In his epic fight with Evander Holyfield, Mike Tyson was asked whether he was worried about Evander and if he has a plan. Mike nonchalantly answered, “Everyone has a plan until they get punched in the mouth”. Mike had a plan and so did Evander. Mike stuck with his plan while right at the onset Evander’s plan was not going too well. He had studied Mike’s deadly infamous left hook when he will dip to his left to land the punch, but instead, Mike elected to hit right crosses at him. Evander then had to adapt and eventually went to win the bout despite the betting odds of 25 to 1 was in favor of Tyson.

In our 2022 strategy The Long and Unwinding Road, we expect growth to moderate sharply in 1H22 as the unsustainable demand in goods in the past year will peter out in part due to the reopening of economies diverting spending from goods to services. Think of this example. I don’t need another Peloton bike (goods) anymore and would prefer to go to Disneyland(services). The fading of fiscal stimulus including no more helicopter money is another reason contributing to this slowdown. We also posit that inflation will moderate in 2Q22 in tandem with the slowdown in growth but also principally supply chains will normalize as covid restriction becomes less frequent and labour force returns to work. With these macro-dynamics in mind, we upgraded Fixed Income to Neutral for the first time in a while as we forecast inflation to peak in 2Q22 providing breathing room for the Fed to adopt a measured pace of monetary tightening. We kept our then contrarian call in October to underweight Equities but mused they could be a chance for an upgrade in 2Q22. However, history would have it that the unexpected escalation in Ukraine-Russia affairs would deliver such a profound and far-reaching impact to inflation through the channels of hard and soft commodities, and a tightening of financial condition complicating the reaction function of central bankers globally.

The multi-billion-dollar questions are (1) How long and how bad will inflation be, and (2) Has this raised the risk of policy mistakes on the geopolitics and/or monetary fronts such that a recession or worse stagflation becomes inevitable? As the foreword of this strategy has suggested, it is important to have a plan but equally important to be humble and mark to market the assumptions and devise a new plan if required.

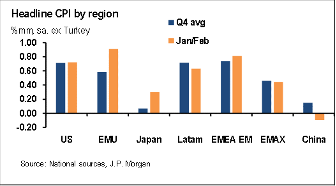

US March Core PCE price index (which is the key inflation indicator the Fed monitors) continued to rise month on month by 35bps or 5.40% yoy. However, with many commodities spiking post Russian invasion of Ukraine in February, we now expect month-on-month and year-on-year inflation prints to trend even higher in the coming months. Even before this war, the jump in inflation has already been broad-based across many regions. The surge in oil and natural gas prices will impact Europe and Japan the most given they import much of their energy needs, while the surge in global food inflation of 9.2% ar poses a significant risk to many emerging economies as the food basket constitutes a larger portion of inflation computation than developed markets.

Broad-based jump in inflation across many regions

Rise in food inflation is the fastest since 2008

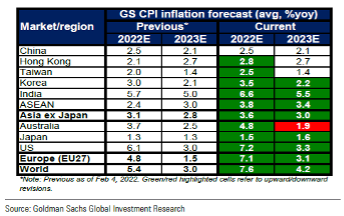

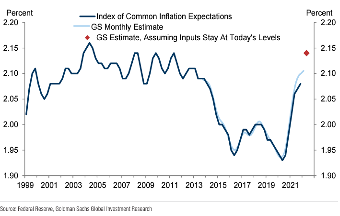

It is no surprise that every economic forecaster has increased their inflation projections materially. For example, Goldman Sachs raised their global inflation forecast to 7.6% and 4.2% in 2022/23 from their forecast of 5.4%/3.0% made just a month ago. The index of Common Inflation Expectations survey, which is an amalgamation of economic forecasts, market participants view of inflation, and consumers and businesses surveys is now at the highest since 2013.

Many are revising upwards inflation forecasts

Survey of inflation expectations have risen too

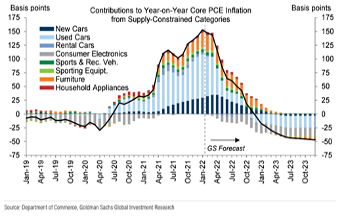

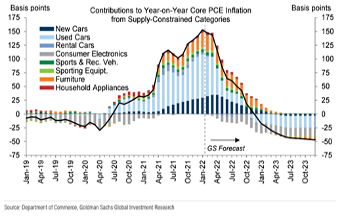

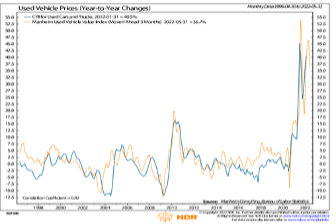

However, we maintained our view that the inflation trajectory will still peak this year but not in 2Q22 as we have earlier forecast, but by early 2H22 instead. As commented in January’s Navigator, there are several cyclical drivers of inflation we need to constantly mark-to-market. Taking the dynamics of US inflation as an example, the main contributor of the surge in inflation in the last 12 months has been car prices including new, used and rental cars. That category alone accounted for more than 70% of the jump in the US Core PCE Inflation. We have argued in our January webinar the automobiles are commodities and automakers do not have any pricing power. The surge is car prices are one-off driven by series of events. Firstly, a dramatic reduction in the pool of cars for both new and rental cars when the pandemic first took hold, followed by a surprise surge in demand several months later as more move out of the city to the suburbs to work from home, fueled by another round of demand from the government largess of transferring money directly to household. At the same time, production of new cars was hampered by wide-scale lockdown in key production hubs. In the early months of the pandemic, semiconductor fabrication facilities diverted capacity from the automotive segment to supply the demand coming from an insatiable consumer tech and when auto demand started to improve, the automotive supply chain was short of semiconductors. All these issues are unwinding now, and we are already seeing signs of auto production accelerating and car prices coming off. Historically, car prices lead its related component in the CPI by 3 to 6 months.

Auto prices is the major driver of US inflation

And they are coming off

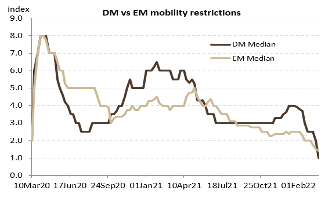

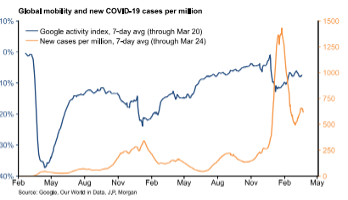

Outside of car prices, we have observed that the supply chain disruptions caused by the Omicron variant is waning. We use a myriad of alt-data to conclude that. The recent Omicron surge across the globe has not led to mobility restrictions unlike the previous waves nor significant decline in Google activity. This improvement addresses the issue of factory lockdowns and labour availability.

Aside from the Delta wave, all subsequent waves of variants have a decreasing impact to mobility

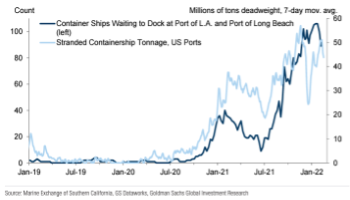

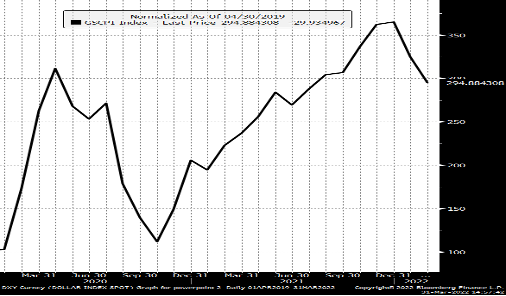

Port congestion remains tight globally with the US easing but China worsening in the last couple of weeks. However, the cost of logistics across air, sea, and bulk have already moderated from its peak, albeit still at substantially higher levels than pre-pandemic levels. We are also tracking a newly developed index by the Fed that tracks supply chain pressure and that has started to moderate but caution we need to see March release to affirm the downtrend since Dec last year is intact.

Port congestion easing in the US but recently worsen in China

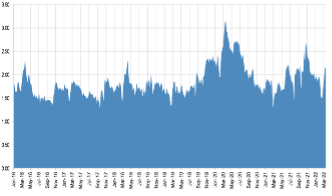

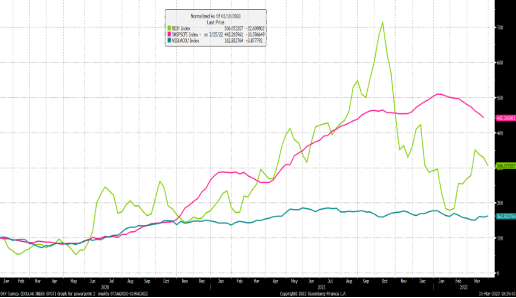

Logistic costs have fallen from their recent peaks

Fed Supply Chain Pressure Index eased

Source: Bloomberg. Green = Bulk rates Pink = Container, Blue = Index of companies in freight and courier. Black = Fed Supply Chain Pressure Index

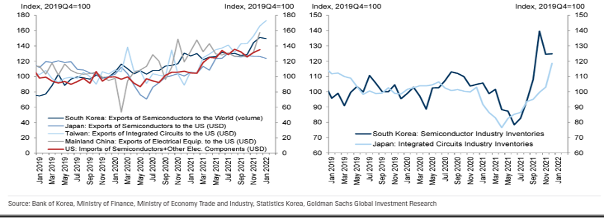

From the early onset, we have disagreed with the consensus view of a severe shortage in semiconductors and argued only certain components in automotive production and graphic cards were. US imports of semiconductors are 135% above the pre-pandemic level while Taiwan and South Korea exports of semiconductors are at new highs. This data reinforced our view and should well suggest there are wide-spread double booking. The front-end and back-end assembly of the semiconductor production cycle are expected to sync now as key back-end assembly countries of Malaysia and Vietnam have eased or lifted restriction since 4Q 21.

Semiconductor shortage has eased since 3Q21

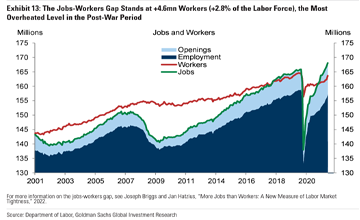

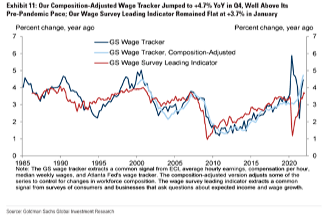

The drivers of inflation we have mentioned above are merely one-off pandemic-induced effects. The sticker form of inflation such as wages and shelter will remain elevated and we do not expect any easing of these two issues anytime soon. The gap between the availability of jobs and workers is the highest it has ever been in the US since World War II. Unlike many countries where labour force participation is already close to the pre-pandemic level, that has not happened to the US. Wages in the US are now rising above 5% yoy and are likely to rise even more in the coming quarters based on several leading indicators.

More jobs than workers available in the US

Surveys point to higher wages ahead

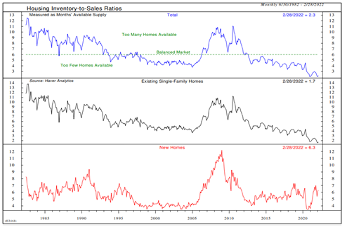

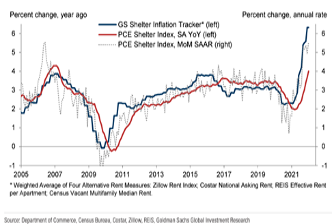

We have commented in last October, Another Lexicon, house prices, and rental rates will continue to rise because the US has under-built homes in the last many years. According to NDR, the US inventory-sales ratio now is only 2.3 months in contrast the long-term average of 6 months. The recent increase in mortgage rates will further reduce the supply as new home sales is down -4% year-to-date. Shelter inflation in PCE index is now running at 4% yoy, the hottest since 2007 before the US housing crisis.

More jobs than workers available in the US

Surveys point to higher wages ahead

On balance, we are expecting inflation to be higher and persist for a longer period but our view that the inflation trajectory will peak out in this year remains intact. This delta of change in inflation is probably more important than the absolute level for shifts in portfolio construction.

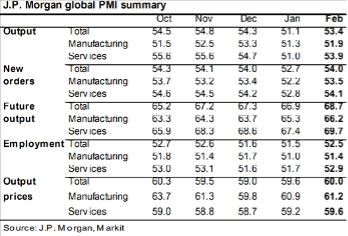

The latest hard and soft data we tracked is pointing to a very strong 1Q22 in the range of 3.5 to 4.0% ar. Forward indicators such as PMIs remain in the expansionary phase in February and flash PMIs released in March post the invasion is still indicating a global economy in firm footing with weakness in Europe and Japan offset by stronger releases in the US. China remains on the watchlist, but we believe it will achieve its 5% GDP target as forward macro data such as Total Social Funding are inflecting higher while the housing market has stabilized in the last 3 months. We understand the impact of a 10% increase in oil prices over a 12 month period to the global economy and inflation ranges from 0.5 to 1.0% reduction in GDP growth and lifting inflation by the same magnitude. At the start of the year, most oil forecasts were between $85-95 and with oil price now at average of $112 post-invasion, forecasters have expectedly downgraded their global GDP for 2022/2023 from 4.4% to 4.0% and 3.6% to 3.5% respectively from their end-Dec 2021 forecasts. Inflation forecasts have increased from 3.50% to 5.1% in 2022 and 2.90% to 3.30%. These numbers suggest a material slowdown from last year’s GDP growth of 5.9% and a jump inflation of 4.0% but these numbers are not recessionary nor stagflationary outcomes.

PMIs still point to a strong global economy

Leading indices for China housing improving

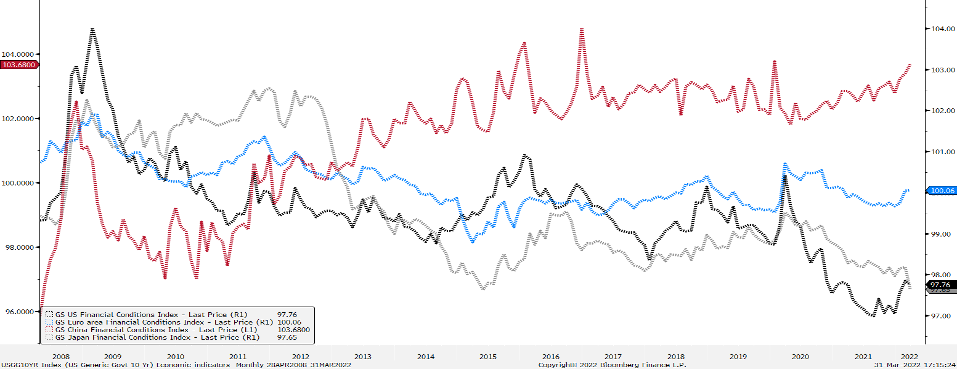

Another important indicator we monitor is Financial Conditions Index. This index encapsulates various market indicators to assess if events have led to a tightening of credit availability and higher cost of liquidity/credit. Since credit is the lubricant of the global economy, this index is often a good harbinger to future growth. Except for China, the Financial Conditions Indices of all regions are nowhere near 2020 covid levels, 2015 commodity shock and EM growth slowdown, 2011-2012 Europe existential crisis, and certainly not the 2008 Global Financial crisis levels.

Financial Conditions Indices have tightened but nowhere near previous crisis levels

Source: Goldman Sachs

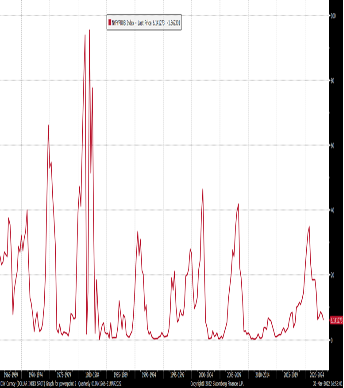

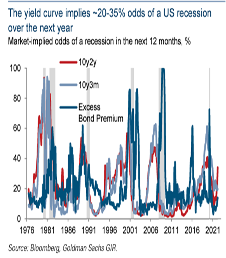

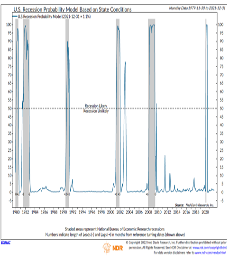

Tracking 3 different recession prediction models: None suggesting one is near in next 12 months.

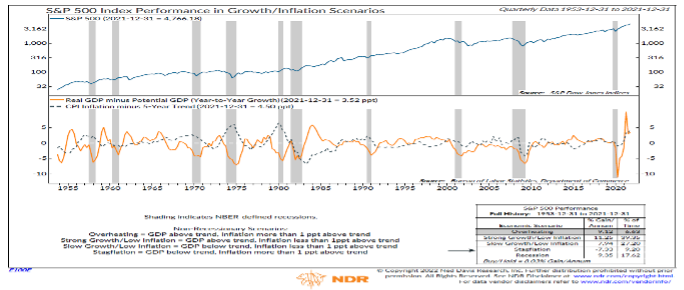

Since the media started touting the world stagflation, we must define the differences between recession and stagflation. Recession is commonly defined as two consecutive quarters of decline in real GDP and inflation falls as instructed by conventional economic theory. Stagflation is defined as slower economic growth accompanied by high inflation and slower economic growth. “Slower economic growth” is loosely defined as below-trend growth which for the global economy it is anything below 3.0%. The US economy has only experienced a few periods of stagflation in 1980, 1974-75 and to a lesser extent 1958-59. If we dissect our ever-reliable investment clock into five phases instead of four: Recovery, Reflation, Overheating, splitting Recession, and Stagflation, there have only been 9% of the time Stagflation has happened since the 1950s in contrast to Recovery (27%), Reflation (39%), Overheating (6%), Recession (17%) according to NDR. Among the five cycles, Stagflation is the only phase that average return is negative -7% for the S&P500. Even in a recession, the average return has been positive 9.4%. Stagflation is a rare occurrence but is the most deleterious phase as returns for bonds and equities are negative from a nominal and real returns perspective. It is important to remind readers that the latest consensus GDP and inflation forecasts are not suggesting this will be the case in the next two years. Neither are we subscribing to that view as well.

Stagflation has rarely occurred but is the worst outcome for both equity and bond returns

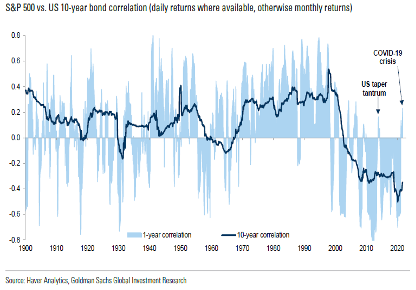

This author is well aware that his formal education in economics only started in the late 1980s. We have been lulled into assuming equity and bond are negatively correlated meaning when bond prices go down (ie yields go up), equities generally go up. However, Goldman Sachs have examined the last 100 years and concluded that this negative relationship is the exception rather than the norm. Only during the Great Depression, the roaring 50/60s, and the late 1990s equity/bond correlations were consistently negative and that is often because inflation is well anchored during these periods and the lexicon of Fed’s put became a common adage.

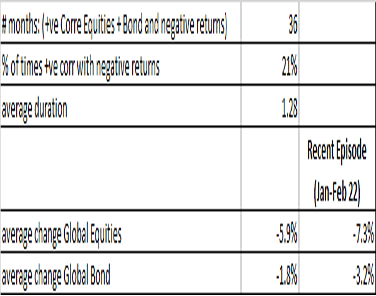

We have noticed that since QE started in 2009, such positive correlations between bond prices going down (yields go up) and equities go down are happening more frequently. There have been 36 months out of 170 monthly returns that the equity/bond correlation is positive and has resulted in negative returns or 21% of the time. But of the 36 months, 7 of them have happened from 2020. The duration of such incidents has been on average 1.28 months which is not a prolonged dislocation but the incidents when it lasted more than the average of 1.28 months have happened more frequently in the last three years. The average declines in those incidents where -5.9% and -1.8% for MSCI World Equities and Global Bond respectively (All source from Bloomberg). The simplest reason for this slow recoupling is that bond yields at such artificially low level as a result of QE have rendered bonds less of a portfolio diversification tool while the elevated valuation of equities has been made possible by cheap and abundant liquidity.

Negative correlations between equities/bonds were exception than norm.

What does this emerging and possible break from conventional wisdom means for a multi-asset portfolio allocation? The conventional suggestion of a 60/40 equities/bond will become riskier as we witness more frequent positive equity/bond correlations with negative return outcomes. Having the liquidity to quickly reposition your public market investments is critical, anchoring the portfolio with predictable income from both physical and financial assets to help generate “passive” cashflows is necessary, and the search for low and uncorrelated strategies has become a bigger imperative for us. On this front, we are quite excited with the opportunities we have recently and will discuss more about them in the next Navigator.

Fixed Income: Neutral and happy to own US Treasury if 10 yield is more than 2.5% even if the real return of the US Treasury is negative, the same can be said for owning Singapore REITs (barely 1% spread), German property, let alone fixed deposits with inflation at such high prints everywhere. US Treasury is still the largest asset class in the world and its relative yield even after currency hedging offers the second-best returns after China government bonds on comparative credit quality. There will always be natural buyers coming from pensions, insurance companies, and foreign governments for now! However, a pernicious outcome of the US and its allies unilateral exclusion of Russia from the SWIFT system will have serious long-term implications on the dollar’s safe-haven status. Sticking mostly to government bonds, unconstrained fixed income managers, low-correlation alternative credit managers.

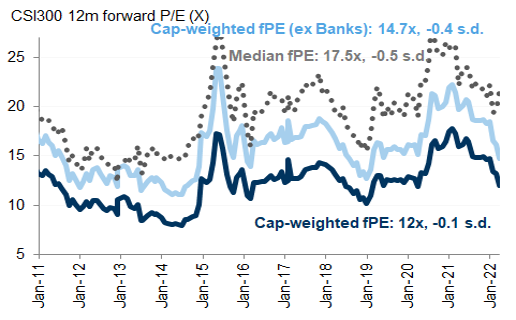

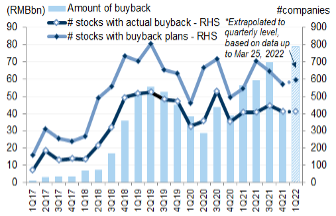

Equities: Still underweight but will be looking to upgrade them when we have clearer confirmation that inflation is peaking and/or long-term yield trades above our target of 2.5%. US equities are now the preferred exposure at the expense of Europe, Japan, and the rest of Asia. The US is the only major country in the world that is self-sufficient in oil and agri-commodities. It now has a well-articulated monetary normalization policy that is in sync with the market, whereas we see the risk of a disconnect between the market and ECB on inflation and the appropriate policy rate in Europe. China economic recovery has been slower than expected but the equity valuations have already discounted much of that as it trades below its 10yrs PE and PB averages and is witnessing the largest shares buyback in the A-shares market in the past few years.

Valuations discounted bad macro and shares buyback in A-share largest in many years

FX: Long US dollar overlay. We think the dollar smile exerts its influence for the next couple of months but as inflation peaks and US yield retreats, we will exit this long dollar trade. Similarly, to the US Treasury, the rest of the world must be casting a cautionary stance of holding too much Dollar after the melee of sanctions the US has waged against China and now Russia.

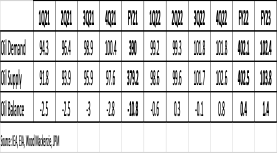

Commodities: Like our Dollar view, we look to exit this trade as we are expecting growth to transition from overheating to the slowdown phase. The math behind the oil shortage is not insurmountable. Russia exports 4.5-6.5 mbd in the seaborne trade. The return of Iranian oil will add 0.80 mbd, US shale is forecast to increase by 0.80 to 1.0 mbd in the next 12 months. The IEA has already announced a 60mb release from its strategic reserves while the US has announced over the weekend a release of 1.0 mbd over an unspecified length of time. There is speculation they will cajoling the IEA to release more in the coming weeks. Saudi and UAE each have 1.0-1.2 mbd of spare capacity if they were to accede to international pressure. Lastly, there is natural effect of demand destruction when oil is so extensive. Time to downgrade the V12 to EV! JPM latest update is now forecasting oil surplus by 4Q22 and into 2023 in contrast to their forecast in Dec for oil to remain in shortage in 2022 and 2023.

This weaponization of the oil and Dollar will certainly fuel an accelerated interest in energy independence. The renewables will get another leg up in investment post-Covid world surge but more importantly, the prospect of large-scale adoption of hydrogen and nuclear fusion technology will be very interesting trends to watch. We will be keeping tabs on them especially nuclear energy. We are keeping our long-structural call on Copper though in retrospect we should have replaced it with a general commodity ETF for a quicker bang for buck.

Oil foecast has tilt from shortage to balanced by 4Q22

Copper inventory lowest in years

Alternatives: Plenty of new opportunities have emerged. Will comment more when appropriate.

Cash: Holding cash 5-10%.

君子动口不动手

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.