Have you ever paid a few hundred dollars to see your favorite artist perform live only to have the occasion marred by fellow revelers holding up their phones to record the entire concert and blocking the view of everyone else including themselves? You ask yourself should I follow the crowd and record the moments, or should I ignore and live in the moment? What kind of concertgoer are you? It is carpe Diem for me.

At the start of the year, in The Indomitable Human Spirit Navigator, our central thesis for overweighting Treasuries and high-grade debt centers on our view that inflation will fall precipitously. But central bankers’ tunnel vision to restore their lost cred in fighting inflation will push the global economy into a recession, and they will have to pause their tightening by 2Q-3Q23 and reverse course by the end of the year or early first quarter of next year. We were looking to reverse our long-standing underweight in equities sometime in 2Q23 following the contours of our view of inflation and policy rates but have caveated this decision with the global economy not slipping into a severe recession. However, the view to overturn our underweight in Equities was truncated by the US banking crisis in March and the dissolution of Credit Suisse in the same month.

We opined in Down in the valley to pray in March and Everything, everywhere, all at once in April that these developments will likely tilt the US from a mild-moderate recession into a moderate-severe one. We were surprised that there are still more than 4,000 banks in the US and even more shocked that the smaller banks in the US have enjoyed regulatory arbitrage for so long. This has allowed them to grow significantly faster than the GSIB banks like JP Morgan or Bank of America and they have played an outsized role in providing credit to the US economy. For example, smaller banks with assets below $250bn hold 80% of the commercial real estate loans in the system. Furthermore, we reiterated our long-standing view that decades of easy money have led to a colossal bubble in real estate and this bubble is global in nature. We collated our months-long discussions with various fund managers and companies spanning across different real estate asset classes from publicly listed REITs to a mezzanine financier in commercial real estate in Germany and they reinforce our view this bubble is bursting in many arrays.

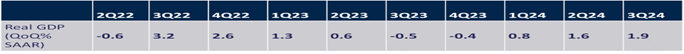

With this backdrop of a slowing economy riddled with more bank bankruptcies to come accompanied by fraying real estate, it has become even more exigent to determine the probability of a recession and the kind of recession we might be in. Of course, predicting a recession, let alone the severity of one, is a career suicide job. If you are wrong, you be called an alarmist and if you are right, you will be fired. As we have highlighted in various Navigators, our approach to predicting a recession is multi-prong. First, we look at the consensus economic forecast. The consensus is expecting a recession in the US to commence in 3Q23 and last till the end of the year. But they are expecting only a mild one with a cumulative decline of just 1.0% contraction from the peak in 2Q23.

Consensus economic forecast expects a mild US recession to commence hereon

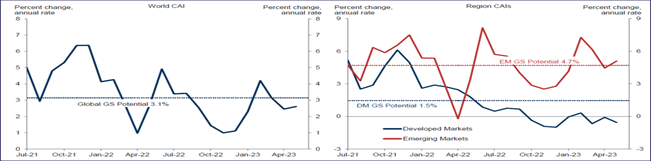

The second method is to look at the Nowcasting model which considers current economic data to estimate what is the current state of the economy. The Nowcasting model tells us the global economy is already growing below 3.0%, which is the threshold between growth and recession. Developed markets are already in negative growth reinforced by the recent news that the Eurozone has entered a technical recession. Emerging markets are barely growing above its potential and China will pose a significant drag in the coming quarters for the region and the globe. Its recent policy responses have been measured and targeted but they are not enough to lift its growth back to its target of 5%; at best we think China will grow 3-4% this year.

Nowcasting says we are already in a global recession

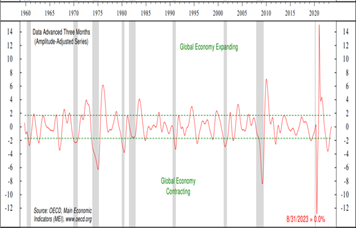

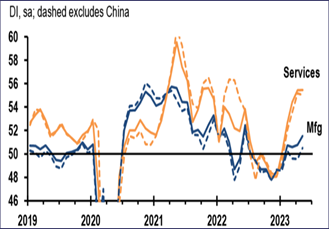

The third method is analyzing Forecasting indicators which attempt to predict the state of the economy in the coming 1-2 quarters. However, forecasting indicators are conflicting with the OECD G7 Indicator indicating zero growth in the coming quarters for the grouping but the more widely followed PMI shows services and manufacturing powering into expansionary phase after miring in contractionary levels for much of the second half of last year.

Forecasting indicators are contradicting each other

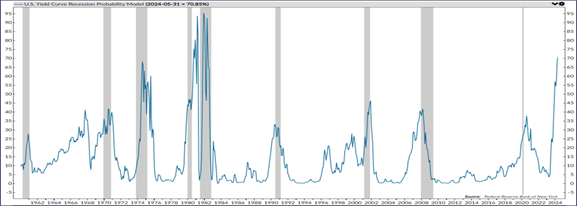

The fourth method is to rely on market indicators. The most reliable market indicator is the shape and duration of an inverted yield curve. This market signal has an impeccable record of calling a recession within the next 12 months. The yield curve has been inverted since July last year and the current reading is extremely elevated; at a level that is commensurate with the recession of the last two oil shocks of 1974 and 1980.

Yield curve is extremely inverted signaling an impending recession within next 12 months

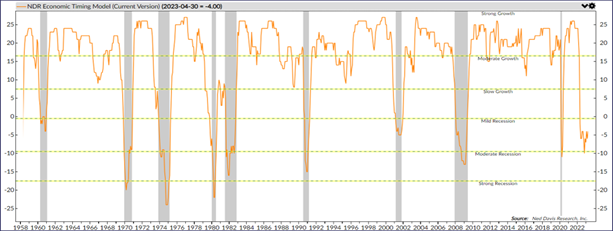

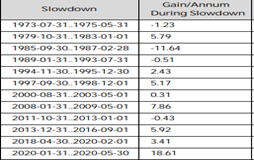

Four and half of the barometers we use are signaling an impending recession for the US and by implication likewise for the global economy as well. Critically, what kind of recession matters more as we will demonstrate later. Based on the consensus economic forecast detailed above and Net Davis Research economic timing model, the upcoming recession is assumed to be a mild one.

Seems like it is going to be a mild-moderate recession in the US

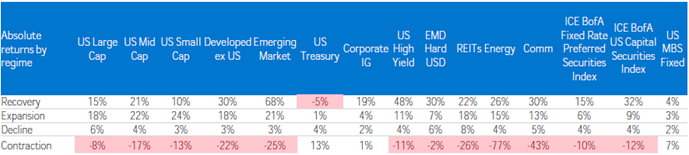

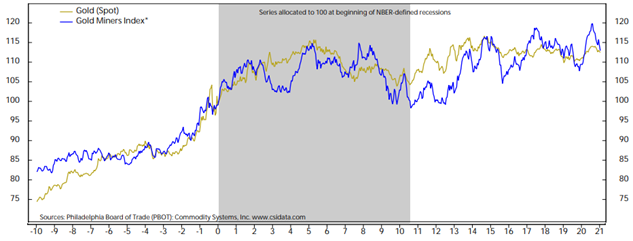

Given the overwhelming evidence that a recession is inevitable, we are managing our portfolios with this as the base case. From a cross-assets perspective, very few asset classes generated positive absolute returns during a recession. Only the US Treasury, investment-grade debt, gold, and ironically the USD have positive returns.

Hiring has peaked and job cuts increasing. More jobs lost than openings availed

The weight of evidence supports our views that inflation should fall across all the major drivers in the next 6 months. This leads us to believe the positive correlation between equities and bonds has peaked in the near term. As for the longer term, most of the drivers of deflation remain relevant particularly ageing demographics, lack of labour bargaining power, and technological advancements. We add another factor that will depress consumption and concomitantly inflation, ie is the high level of government debt across many nations. However, as we have pointed out in our January 2021 webinar, After the storm, what comes next? other deflationary forces are reversing. Presciently, we stated that globalization has peaked and is replaced with friend shoring which should lead to higher prices. China becomes the net exporter of inflation instead of deflation as its costs level up. The cadence of the e-commerce penetration should slow from hereon, while the adoption of ESG will be expensive in the near term.

Gold and the USD generally post positive returns during recession

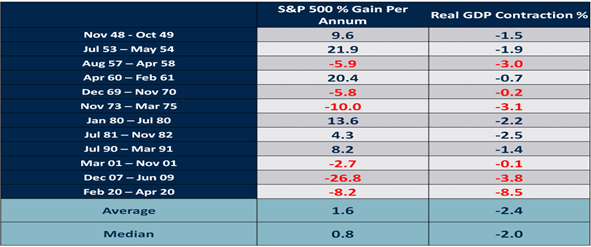

Equities: Remains Underweight. We have alluded to what kind of recession is critical and nowhere is more apparent than in equities. When we analyzed the performances of the S&P500 during a recession since 1948, we found that on average the S&P performance was unchanged. We also found that half of the time, S&P generates positive returns and when returns are positive, it is skewed better than when returns are negative. The average positive return is +13% in contrast to average losses of -11%. However, the most important conclusion from this analysis is that when the recession is mild to moderate ie less than 2.0% contraction from the last peak, S&P returns are almost always positive. Of course, anyone with simple arithmetic logic will know whilst return can be positive, the point-to-point transverse can be a lot hairier.

S&P performances during recession are equally split between positive and negative returns

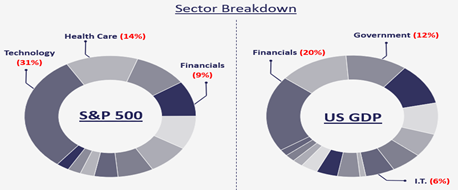

How can S&P generate positive returns as it runs counterintuitive to a dreadful economy? We venture two reasons. First, the stock market is not the economy. As shown by the charts below. The two largest constituents of the S&P500 are technology (31%) and Healthcare (14%) but from a GDP breakdown, Financials are the largest at 20% of total GDP in contrast to its 9% representation in the stock market. While the narrower definition of technology in GDP definition as IT, which is 6% of GDP but is 31% in the stock market.

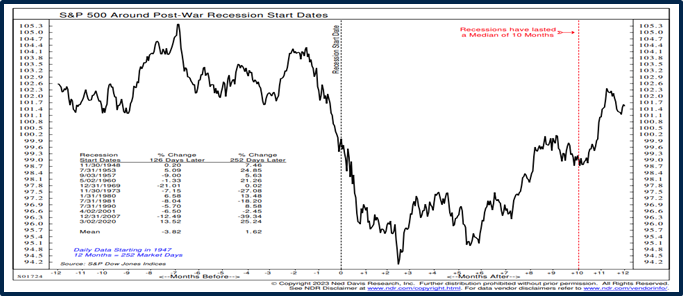

The second reason is the stock market is forward-looking. It tends to peak 6-7 months before the start of a recession, trough 2 months after a recession has started, and by the time the recession ends, the market has rebounded 9% from its bottom.

Stock market is forward looking. Peaking before a recession starts and troughing before it ends

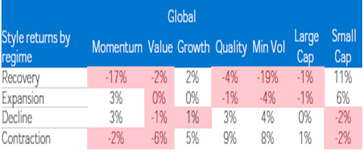

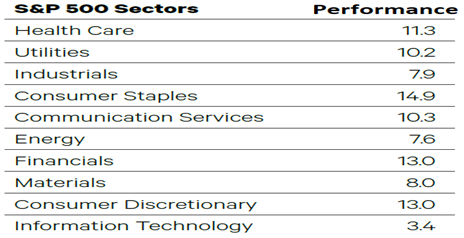

From a style perspective, Growth, Quality and Large-Cap perform better. As expected, Consumer Staples performs the best as the sector offers defensive earnings quality, though surprisingly Financials and Consumer Discretionary performances are close to consumer staples. Healthcare is the other sector that performs well because of its recession-proof business model.

Opting for Quality, Larger Cap, Growth stocks

and Consumer Staples, Healthcare

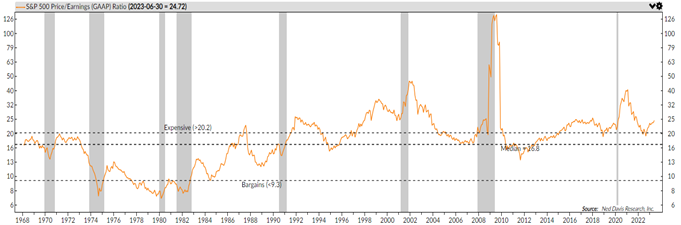

Since the start of the year, EPS for 2023 and 2024 have been revised downwards by 2-3% for both years leaving EPS growth of -1% for 2023 and 9% for 2024. With the S&P500 up 14% in the first half, this implies the entire driver of performance was due to valuation multiple expansion, not earnings momentum. This leaves valuation very rich with S&P trading at 25x trailing PE and 20x 1-year forward PE. These levels are higher than their long-term averages of 17x. And if a recession is the base case, S&P500 has historically traded at 14x trailing PE. These facts underpinned our preference to remain underweight equities given that there is no room for disappointment. Accentuating the risk is the narrow market rally with the top eight stocks now accounting for 28% of total market capitalization which is a record high and is higher than in Jan 2021 when the current bear commenced.

Valuations are more expensive now than at the start of the year as earnings forecasts have been reduced

The underweight in equities have been reduced compared to the start of the year where the general construct is to be underweight US, Europe and now China and with Japan as our only meaningful overweight. For our growth expressions, we have also substituted our tech exposure to a covered call expression on NASDAQ given its substantive performance YTD while augmenting with single names like turnaround tech names in the semiconductor space and in Japan electronic manufacturing ETF. Our growth expression extends to our holding in an environment-focused equities manager. For Quality expression, we have adopted an active and systematic ETF that focuses on Quality. We are still keepers of large US banks on valuation grounds and European and Japanese banks given their high earnings sensitivity to their central banks’ policy actions. The larger part of our equities expression remains in fundamental long-short equities managers across the US and Asia.

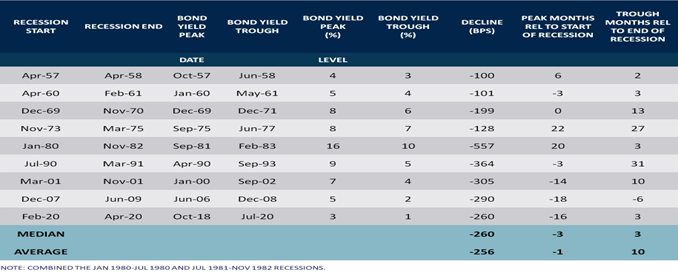

Fixed Income remains overweight in US Treasuries and Investment Grade given they have historically performed better both on relative and absolute basis during recessions. Furthermore, there is no ambiguity to the path of Treasuries yields in contrast to equities when recessions happen. US yield falls all the time as the economy enters a recession with an average decline of 256bps in yield from the start to the end of a recession. Moreover, US yields generally peak ahead of a recession and drift lower even as the recession has ended as the bond market participants are more conservative than equities investors in pricing a recovery.

US Treasury Yields often peak before start of recession and always decline during one

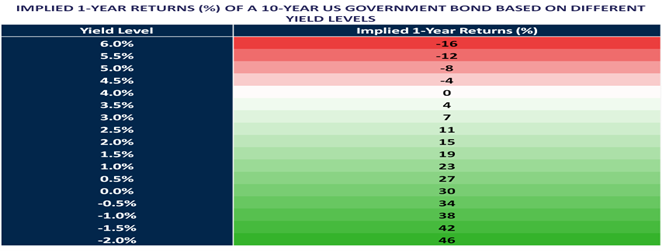

With interest rates at this level, bond convexity has now skewed an asymmetrical return for holding Treasuries. Even if the Fed continues to raise policy rates by another 50-100bps and Treasury yield does a parallel shift of 50-100bps too (which never happens at this late stage of a hiking cycle), the forecast 12months loss of holding a 10-year government bond will be -4% to -7%. But if yield moves lower by 50-100bps, the forecast gains will be 7 to 11% and if history repeats with a 250bps decline in yield from the start to the end of a recession, the gains will be material at 19-23%. That is not our base case though and we believe 10yield will settle in the range of 3.0 to 3.5% translating to a respectable gain of 4 to 7%.

Bond convexity is skewing asymmetric returns outcome for holding even Treasuries

The credit spread for investment-grade debt is fair for now. We think it might widen by at most 50bps from the current level if we have a mild-moderate recession. This will be offset by at least 80-100bps decline in Treasury yields that we are expecting. There have only been 20% of the time since 2009, investment-grade debt yields higher than the current 5.7%.

Investment grade yield of 5.7% now have rarely been higher since 2009

Alternatives: We continued to build out a multi-manager and multi-strategy hedge fund sleeve that comprises systematic as well as fundamental driven long-short equities managers, a macro CTA manager that is particularly strong in fixed income and commodities markets to diversify our larger sleeve of equities centric hedge funds. We also own a relative value option trader and a multi-strategy hedge fund replication manager. We have also expanded our alternative credit managers to include a litigation finance manager on top of our trade finance specialist.

FX: No change and expecting the US dollar to weaken marginally. The key risk to this view remains the escalation of geopolitics risk and the classic USD hegemony should the global economy sink into recession even if the source of stress is coming from the US itself.

Commodities: Remain bullish on oil in the intermediate term.

Cash: Cash holdings have been reduced to less than 10% since high-grade debt such as government bonds and investment grade debt yield are attractive and their valuations are not demanding.

Charlie Chaplin made 82 films in his long 75 years of movie making and he only spoke in 5 of them. The first time he ever spoke was in his critical and commercial success, The Great Dictator.

Click to watch Charlie Chaplin, the Great Dictator Speech

“To those who can hear me, I say – do not despair. The misery that is now upon us is but the passing of greed – the bitterness of men who fear the way of human progress. The hate of men will pass, and dictators die, and the power they took from the people will return to the people. And so long as men die, liberty will never perish.” CC

And these days there are too many dictators.

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.