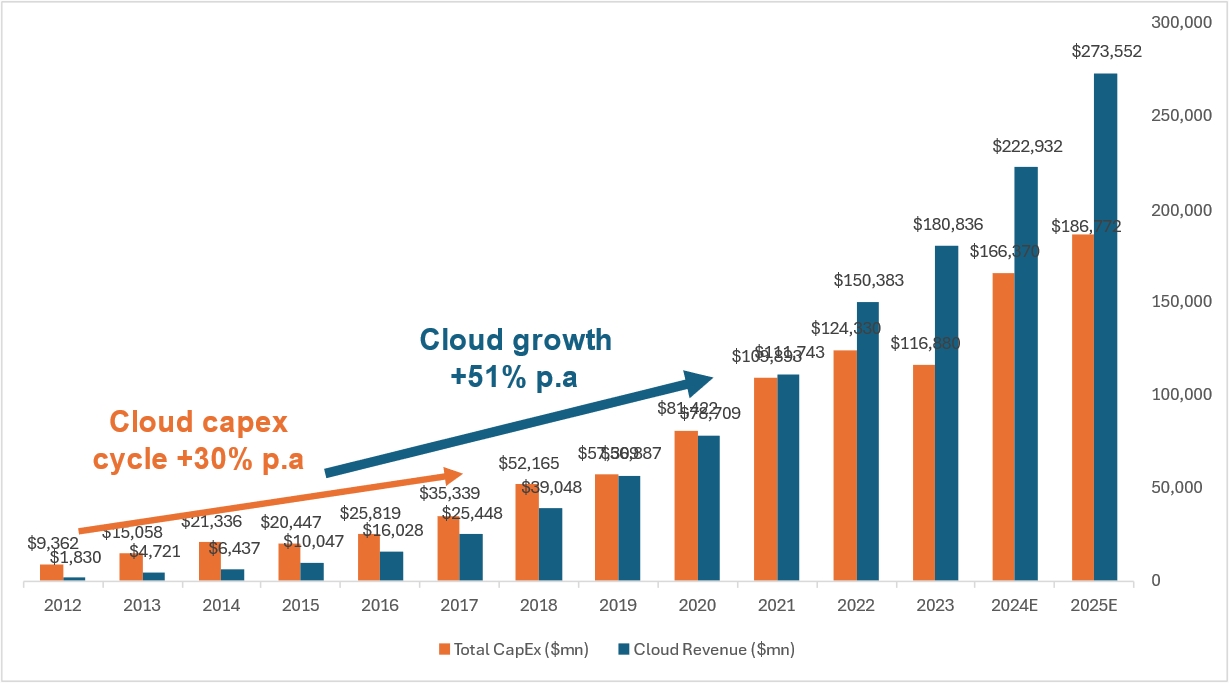

We observed a similar uplift of CapEx during the previous “Cloud computing” cycle (+30% p.a from 2012 to 2017) as the big-3’s CapEx intensity rose from 5.4% in 2012 to ~12% in 2020. This investment in turn spurred an impressive +51% CAGR growth for their Cloud segment in the 2015-2020 period (figure 9).

Figure 9. Big-3’s Cloud annual revenue ($mn) and annual CapEx ($mn). Source: Visible Alpha, Covenant Capital.

Moreover, following a period of plateaued growth, investments in Gen AI have begun to rejuvenate the Cloud growth rate, as illustrated in figure 5 above. Consequently, the big-3 will continue to invest as long as future growth prospects remain promising. They can sustain this level of spending as they are still projected to generate over $200bn in free cash flow in CY2024E.

Is the 14% CapEx intensity level too high? I think the “asset-light” period, with CapEx intensity below 5% and a significant portion of revenues derived from software, search, and advertising, has long gone. Suffice to say that these corporates have gone “asset heavier”. In my opinion, the 14% level is acceptable at the moment, provided that growth continues. This level is also considerably lower compared to other asset-heavy and investment-intensive areas in technology, such as foundry and memory, which have CapEx intensities of 30-40%.

One important indicator to gauge the longevity of this Gen AI infrastructure phase is to track Gen AI models’ “refresh cycle” – specifically, how frequently the large language models (LLMs) are being updated. The concept of Gen AI models’ refresh cycle is similar to the “replacement cycle” during the smartphone and PC eras. The replacement cycle refers to how often users replace their devices.

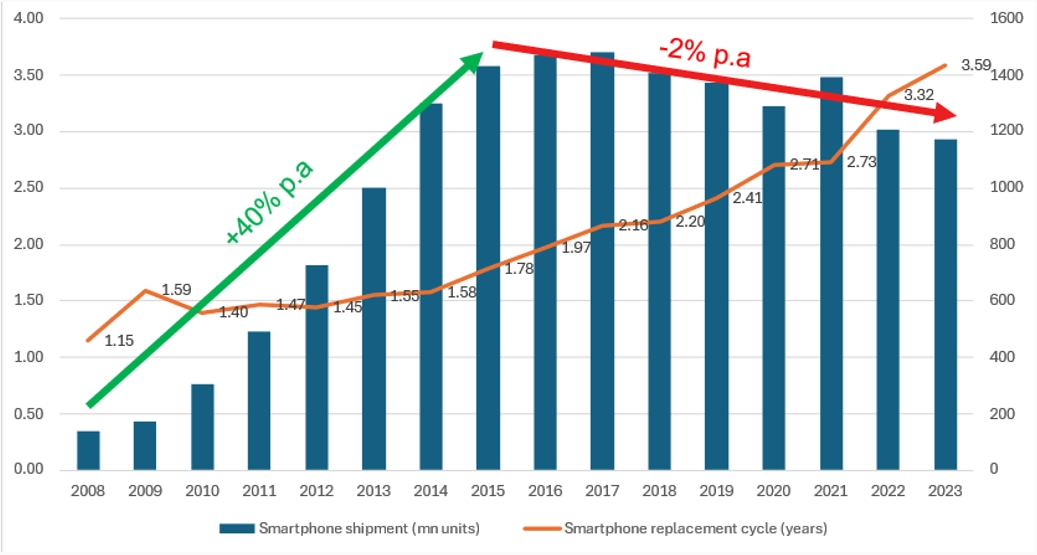

The smartphone market experienced a stellar +40% CAGR growth rate in the 2008-2015 period (figure 10). However, as the replacement cycle extended to nearly two years by 2015, users became less motivated to upgrade to new phones. This was due to increased durability and the commoditization of smartphones. Consequently, the smartphone market’s growth cooled down, declining to a -2% CAGR from 2016 onwards.

Figure 10. Smartphone market’s shipments (right axis – mn units) and replacement cycle (left axis – years). Source: Statista, Counterpoint Research, Business Wire, TechInsights, IDC.

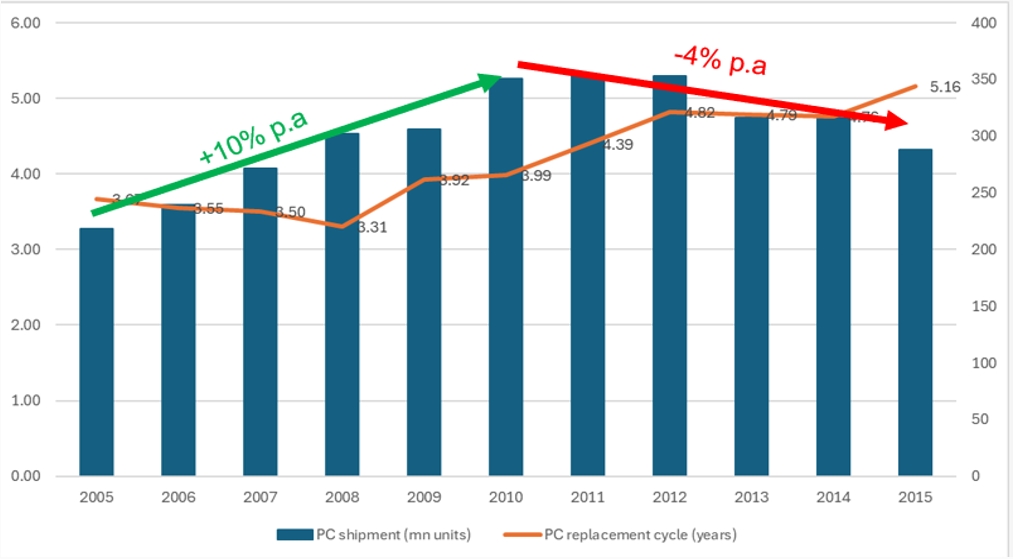

A similar finding was observed in the PC market as the growth rate tapered off from +10% CAGR in the 2005-2010 period to -4% CAGR in subsequent years as the replacement cycle exceeded 4 years.

Figure 11. PC market’s shipments (right axis – mn units) and replacement cycle (left axis – years). Source: Wikipedia, Statista, ITCandor, GSMA Intelligence.

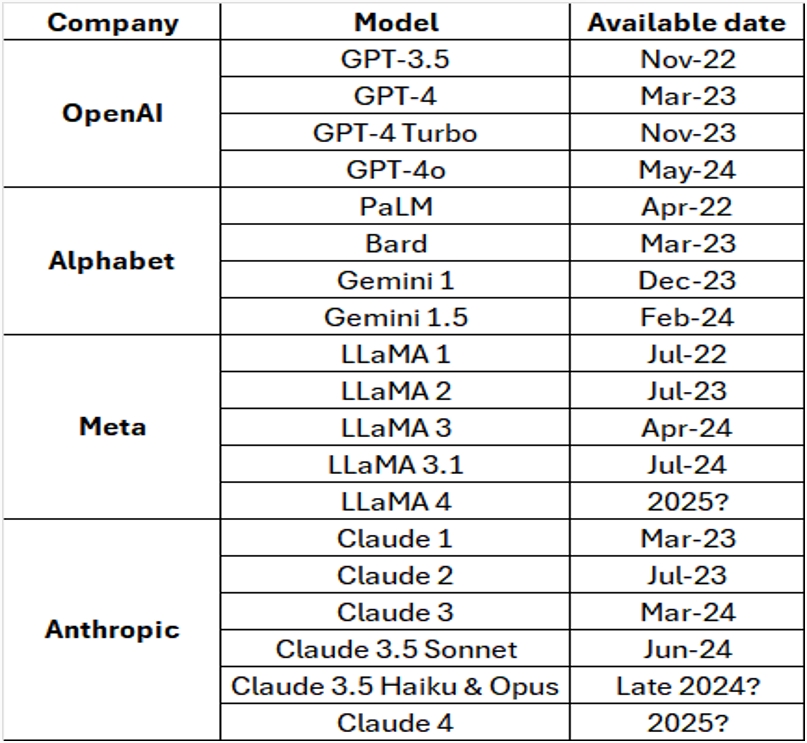

At the moment, major models such as OpenAI’s GPT, Anthropic’s Claude, Google’s Gemini, and Meta’s Llama are being refreshed at a cadence of shorter than 1 year (figure 12).

Figure 12. Major Generative AI large language models & available dates.

Therefore, I believe that we are still in the early innings of the build-up phase. However, when models are deemed adequate, the “refresh cycle” will lengthen and infrastructure investment slow. This stage will warrant a cautious reassessment of the infrastructure plays.

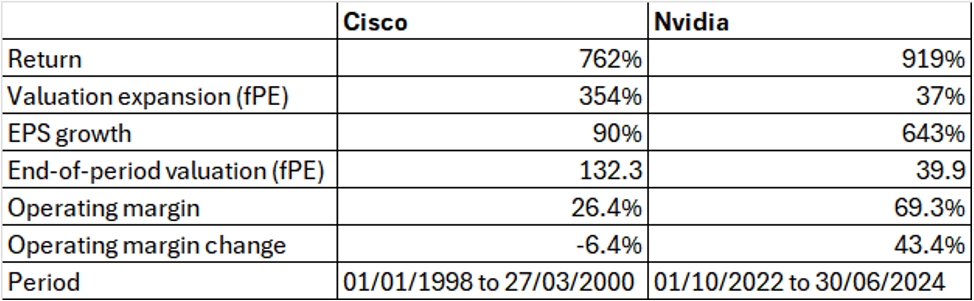

Cisco had an eye-popping run (+762%) from 1998 to March 2000 before the Dot com bubble burst, resulting in the subsequent collapse of the stock (blue line in figure 13). Will Nvidia meet the same end after a +919% rally since October 2022 (green line in Figure 13)? The short answer is not likely as the underlying drivers of their performances draw striking distinctions: Cisco’s price was propelled largely by an exuberance reflected in valuation expansion while earnings and margins lifted Nvidia’s stock.

Figure 13. Rallies of Cisco (blue) and Nvidia (green). Source: Bloomberg.

I have broken down the drivers of these 2 incredible rallies:

Figure 14. Breakdown comparison between Nvidia and Cisco’s runs. Source: Bloomberg, Covenant Capital

A few takeaways from the above table (figure 14):

Nvidia has run on a solid foundation and not false hope. Therefore, we do not believe that the stock will face the same fate as Cisco.

In summary, the 70/30 strategy offers a robust framework for stock analysis, balancing long-term fundamentals (4M) and short-term dynamics (valuations & catalysts). This strategy effectively combines bottom-up stock selection with top-down macro-overlay, while providing a structure for portfolio construction that blends core holdings with satellite and tactical positions.

When evaluating technological trends, particularly the current Gen AI, the IPA (Infrastructure, Platform, and Application) model proves invaluable. However, it’s crucial to recognize that Gen AI is still in its nascent stages. Given this early phase, our investment focus is primarily on the infrastructure enablers – the shovel makers of this gold rush.

While killer apps will likely emerge in a later stage, this process may take years. In the interim, monitoring the refresh cycles of Gen AI models serves as a key indicator of the infrastructure cycle’s longevity. At the moment, the hyperscalers have experienced a resurgence in growth and will likely continue their investment to build up this ecosystem, mirroring their approach during the Cloud computing cycle.

Featured Picture/Quote: ChatGPT dating gone wrong. Thank God I am married.

https://www.tiktok.com/@thechattinghour/video/7371150343163350305

Josh Le, CFA, MSc in FE

Senior Vice President

Portfolio Manager

joshle@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.