By Edward Lim

In more than my 25 years of this business, I have witnessed many bank bankruptcies, but I have never seen a bank that collapsed due to a bank run and certainty not at the speed of Silicon Valley Bank. More often, many bank bankruptcies stemmed from the impairment of their assets chiefly loans to the consumers, corporates or proprietary investments. These three types of bankruptcies have different resolution duration and magnitude of recovery. A corporate loans instigated bankruptcies typically last the shortest and have reasonable recovery rates. Consumer loans bankruptcies are often the most long-drawn, while blow-ups in proprietary investments are often debilitating and immediate. But a liquidity run bankruptcies is one of crisis of confidence and I will surely learn many important lessons from the demise of Silicon Valley Bank and Signature Bank in months to come especially asset-liability management (ALM).

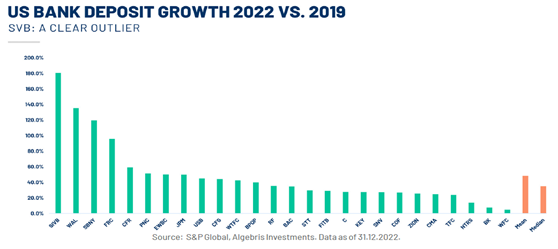

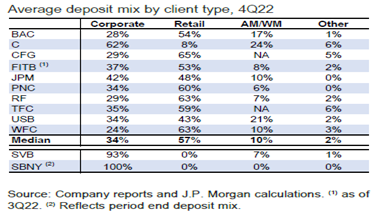

Silicon Valley Bank (SVB) is a truly a textbox study of what a poorly conceived ALM should look like, but still the extent of mismanagement is quite unbelievable. It even operated without a Chief Risk Officer from April 2022-Jan 2023. From 2019-2022, SVB grew its deposit base by 180%, the fastest pace amongst all the banks in the US, surpassing the industry growth rate of 60%. Furthermore, its deposit mix was amongst the most concentrated with 93% of deposits coming from corporate customers, aka VC/PE funds and their investee companies. Corporate deposits are most sensitive to rates. Whichever bank that offers corporates slightly higher bps, the corporates will move funds over. Hence, corporate deposits are considered the flightiest deposits, while retail and asset/wealth management deposits are stickier. This is in sharp contrast to the GSIB (Globally Systemically Important Banks) which has actively managed their source of deposit funding. For eg, Bank of America has a good deposit funding base consisting of 28%/54%/17% of corporate/retail/asset and wealth management deposits. JP Morgan is evenly spread at 42%/48%/10%. Furthermore, SVB’s vulnerable deposit mix is aggravated by the fact it has higher concentration of large corporate accounts with more than 97% of its deposit accounts have balance of $250,000 or more, with an average balance of $4.2mn in contrast to the closest comparison, First Republic Bank, that has 63% of its deposits with less than $500,000. SVB has more than 52% of its deposits coming from PE/VC sector as well. Truly an amazing dereliction of proper liability management.

GS Nowcasting says global economy growing below trend

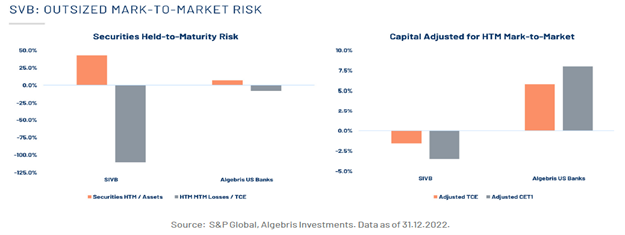

But you cannot fault SVB for having lousy assets. It has total assets of $211bn at the end of last year of which 63% are in liquid assets of either cash ($13bn) or short-term investments consisting mainly of US government bonds ($91bn are held to maturity and $29bn held as for sales). Commercial loans are $72bn. However, the unintended consequence of trigger-happy Fed has wrought significant mark-to-market unrealized losses on its US government bonds holdings. This is again where its poor management of assets is exposed. With 57% of its asset is US government bonds, the risk of unrealized losses on its supposedly held-to-maturity holdings was so large in the last quarter and if they were sold, would have wiped out 124% of total common equity! Even its held-for-sales bond holdings registered -4% mark-to-market loss in contrast to the bank holdings of our alternative capital fund manager which have far less impact than SVB on both fronts.

Never seen such a bad ALM before

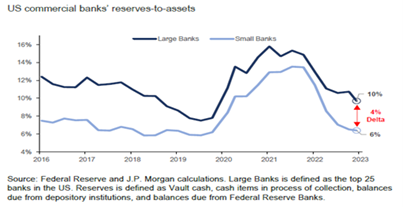

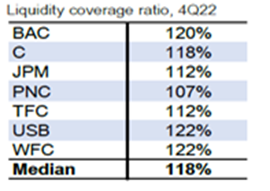

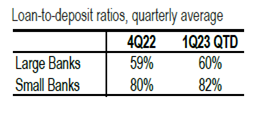

As of this morning, the Fed, Treasury Department, and the FDIC have already announced their rescue plans and we shall not delve further, CNBC: Regulators unveil plan to stem damage from SVB collapse, but instead will focus to ascertain if there will be contagion within the financial systems. Aside from the this morning announcement of the establishment of the Bank Term Funding Program by the Fed and a $25bn Exchange Fund from the Treasury department to prevent short-term contagion, we would argue that SVB and Signature Bank (SB) do not pose a systemic risk. Banks like SVB, SB, First Republic and Western Alliance have total assets of $592bn or just <3% of total systems assets. JPM alone has asset base 6x larger than the four banks combined. The large banks have far larger liquidity buffer than SVB and SB. On average, the large banks holds 4ppt more in reserve to total assets than the smaller banks. Liquidity coverage ratio is well above 100% for the GSIBs and for the record, SVB alongside SB and First Republic have cleverly orchestrated themselves out of Fed’s supervision to maintain this critical ratio. The larger banks’ liquidity is also not as stretched with its loans-deposit ratio at 59% in contrast to small banks 80%, and they have a better spread of deposit mix as well. Lastly, large banks are well capitalized with CET1 ratio as of 4Q22 at 12.1%, 5ppt above regulatory requirement.

Look the same, but ain’t the same

Covenant Capital has no dealings with SVB or SB nor First Republic and Western Alliance. We have asked our custodians this morning and they have all reverted they have no exposures to SVB or SB. In terms of the companies we own across mandates, the impact is immaterial. We have a blockchain PE fund manager that has direct and indirect exposure in SVB and SB, but they have informed us their exposure within the firm is immaterial and will not affect their operation and are not aware of any of their portfolio of companies that will have material issues.

We are not concerned with direct exposure, but we recognize that advertisers, cloud customers, developers, and others in our ecosystem likely have some exposure to SVB

We are not concerned with direct exposure, but we recognize that third-party sellers, cloud customers, advertisers, and others in our ecosystem likely have some exposure to SVB

4% deposits in SB but all will be covered in FDIC original scheme.

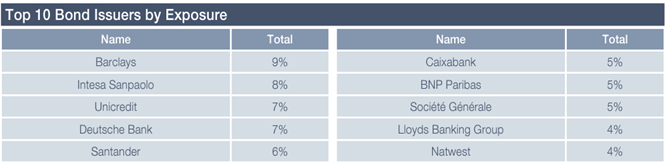

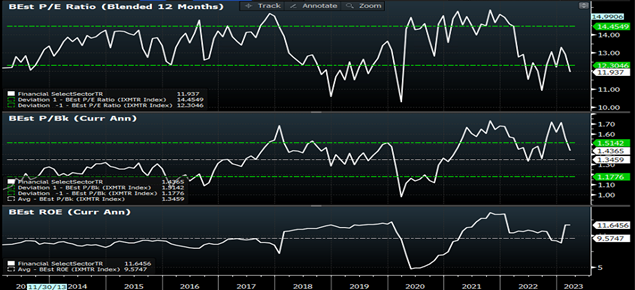

We have exposure in the GSIB banks but we believe this shakeout will be beneficial to them as deposits will flee to them given their higher capital adequacy and better managed ALM. The US Financial Index ETF is now trading at 11x forward PE, 1.3x P/B, 2yrs EPS is forecast to grow at CAGR of 7%, generates ROE of 11-12%, and pays dividend of 2.6%. It looks attractive trading below its -1sd ten-year PE band, and is at the average of its ten-year average PB band, but generated 2ppt higher ROE that the same period. We also own a fund manager specializing in the alternative capital instruments of financial institutions. We are confident in their holdings as they own mostly in systematically important global banks and bulk of their portfolio are in additional tier-1 of the capital structure.

Holdings of our alternative capital fund manager

The US Financials ETF is attractively valued with large banks benefitting from the flight to quality

This is our quick read on market implications and ensuing asset allocation strategies.

Rates (our view is unchanged with US10 trading within 3.5% to 4.0% throughout the year): Market has gone ahead of itself at the start of last week on the back on payrolls and entourage of Fed speakers sounding the hawkish bells. Before this debacle and as late as Thursday, market was pricing the possibility of terminal rate of 6% versus our view of 5.25-5.5%. Market also pushed out first cut from January to April versus our view a first cut could come in December or January. Short of a disastrous CPI on tomorrow, if the Fed would raise by 50bps instead of 25bps, it would be absolutely tone-deaf on their part. We are sticking to our views another 2 more 25bps hikes or at best 3, but US10 yield to trend lower even as Fed fund rates increases.

Fixed income (no change either): Stay in high grade, recession risk is still high. Not forgetting investment-grade debt has longer duration hence will benefit more than high-yield debt as yields fall besides the attendant lower historical default rate but higher recovery rate of IG versus HY

Equities (still underweight): While we like the fact that earnings expectations have been materially recalibrated falling for 9 months now and revised down by 10% since its peak back in June last year and is now within historical norm associated with a recession, valuation is a major stumbling block. Short-end rates is now 4.5% but SPX earnings yield is 5.7% and dividend yield is less than 2% makes it uncompelling from a cross-asset valuation point of view on the back of negative EPS growth for this year.

FX (not quite sure): The interplay between flight to safety to USD in the short-term versus the diverging path of interest rate trajectories between the Fed vs ECB/BOJ, which is medium term bearish, makes it a tough call to be long or short the USD. Just keeping FX exposures neutral to clients’ reference currency.

Cash: Still holding 10% cash.

Victory is sweet, even it is for the moment.

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

As per the PDPA, the below information maps out how Covenant Capital Pte Ltd. collects, uses, discloses, and protects the personal data you have provided to us.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

The below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

a. Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints

2. For our Internal Operations

a. Aid our analysis so that we can improve our services and products

b. Manage the company’s day-to-day business operations

c. Ensure that the information that we have on you is current and up to date

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist Financing Schemes

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities

f. Seek professional advice, including legal

g. Provide updates to you

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service provider

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies

4. Your authorized representatives and any other third-party whom you authorize the company to disclose your personal data to;

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint. Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.