If you spent your childhood in the late 70s and early 80s like this writer did, you will likely remember this brand of bubble-gum, Bubblicious. It was marketed on one big difference from the competitors; it can be blown to a bigger bubble than the rest. For a few glorious minutes, the expansion seemed limitless, defying the laws of physics until the inevitable: a sticky mess that leaves you picking residue off your nose. But like all fad, Bubblicious, and the rest of the gum industry peaked by the 90s as it went from as symbol of youth and rebellion to thrashy and unhealthy junk at the turn of the century. Investors are currently blowing an AI bubble. It is ubiquitous in everyday lingua franca, enthusiastically hyped, and yet capable of producing something genuinely impressive. But will it have lasting substance beneath the initial rush, or whether we are once again watching a very large bubble being blown?

There are three important developments we will be watching for in 2026. Will a jobless growth lead to an economic recession? Will the AI bubble finally burst? Will Fed lose its independence? Each on its own will have important ramifications to asset allocation; all of them happening together will have serious negative consequences to returns.

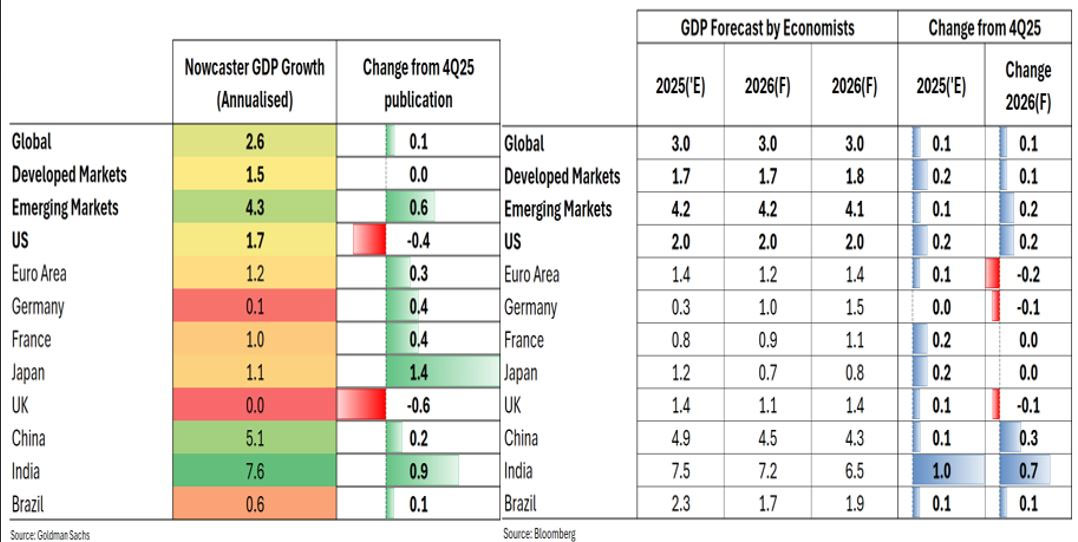

It is remarkable how well the US and global economies have endured the tumultuous and brouhaha of US tariff in 2025. At the start of the year, we argued that consensus forecasts of 2.1% growth for the US and 3.1% globally were overly optimistic, given the rhetoric surrounding tariffs and immigration. Our own expectation was for trend-like outcomes: 1.8–2.0% for the US and 2.8–3.0% globally.

That assessment was tested in April, when ‘Liberation Day’ tariff announcements raised the spectre of stagflation should the proposed measures persist for two quarters or longer. In the end, pragmatism prevailed. A combination of negotiated retreats, asymmetric concessions from trading partners, and selective enforcement diluted the worst outcomes. When coupled with an accelerating AI-led capital expenditure cycle, expansionary fiscal policies, easing financial conditions, and resilient corporate profitability, both the US and global economies are now on track to end the year growing at approximately 2.0% and 2.7% respectively remarkably close to our initial expectations.

For 2026, we continue to rely on our three-pronged framework to assess the global growth outlook. First, near-term momentum, as captured by our Nowcaster, points to annualised growth of 1.7% in the US and 2.6% globally. Second, forward-looking indicators remain constructive: the November Global PMI of 52.7 and US Composite PMI of 53.0 imply medium-term growth of roughly 2.9% and 2.5% annualised. Third, consensus forecasts for full-year 2026 anticipate growth of 2.0% in the US and 3.0% globally. Taken together, the evidence points to another year of trend-like global expansion, no recession.

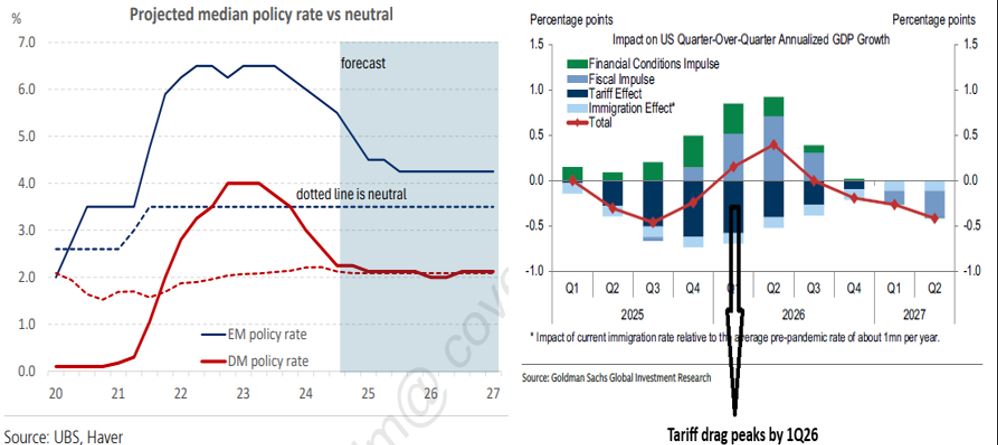

The drivers of growth in 2026 are expected to resemble those of 2025. AI-related capital expenditure remains the dominant force. Spending by hyperscalers alone is projected to rise 33% year-on-year to approximately US$660bn in 2026. Globally fiscal policy will also remain moderately expansionary, supported by higher defence spending across developed markets, the implementation of the One Big Beautiful Bill Act in the US, and a wider augmented fiscal deficit spending in China. Financial conditions are likely to ease further, although the rate-cutting cycle in most developed economies is approaching its end. More importantly, credit impulses are poised to turn meaningfully positive across the US, Europe and China. This reflects a combination of looser bank capital requirements, rising corporate loan demand, and continual government pump-priming. Meanwhile, the drag from US tariffs is expected to peak in the first quarter of 2026 at roughly -0.5%ar before fading sequentially thereafter.

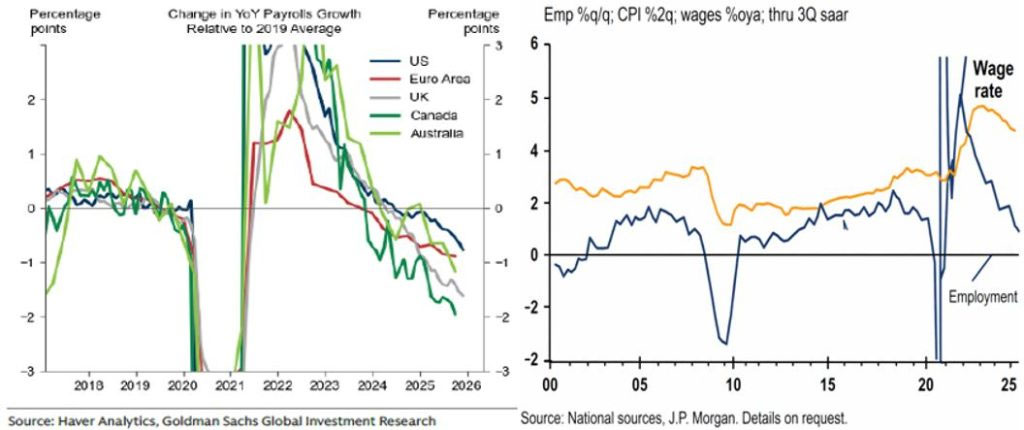

Yet beneath this constructive growth backdrop, labour market conditions have deteriorated noticeably. US non-farm payroll growth has been effectively flat year-to-date and has turned negative since June. The unemployment rate has risen to 4.6%, edging close to triggering Sahm’s Rule — historically a reliable recession signal. Wage growth has slowed to 3.5% from 4% at the start of the year, while hours worked have stagnated, leaving aggregate labour income growth near zero.

This dynamic is not unique to the US. Employment growth across much of the developed world has rolled over relative to pre-pandemic levels, and unemployment rates have risen steadily since bottoming out two years ago. With wage growth stalling, job opportunities diminishing, and food inflation remaining elevated, risk of consumption slowing mounts.

Markets have increasingly focused on the apparent contradiction: a weakening labour market alongside resilient growth. The prevailing concern is that joblessness must inevitably lead to recession. We believe this conclusion is premature.

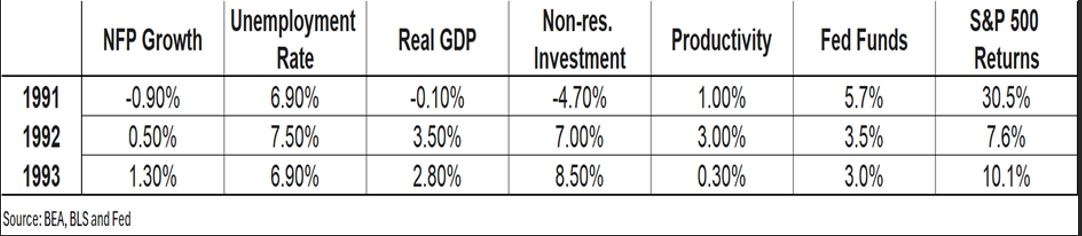

A historical parallel can be found in the period between 1991 and 1993. During those years, non-farm payrolls contracted by 0.8%, unemployment rose from 6.4% to 7.8%, and wage growth slowed to below 3%. Despite this, real GDP expanded by 3.5% in 1992 and 2.8% in 1993. Non-residential fixed investment grew at a robust 7% pace, while productivity accelerated above trend to more than 3%. The Federal Reserve also provided substantial policy support, cutting rates by over 200 basis points. Equity markets responded accordingly, with the S&P 500 delivering a cumulative return of approximately 55% over the period.

That episode coincided with the large-scale deployment of personal computers and enterprise software. Rapid declines in hardware costs, the dominance of Windows 3.0, and the adoption of ERP and just-in-time business practices drove a surge in productivity — a textbook illustration of Jevons’ Paradox.

The parallels with the current environment are striking. From 2026 onwards, AI deployment is set to move decisively into the mainstream. Just as the PC revolution reshaped productivity in the early 1990s, widespread adoption of AI is likely to lift output even as labour intensity declines. Estimates of the potential productivity dividend vary widely, but the direction of travel is clear. Across academic and sell-side research, estimates of incremental GDP gains range from US$1.2 trillion at the low end to as much as US$7 trillion by 2030. While the dispersion reflects differing assumptions, the implication is the same: productivity gains from AI could offset labour market softness for longer than markets currently assume.

Every speculative episode shares a familiar anatomy. Over-estimation of its usefulness, Over-leveraged, Over-owned, and Over-valued. Even when all four exist, the precise catalyst that ends a boom is rarely obvious. Still, this ‘four Os’ framework provides a disciplined way to assess where the risks are accumulating.

Over-estimating its usefulness? As we have shared in our outlook event a year ago, we believe the first use case of AI will come from productivity improvements rather than a killer app. We believe 2026 will mark the year of wide-spread enterprise adoption. The case of coding, customer services, and content creation as the early adopters are simple to comprehend, but this is the year, the more consequential shift is underway where the physical world interacts with generative AI.

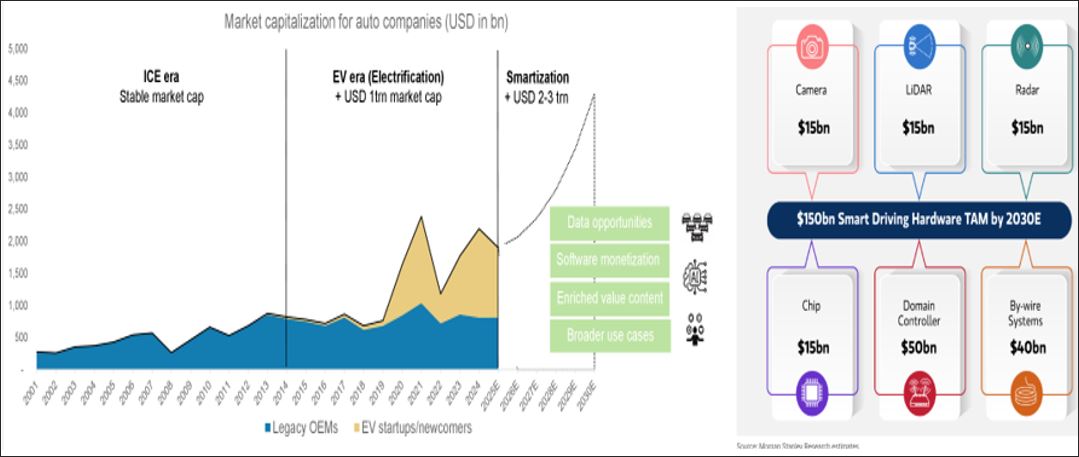

In manufacturing, we are moving from repetitive rules-based, to training based, and eventually to context-based robotics. 2026 will also mark the deployment of autonomous vehicles across many countries. The adaption of vision-language-action AI models will compress L4 driving technology curve. The advent of EV car has already added an extra of $1trn in market capitalization for the automobile market in the last 5 years. According to Morgan Stanely, the “smartization” of cars in the next 5 years could potentially add another $2-3 trn in potential market opportunities. Humanoid robotics will attract increasing attention as well, though we view large-scale deployment as a post-2030 story.

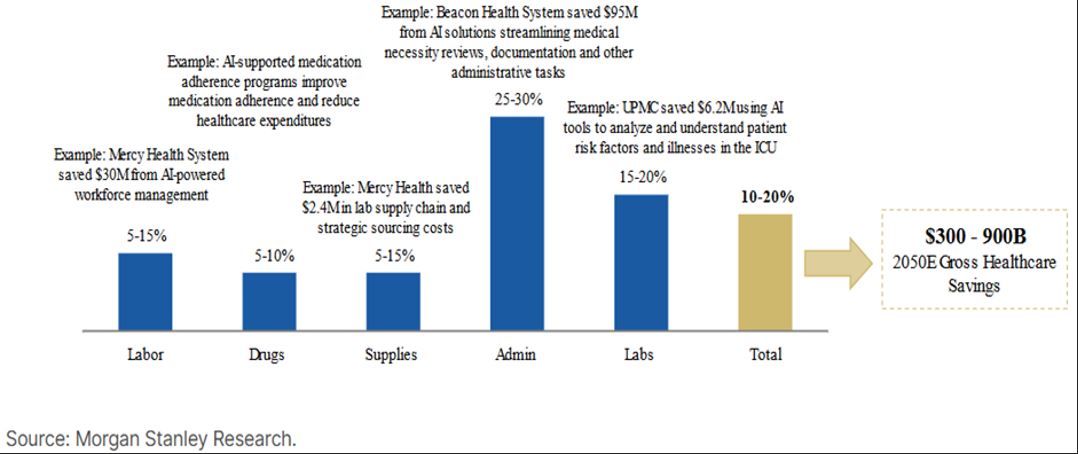

In the healthcare, the deployment of AI will come managing workforce and patient loads, improvement in workflows, and predictive analysis on inventory and patient care. Morgan Stanley estimates that 10-20% of cost savings can be accrued to cost of healthcare amounting to $300-900bn gross saving till 2050.

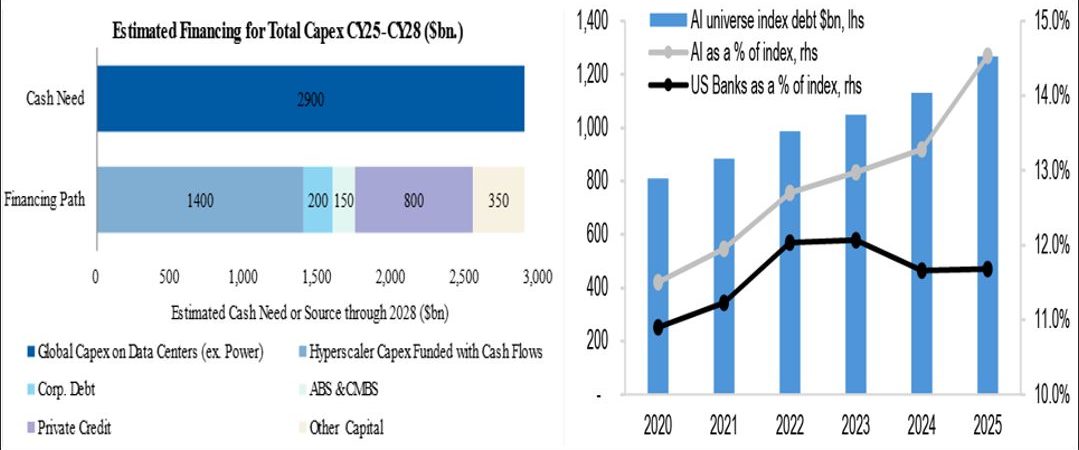

Higher leverage but manageable: It is estimated that the total AI related capex will top $2.9trn by end of 2028. Half of that will be financed by the internal cashflow of these companies but the rest will be via the debt market through a combination of private credit and public debt markets. In fact, AI related debt issuances in 2025 dominates the investment-grade debt market and is now 15% of the market, larger than the second largest sector which is banks at 12%. It is appropriate for investors to gauge the vulnerability of these companies.

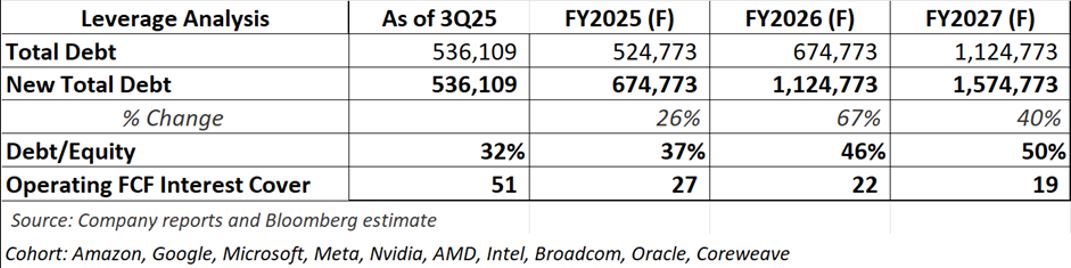

Our analysis suggest gross gearing of this cohort of AI companies will increase from less than 30% in Jun 2025 to 37% by end of this year and peak at 50% in 2027 as their debt financing needs increase. But 50% gross gearing is not a significantly precarious level and if you factor that they collectively held $421bn in cash, their net gearing would have fallen below 40%. The interest coverage ratio will also decline from a high of 52x to 19x but at 19 times cover, that is also a significant buffer. Yes, leverage will increase but as a cohort they are not overly leveraged but some companies are more vulnerable than others, e.g. Oracle and Coreweave.

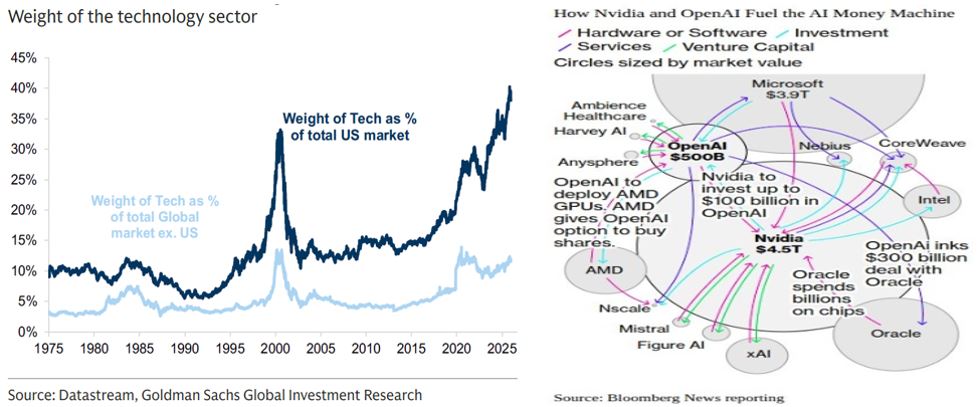

Over-owned for sure: Performance of the so-called ‘Magnificent Seven’ over the past three years, combined with their weight in major equity indices, has left investors heavily positioned. The same is true in VC/PE and private credit markets, where AI has become the dominant issuer.

More concerning is the web of circular financing arrangements emerging around OpenAI, echoing elements of vendor financing seen during the dotcom era. Nvidia, Oracle, AMD and CoreWeave are simultaneous suppliers, financiers, and stakeholders. While this creates concentration risk, it is also highly visible. By definition, black swan events are rare, impactful, and unpredictable. AI is clearly impactful, but given the intense scrutiny, it will not be easy for the vulnerability of OpenAI or others to be concealed within the hype and become unpredictable and an unknown risk.

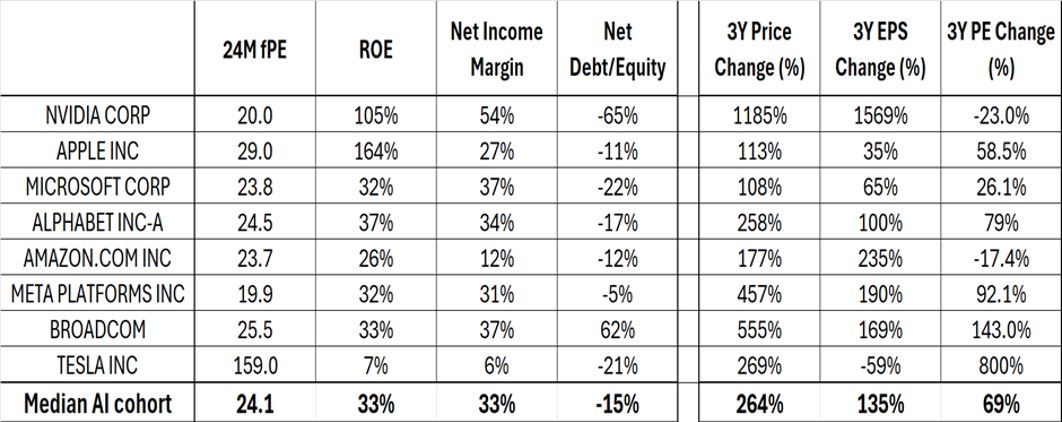

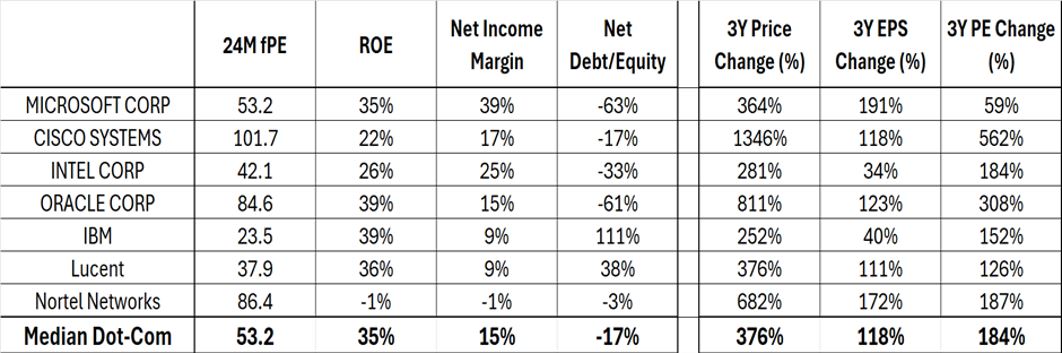

We do not agree that the AI-related names are over-valued. AI-related equities are not cheap, but nor are they obviously overvalued. As a cohort, they trade at 24x 2-years forward PE however their median net income margin is 33% and generates ROE in excess of 25% (except Telsa) and most are net cash companies (except Broadcom). In the last 3 years, their 264% rise share price was supported more by EPS growing 135% in the same period than valuation expansions.

When we contrast the dot-com era cohort, they traded at even more expensive level of 54x forward PE, earned half the net income margin than the AI group, and their share price appreciation of 376% were driven more by multiple revaluation (184% jump) than EPS growth.

The most important lesson I learned as investor of 30 years’ experience is that no housing and financial institutions collapses, frequent boom-bust of oil, and not even a once-in-lifetime global pandemic and can reverse a bull market except that of a hawkish Fed and a commiserating rise in yields.

We do not claim expertise in US constitutional law. Our task, as investors, is more prosaic: to identify, quantify and price risk. The focal point is the pending Supreme Court case, Trump v Slaughter, with a ruling expected in the second half of 2026. A judgement in favour of a broader interpretation of ‘for-cause’ termination would materially expand presidential authority over independent agencies, including the Federal Reserve. Such an outcome would also set precedent for the related Trump v Cook case, potentially allowing the President to remove sitting Federal Reserve governors. While these scenarios remain uncertain, they are no longer theoretical and warrant close monitoring.

The Federal Open Market Committee comprises seven governors. Four of whom were nominated by President Trump and alongside a rotating cast of regional Federal Reserve presidents that does not need to be nominated or approved by Trump. Chair Jerome Powell, himself a Trump nominee, is expected to step down upon the completion of his term. Governor Miran is departing, while Governor Cook faces the risk of removal pending legal outcomes.

Therefore, the composition of voting regional presidents in 2026 should introduces a counterweight to heavy handed political influence. Traditionally dovish voters will rotate out, replaced by more hawkish figures such as Kashkari, Logan, and Hammack. Williams of New York and Paulson of Philadelphia are regarded as centrists. The net effect is a committee in which pro-easing influences may increase but are unlikely to dominate.

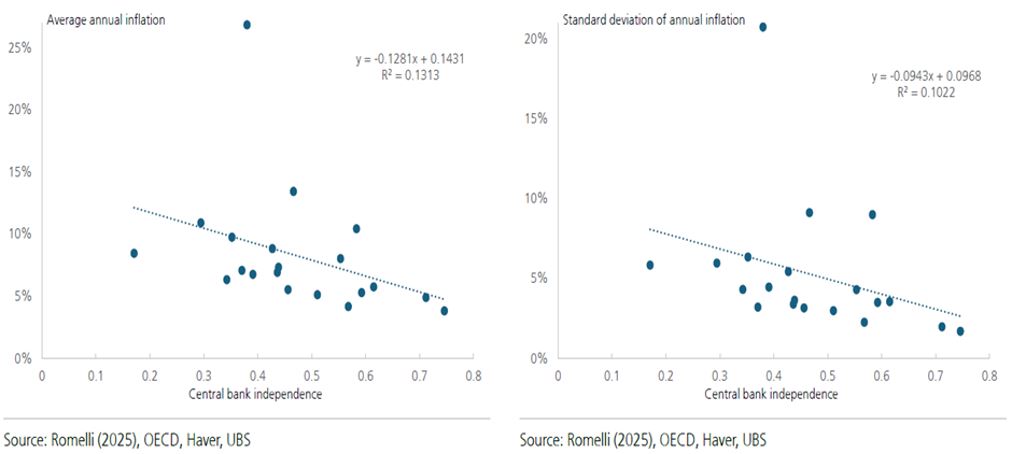

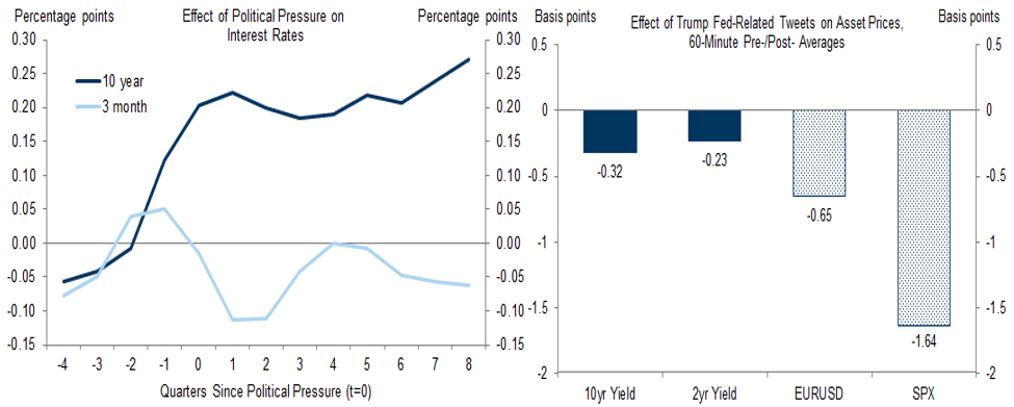

What does it mean if Fed does losses its independence? Empirical evidence suggests that greater central bank independence is associated with lower and less volatile inflation. Freed from short-term political pressures, central banks are better able to execute their mandates credibly. Conversely, political interference has historically been linked to higher inflation volatility and, paradoxically, higher long-end bond yields. While short-term rates may be temporarily suppressed, investors demand compensation for diminished policy credibility.

However, it must be noted both studies have limitations as central banks have in general become more independent in the past decades and the central banks that have been perceived to have lost their independence were mostly emerging economies, not a developed country like the US.

But perhaps, the impact could be far worse for the US? We are already experiencing this in the recent Fed easing cycle. Historically, when a Fed eases. 10-year yield typically falls, The Rare Ones. However, the 10-year and 30-year yields have risen by 10bps since Fed resumed its easing in September. If political pressure intensifies alongside a widening fiscal deficit, the risk is a steeper curve driven by rising term premia even as policy rates are pushed lower. There is the risk that Trump’s meddling of Fed’s dual mandate could eventually stoke higher and more volatile inflation pathways. It is not our base case, but it is a risk investor must monitor.

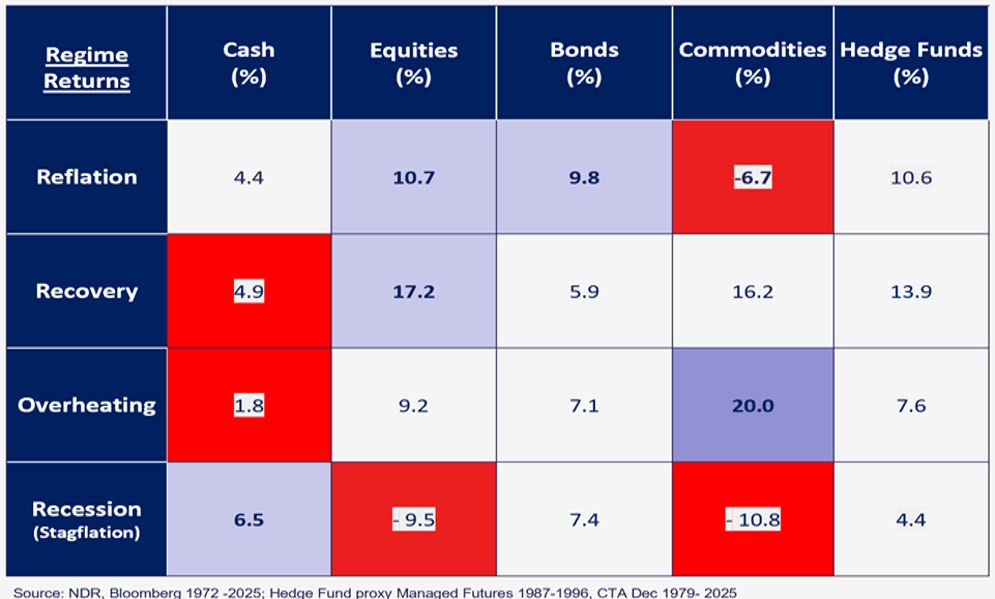

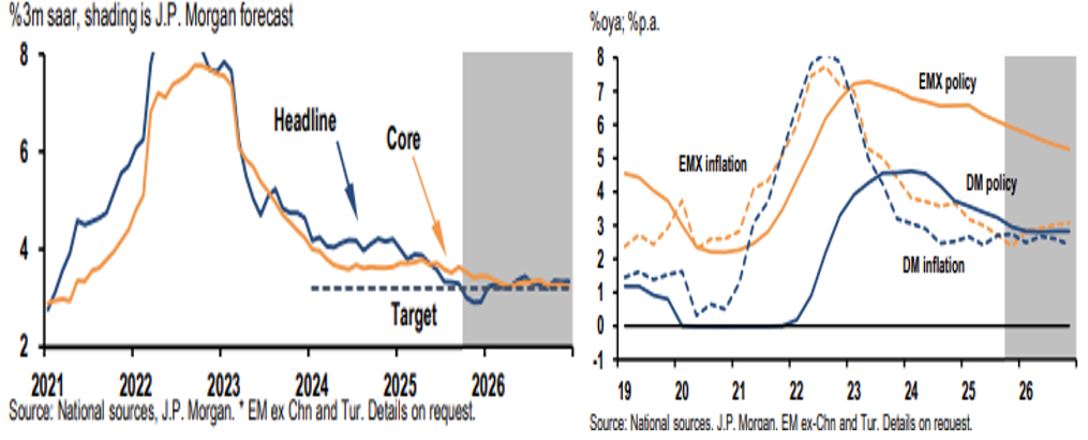

The macro set-up remains conducive for risk assets with growth expected to be trend like. We expect inflation to trend lower albeit still above central bankers above 2% target rate, but the path of policy rate will diverge in 2026. ECB has signalled the end of their easing cycle as inflation is re-anchored to target and growth risk has eased. BOJ needs to hike further as inflation is entrenched. BOE has reverse course from hiking to cutting rates recently citing growth risk outweighs inflation. PBOC will use more off-balance sheet tools than cutting rates outright. Critically, we are out of consensus in our belief that the Fed is near the end of this easing cycle.

This put most economies in the recovery part of the investment clock favouring equities, commodities and hedge funds over bonds and cash.

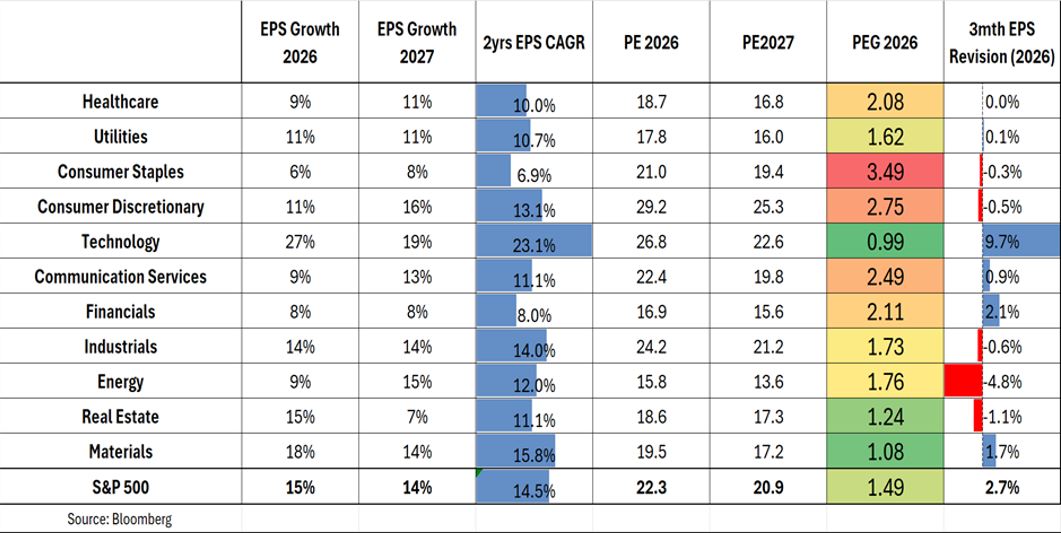

Overweight Equities: The broadening of the bull. The common pushback for equities has always been valuation is steep. We have argued in various publications of the Navigator, I’ll be back, a starting point of high valuation does not mean negative returns in the year ahead. There are 2 key preconditions to overcome the vulnerability of expensive markets. First, EPS growth needs to be positive and second, arguably more important, earnings revision momentum needs to be positive. Case in point, at the start of 2025, S&P was expensive at 22x forward PE or +1.5sd to its ten-year average but it still returned 19% last year. Consensus forecasted EPS to grow 9% at the start of the year, and aside from the momentary post Liberation Day revision downgrade, EPS was consistently upgraded throughout the year and is likely to end the year at 11-12% yoy. If you have been a miser, eschewing returns on the ground of steep valuation, you would have missed out 48% returns in the last two years.

EPS growth across all regions are forecast to be strong with the US markets leading in both growth and earnings revision momentum. However, the growth differential between S&P and MSCI World is set to narrow this year at +2% compared to previous years of 4 to 5% ppt higher. EM markets look particularly attractive from growth, PEG and ERM but overall, we will be taking lesser regional bets preferring to diversify and let bottom-up selection dictate regional compositions.

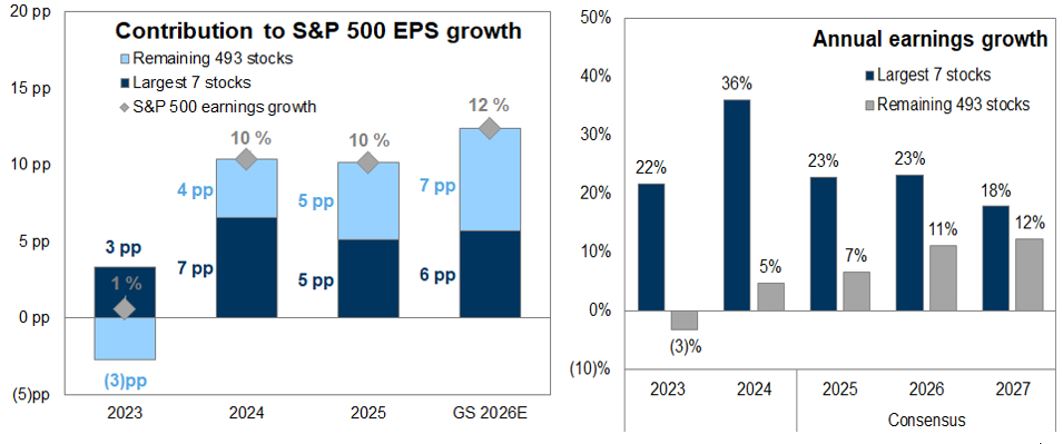

At the US sector levels, we are also seeing a broadening of growth drivers. While still dominated by tech sector, 9 out of 11 GIC sectors will post 2 years EPS CAGR of more than 10% with cyclical sectors like materials, consumer discretionary, and industrials posting growth above 13% in the next two years. If we narrow down to the Mag 7 versus rest of S&P 493, their dominance will also recede in the coming two years. The broadening of growth across regions and sectors provides a larger pool of investment picks beyond the confined narrative of everything AI. All good characteristics of a sustained bull.

We prefer sectors with both value and growth, coupled with endogenous upside catalysts such as financials (greater regulatory forbearance, higher loan growth, and margin expansion), healthcare (under-valued, under-performed but with streams of clinical wins, drug launches, AI-innovation, and end of managed care and drugs repricing risk). In the tech space, we will be more discerning; think inferencing over training, TPUs over GPUs, SRAM over HBM memory, underperforming software over semiconductors. Industrials will be another area we will be looking into as Trump has delivered reshoring initiatives many past Presidents have pledged but failed to do so.

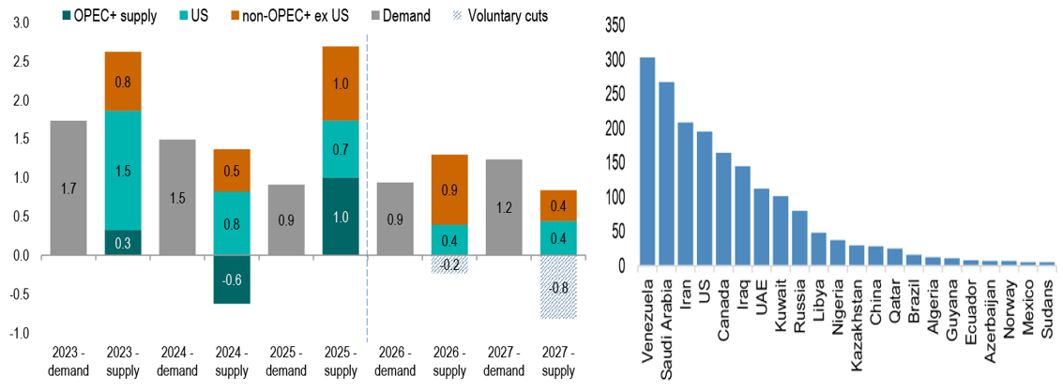

We have held utilities, Who really knows? as a 2nd derivative play on AI for a while now when it was an anti-consensus trade but we believe political headwinds will increase as cost of electricity has become a mid-term election issue. The sector’s valuation is no longer attractive, consensus EPS estimates could be too high, and with Fed at the end of its easing cycle, the added impetus of lower rates for a highly geared sector will fade too. Instead, we are looking into another contrarian trade in energy names on the back of earnings inflecting higher to 12% CAGR in the coming two years versus morbid low growth seen in the past two years. The supply glut that has pervaded the industry in last few years could start normalising by 2H27. Trump’s recent audacious kidnapping of Venezuela’s President should be view through the prism of both risk and rewards. There is risk is that in the medium term, Venezuela supply could flood the market up-ending current forecast of supply balance by 2027, but it could also be viewed as larger production therefore higher revenues for US oil majors.

Fixed Income: Underweight but still an adequate carry to be earned. We believe we are in a shallow Fed easing cycle and do not agree with market expectation of 3 cuts in 2026. The economy is unlikely to head into a recession even as the labour market weakens. The K-shape consumer market means a cautious lower-income consumers, but with middle to high-income consumer experiencing positive real wage growth, higher equity and property values, a large-scale consumption contraction is unlikely. We believe productivity improvement will be evident in the coming 2 years as physical AI takes root across many industries counterbalancing negative immigration flows. Animal spirits evident in the IPO market, higher loan demand, and industries reshoring has put US capex growth at one of its highest levels in a decade.

Taking cue from our empirical research, in a shallow cut scenario, 10-year yields is broadly unchanged, curves flatten marginally, and credit spreads narrow modestly. Our range for US10 yield for 2026 is from 3.80% to 4.20% if a recession is avoided, therefore keeping our duration neutral. We continue to favour emerging markets debt over developed markets. Emerging market economies have demonstrated resilience through a period of pronounced trade policy uncertainty and external shocks. Growth in 2025 has exceeded trend, supported by stronger than expected exports, AI related demand for manufactured goods, and a more gradual implementation of US tariff measures. At the same time, subdued domestic demand and contained wage growth have kept inflation pressures manageable, leaving real interest rates elevated and creating a supportive environment for bondholders as central banks have been able to ease policy without undermining price stability. Looking into 2026, emerging market growth is expected to remain close to trend, with inflation broadly anchored near targets and monetary policy still accommodative.

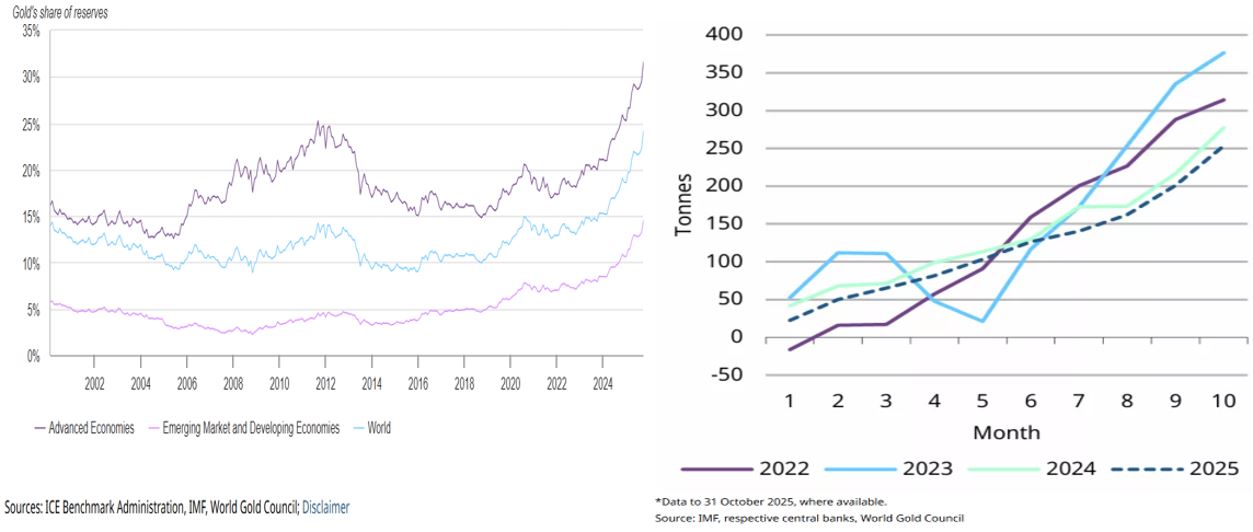

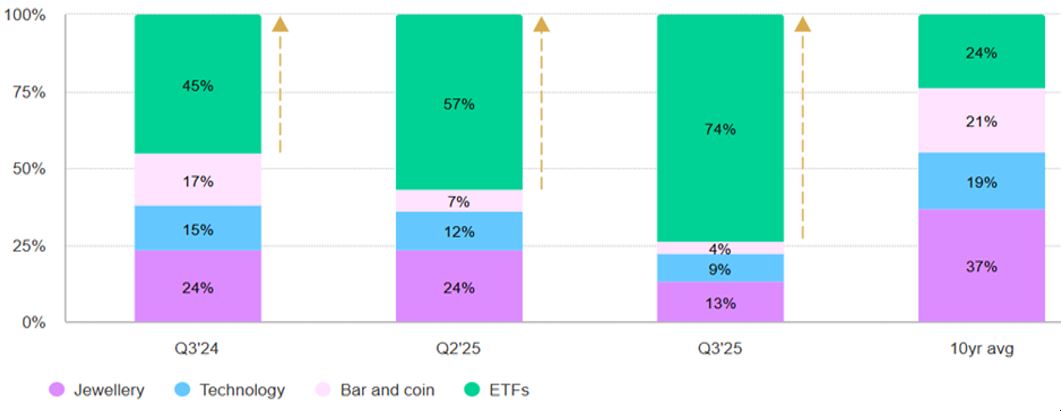

Commodities: Our preference for Bitcoin versus Gold in 3Q25 was premature with the latter powering to all time high but Bitcoin return negative -6% for the year. With Fed and several developed economies nearing the end of their easing cycle, the appeal for fiat alternatives such as gold and bitcoin should wane. There are 2 headwinds for both asset classes and we have reduced exposures in both. We have advocated owning gold as hedge against inflation, dollar hegemony and especially after the world sanctioned and froze all Russian assets in the 2nd invasion of Ukraine spurring many countries to reconsider the dollar holdings in their reserves. We believe this switch has largely occurred with many economies now holding the largest percentage of gold in their reserves in more than 30 years. This is evident when we look at their purchases in the last 6 months where they have slowed down and are more price sensitive. The entire push past our target of $4000 in the last 4 months is driven by easy and speculative money flows into ETFs which could easily reverse if there is a peace dividend in Europe.

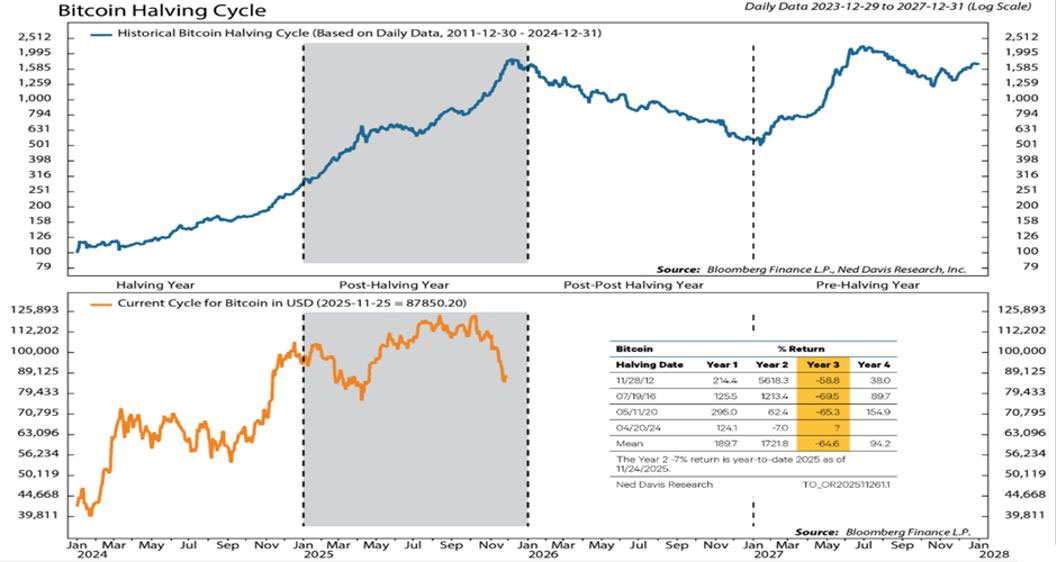

Typically, year 3 post bit-coin halving event, the price of bitcoin fell more than 60%. We have previously contended Bitcoin can escape the scourge of post halving Year 3 blues given widespread institutional interests and bouts of hedging characteristic it as exhibited. But looks like history is repeating itself with bitcoin correcting 31% since it peaked in Oct and is at risk of another -40% correction if history serves as a guide.

Alternatives: No change with 30% allocation to hedge funds. We continue to advocate for hedge funds over all sub-classes of alternatives from the angles that returns are comparable when one adjusted for leverage in PE funds, better liquidity terms, and more transparent mark to market. The holding in our one-stop fund of hedge funds solution have provided an alternative stream of returns that has quintessentially been low beta to equities and almost no correlation to bonds.

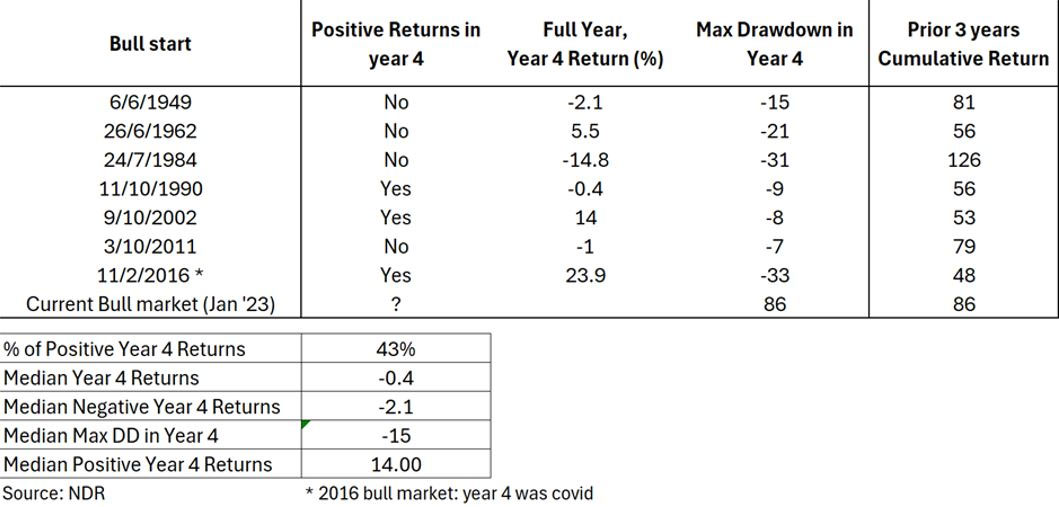

Cash/FX: Will be nimble with cash holding even as we espouse a constructive view because history can humble us. Three historical cues to keep in mind. There have been few bear markets (more than 20% drop peak to trough) outside of a recession, but for the few times it did, it occurred between 37 to 49 months of an ongoing bull market. This bull market is 36 months long now. Second, since 1949, 4 out of the 7 cyclical bull market, the Year 4 returns were negative from -0.4% to -15% in that year. Third, in every of the year 4 bull market, drawdowns are expected and can be large.

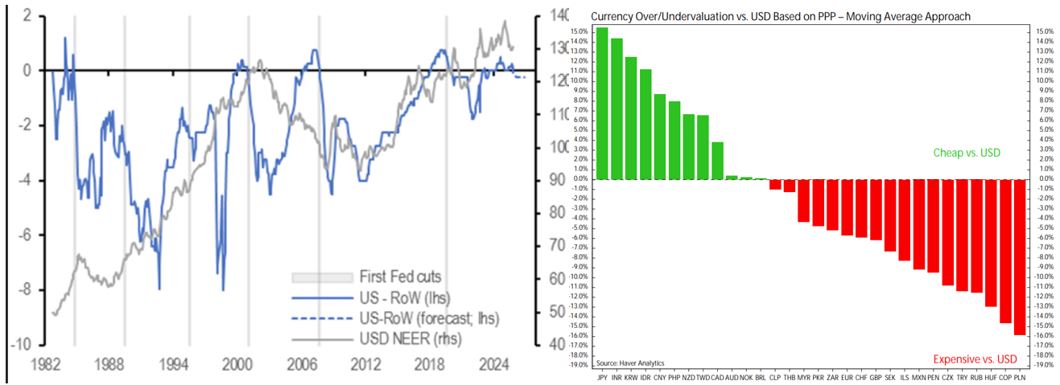

We capitulate on bullish Yen trade. Even as USD-Yen yield spread is now at the narrowest since 2022 and should precipitate to a stronger Yen. The spectre of rising fiscal deficit spending aggravating Japan already the highest debt/GDP ratio amongst developed economies and a reluctant hawk in BOJ has truncated this relationship. On the other hand, we believe the bout of dollar weakness, the worst decline since 2003, is near the end and would be cautious to embrace the widely held consensus call for more dollar weakness. Dollar carry is now the near its four-decades high and on a purchasing-power parity basis, the list of currencies that are more expensive than the USD has increased from our last update. The Pound, Euro, Swiss Franc are 5 to 7% more expensive than the USD.

Featured Picture/Quote:

AI slop is the second-best thing that’s happened to the Internet in a long time.

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.