By Edward Lim

When I was fifteen years old, my form teacher wrote in my report book, “Edward has a vociferous appetite to challenge and question norms. If that energy is channeled properly, he can be a great leader”. I had to look up in the dictionary what vociferous meant and when my dad asked me, I told him she said I was loud. I am sure her intended operative word in that sentence was “if” and not “great”. The common adage in investment is “Don’t fight the Fed”, but that doesn’t mean we should not question or even derided them for their mistakes, after all, the Fed governors are merely human like all of us and not some financial gods. As early as in Jan 2021, After the storm, what comes next?, we highlighted the risk that the market could be under-estimating inflation as a combination of cyclical issues such as overly large fiscal and monetary responses to the pandemic alongside long-term structural changes to operating costs as globalization reverses and decarbonization accelerates. We followed up on this view devoting much of Mar 2021 Navigator, Low and slow. By May 2021, When it peaks, we have downgraded Equities to Neutral on concerns about inflation as well as valuation grounds. In July 2021, Courage on the blocks, we wrote “ We expect a challenging second half of the year. The market will genuflect between economic growth that might be short-circuited by an emerging and even more virulent strain to that of pent-up demand stonewalled by supply chain bottles that could drive a transitory inflationary pressure to become more permanent. Overlayed with the herculean balancing act by central bankers to calibrate the correct monetary policy that promotes growth and full employment without stoking inflation and asset price bubbles.” We subsequently downgraded Equities alongside the underweight in Bonds and raised cash as a defensive strategy. These views articulated in early 2021 were contrarian at that time and had challenged the Fed’s proclamation of a “transitory inflation” and will only move “when they see the whites of the eyes” of inflation. We are again questioning the Fed’s narrative that inflation is stubbornly high and doubt their confidence that their financial maneuvers will not inflict too much economic pain.

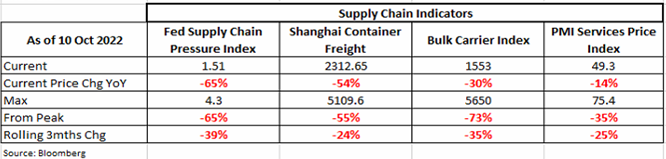

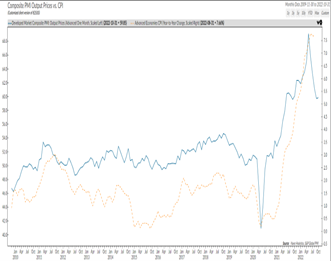

We have highlighted four key inflation drivers that need to be continuously mark-to-marked as detailed in April 2022, Everyone has a plan until they get punched in the mouth. and Jul 2022, The Bear Necessities. They were supply-chain-induced pressures, energy and soft commodities complexes driven by the Ukraine-Russia war, wage inflation, and shelter inflation. We remain sanguine that the first two drivers have moderated significantly and will provide much relief to their respective categories in the inflation basket in the coming months. We track a myriad of high-frequency indicators such as a Fed-devised measurement of supply chain pressure, rates on container freight out of Shanghai, and bulk carrier as barometers of trade and commodities flows, as well as our trusted PMI survey on price. As evidenced in the chart below, all four indicators related to supply chain are substantially lower than their peaks in the year and is also down on a year-on-year basis and on a rolling 3-months.

High-frequency supply chain indicators show pressure is almost absent

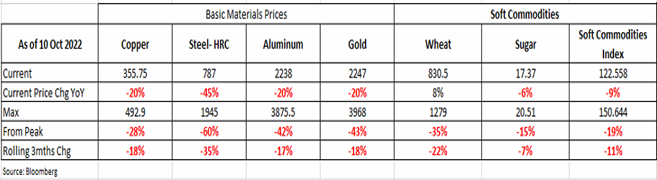

We also tracked the prices of basic building blocks of economic activity such as ubiquitous copper and aluminum. These basic materials prices have similarly fallen on a year-on-year, on a rolling 3-months and from their peaks. When we look at the commodities most affected by the Ukraine-Russian conflict such as wheat, the increase is now only 8% yoy versus the high right after the invasion was a staggering +47% yoy. Wheat has fallen 35% from that peak and -22% on a rolling 3-month basis. The broader soft commodities index is down -9% for the year and is also down from the peak and on rolling 3-months.

Most hard and soft commodities prices are already negative for the year

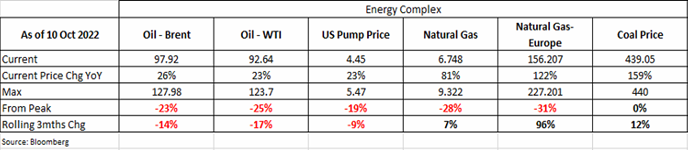

The energy complex is more complicated. This is obviously due to the cartel that operates for its own objectives rather than on free-market principles. Even as OPEC+ tries to maintain high oil prices, Brent, WTI ,and US retail pump prices have also fallen from the peak and on a rolling 3month basis. Natural gas remains elevated, and its reasons are well documented given Europe over-reliant on Russian oil complicated by the messy attempt to coordinate their purchases and to impose price-cap among the EU buyers. The significance of OPEC+ recently cutting output by 2mn barrels on the day of Yom Kippur is not lost among keen students of history.

Energy complex is still up for the year but is off from its peak and delta of change is negative

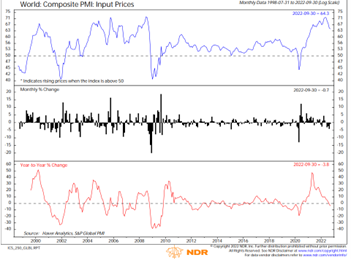

Putting all these data together, we are already seeing companies lowering their expectations of input and output prices. Global PMI-Input Price is already down -3.8% yoy based on Sep’s reading, while the Global Output price has moved down 0.1 point and it is at the lowest reading since March 2021! We have called out the Fed’s inaccurate reading of rising inflation in Jan 2021 and we are now calling out Fed’s poor assessment that inflation is sticky. If my late form teacher was still alive, she would have chided the Fed “Patience is a virtue; haste makes waste”.

PMI Input and Output Prices are fading fast; Fed should be patient

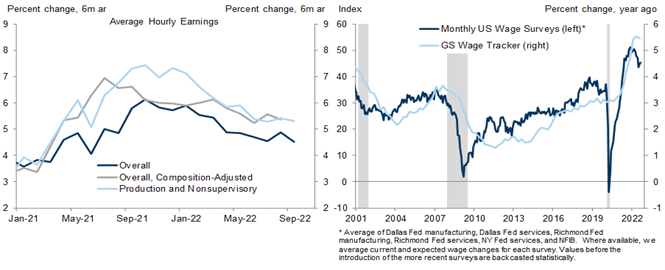

The other two drivers of inflation, wages and housing, are moderating but not as fast as the goods and services segments of the economy. A unique feature of this post-pandemic inflation dynamics has been the attrition in workers seeking re-employment in the lower-wage segment of the economy. This is driven by a combination of lesser mobility, lower vaccination rates, higher mortality rate, and the general reluctance to rejoin workforce as they have enjoyed a large fiscal windfall. The baby boomers were also electing not to return to work but instead to enjoy their remaining sunset years (I can attest to that during my recent trip to Italy. The number of elderly American tourists was overwhelming with one tour guide chiming that she is the busiest she has ever been with American groups in her 40 years in this business even though this was supposed to be the tail end of the season). But there are encouraging signs some of that is reversing. The chat below illustrates a few important points. The wage growth of “Production and Non-supervisory jobs” aka lower-wage segment” has increased at a much faster pace than overall wage growth. Their outsize increase has contributed to the surge in overall wage growth in the early days of reopening. However, the wage growth of “Supervisory roles”, aka higher-wage earners, was growing within its long-term trend of 2.5 to 3.0%. The latest data shows that “Production and Non-supervisory roles” wage is moderating from a high of 7% in 3Q21 to 5.7%; no doubt still higher than long-term trend. This has helped overall wage growth to moderate to 5.0% for its recent high of 5.6% in Mar 2022. Job openings have been slipping in tandem with weaker macro-outlook declining 1.1mn in August. This has allowed the gap between job openings and workers available to fall to 4.3mn down from a peak of 5.9mn. The easing of workers shortage should ease wage pressure in the coming months.

A bifurcated tale of wage growth between production versus supervisory workers in the US

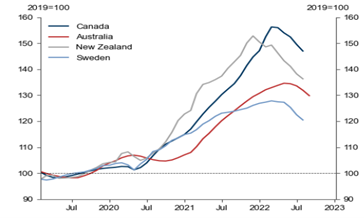

The red-hot housing market in many developed economies has slowed as decades-high mortgage rates is curtailing demand, allowing supply-demand gap to normalize. Home sales in New Zealand, China, Canada, Sweden, and the US are now below pre-pandemic levels after the initial surge of post-pandemic migration from cities to suburbs.

Globally home sales are falling as higher mortgage rates bite into demand

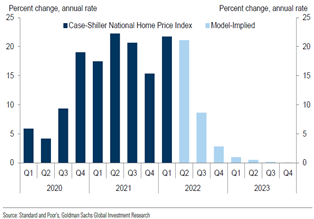

Consequently, home price increases are already negative in China and are falling quickly in Canada, Australia, New Zealand, and Sweden. Some economic models are now expecting US home prices to be flat throughout 2023. Granted that inflation basket considers rent rather than home prices, there will be a lag effect of 9-12 months for falling home prices to feed into the rent component of the inflation basket. The latest rent inflation indicators are pointing to a 6.5% yoy increase, which is 3% ppt lower than the PCE Shelter Index of 9% and that gap is at the widest on record. In summary, three of the four main inflation drivers are moderating significantly and for rent, we expect that the recent decline in home prices will filter to lower rents in the next three quarters.

Home prices are falling and should feed into rent component of inflation basket by the next 3 quarters

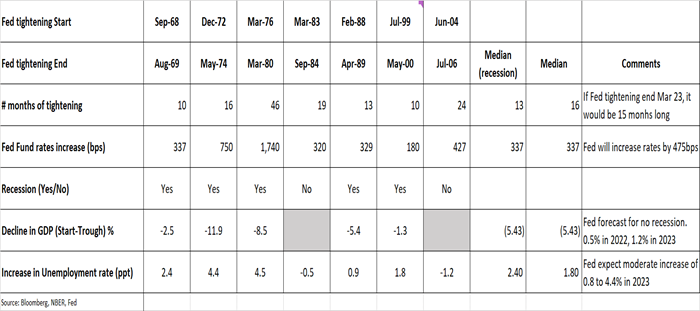

Growth is a bigger risk than inflation. Since 1968, the Fed had to tighten monetary policy 7 times because of rising inflation. 5 out of the 7 episodes, recession ensued. In other words, Fed has a very poor record of engineering a soft landing rendering its latest economic projections as an anomaly. During this episode, the median GDP contraction has been 5.4% and if there is a recession, the GDP decline was larger at -5.4% peak-trough. This fact contrasts sharply to Powell’s Fed forecast of no recession in 2022 and 2023; just sub-par growth of 0.2% and 1.2% respectively. The median increase in the unemployment rate was 1.80% and if a recession ensued, unemployment rate increased by a larger extent of 2.4% defying the Fed’s forecast of just 0.8% increase in unemployment from the current level.

Fed’s track record of a soft landing isn’t great

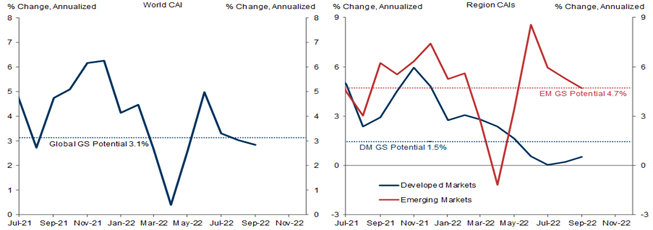

As we have outlined in the previous Navigator, we used a four-prong approach to gauging the probability of recession. Latest nowcasting data points to below-trend growth globally with DM deviating from its potential the most. Global growth is currently growing at 3.1% but in Developed Markets growth is almost zero. Biggest weakness is emanating from Europe as expected with its nowcast at -0.3% and UK -2.6% while the US is growing at meagre +0.6% and that’s on the back of two consecutive quarters of negative GDP.

Nowcast data shows a weak global economy with Europe, UK already in recession and US barely positive

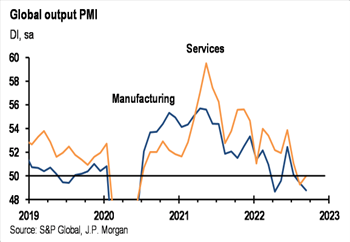

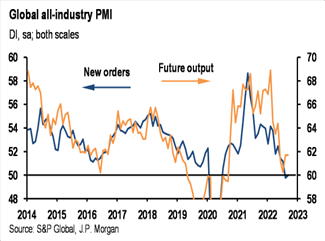

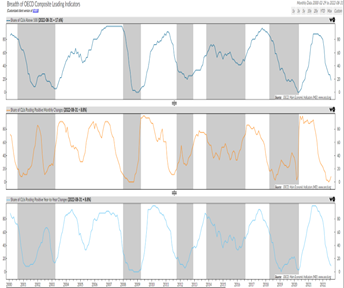

Forecasting data paints an even grimmer picture. The latest September Global PMI of 49.7 is the second consecutive month of negative readings. Weakness is widespread across both manufacturing and services sectors as both indices are below 50 for two straight months. Amongst all of PMI forward indicators, the New Orders and Future Output indicators are very important harbingers of growth momentum. New orders for manufacturing have been below 50 since Jul while new orders for services is just treading above 50 in the last few months. Echoing this weak sentiment is Future Output which has been on a downtrend since peaking in early 2022. These PMI readings are corresponding to a growth slump of only 1.8% ar; far lower than the current full year consensus forecast of 2.9% or the nowcast of 3.0%.

PMI indicators paint a grim outlook on growth in the coming months

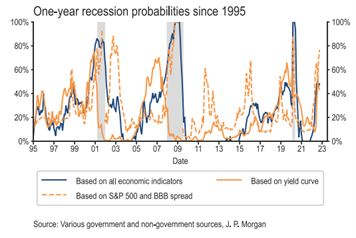

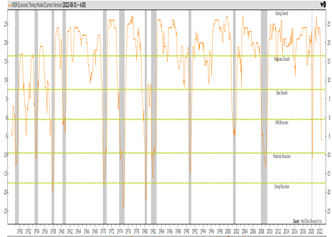

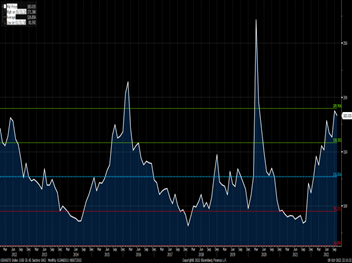

Next, we look at the recession probability models. JPM recession models are all above their threshold signaling levels of an impending recession. NDR’s economic timing model shows we are likely heading into a mild recession.

Various recession models point to high probability of recession

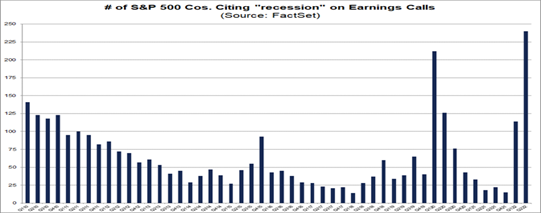

Lastly, we listen from the bottom-ups to what corporates are saying about their operating environment. 3Q22 earnings season will be in full swing in the next couple of weeks, but based on the 2Q22 earnings transcript, we already have 240 companies in the S&P 500 mentioning recession during their calls, well above the average of 52 and is the highest going back since 2010. Key canaries in the coal mines sectors like Financials (85%), Real Estate (73%), Materials (64%) and Industrials (53%) have a very high percentage of companies talking about recession during their earnings call.

Highest on record number of companies since 2010 citing “recession” in their earnings call in 2Q22

At the start of the year, our macro narrative was for the unsustainable surge in the goods segment to abate and for the growth baton to be passed to the services segment as vaccination rates increases and the economies reopened. Given that the service segment is far larger for many economies, our base-case assumption was for the global economy to grow at a trend pace even as inflation bites and interest rates increase. Supporting this consumption resurgence are the high saving rates that consumers can tap on, and the relatively strong corporate balance sheet that supports a capex upcycle. Our view is for inflation to peak in 2Q22 and to moderate quickly thereafter. However, several unexpected developments have adversely affected this trajectory. The Ukraine-Russian spillover effects, reticence of labor to return to work was unexpected, while geo-political risks have intensified and are now played across many spheres beyond US versus China, to Western democracies versus authoritarian system, OPEC+ versus environmentalists. The consumer had to tap into their saving rates to sustain real spending and corporates are now delaying not only capex decisions but marketing and advertising expenses as well. The latest macro data points to an inevitable recession in the brew and the focus now is how severe this recession would be as the risk of policy mistakes have been amplified. The portfolio is positioned even more defensively than a year ago when we downgraded Equities to Underweight. For the first time, our cash holdings are more than our equities holdings, which is already way below the low-end of our 40% range. Our conviction in Treasuries have also increased not just for carry but also as a defensive hedge to a heightened risk of recession.

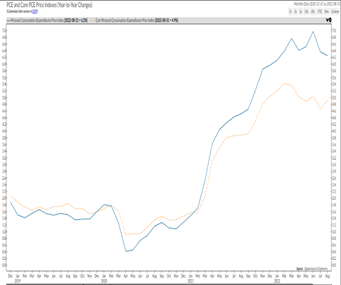

Inflation has peaked and is moderating

But global growth is slowing even faster

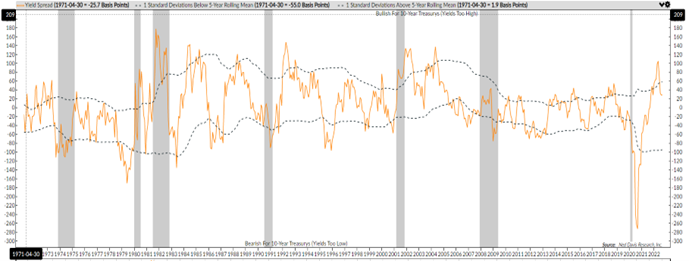

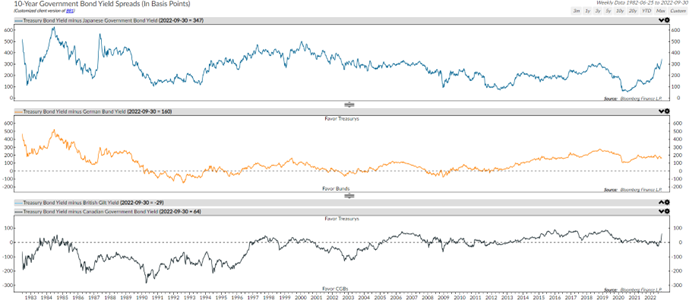

Fixed Income (Overweight in US Treasuries): The key tenet of our analysis is that we expect inflation not only to have already peaked but to fall materially in the coming quarters alongside a pernicious and possibly precipitous decline into a recession. In our last Navigator, we provided a detailed analysis on how we have derived the range where US10 yield should be trading using historical precedents when the Fed was tightening in face of rising inflation. Hence, we are contrarian here and prefer to own long-dated US Treasuries and to own a well-diversified high-grade corporate debt portfolio but are eschewing emerging market, high-yield, and private credit debt structures that lend to vulnerable sectors of the economy. We know from similar tightening episodes since 1960s, 70% of the time US10 yield peaks lower than where the Fed Fund rate is at the end of the tightening cycle, and it peaks 3 months ahead of end of the tightening cycle. Even as the Fed has recently moved its terminal rate to 4.5-4.75%, the latest Fed fund futures show the Fed will front-load the increases and will be done by Feb-April 2023. With history as a guide, we can gauge the US10 yield should peak in this quarter and should trade in the range of 2.4% to 3.5%, ie lower than end Fed Fund rate. From a fundamental valuation perspective, US10 Yield is trading at an attractive level now relative to a regressed model consisting of PCE, 6-months Bills, Real German Bond Yield, and Real GDP Output gap. The current positive spread of +58bps is in sharp contrast of -90bps during periods of recession. From a TINA (There Is No Alternative) perspective, US Treasury yield offers an attractive carry relative to Japanese, German and Canadian government bonds . Owning US Treasuries is also a portfolio hedge if indeed the economy slumbers more than we are currently anticipating as yield will fall further than our fair value computation.

UST10 Yield is 25-50bps too high and offers attractive spreads relative to other govies

We like US investment grade debt as well given the OAS spread of 182bps is trading at the high end of its historical range and is within the recession ranges of 160-250bps. Yield of an BBB US credit is now 5.7% and offers 3.88% pick up from S&P500 dividend yield. This spread is also the highest it has been since 2008. We have recently collaborated with Principal Asset Management; a global investment company based in the US that specialises in fixed income investing. Our mandate is to create a customized well diversified global investment grade bond portfolio that offers more than 5.7% yield and has a short duration of less than 5 years. (Please speak to your relationship manager for more details about this collaboration)

IG debt OAS is at recession level

US IG Yield 5.7% and 388bps more than equities

Equities: We have been underweight Equities since October last year, the longest streak of being underweight on our record. As recession risk has heightened and is arguably inevitable, our past analysis tells us that the equity market could fall further by another 15-20% from the current level as valuation needs to fall closer to 13-15x depending on which valuation metric versus current valuations of 17-18x forward and trailing PE. Moreover, earning revision momentum (ERM) has only fallen 2-3% from its peak while our past analysis shows ERM needs to decline by 9% from its peak to mark the trough of earnings expectation during recession.

Equities valuations are expensive if we are heading into a recession

While we have kept our equities exposures through the last 12 months within 30-45%. In hindsight, we should have made an extraordinary exception to run an even lower allocation. Currently, nearly half of our 35% equity exposures are in long-short hedge fund managers that has demonstrated their abilities to outperform challenging markets including this year. Thematically, we continue to like companies engage in the multi-decades de-carbonization efforts and companies that have consistently compound their dividend. We are conducting due diligence on a long-short technology manager.

FX: Long US dollar overlay. We think the dollar smile exerts its influence for the next couple of months driven by the flight to quality in an environment of beggar-thy-neighbour economics and geopolitics schism.

Alternatives: Our low/non-correlated strategies are now 25% of the portfolio spanning across credit, volatility arbitrage, CTAs and long-short equities managers.

Cash: Cash holdings is large >25% and been put into fixed deposit to avoid cash drag.

Commodities: Nil, the investment clock says we are already in the recession/stagflation quadrant

Oh dear, we are in good hands.

Tenure

FED Governors

Arthur F Burns

Feb 1970 to Jan 1978 (8 yrs)

Economics major from Columbia University

George William Miller

Mar 1978 to Aug 1979 (1.5 yrs)

Law from UC Berkeley and came from private sector

Paul Volcker

Aug 1979 to Feb 2011 (31+yrs)

Princeton and an economist in the Fed

Alan Greenspan

Aug 1987 to Jan 2006 (19 yrs)

Economics MA from Columbia University

Ben Bernanke

Feb 2006 to Jan 2014 (8 yrs)

Economics Phd from MIT

Janet Yellen

Oct 2014 to Feb 2018 (3+ yrs)

Economics from Brown University

Jerome Powell

Feb 2018 to present (Present)

Politics from Princeton and Law Degree from Georgetown

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.