The semiconductor industry was once thought to be an unexciting and declining industry in the 2000s. However, the industry has revitalized itself since 2016, driven by large-scale migrations into cloud computing and hyperscale data centers, the booming of artificial intelligence (AI), deep learning, the internet of things (IoT), hardware innovations such as virtual reality (VR), augmented reality (AR), and wearables.

Even though these multi-year trends are still in play, they have also become well-understood. In the quest to search for future growth drivers for this industry, we have found gold in new areas such as green technology, the metaverse, and blockchain & cryptocurrency.

While these up-and-coming markets present an enormous opportunity for investors in the long term, they are without a doubt new to many and full of hypes, risks, and even fraud. They are akin to the new goldrushes.

During the California Gold Rush of 1849, some miners struck it rich. However, most of the money was made by “shovel makers” who sold shovels, equipment, supplies, tents, and jeans (remember Levi Strauss?) to the gold miners. In the same way, semiconductor companies are the “shovel makers”. Although investors could make good returns investing directly into metaverse companies, blockchain projects, and EV car manufacturers, chip-makers will certainly stand to reap the benefits as new ecosystems and supply chains are being built up.

From zero to hero

Semiconductor products have become ubiquitous in our daily life. They are the basic building blocks of many electronic devices surrounding us. Since the outbreak of the Covid-19, we have increasingly seen that many nations now have prioritized ramping up their semiconductor capacity not only for economic development reasons but also for national security ones. Robust demands have driven the revenues of many companies such as Nvidia, TSMC, Micron, Broadcom, ASML, or Infineon to record highs.

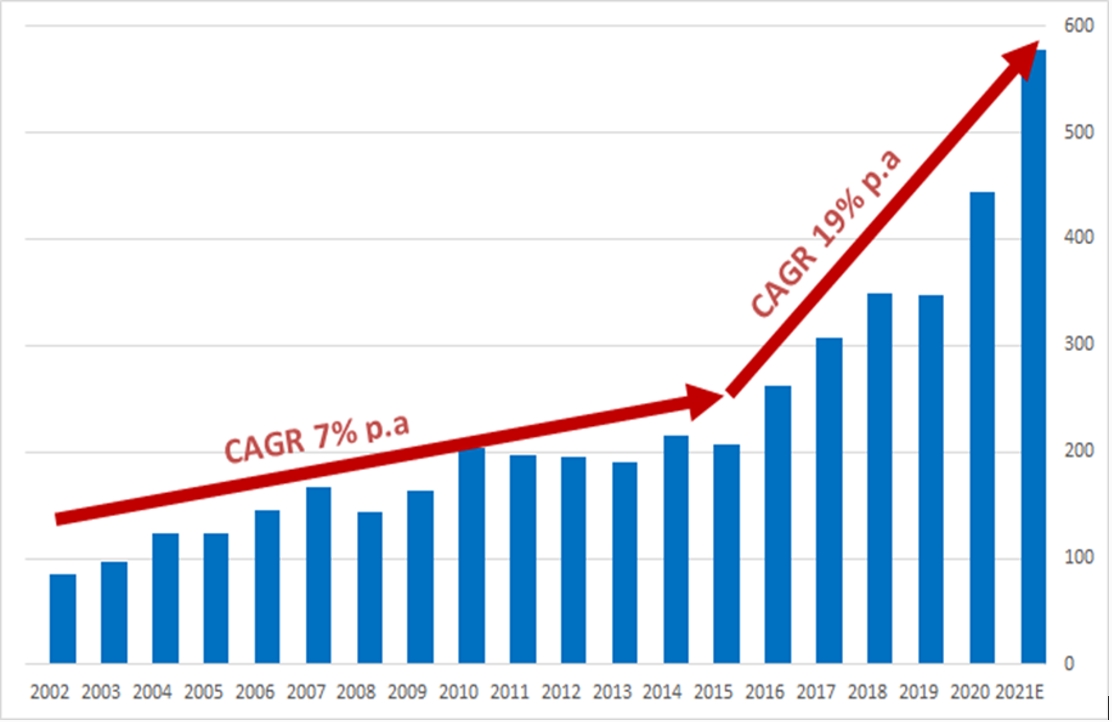

However, that wasn’t the case before 2016. As recent as 6-10 years ago, this industry was thought to be boring and even “dying” in the eyes of many investors. Revenue of the SOX (Philadelphia Semiconductor Index) was stuck at single-digit growth rates from 2002 to 2015 with a long downdraught from 2011 to 2013 (figure 1), thanks to the maturity of PC and smartphone markets and the lack of new drivers.

The SOX index delivered a mere 2.9% p.a. return in the same period, underperforming the S&P 500 significantly at a 6.3% p.a. return.

Decades-long industry consolidation, well-spent R&D and faster, more reliable connectivity gave rise to the proliferation of cloud computing, SaaS, AI & deep learning, AR/VR, wearables, and streaming. Since 2016, SOX’s revenue growth has risen to 18.7% p.a. (figure 1), 3x the rate from 2002 to 2015!

In this period, the SOX index has posted an impressive 37.5% p.a. gain vs 17.4% p.a. for the S&P 500 (figure 3).

This industry certainly is still in its early innings. Let’s dig deeper into the developments of green technology, metaverse, and blockchain & cryptocurrency to understand how these gold rushes will propel our shovel makers’ future growth.

Goldrush #1: Green technology

Buzzwords are flying around in this space – ESG investments, renewable energy, electric vehicles, the COP26, the race to net zero emissions … Governments have increasingly ramped up their green power grid, reduced fossil fuel usage, cut down coal power plants, and rolled out more EV charging stations. Corporates have no choice but to march in lockstep with the governments. They talk about their own ESG approach and commitment to net-zero emissions. Many of them are walking their talk to upgrade their equipment to be less energy-intensive and build energy self-sufficient factories and fabs.

Let’s explore some green technology trends here.

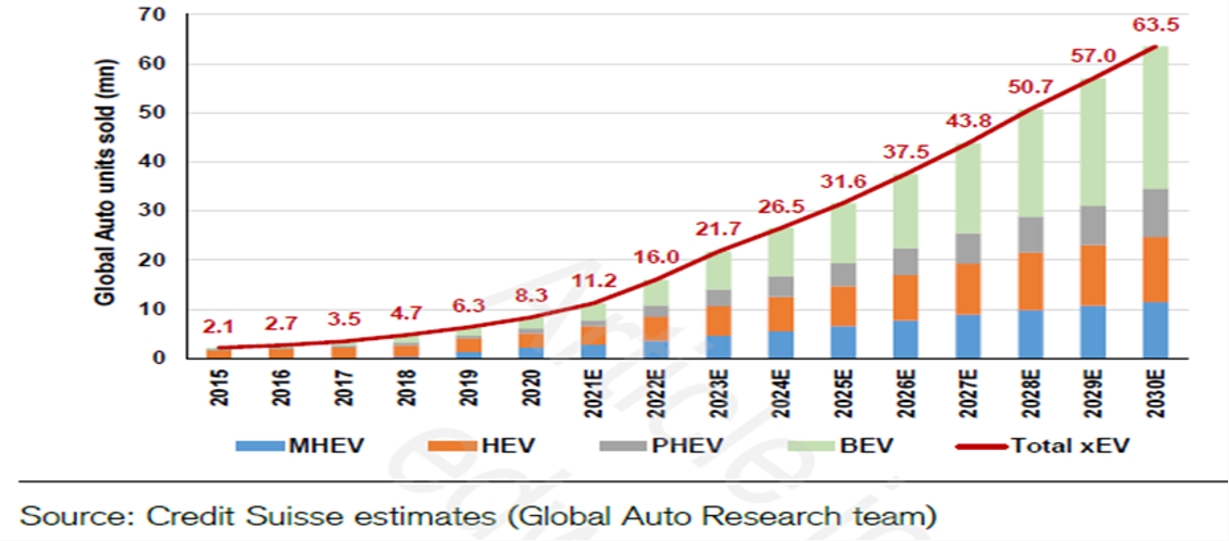

Electrical vehicle (EV): Credit Suisse estimates EV cars to grow from 8.3mn units in 2020 (~10% of global car production) to 63.5mn units in 2030E (~60% of global car production). Other banks such as Goldman Sachs have similar estimations.

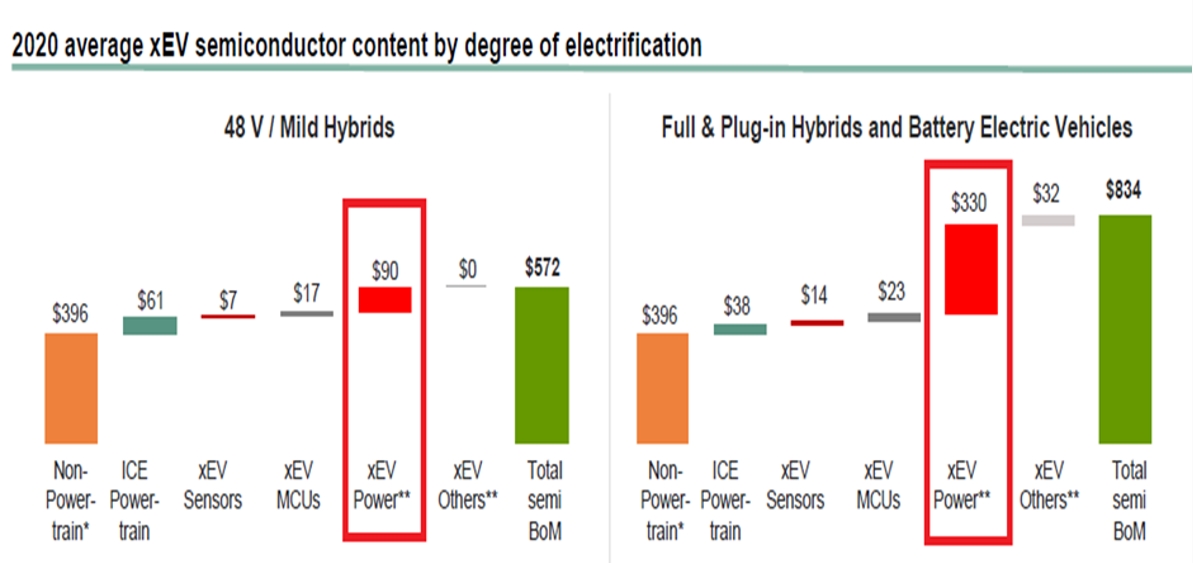

Automotive semiconductor companies such as Infineon, ST Micro, ON Semi, NXP, and Texas Instruments will capitalize on higher semi dollar contents when consumers upgrade to EV cars from ICE (internal combustion engine) or hybrid models. For example, Infineon expects total semi BoM (bill of material) to rise to $834 for an average full plug-in BEV (battery EV) from $572 for a mild hybrid car – a 46% content gain (figure 5).

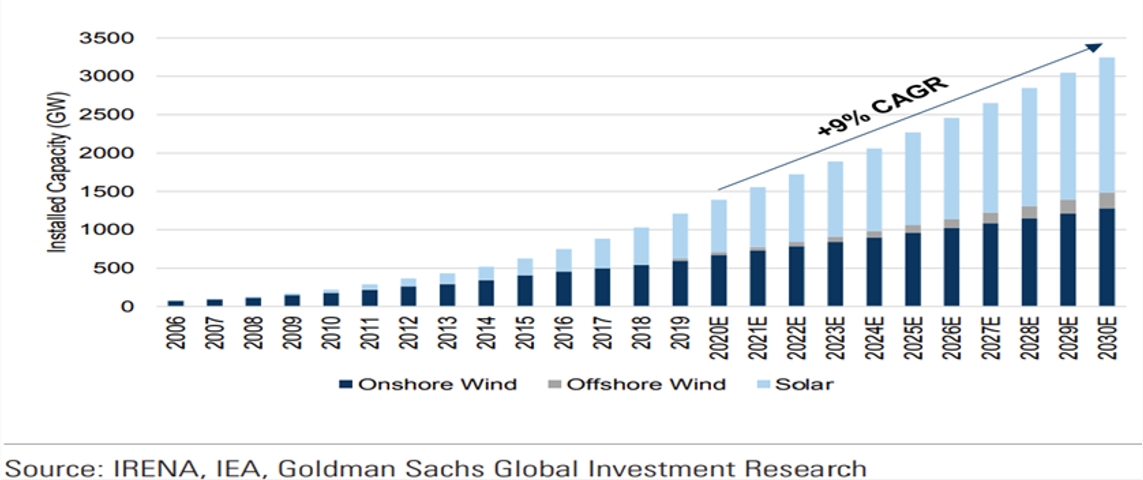

Renewable energy: collective pushes from governments around the world have enlarged the size of onshore, offshore wind, and solar markets (figure 6). Infineon as well as other green-enablers have secured contracts with the top players in solar and wind energy such as Vestas, Siemens Gamesa, GE, Sungrow, and Solar Edge to provide innovative power management components.

Investments from Infineon, ST Micro, ON Semi, NXP, and Qorvo into new Silicon Carbide (SiC) and Gallium Nitride (GaN) fabs will be well paid off. These technologies are emerging to support applications that require more energy-efficient, higher voltage & current, and higher temperature such as EV, renewable energy, and data centers.

Power efficiency for Data centers and PCs: according to Goldman Sachs, global data centers’ power consumption could have increased ~10x from 210 TWh in 2020 (~1% of global power consumption) to 2,020 TWh in 2025 (~7.2% of global power consumption). However, thanks to innovations in energy efficiency, the actual figure in 2025 will likely be reduced to 308 TWh, which means ~1,700 TWh of electricity will be avoided (~6.1% of global power consumption). In a similar fashion, PCs’ annual consumption in 2020 is 108 TWh (0.4% of global consumption). GS expects an additional 21 TWh will be avoided by 2025 from efficiency gains for PCs.

Advancements in chip structures such as CPU, GPU, and memory play a crucial role. For example, Samsung estimates that 1.5 TWh would have been saved in 2020 by replacing all server HDDs with power-efficient SSDs.

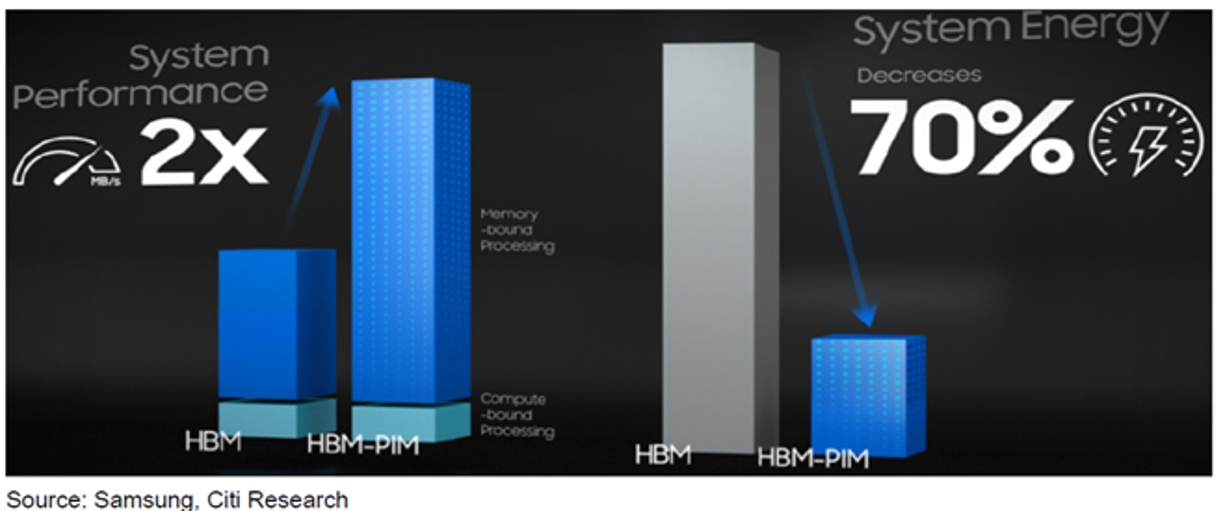

Working with DRAM companies such as Micron, Samsung, and Hynix, chip designers – AMD, Nvidia, Intel, and Broadcom are increasingly shifting toward more efficient structures such as HBM (high bandwidth memory). HBM-PIM (processing-in-memory high bandwidth memory), the latest technology, is expected to deliver 2x the speed and decrease system energy by 70% compared to the HBM predecessor (figure 7).

Goldrush #2: Metaverse

Metaverse is a virtual world where people can build, socialize, work, collaborate and play. This concept is not new but a series of recent events by mega-tech firms from Meta Platforms (formerly Facebook), Microsoft to Nvidia has breathed life into the “Metaverse” rally. Without meandering into the debate whether Metaverse is the future or a fad, let’s explore our direct and indirect options to profit from this trend.

A direct play into this trend is apparently the “Metaverse creators”. These “creators” in the listed space range from Meta Platforms, Microsoft, Roblox to gaming companies and Unity software game engine. In the “Wild Wild West” land of cryptocurrencies, Metaverse projects – Sandbox, Decentraland, and Enjin have skyrocketed “to the moon” 🚀🚀🚀, fuelled by the Metaverse craze.

From a hardware perspective, devices such as Meta Platforms’ Oculus, Google Glass, and Microsoft’s Hololens will be the direct play to help users enter the virtual world. Take a deeper look, we will come to the realization that underlying semiconductor components including display (Samsung, Sony), SoC (Qualcomm), processors (Intel, AMD), graphics (Nvidia), memory (Samsung, Micron, Hynix), acoustics (Goertek) and power management (ON Semi, Texas Instruments) take up a large chunk of these devices’ BoM (bill of material).

Metaverse applications are extremely data, connectivity, and graphic intensive. Therefore, after Facebook changed its name to Meta Platforms and announced its Metaverse ambition, the company also raised Capex from ~$19bn this year to $29-$34bn in 2022 to fund investments in data centers, servers, and network infrastructure. Apart from Meta Platforms, we also expect the top 4 US hyperscalers to increase their data center Capex by 30% to north of $90bn in 2022.

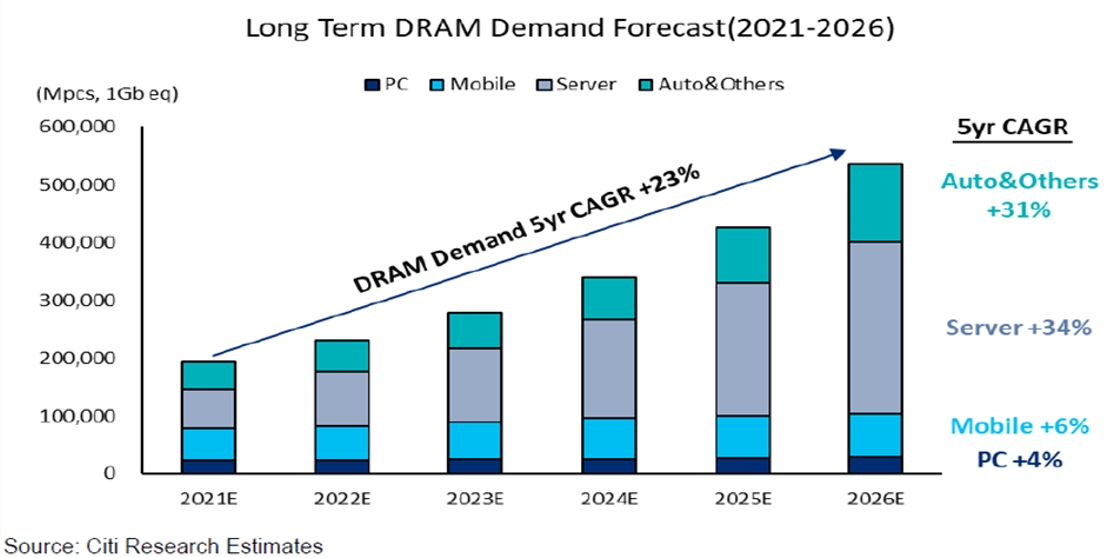

Higher data center Capex means more switches (Broadcom, Marvell), CPU (AMD, Intel), GPU (Nvidia), and memory especially DRAM (Micron, Samsung, Hynix) (figure 9). Faster connectivity either via 5G or via WiFi 6 will rely on chips made by Xilinx, Texas Instruments, Qualcomm, Broadcom, Qorvo, Skyworks, and Infineon as well.

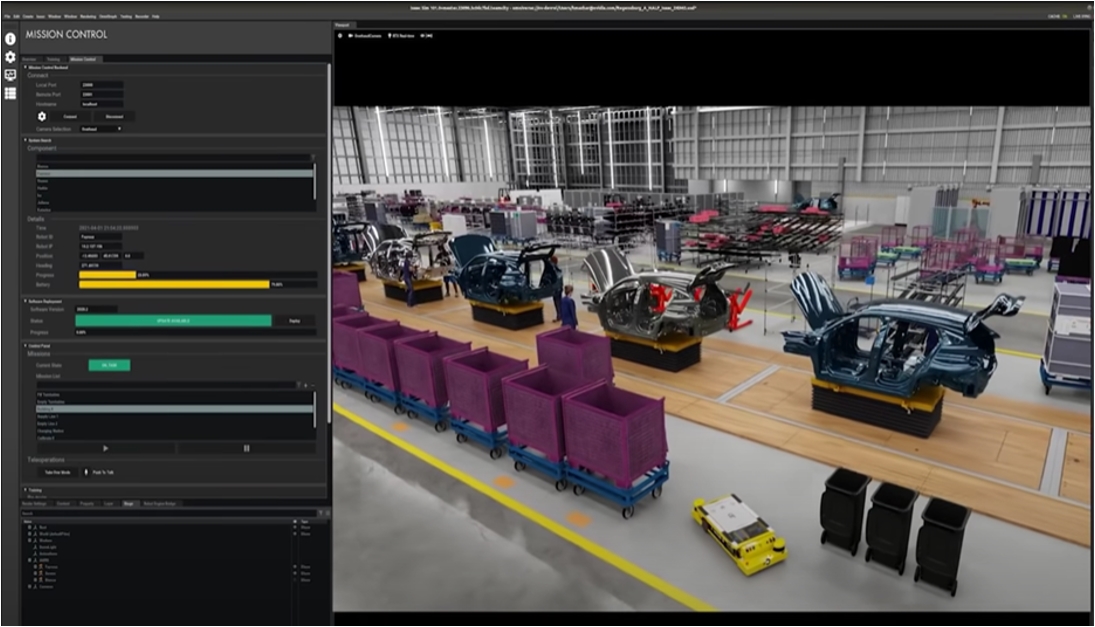

Moreover, graphic intensity in the Metaverse world will certainly require Nvidia’s solutions such as new GPUs or Omniverse platform (check out their super cool Omniverse platform on YouTube – figure 10).

Burgeoning demand for chips trickles down to foundry business where firms such as TSMC, Samsung, GlobalFoundries, and UMC are dominating. Eventually, new foundry fabs will depend upon ASML, Lam Research, and Applied Materials to build and supply their cutting-edge equipment.

Goldrush #3: Blockchain and Cryptocurrencies

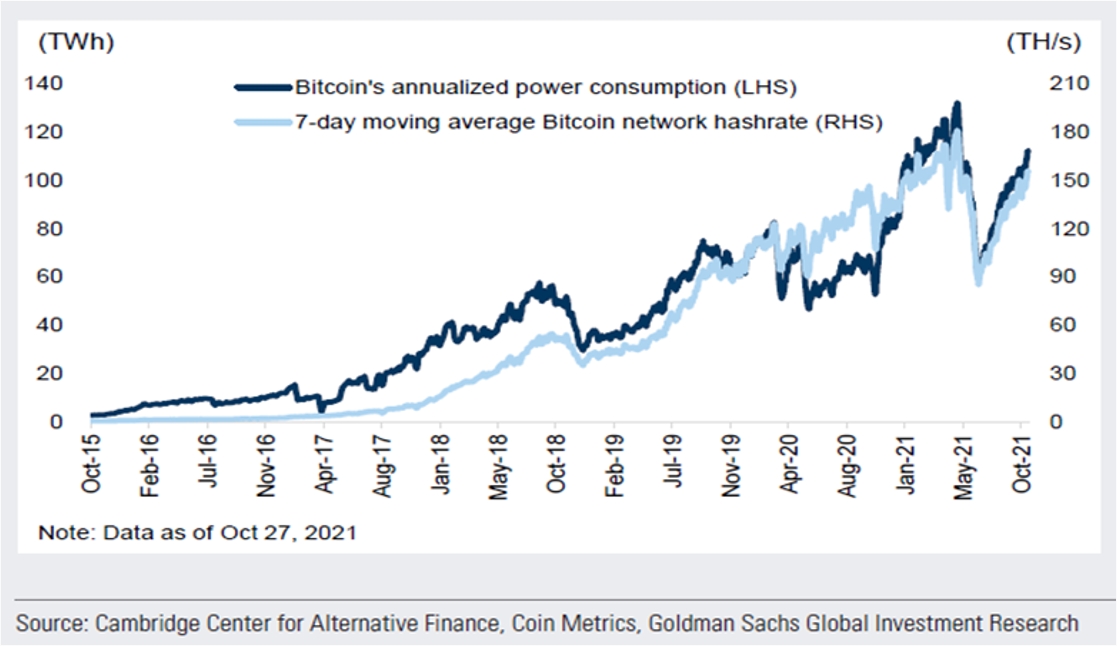

The first thing that pops up in everyone’s mind when talking about blockchain and semiconductor demand is cryptocurrency mining. BTC and ETH 1.0 are still on PoW (Proof-of-Work) consensus mechanism and thus involve an energy-intensive mining process. Although this mining activity will lead to a higher demand for GPU (Nvidia, AMD) and ASIC chips which will also flow down to TSMC’s revenue, we are not a fan of crypto-mining at any level. The reason is twofold. Firstly, the majority of blockchain projects have shifted to more energy-friendly consensus mechanisms such as PoS (Proof-of-Stake). ETH 2.0 is expected to transit to PoS by 2022. Secondly, cryptocurrency mining goes against our belief in ESG to be energy-efficient and environmental.

The cryptocurrency market has grown into a staggering $2.6tn economy, spreading across a great deal of applications – DeFi (decentralized finance), lending, derivatives, stablecoins, wed 3.0, decentralized storage & data management, gaming, and NFT (non-fungible token).

Suffice to say, this market is a computing, storage, and connectivity-demanding hot feast for all semiconductor companies ranging from data-centers, processors, accelerators, memory to smartphones and PCs. We will zoom in to a few up-and-coming areas of blockchain to analyze the potential roles of our “shovel makers”.

Web 3.0: The internet progressed from Web 1.0 (static web) in the 1990s to Web 2.0 (social and interactive web) in the mid-2000s that subsequently paves the way for applications such as Facebook and YouTube. And now, Web 3.0 is underway, thanks to decentralized blockchain technology.

In Web 3.0 (semantic web), the internet will be built on decentralized protocols and enable machine-based understanding of data and interaction. What are the implications?

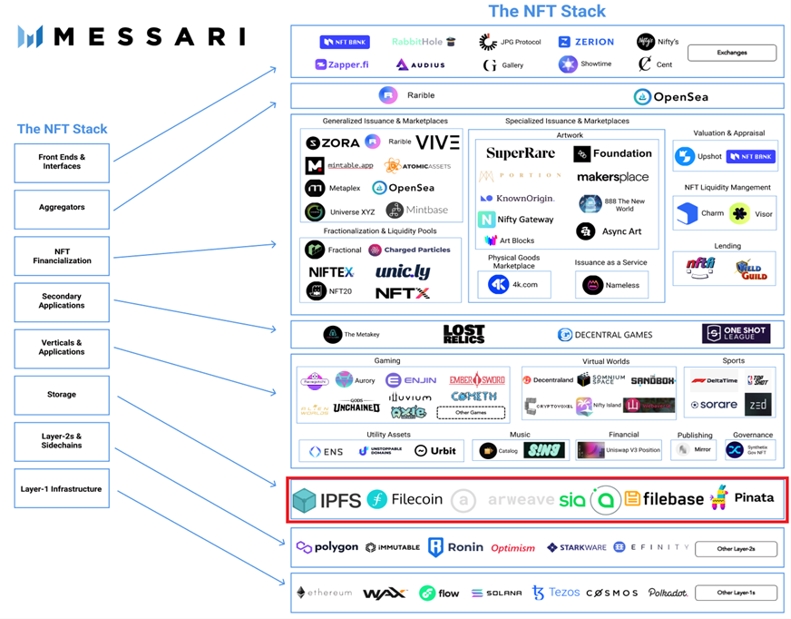

Decentralized data and storage: Blockchain projects – Filecoin and Arweave are at the forefront to develop decentralized data platforms. Decentralized applications (dApps) such as Theta Network (decentralized video streaming and consuming) and NFT entail decentralized storage systems. Figure 12 shows the NFT ecosystem with highlighted storage stack.

Certainly, decentralized data lift demand for memory – NAND & SSDs (Kioxia, Western Digital, Hynix, Micron, Samsung) and storage solutions (Broadcom, IBM, Dell).

Once again, foundry companies (TSMC, Samsung, UMC) and semi equipment manufacturers (ASML, Lam Research, Applied Materials) will stand to reap the harvest.

Josh Le, CFA, MSc in FE

Senior Vice President

Portfolio Manager

joshle@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.