One of my favourite childhood songs is “The Bear Necessities” from the Disney cartoon “The Jungle Book”. In this song, Baloo (the bear) shared with Mowgli (the boy) about living a life of simplicity and being adaptable to whatever life may bring to you. The part of the song that resonates most with me in these discombobulating times is “Look for the bare necessities, the simple bare necessities forget about your worries and your strife”. Sage words for the battered investors reminiscing about the good ole times of quantitative easing. But we are in the business of managing money and the fiduciary duties associated with this role are onerous. So, let’s map the contours of bear markets.

In our last macro update via podcast, Which is a greater risk from hereon? Inflation or recession? (Password: Podcast2022!) , we maintained our view that inflation will peak in the coming months in synchrony with a slowing growth trajectory. We cautioned that recession risk is a graver concern for us than high inflation. We acknowledge that the risk of recession has increased but it is not inevitable framing our conclusion with a four-prong approach that encompasses (1) Nowcasting analysis to ascertain the current state of the economy, (2) Forecasting analysis using data like PMI to help us gauge the direction of the economy in the next 3-6 month, (3) Taking cues from recession probability models, and (4) Bottom-up observations of what corporates are telling us about their operating environment.

The latest data on inflation reaffirms our view that inflation should moderate in the coming months. If we look at the four key sources of inflation chiefly from commodities supply shock arising from Ukraine-Russia war, supply chain pressures from covid lock-up, wage increase from labour shortage, and rising housing costs, there are clear signs that first three drivers have already peaked or will peak soon. It is the housing shortage that challenges our sanguine view of inflation given its direct contribution to inflation is as high as 17-20% in the US (see Everyone has a plan until they get punched in the mouth for more of this issue.

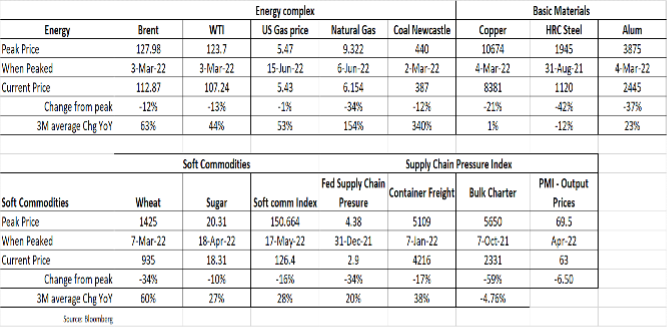

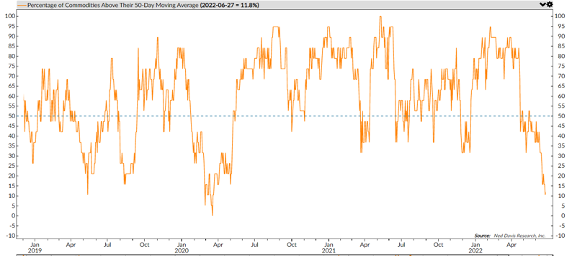

We are tracking several indicators of inflation and the most elementary is to track market prices of key commodities including those purported disrupted by the war in Ukraine. Brent and WTI crude oil prices have both retracted from their peak by -12/-13% and their peak was just 2 weeks after the war erupted in March. Natural Gas has fallen -34% since it peaked on 6 June, while coal prices has fallen -12% since peaking 2 Mar 22. Basic materials such as copper, steel, and aluminum (Russia is the 2nd largest exporter of alumina and 5th largest exporter of aluminum products globally) have fallen -21%, -42% and -37% from their peak in early Mar 2022. In the soft commodities space, wheat, sugar, and the overall soft commodities index have retraced -34%, -19% and -16% from their peaks which occurred around March to May. Summing up the above points made, the breath of commodities price increase has also eased off significantly in the last few months with only 12% of 19 commodities that NDR tracks are trending above their 50-day moving averages, a far cry back from March when nearly 100% of all these commodities were trending above. Supply chain indicators such as the Fed Supply Chain Pressure Index, Shanghai Container Freight, and Bulk rates paint the same picture. PMI survey on input prices has also plateaued in the last several months. We are not blasé about inflation as most of these market prices and indicators have seen sharp increases on a year-on-year basis, however in the context of the stock markets, the delta of change is more important, and it is inflecting lower.

Many data are pointing to inflation has peaked though YoY increase is still large

Breadth of commodities prices increased has declined materially

Market participants’ view of inflation has also come off from their peaks. The 1-year inflation swap has retraced from a high of 6% in mid-Jun to 5% currently. The market has also repriced inflation expectations lower across the 5 and 10-year horizons. Critically, they are expecting inflation to be lower across time with inflation expectation 1-year out at 5% which is lower than the most recent headline CPI of 8.6%. Across the 5 and 10 years, the market is pricing lower inflation in each sequence at 3% and 2.8% respectively.

Market is saying inflation has peaked and expects inflation to moderate across time

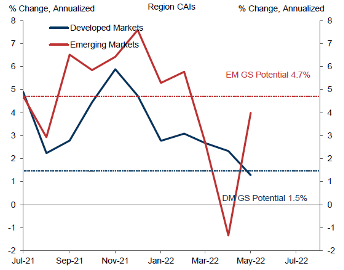

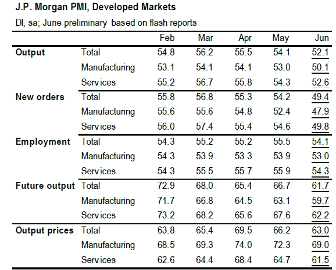

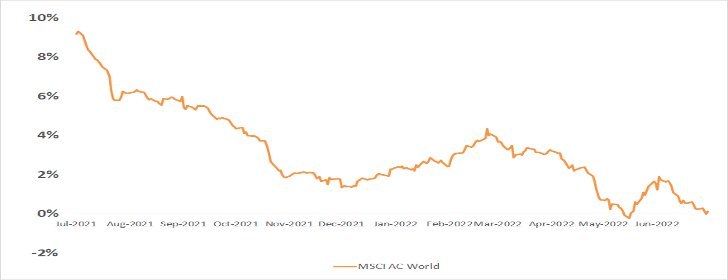

As we have mused many times, inflation and growth move in tandem. While inflation should be moderate in the coming months, the deceleration in growth has been more pronounced since our last update. The nowcasting data we tracked points to the global economy is currently growing at 2.8% yoy below its long-term potential of 3.0% with both developed and emerging economies below their long-term potential. US 1Q22 GDP has already contracted by -1.5% and the latest nowcasting data from Goldman shows the US is precipitously close to a technical recession with just 0.90% growth in the current quarter. Our forecasting tool using PMI points to an even grimmer outlook for the upcoming months. The latest flash PMI in June from developed economies contracted 2 points to 52.1, the weakest this year, and it correlates to a growth of 1 to 1.2% in the coming months further slowing from the current quarter nowcast estimate of 2.8% and is half the pace of 1Q22 growth. Under the hood, the PMI reveals weakening internals. Output for manufacturing is just above the expansionary level at 50.1, contracting 2.9 points. We were already expecting goods demand to contract as the economy reopens with demand shifting towards the service sector. However, the decline in services output to 52.6 was unexpected. A critical leading component of PMI- New Orders for manufacturing and services new orders are now at contractionary levels.

GS Nowcasting says global economy growing below trend

Forecasting tool says it is going to get worse

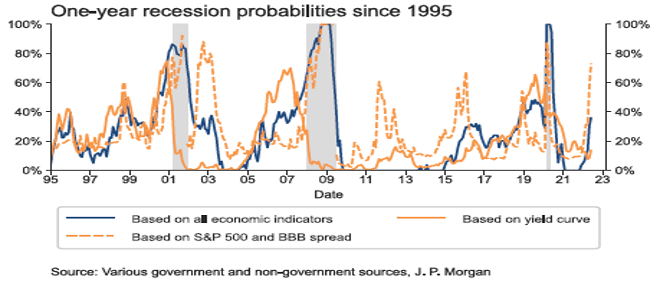

One of the recession probabilities models we are tracking is nearing it’s signaling thresholds. Based on JPM models, their economic indicator model is now predicting a 36% chance of a recession within a year and is close to its threshold signal of 40%. Their equity/credit recession model is elevated at 73% probability though we caution this signal have produced many false positive in the past. The yield curve they used has now narrowed to 155bps and is signaling a 14% risk in contrast to less than 10% chance many months ago.

One of our recession probability models is flashing red

Putting all the data above in layman’s language, the baton of growth of the global economy was supposed to transition from a goods demand to services. However, the increases in price of daily necessities have dampened consumption possibly truncating the growth in the service sector. Even as consumers tapped into their elevated savings and are seeing nominal increase in wages, it has not been able to offset the increase in prices and compounded by higher debt servicing costs across the globe as rates have risen. The risk of policy over-tightening is high and as US senator Elizabeth Warren recently questioned Jerome Powell how will raising interest rates help solve high fuel and food prices. Instead, higher interest rates will increase borrowing costs for families (and corporates) and potentially cause job losses.

I have always quipped the central bankers in developed economies are very poorly equipped to handle micro-economic issues of excesses or shortage. Their policy tools of controlling the cost of money and quantity of money are too blunt to address and curtail financial risks. As Singapore luminary statesman, Tharman Shanmugaratnam, cautioned in 2013 in the aftermath of the Global Financial Crisis, there is an over-reliance on an antiquated monetary framework and has espoused the view that central bankers and government should coordinate their fiscal and monetary policies, while the arsenal of the central bankers’ tools should also include utilizing counter-cyclical macro-prudential measures.

Think of the housing boom and bust cycle. Fed’s only tool to address this sector is using its Fed-Fund rate given mortgages rates are directly tagged to it. But that does not address issues of underbuilding or overbuilding of homes, loose credit evaluation, and excessive exposures in the banking system. Instead, by coordinating with the relevant government bodies to control supply of homes and tools like setting maximum Loan-to-Value and debt-service ceiling can curb over-leveraged buyers, over-exposed financial system and smooth out property cycle.

Recession risk has certainly increased and perhaps the recent bear markets is already foretelling one. Or is it?

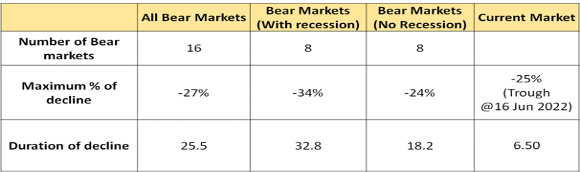

Fact 1: Is the stock market a harbinger of an impending recession? Not really. There have been 16 bear markets for SPX since 1968, half of these bear markets did not coincide or lead an economic recession in the US. The SPX generally bottoms 6 months after the start of a recession. The problem with this fact is we will only know the economy is in a recession when the recession is officially declared two to three months after the fact. By then, the stock market would have already reacted during this 6-8 month period. Nonetheless, the average decline of these past 16 bear markets is -27% from peak-trough and lasted 26 months long. If the bear market does not accompany a recession, the average decline is smaller at -24% than the average of all bear markets and far smaller if there is a recession. Likewise, the duration of the peak-trough is shorter for non-recession bear markets than the average of all bear markets and recession bear markets.

Equities market not a good harbinger of recession

Application of Fact 1:

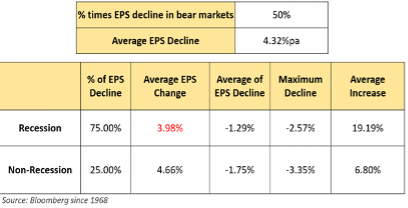

Fact 2: Most of equity market derating is driven by valuation and not by EPS decline. Valuation multiples tend to contract 15 points from its’ peak valuation to the trough. The multiple contracts less when there is no recession compared to a recession. The current bear market has already seen trailing PE contracted by 13 points exceeding the level of no-recession bear markets and close to all bear-markets average and just 3 percentage points away from recessionary bear market.

EPS increased on average of 4.32%pa during bear markets and half of the time, EPS increase against conventional thinking EPS growth should plummet. While EPS declined 75% of the time during recessionary bear markets, the average decline is small at -1.3%pa and the maximum is only -2.6% pa. That leads to the point that forward PE can be relied on as EPS declines should not be significant. SPX forward PE has derated from a high of 24x to 17x but at 17x is still above its long-term average and still above various bear market scenarios.

Application of Fact 2:

Valuation has retraced materially, and any further downside could be limited to another 10-15%, similar to the conclusion from Fact 1.

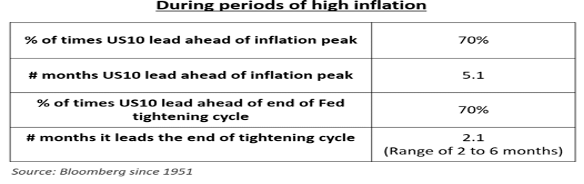

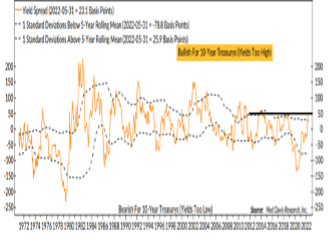

Fact 3: During periods of high inflation, does the US10 yield peak ahead inflation peak and the end of Fed tightening cycle? Yes, it does. The US10 yield is far more important than the Fed fund rates when it comes to the real economy. Corporates and consumers borrow at a spread off US10 yield not Fed Fund rates. Asset prices are discounted against US10 yield. US10 yield incorporates not just Fed fund rates on the short end of the curve but also hosts other medium-term information such as counterparty credit risk, term premia, and inflation expectations. 70% of the time the US10 yield peaks ahead of inflation peak by 5 months. 70% of the time US10 yield leads the end of the Fed tightening cycle on average by 2 months and over a range of 1- 6 months.

Treasuries lead ahead of inflation peak and end of tightening cycle

Application of Fact 3:

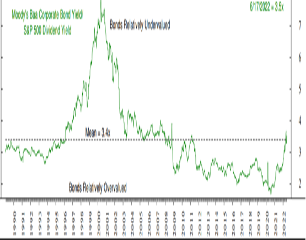

Long-dated US Treasuries and Investment-grade bond are attractive now

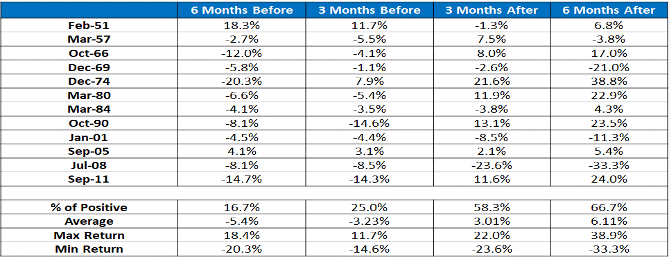

Fact 4: During periods of high inflation, does SPX trough ahead of inflation peak? No, unlike the bond market which tends to peak ahead of inflation, SPX does not. The weight of evidence informs us it is better to buy after inflation peaks. The incidence of positive months altered significantly after inflation peak with 58% and 67% of positive returns 3 and 6-months after inflation peaks whereas only 25% and 17% of the times SPX generated positive returns 3mths and 6 months before inflation peak.

Better to wait for inflation to peak to buy equities

Application of Fact 4: Better to have confirmation of inflation has peaked for equities.

Fixed Income: Upgrading to overweight but sensitive to price levels and only buying long-dated US Treasuries as well as high grade debt of companies that have defensive earnings quality and low gearing. There is a misplaced belief that yields can only peak after the Fed has ended its tightening. Our analysis shows that during periods of higher-than-normal inflation, 78% of the time of the US10 yield is lower than the Fed Fund rate at its end of tightening cycle. Furthermore, the peak of US10 yield during the tightening cycle is often lower than the Fed Fund rate by the end of the cycle 78% of the time. In fact, US10 yield on average is 183 bps lower than the Fed Fund rate at the end of the cycle and the peak of US10 yield during the tightening cycle is 136bps lower that the Fed Fund rate at the end of the cycle. The empirical evidence ties in with economic logic that yield curve flattens when the economy slows as Fed tightens.

Sliding Earnings Revision Momentum

FX: Long US dollar overlay. We think the dollar smile exerts its influence for the next couple of months but as inflation peaks and US yield retreats, we will exit this long dollar trade.

Commodities: Exiting as the economic risk has risen with several economies on the edge of a recession.

Alternatives: Our low/non-correlated strategies are now 20% of the portfolio. We have added a multi-strategy multi-asset class manager and are exploring a quant-driven short-term technical trading manager as well as bridging loan manager.

Cash: Cash still large 10-20% plenty of dry powder to capitalize on weakness.

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.