The Four Horsemen of the Final Judgement were detailed in the last book of the Bible, Revelations. It describes the Christian apocalyptic vision with the Four Horsemen as the harbingers setting the divine end of time. This writer isn’t trying to be prophetic but instead am just taking the liberty to associate four mega and irreversible trends that will affect the global economy and ensuing portfolio implications. The four horsemen connote plague, sword, wild beasts, and famine.

Plague. Covid-19 will not be the last of pandemics. Since the 1980s, we have already witnessed numerous zoonotic viruses crossing over to humans. From HIV, SARs, Ebola, MERs, Covid19 as well as a host of lesser- known viruses like the Nipah and Hendra. According to the National Center for Biotechnology Information, it is estimated that every year, 4 new zoonotic viruses are found. Many factors have led to the increase in frequency of emerging zoonotic diseases infecting humans including the modernisation of farming practices, particularly in the developing world, habitat destruction, human encroachment, and climate changes. Better connectivity via air and sea travel is also enabling the spread from one continent to another much faster than ever before. Unfortunately, the global response to the Covid19 pandemic by many parties is marred by a litany of opaqueness, lethargy, finger-pointing and most of all lack of coordination and cooperation to assist each other. It also exposes the vulnerability of employment for economies that are services-oriented, which is ironic as this sector has often been considered the bastion of stability. It is unthinkable that the US unemployment rate could go from the lowest in 50 years to the highest in 80 years with 38.6mn unemployed in a matter of months. Contrary to the popular narrative that Covid-19 is social leveller that does not discriminate race or income, the virus has infected the lower-income and minorities disproportionately. In the US nearly 23% of the reported deaths are African American even though they make up 13% of the nation’s population. In the UK, the number of deaths per 100,000 people is more than double at 55 deaths in the poorest part of England compared to 25 in the wealthiest area. There are many reasons for that including access to healthcare, higher co-morbidities among the poor or simply a case that the poorer segment of society is likely in jobs that are deemed essential services with no luxury to work from home. It is also not a surprise that the clamour to open the economy rings louder among the poor than the rich when livelihoods take precedent over lives. What it means for portfolio construction is that black swans, by definition should be infrequent, are going to occur more often going forward. An asset allocation that is titled too much to equities or illiquid private equity should be avoided. Finding tail-risk hedging strategies and uncorrelated returns have become even more urgent for us.

Online strategy is no longer an after-thought but is now a quintessential sales channel for many sectors including the less penetrated segments of groceries, luxury, pharmaceutical. The adoption of online learning will no longer be for after-school tuition but be incorporated into school’s curriculum spanning both primary and tertiary institutes. Telecommuting and remote-controlling of industrial machinery will become sine-qua-non for the future of work.

Sword. The sword that thwarts future growth is ageing demographics. According to data from World Population Prospects: the 2019 Revision, by 2050, one in six people in the world will be over age 65 (16%), up from one in 11 in 2019 (9%). By 2050, one in four persons living in Europe and Northern America is 65 or over. In 2018, for the first time in history, people aged 65 or above outnumbered children under five years of age globally. The number of persons aged 80 years or over is projected to triple, from 143 million in 2019 to 426 million in 2050. This has significant implication including lowering the overall demand for goods and services, such as housing and transportation. As the propensity to spend compared to save will tilt to the latter when the world ages, we should expect greater demand for the state to step-in to provide social safety nets.

The economic implications would be an increase in fiscal spending against a backdrop of declining revenues. To compensate for the expected shortfall in revenues, tax rates will have to increase alongside an expansion of more types of taxes. A poster of child of such flagrance is in Japan. It recently announced a $2.2trn stimulus packages, 40% of its GDP, that will require the country to issue Yen90trn of government bonds, which is a record level. If we include the government debt due for rollover for this fiscal year, Yen 212 trn worth of debt is coming to the market for financing, widening its fiscal deficit to 14.9% of GDP, a multi-decade high. To put the near 15% deficit spending in perspective, Japan must run a balanced budget while generating 2% pa growth over the next 7 years to normalize its fiscal deficit incurred in 2020. This will be a tall order as the average GDP growth in Japan since 1995 has only been 1.5% pa and it has never run a balanced budget since 2009. Furthermore, as postulated by the Ricardian equivalence theory, the current efforts to stimulate the economy via unsustainable debt-financed government spending will fail as consumers would rather save in expectation of higher taxes and/or are less sanguine of future growth in income. This behavior is evident in post-GFC world. We witnessed US savings rate jumped from the average of 4.6% between 2000-2008 to 13.1% as of Mar 2020. We can draw the same conclusion in Europe and Japan as well. From a portfolio perspective what this trend means the search for income will continue but the challenge is to find reasonable yield in a world where close to $16trn debt are yielding zero or negative yields. There will be clear winners in sectors like healthcare and robotics; areas the team is focusing to build both internal and external expertise.

Wild Beasts. We wrote back in May 2018, The Thucydides Trap, about the risk of US and China falling into the Thucydides trap. Since then, diplomatic wrangling has become more cantankerous. It this author’s opinion neither of these two countries have demonstrated leadership and benevolence in this time of crisis. The recent comments from China’s foreign minister remarking “U.S. political forces are taking hostage of China-U.S. relations, attempting to push the ties to the brink of so-called ‘new Cold War” which was followed by the US Secretary of State declaring that it no longer view HK as autonomous are bellicose statements leading to the inevitable conflict. While many have hoped that relationships between both countries can improve if the current US administration is not re-elected in November, the deterioration in their relationship between both countries did not arise from the Trump’s administration but has been festering since Obama’s strategic “Asia pivot” in 2012. The core of US’s bi-partisan view of China as a strategic competitor and adversary predates the “Asia pivot”. It stems from deep rooted issues such as loss of employment among the middle and lower rungs of its society as firms outsourced to China in droves after China’s ascension to WTO in 2001. As for China, its abhorrence of western powers interference in its domestic affairs including treatment of Muslims in restive Xinjiang province, Hong Kong’s “One country, two systems” and Taiwan’s independence can be traced back to its humiliating loss during the 18th century Opium war. While conflicts are inevitable as an upcoming nation challenges the incumbent’s status quo, it does not mean a war is imminent. As mentioned in his book, Destined for War, Dr Graham Allison cited several occasions the dislodgement of dominance did not lead to war with the US-Soviet narrative as the most relevant. The presence of nuclear arsenal in both countries set the condition of “mutually assured destruction” therefore deterring an all-out war. From a portfolio implication, dollar hegemony will wane over time. China alongside many EM central banks have been buying Gold and reducing their US$ holdings in earnest since 2018. The biggest threat to US$ hegemony does not come from ancient relic with negative carry and little industrialized use but from new technologies enabling digital currencies to be used not only for trade settlements and prevention of money laundering but perhaps for more nefarious intends like avoiding unilateral trade sanctions. China has spent the last five years studying a state-backed digital currency that not only can be used domestically via their ubiquitous digital wallets system but as a way of internationalizing its currency with its trade partners while not losing its ability to control capital flows. They have already piloted this project in four major cities two months ago and unlike the digital currencies we know that is vulnerable to cyber-attacks, fraud and wild swings in value, China digital currency is backed by the country reserves and centralized with PBOC in control of its supply. The plan is for PBOC to issue digital currency to state-owned banks as well as payment gateways who will then use it for goods and services settlement. Current laws in the US grants the American legal and financial systems wide-wielding power to freeze and seize US$ assets anywhere in the world under the guises of terrorisms etc. However, if the currency of trade between say China and Iran is via China’s digital currency that bypasses international settlements system, US would have lost one of the most powerful aspects of its dollar.

Insourcing and truncating global supply chains to be closer to home markets is another trend that should present opportunities for logistic companies. Companies that have production bases and dedicated sale strategies targeting countries with large population progressing into middle-income such as Vietnam and Indonesia will benefit tremendously. As we believe an outright nuclear war is an abominable unlikely outcome, conflicts between countries will likely be waged on the economic fronts including technology and medical supplies blockades and subversive intrusion in domestic politics. Cybersecurity, surveillance, biotech and of course 5G will be at the forefronts of this conflict.

Famine. The days of unbridled capitalism is over, to be more specific the days of neoliberalism is over. Neoliberalism is an ideology championed in the 1980s by Reegan and Thatcher, which advocates free market against government regulation and centralized planning. Neoliberalism sees competition as the defining characteristic between consumers, corporate and government relationships. It encourages consumers to exercise their freedom of choices and cement the mentality that their conspicuous consumption spending and accumulated wealth is due to their own merits; don’t need to be apologetic about it. Corporates continue this Darwinism thinking taking no prisoners in the name of efficiencies and profit-maximization. Any efforts to create level playing field or to accommodate social exigency at the expense of profits are portrayed as distorting market forces. Lesser taxes, fewer regulations are good, organized labour is evil and public goods should be privatized in the name of efficiency. As for the governing cohort, their modus operandi is to perpetuate this rent-seeking mindset. Centralized economic planning that addresses longer-term issue like climate changes, narrowing income disparities, demands of an ageing population are side-swiped for lobbyists with the eye on the next election. In neoliberalism, the role of the government should be minimized and is best epitomized by Ronald Reegan famously said, “Government is not the solution to our problem, government is the problem.” In the US, the Republicans call for big business, small government while the Democrats call for globalization and outsourcing blurring the lines of their ideologies when it comes to defining capitalism. The best example is the listing of SMRT back in 2000 with the view that such public good and services are best facilitated by the public capital markets. But without an equitable pricing model that serves the public increasing need and the capital markets profit maximization demands, the train operator had to be privatized by 2016 to much chagrin of both stakeholders. However, the post Covid19 world will rewrite these rules. The rich-poor schism is a tinder box of riots and revolutions. Corporates seeking government bailouts cannot go on with their model of profit maximization while paying gig-economy wages. The record level of fiscal deficits that the global government are spending comes with greater accountability after all it is their governing citizens that will have to pay for it eventually.

Portfolio selections become multi-dimensional. Incorporating ESG alongside traditional financial metrics will be more persuasive and pervasive. State involvement in strategic industries will become more widely accepted which could mean better to own their debt than their equity. Days of leveraging the balance sheet to do more shares buyback are over. It is precisely the neoliberalist view of 2018 corporate tax cut that led to a record increase in corporate shares buyback even though the bill was sold to the public as tax reform package that will raise wages and spur hiring as US corporates repatriated money back in the US. The monetization of debt to fund targeted spending/assistance programs will erode central banker’s independence from the government of the day. Only a few countries will have the luxury of deploying MMT like the US. China could to a lesser extent if they can accelerate the internationalization of their currency, and Europe only if they can agree on the mutualization of their debt. This leaves many EM countries vulnerable especially those will poor fiscal discipline and a large stock of US$ denominated debt.

In our April’s strategy piece, Never let a good crisis go to waste, we laid out 4 markers to guide our asset allocation strategies. They are (1) Tracking the Covid19 virus, including the pace of new cases, the mortality rate, and advances in the medical efforts to test, treat and vaccinate, (2) The pace of recovery as fiscal and monetary responses percolate into the economy while lock-down eases, (3) Investor positioning and lastly (4) Historical precedents we can draw from when analyzing the risk of further earnings downside, valuation extremities, and the magnitude and duration of asset prices declines (at this current juncture, it will be the extent of recovery). There have been significant positive developments for markers 1 and 2 which has also led to marker 3, positionings across many asset classes, skewed towards the expectation of a bullish V-shape recovery that we have assumed. However, our base-case economic trajectory is for a V-shape recovery spanning only 2Q-4Q20 and we are more bearish on the mid to long-term prospects of the global economy for reasons articulated above and as well as fading impulses from fiscal stimulus. We characterized the shape of the economy as square root, with a down slopping horizontal line.

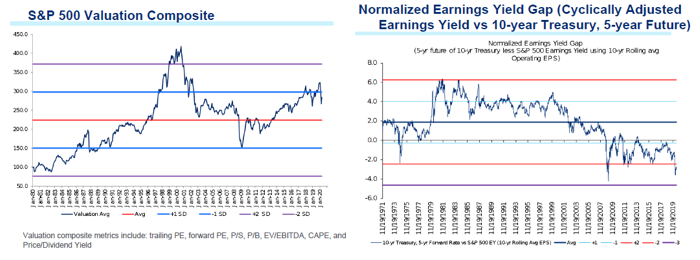

Equities: We upgraded equities in late-March which at that time was a controversial decision. MSCI World Equities has since rallied 36% from the bottom, the fastest bear market rally in 88 years and from using marker (4) as a historical guidebook, this rally is too much and too soon. Looking at the price actions of past recessions, the extent of the current retracement normally only happens a month before the recession ends implying the market is pricing recession to have ended in the month of either May or June. This is not our base case view as we are expecting continual qoq contraction in 3Q and only a small recovery sequentially in 4Q20. The global economy is still expected to end the year in negative growth of -3.5% yoy; a 6.4 ppt downgrade from the beginning of the year forecast. The rally in the US has been very narrow with five mega-cap tech stocks, Microsoft, Amazon, Apple Google and Facebook, are up 15% but the rest of 495 stocks in S&P500 down -8% year to date. Coupled with our concern on the end of unbridled capitalism, we will not be surprised if more regulations are imposed on big tech with Trump’s latest salvo at Twitter as a case in point. We are downgrading equities to Neutral as valuation across different metrics we use is expensive now in contrast back in April when valuations were supportive.

Fixed Income: Underweight. Fixed income has not been attractively valued for a while now and has become even less attractive with renewed QE globally. The case for owning equities for yield over fixed income is the reason why we have kept fixed income underweight for a long period. The spread between equities earnings yield versus US ten-year bond is now at -1std in favour of equities. We rather take equities risk in the overall portfolio to generate capital gains and keep credit quality robust with companies with strong balance sheet and relatively better operating outcomes. A record $1trn issuance in high-grade debt has been well absorbed by the market spurred on by Fed’s backstopping corporate credit for the first time in modern day history. We continue to be overweight in Treasuries and investment-grade credit. Within the regions, we prefer the US over Europe due to the Fed’s unlimited commitment. We prefer to own financials credits and defensive sectors such as utilities and tech companies than cyclical credit. We added more to China real estate investment-grade debt over the rest of the EM high yield. We have recently added to an income strategy that is uncorrelated to capital market focusing on short-tenure and lucrative trade financing opportunities.

FX: Short-term we expect USD to weaken slightly but still within the range. Longer-term, we see dollar hegemony to end.

Commodities: Underweight with long Gold as the key expression.

Alternatives: As we expect black swans to occur more frequently, we have recently added a tail-risk manager that is up 54% this year due to its risk-off positioning mindset. We are currently exploring more uncorrelated strategies including digital currencies strategies and will likely be adding more long/short equity managers to reduce the overall beta.

Featured Picture/Quote: Is the US and China destined for war or has China won? Graham Allison and Kishore Mahbubani

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.