By Edward Lim

We see the chronology of blows up in the past 15 months as inter-connected. It first started with the Fed and many central banks normalizing their post 2008-GFC and Covid largesse. The initial gradual increase in policy rates gave way to an overzealous pace of hiking by the middle of last year. The first to unravel was crypto-currencies and its’ pseudo financial intermediaries, followed by NASDAQ peaking around the same time. Nothing is spared with the bond market having its worst performance in 122 years. Just when we thought we had exposed these “lives” of irrational exuberance that quantitative easing has created; it was soon followed British Gilt mini-crisis and the first substantive markdown in private equity/venture funds in more than a decade. The ongoing March 2023 madness of bank runs and bankruptcies underscored this complex web of connectivity and unraveled fault lines. The first is the assumption that rates will stay low forever and cheap financing will always be available for both public and private companies whose mantra was to grow at all costs. All these bombastic jargons associated with the crypto world are but unadulterated shenanigans. The omnishambles of inept management of banks by both banks’ executives and regulators were dereliction of duties at its best. The craziest irony of this March 2023 madness is that it was facilitated by a dying social media platform. A platform that has just changed ownership to a larger-than-life personality who has boldly declared the platform will be an unbridled cacophony of opinions and half-truths.

Swift actions were pursued to stem a global contagion of the financial system with regulators and eagle-eye investors dusting out their established playbook of protocols, policy tools, and plain sensible good ole bargaining. Of course, special mention must be made about the Swiss National Bank which has made its venerated and centuries-old banking system become a pariah in the international community in just one crazy weekend.

By now, you would surely appreciate the choice of title for this edition. However, we believe the excess “lives” do not just stop here. We see two gigantic risks that could derail our more constructive view of the economy and capital markets at the start of the year. We have stated that while it is likely the world will enter into a mild-moderate recession, the rates and oil markets have already priced in this risk and equities are at the tail-end of its bear market cycle.

But before we unbox these two “lives”, let’s mark to market the inflation dynamics. Our view on inflation remains unchanged where we are expecting inflation to decline throughout the year enough for the Fed to pause sometime in 2Q23 and the ECB in late 3Q or early 4Q23. We have emphasized the key inflation data to monitor are housing (as it forms a large part of the inflation basket), wages (given its ancillary contribution to all items in the basket), and the energy/food complexes (as this is the most optically obvious to the man on the street).

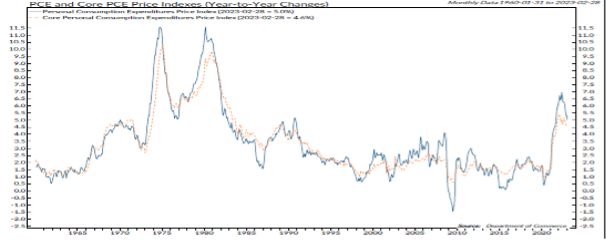

Fed’s preferred inflation indicator continues to trend lower but slower than market is expecting

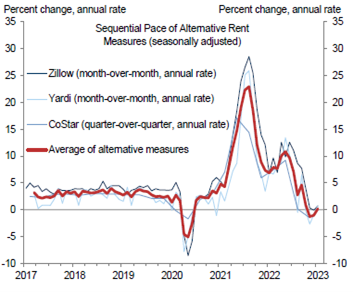

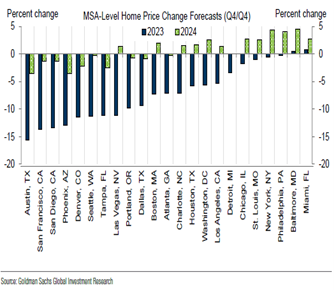

The latest PCE and CPI in the US continue to trend lower, albeit at a pace that is slower than what the market is expecting. However, we remain unconcern because leading indicators of housing inflation have significantly abated. The various high-frequency indices of rent are now at zero yoy growth. The number of homes under construction in the US (258,000 homes) and the pipeline of homes construction not started (94,000 homes) are at levels similar to the pre-2008 subprime crisis. The inventory of completed homes has now recovered to 75,000 homes level, which is consistent with the average of the last 5 years pre-Covid. This has doubled the inventory-to-sales from an all-time low of 2 months during much of 2020-21 to 4 months; 2 months short of its 50 year historical average. Home prices across many states in the US are under pressure as inventory increases while demand frays due to higher mortgage rates.

Rents growth has stalled

Home prices are forecast to decline across many states

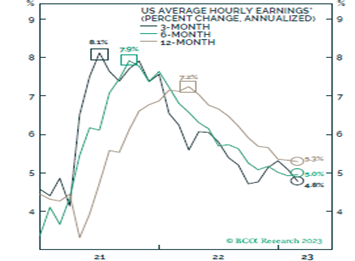

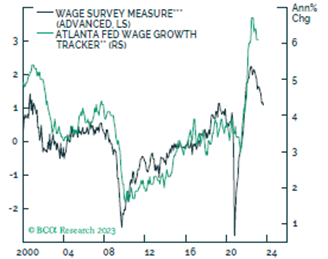

As we have detailed in Don’t call the car mechanic when it is the bathroom that is leaking, the unemployment rate is a late indicator to track wages as well as the health of the economy. Using data since 1968, we note that in all recessions, the unemployment rate trough before the official start of a recession. In fact on average, unemployment trough 9 months before the start of a recession. Moreover, most of the time, unemployment only peaks after a recession has officially been declared over. In other words, the Fed’s use of unemployment to gauge whether it should pause or to continue to hike is so misguidedly late. For the record, since 1968, the Fed’s track record of engineering a soft landing is limited to only 2 out of 7, and on average unemployment rate rises by 1.80 ppt. The latest actual hourly earnings and forward-looking surveys collaborate with our views that wages will fall quite quickly. We believe it might fall faster than housing and rent inflation.

Wages are slowing

Survey points to further weakness

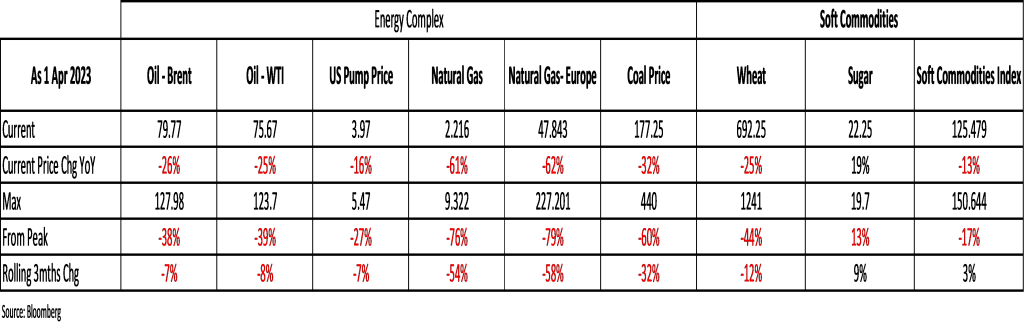

The cadence of supply chain disruptions on the food and energy prices has slowed even more in the last 3 months. Oil prices are down more than -25% yoy, US pump price has fallen -16% yoy while Natural Gas prices decline on yoy basis are steeper than oil. All the energy complexes right down to coal are seeing declines on a rolling 3-month basis. Wheat prices are down -25% yoy and -12% on a rolling 3-month basis while the broader soft commodities index that includes (wheat, hogs, and orange juice) are down -13% yoy. While readers may dispute these observations given the price of chicken rice has increased or the portion has shrunk, we would argue there are other factors in play such as GST increases (Singapore) or logistical red tape (Brexit), and argue that the moderating prices of primary food ingredients should feed to lower prices in the intermediate term; pardon the pun. Lest we forget, all food-related commodities have a short production cycle.

Energy and food prices are falling

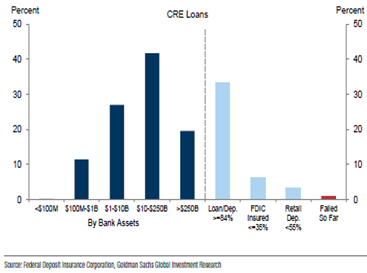

The first connected “life” to unravel is the global commercial real estate sector. Long-time readers would have heard us mention many times that the biggest beneficiary of this dysfunctional monetary policy is that it made every real estate investor a genius. The recent developments in the banking sector have finally short-circuited the liquidity spigot and the days of masquerading interest rate arbitrage as property asset enhancement initiatives are over. Only after the debacle in the Silicon Valley Bank and Signature Bank did we know that the smaller US banks played a disproportionately meaningful role in this sector. Using the US as exemplary tale of caution, we estimate the stock of borrowings from the commercial real estate and retail sectors is at $1.75trn and another $461bn is in construction and land development loans. The loans to these segments have grown 25% from the start of 2019 to February 2023, outpacing the overall banking system loan growth by a mile. 80% of these loans are held by smaller banks with asset size less than $250bn. Aggravating this concentration, regional and local banks’ market share has been increasing, and in 2022 they were the largest lender to this segment.

Small banks account for lion-share of CRE loans

and their market share has increased the most

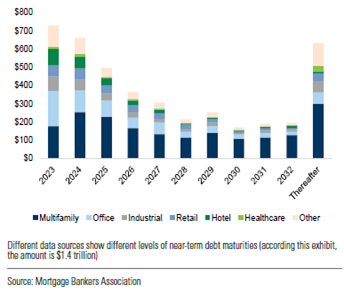

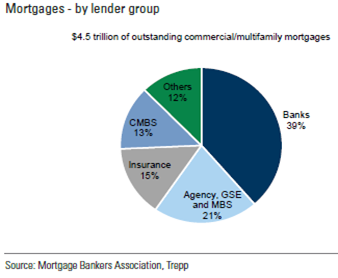

The sector must also contend with a wall of loans maturing in 2023 and 2024. Of the more than $1.1trn debt maturing in 2023 and 2024 in the entire real estate loans, more than $500bn is related to commercial and retail real estate. If these loans struggle to be refinanced, will there be aftershocks to the entire commercial/multi-family mortgage market which is $4.5trn in size. Aside from the banks, the second largest holders of these debts are agency and non-agency mortgage-backed securities, ie held by fund managers (21%) and life insurers (15%). This will be systematic in nature if defaults increase. Even if they can refinance, it will be at least 2 to 3 times higher than their prevailing cost.

Bulk of 2023/24 loans due are in Office

Can it have a knock-on impact to the larger market?

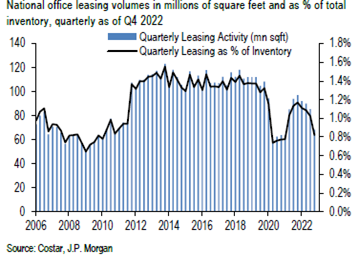

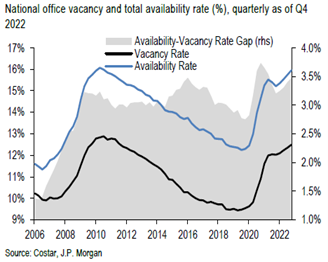

The fundamentals for this sector are not encouraging as well. After an initial recovery in leasing activity post reopening, interest has fallen in the past few quarters and vacancies have crept up to 2008 GFC high.

Office leasing interest has cooled, and Vacancy Rate is at 2008 level

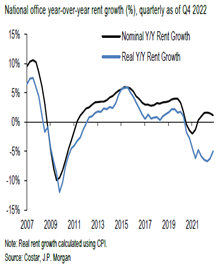

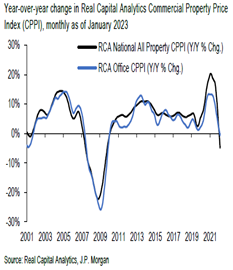

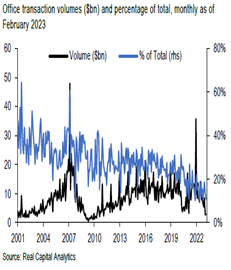

Current real rentals when adjusted for inflation are now negative. Even if the owners were to dispose of them, they will be transacted at unfavorable prices with the latest price data pointing to negative growth. Transaction volume has also slowed and that complicates exits.

Real rents are now negative

Prices are now negative yoy

Lackadaisical transactions

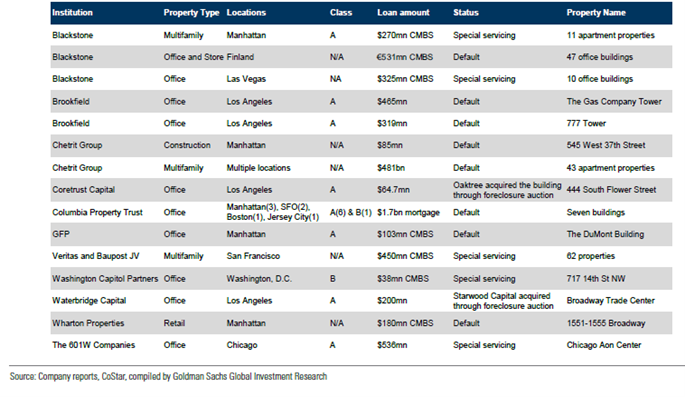

And this concern is not confined to the US. In the last four months, we have had so many conversations with managers across the globe. Late last year, a manager that specialized in lending to commercial and residential developers in the German market commented that his second largest borrower which had been a client of theirs for the longest time, has defaulted on its loans. The developer cited he was unable to secure refinancing from several of his German banks because the banks have decided to pare down their exposures in real estate. This borrower is one of the largest privately held developers in Frankfurt. One of Singapore’s largest real estate conglomerates has asked for an extension of its property fund that invests in student accommodation across the US and UK after it was unable to sell off the remaining assets when the fund life ended last year. In the call, they commented that while the occupancy rate has increased, accommodation rates have not. It is also hit with a double whammy of higher operating costs and higher refinancing such that its gross property yield barely cover its interest costs. Even if there are buyers, they will be selling at 20% lower than what they paid for 5 years ago. One of the largest property fund managers and developers in the US recently defaulted on its loans for two Class A buildings in LA for a total of $784mn. We all know that Blackstone exercised the right to halt withdrawals on one of its largest property funds just several months ago. All of these are not isolated events and all of them happened even before Mar 2023 madness. We are now expecting banks to rein in their lending further as they will be regulated even more tightly, and depositors will be scrutinizing them even more closely. Oscar Wilde once charmed “The public is wonderfully tolerant. It forgives everything except genius” and the time for the real genius to show themselves is now.

Several high-profile commercial property defaults since the start of the year

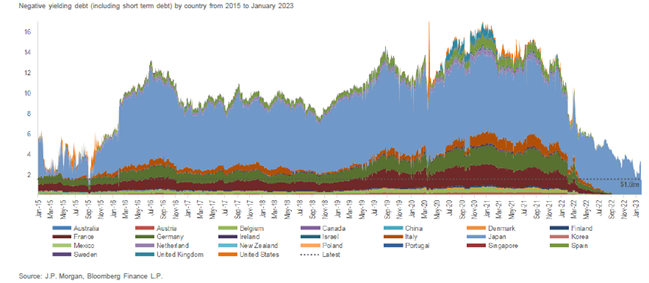

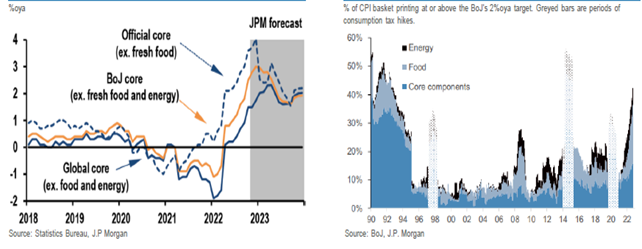

Japan has the undisputed inventor of both ZIRP (Zero Interest Rate Policy) followed by NIRP (Negative Interest Rate Policy) Bank of Japan (BOJ) is also the first central bank to embark on QE. You can trace the advent of their unorthodox policies as far back as in the late 1990s when its economy stalled after decades of runaway growth and excesses. It started with ZIRP in 1999, followed by QE in 2001, and post-GFC, they joined the other global central banks to explore the world of NIRP. Japan was deep in QE even before the lexicon was created and went mainstream! All central banks have now exited the experimental NIRP leaving Japan as the only central bank still mired in it. Japan is now the only remaining negative-yielding debt stock in the world with a total size of $1.56trn with the Bank of Japan holding close to 50% of its bonds. However, inflation is now running twice the BOJ’s target level, it is time to call on the curtains of this long experiment. What does the end of this inter-connected “life” mean for its economy and the rest of the world? We have already seen the pernicious first and second-order effects of Fed, BOE, and ECB tightening, but BOJ will be engineering the mother of all tightening sometime between now till 2024. The market consensus is calling for BOJ to widen its yield curve control by +/-100bps in the next few meetings with a shift towards guiding the front-end of the treasury curve, followed by the abandoning NIRP sometime in 2024.

Japan started NIRP and now is the only country left in the yoyo land of negative -yielding debt

But the time to leave NIRP is now as inflation has overshot BOJ’s target

The most likely sequence of Japan’s monetary policy normalization

We attempt to analyse the ramifications of this exit and we stress the operative word is “attempt” as we can only identify possible spillover effects while acknowledging there are many hidden risks our feeble mind has yet to identify. We start by categorizing the domestic impact of the BOJ shift in monetary policy. On the fiscal side, as Japanese Government Bonds (JGBs) yield increases, debt prepayment burden will also increase. This will have a negative impact to contributions from BOJ to the Ministry of Finance, therefore, curtailing future fiscal programs especially now that Japan is embarking on an expensive military upgrade to the tune of at least $55bn a year. Japan could face similar risk to the British Guilt crisis in November last year when leveraged accounts have to dump Guilt bonds aggressively forcing yield even higher and necessitating the central bank to back-pedal it’s plan of quantitative tightening. It has to be careful not to impede the functionality of the JGBs market as any sharp and quick jump in yields will result in substantial unrealized losses for BOJ and the financial institutions; similar to what we have seen in the UK and in Silicon Valley Bank, Down in the valley to pray. The saving grace is that BOJ and Japanese financial institutions are the only holders of JGBs therefore limiting any international fallout. On the impact on the economy, the Yen will rise which will hurt its export engine but will support domestic consumption.

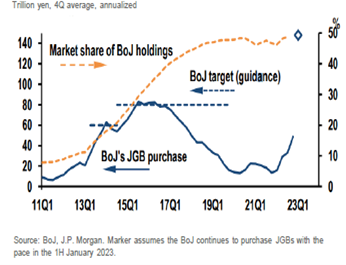

BOJ is the largest holder and only buyer of JGBs

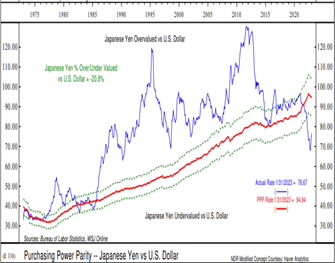

Yen is cheap relative to USD

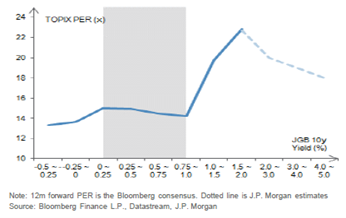

As for the domestic equity market, the path of returns is more complex than the above possible outcomes. Higher inflation allows corporate profits to increase as they can pass through rising costs to consumers. Historically, TOPIX valuation has risen when yield rises but at the same time, we know Japanese equities tend to underperform when the Yen strengthens. This is further complicated by the BOJ’s QE program where it holds Yen38 trn of stocks and ETFs or 10% of the entire market capitalization of TOPIX.

End of deflation is good for valuation multiples

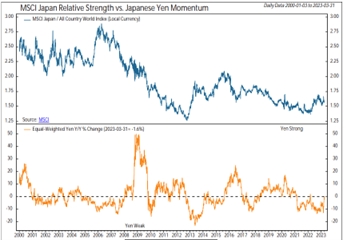

But a strong Yen has historically been bad for equities

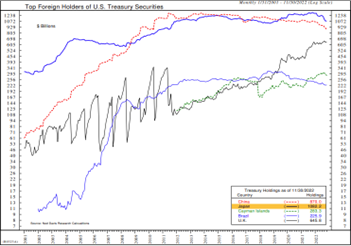

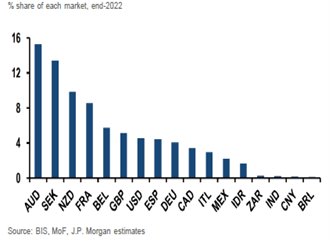

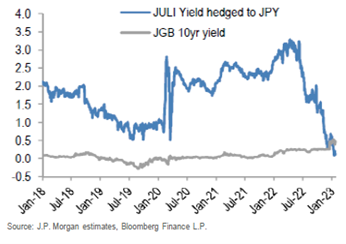

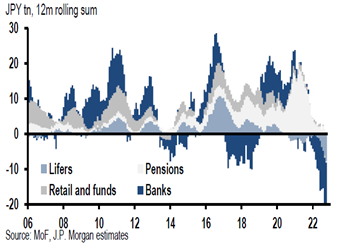

However, it is the international ramifications of BOJ exiting NIRP that worry us the most. Japan is the largest holder of US Treasuries worth US1.08 trn (>4% of total stock of US Treasury). It is also a significant investor in other markets controlling 15% of the Australia debt stock, 13% of Sweden, 10% of New Zealand and 8% of France. On a hedged basis, the 10-year JGB is now yielding more than the yield of US high-grade debt. Rising domestic yield and a higher cost of hedging have since triggered flight back to domestic bond market with them selling a record volume of foreign bonds in 2022. Japanese companies are also the leading FDI investors globally accounting for 25% of the global cross-border credit. Would they start pulling back on their overseas investments now that the carry trade of borrowing cheap Yen to invest in the overseas project is diminishing? The obvious outcomes from the above observations are the repatriation of Yen back by domestic investors back to the domestic capital markets and the subsequent unwinding of the biggest and longest carry-trade of all time. Think Softbank. The less obvious is the pace of withdrawal; will it be a tsunami or a stream? Ueda-San has his work cut out for him!

Japan is a colossal player in the global debt market

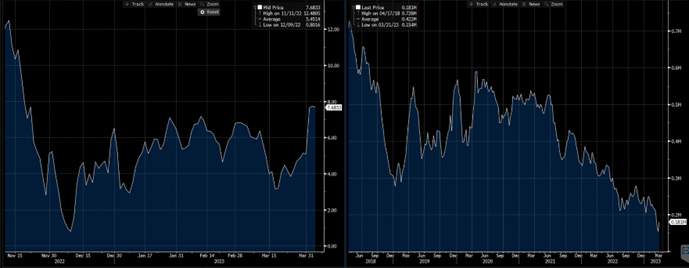

JGB yield > US HG hedged Yield

Leading to Mr and Ms Watanabe coming home

There is a plethora of assumptions and decisions that an investor must make. Will central bankers continue the path of tightening at the expense of financial stability? Can they assume central bankers have enacted enough stabilizers to prevent another bank run? How deep will lending be reined in as the fight for deposits and tougher regulatory scrutiny kicks in? Or perhaps growth will defy forecasts as it has in the last quarter leading back to the question of whether inflation could increase further. What about these two stress points mentioned above? Collectively they are larger than crypto market, the combined assets of SVB, SNB, and Credit Suisse and even the peak of the sub-prime debt.

We judged the first risk to be more imminent than the second, though the second risk is far more grievous and has longer tentacles in its global reach. We have seen reports that the first-order impact of banks reining in their lending will shave 0.5% to 1.0% of GDP for the US which would tilt the economy into recession in 2H2023 – 2024. We have seen reports that estimate the commercial real estate exposure losses could inflict $38bn and $16bn on the banking and insurance sectors respectively. And is not a small amount as it adds up to 4.5% of the Tier 1 Capital of the big 4 banks.

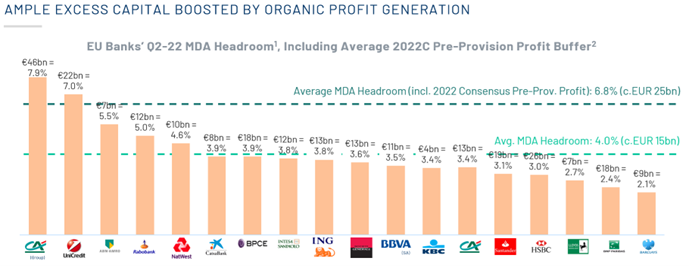

Fixed Income (Overweight in US Treasuries): There is no change in this view. Maintaining the highest quality of debt instruments is paramount. The only change we made last quarter is to increase our exposure to the front end of the US treasury curve as we are expecting the yield curve to bull steepen. We remain overweight investment grade bonds given it historically have lower default rates, higher recovery rate and the current OAS spread is already pricing some recession risk. The pain trade for last quarter is our exposure to the fund manager that specializes in hybrid capital of financial institutions. We view the decision to override the payment waterfall by the Swiss National Bank as an outliner. Since then, many central banks from BOE, ECB, BOC, HKMA and MAS have issued statements that AT1 bonds are an important part of a bank’s capital structure, and they will honor the terms of having equity shareholders write down first before bondholders in the event of a bankruptcy. This asset class now yields more than 12% and trades at a spread of 900+bps, close to the widest it ever trade at 1000bps during Covid. The historical range has been 400bps. If the portfolio is constructed with high quality names, over the next 12 months we could get an expected return of 12% yield + 200bps spread compression.

European banks have in excess of profit even before dividends and AT1s are paid and capital key are triggered

Equities: In our last Navigator, The Indomitable Human Spirit , we have expressed the view that we will be angling to reverse our long-standing underweight in Equities to overweight in the coming months. However, the investment case has become more confusing. On one end, recent developments should precipitate a Fed pause soon and perhaps even cutting rates before the year end, but on the other with credit conditions tightening and the risk of commercial real estate imploding, the economic outlook and earnings and valuation parameters are likely to deteriorate. Having said that the equities market has been remarkably resilient despite a series of shocking internals. The broader market is higher in March Madness and selling has been concentrated in areas where the market is pricing future duress ie the banks, insurers, real estate and REITs. We are retaining our underweight with key expressions in long/short equities managers, a tilt towards the dividend theme. We have also rebuild our tech exposure in the last quarter. We remain overweight only in Japan and Asia.

Alternatives: No changes in this sleeve. Our trade finance, Asia and quant long/short equities, and volatility strategy performed well in 1Q23 with positive performances but more importantly kept their volatility stats intact. CTA and hedge fund replication strategies were whipsawed by their short interest rates (2yrs Treasury had a 91st percentile volatility in 1Q23!), long dollar, and short energy trades and therefore were down for the quarter.

FX: For the next quarter, we expect the US dollar to weaken. The reversal of US growth exceptionalism versus the rest of the world and the narrowing of interest rate differential. The Fed is near it pausing cycle but the ECB has just commenced its cycle and the BOJ is likely to pivot in 2Q23. Our favourite expression is to Long Yen. The risk of this view remains the escalation of geopolitics risk and the classic USD hegemony should the global economy sink into recession even if the source of stress is coming from the US itself.

Commodities: Remain bullish on oil. The prompt spread as well as the 1 year forward spread have turned bullish. As we mentioned in last publication, these have been very good leading indicators of an inflexion point in crude price. Even with the recent spike in oil price, speculative position on oil futures remains at level last seen when oil price collapse from $100 to $40 in 2014-2016.

1 year spread has crossed the magic $4.50

Yet specs on oil is near 2015 lows

Cash: Cash holdings stays at 10-15% and we will be quick to raise cash if our worst case scenario become a base-case.

Don’t take my word. I am a nobody. Read what Joseph’s dog is saying about the Fed.

US inflation, Fed interest rates, high costs, dubious benefits. Joseph E. Stiglitz

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.