In “The Art of the Deal,” President Trump famously advocated for negotiating from strength and employing leverage, suggesting that projecting an image of power is indispensable. One of the key quotes earlier in the book was “The worst thing you can possibly do in a deal seems desperate to make it. That makes the other guy smell blood, and then you’re dead. The best thing you can do is deal from strength, and leverage is the biggest strength you can have. Leverage is having something the other guy wants. Or better yet, needs. Or best of all, simply can’t do without. Unfortunately, that isn’t always the case, which is why leverage often requires imagination, and salesmanship. In other words, you have to convince the other guy it’s in his interest to make the deal.” Fast forward to today, Trump’s provocative tariff rhetoric brings the world closer to the precipice of a full-scale trade war, casting ominous shadows over US stock markets. Yet, beneath the fiery speeches and headline roulette, the reality may be considerably less cataclysmic in our opinion.

In our last Navigator I’ll be back we opined that the biggest risks to the US economy and its markets are tariffs and reversal of immigration flows into the country. But we also countered that moderate fiscal easing including tax cuts and stimulative reshoring efforts coupled with animal spirits brought upon by deregulation provide counterbalance to anti-growth impulses of tariffs and immigration.

But in a world of megaphone newsfeeds and trigger-angsty investors, this ebullient spirits at the start of the year on the US have now descended into cauldron calls of impending recession and start of long-awaited bear market. This is where having a consistent and data-backed process is important to differentiate the noise, half-truths, and actual material changes. By now, most readers will be familiar with our process of accessing the global economy through the lens of “where are now” with nowcasting models and “where will we be” by using various forecasting methods. Our “nowcasting” models suggest the global economy remains resilient, albeit shifting growth leadership from the US to Europe. Specifically, US growth moderated slightly below potential to 1.3%, while Europe emerged from recession with an anaemic 0.4% growth. Still, the narrative of Europe’s “Make Europe Great Again” (MEGA) leadership might be overstated. Despite Europe’s incremental GDP improvement, the US economy still leads on absolute terms.

Nearer term forward-looking models like PMI collaborates with nowcast approach and disputing the common concern of pending recession in the US even as its growth takes a step down from the boomy pace of the last two quarters. Global PMI fell 0.3pt in February but at current level, it remains consistent to a 2.6% annualised global growth rate. In the US, PMI for Manufacturing and Services remains expansionary with manufacturing at 50.3 (marking two consecutive months of above 50 reading after 25 months in contraction) and services at 53.5 is an improvement of 0.7ppt from January resulting in a composite reading of 53.2. Eurozone Composite PMI was unchanged month-month at 50.2 but is an improvement from previous quarter average reading of 49.3. But its manufacturing remains moribund at 47.6 marking 33 months of below 50 reading, fortunately their services remain expansionary at 50, but is a 0.6ppt step down from previous month. PMI data points to US Manufacturing and Services sectors remain expansionary, comfortably eclipsing Europe’s mixed signals.

Wrapping up the state of play of the global economy, consensus full year forecast for 2025 reiterates the same points as Nowcaster and PMI with global growth remaining strong at 2.9% but with Euro Area (+0.2ppt) improving more from the previous quarter than the US (+0.1ppt). As we mentioned in our January macro podcast, we do think consensus forecast are too sanguine on US growth given the spectre of tariffs, immigration, and now adding DOGE into the mix. In recent weeks, we have seen consensus revising down their US full year GDP Growth to 2.0% with much of the downward revision front-loaded into these two coming quarters as tariffs kick in. On the other hand, Europe efforts to bolster its defense and infrastructure have lifted its forecast by 0.2ppt to 1.3%. Stock markets price on expectations and with the delta of change for these two regions economies shifting in favour of Europe, it is understandable why European equities have outperformed the US. Even with these undercurrents, US growth exceptionalism still prevails over Europe on an absolute basis and relative to their long-term growth potential with full year growth of US at 2.0% to Europe at 1.3% in 2025. Even the most bearish forecast for the US incorporating the plight of tariff wars shift US growth down, and the most bullish upgrades for Europe still puts US growing faster than Europe over the next two years.

This brings us back to our opening para. Is Trump’s bellicose rhetoric on tariff part of his art of negotiation technique to advance a broader agenda of making American great again and instilling irrational fear with its partners? We do not have a hot line to Trump, but we can simply look at numerous occasions he has walked away or watered down his initial outlashes. Case in point is his recent step back from his across-the-board 25% tariffs on Canada and Mexico to within “non-USMCA compliant goods” until April. The difference in the walk-back is significant. In an across-the-board tariff, the US effective tariff rate will rise from 2.8% to a punishing level of 15%, while a possible watered-down version suggested by his Commerce Secretary raises that to 10%. Since the estimated first order impact of each 5% rise in effective tariff rates will reduce US growth by 0.50% to 0.65%, the range of US GDP downgrades is from a manageable reduction of 0.40% taking it to trend-like growth rate 1.5-1.6% or to a more ominous fall to 0.8% but not quite recessionary yet.

Another way of calling Trump’s full-scale tariff war bluff is to simply think on how much of “a little adjustments” to the economy Trump is willing to wage. Below is the list of various critical items that US depends on Mexico, Canada, and China. Surely, he and his administration know the same calculus as all of us.

Nonetheless, our primary apprehension isn’t the tariffs per se, but rather their pernicious secondary effects on consumer and business confidence. Already, we’ve discerned wavering sentiment, with businesses reticent to invest and consumers circumspect about spending amid higher inflation expectations.

The last point on tariffs is to take heed of what happened to inflation during the first tariff war of Trump’s presidency. The first tariff was enacted in Mar 2018 with 25% tariff on steel and 10% aluminium from all countries, followed by 10% broad-tariff on all China’s goods in Aug 2018. An additional tariff on $500bn worth of targeted items from China was imposed throughout the year until Aug 2019. The effective tariff rate in the US rose from 1.6% to 2.8% during their period.

Back then, the common assumption was that inflation would rise significantly past 3% and the economy would falter. This led to Powell making first of the many policy mistakes in his tenure. He raised policy rates pre-emptively by 125bps to 2.5% in 2018 on top of the previous year’s increase of 150bps in anticipation of tariff inflationary impact. While CPI did rise to 2.9% by the middle of 2018 but by the middle of 2019 it retraced to below 2.00% even as Trump 1.0 tariff war was already in full swing. Core CPI never went above 2.5% and Fed preferred inflation measure PCE barely rose above 2.0% during this period. Tariff impact to inflation proved to be transitory and Fed has over-reacted and by Sep 2019, they reversed their tightening! There were several reasons why consensus, including us, were wrong about the knock-on impact of tariff on inflation and economic momentum. First and most importantly, the Dollar rose 10% as investors sought flight to safety as global uncertainty mounted. The rise in the dollar softens the impact of higher imported inflation. Second, corporates shifted their supply chain to keep prices competitive and third, consumer traded down. Meanwhile throughout this period, US real and nominal GDP grew on average of 2.75% QoQ and 4.63% YoY respectively debunking recession fears. The Fed’s overly aggressive rate hikes during that period proved precipitate, a lesson now unequivocally acknowledged by Powell. His recent dovish comments—indicating any tariff-induced inflation spike would likely be ephemeral—signal a more sagacious stance ahead and we welcome that.

We believe the final version of tariff will be less destructive than feared as it will exact heavy economic costs if they are implemented as it is. There is also the mitigating second-order effect of tariff can elicit such as an expansionary fiscal policy response as we have already seen in Europe and China. Moreover, we believe it is too early to conclude tariff will lead to higher inflation as the case of 2018-2019 has taught us the folly of consensus view on this matter. We welcome Fed’s learnings its lesson not to be pre-emptive in their reaction and communicating patience and the next policy path is to continue to ease. We also disagree with the view that MEGA trades (Make Europe Great Again) out-Trumps MAGA and recent outperformance of European equities over US is overdone.

Equities: Remain Neutral but we are now upgrading US equities to Neutral after being Underweight from 3Q24. We expect US exceptionalism to prevail contrary to current market narrative and undue discount on Trump’s induced volatility. As we have illustrated above, US GDP growth is still stronger than Europe even after we discounted the first-order impact of tariffs in the US and enlarged deficit spending in Europe. The table below also shows EPS growth for US to remain superior to Europe, generating 2years CAGR of 17% for S&P500 and 38% for NASDAQ which are higher than the broader global market and far higher than Europe. Even if we factor a further back of envelope reduction of 2% in EPS for every 50ppt downgrade in GDP to 1.5%, it will still put S&P growing at 5 to 7% in 2025 higher than Europe’s growth rate of 2%. The 3 months EPS revision in the US is still positive and is larger the Europe revision. S&P500 PE has retreated to 21.9x, which is still high relative to our long fair value multiple of 19.5x but on PE to growth regression line, it is not overly expensive.

NASDAQ is the most attractive on PEG of 0.58 over a 2-year horizon but has seen the largest dollar amount of outflows of $3bn in the ETF since the start of the year. Lastly, when we dissect what are the factors driving year-to-date returns, much of Europe returns have been driven by sentiment and low positioning as reflected in expansion of PE and significant flows in the ETF and not by EPS revision, which has been minuscule. On the other hand, S&P and NASDAQ have been de-rated despite having its EPS upgraded and generate 45% higher ROE than Europe.

We close our 6 months long underweight in the US since valuation has become less expensive. We added NASDAQ ETF in the last few weeks and added US Financials as it has the best EPS revision momentum post first quarter stronger than expected results and we believe this will continue with the upcoming easing of capital requirement which should lead to larger dividend and share buyback programs. The construction of our US Equities remains a blend of low beta long-short manager and defensive ETFs with growth such healthcare and utilities, supplemented with higher beta trades like tech-oriented fund manager, tech stocks and tech ETFs.

Outside of US we have added China equities in the quarter and have kept our overweight in Japan equities and underweight in European equities. Back in Oct 2023, we wrote about the risk of Japanification of China which was an inflammatory topic to say the least, High and dry, but we caveat there are a few differences. China has more monetary and fiscal tools to deploy. In terms of its economic development cycle, it is still at an earlier stage than Japan was when their population dividend peaked. Unlike Japan, the Chinese banks are subservient to the government since they are major shareholders of the major banks in the country. A coordinated bazooka of fiscal, monetary, and curated property and bank rescue plans must be enacted if it is to exit is dangerous spiral of a property, banking, and demographic crisis. We believe they are finally at their turning point now.

In their recent “Two sessions” meeting, the government pledge an increase of fiscal spending by 4.4% yoy funded by an increase of government bond net issuance quota to RM 11.9tn for 2025, up from RMB 9.0 trn in 2024. This will result in an augment fiscal deficit rising by 2.2ppt to 12.6%, the second highest on record outside of 2020 Covid. The key areas of expenditure increased will be on upgrading its technology (8.3% yoy increase, +2ppt more than previous year), local government debt swap program (+7.7%, -1.1 ppt less), improving healthcare (+5%, +14.2ppt), strengthening their Social security and improving employment prospect (+4.7%, -0.9 ppt), and stabilizing and ensuring more public housing supply (+4.4%, +3%).

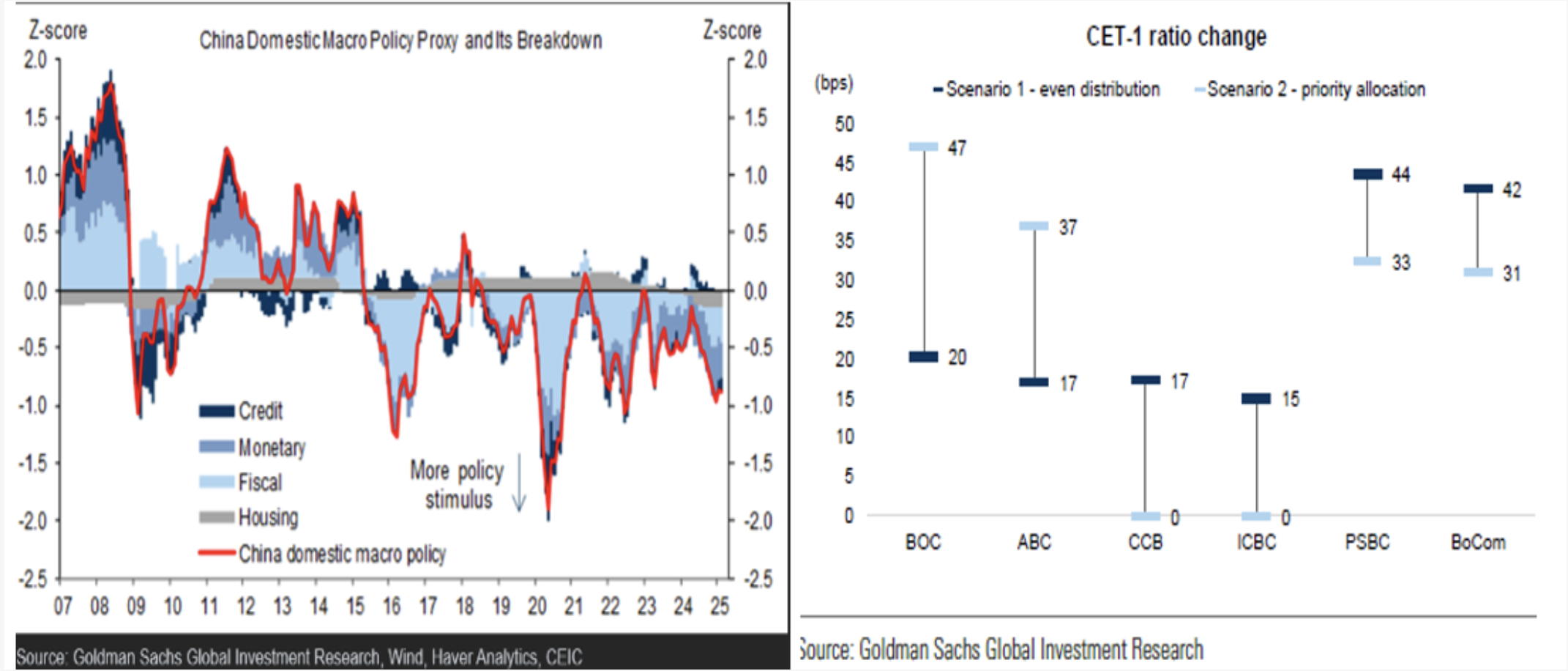

Since the start of its property downturn in 2020, banks’ reserve requirement ratio was reduced by 3ppt to 9.50% and we expect another 50-75bps cut by the end of this year. The prime lending rate has fallen by 100bps to 3.10% and another 25-50 bps decline is probable for this year. But the most important development for the banks is the authorities have finally decided to backstop the banks with an expected RMB500bn capital injection by this year and more will be done for specific systemic banks. This will improve the CET-1 ratio by an average of 21bps for the industry. A large reprieve from central government debt transfer to local government is in store with over RMB10.3trn (+8.4% yoy) budgeted for the year. In the last 14 months, over RMB 8 trn of LGFV debt has already been restructured and on average it carries 250bps lower interest rates than prevailing stock.

All these measures combined have led to finally green shoots emerging from the property sector. Primary and secondary sales have started to rebound with the Tier 1 cities rising by 30.4% yoy and 48% yoy respectively year-to-date. Selling prices have finally bottomed out for both primary and secondary sales. Tier 1 cities inventory has now normalized, and Tier 2 and 3 cities inventory are on the downtrend too. Only start and real estate investment have not recovered but this is expected in a deleveraging stage.

Fixed Income: Underweight. The rates and credit markets have been sending quite different signals from the equities markets with the formers pricing in a more sanguine macro environment. Whereas SPX and NASDAQ at its recent bottoms have retraced all of post-Trump election victory falling 10% and 15% respectively from the peak, 10-year yield rose 30bps post-election and investment-grade credit spreads only rose 10bps in the same period. Only the high-yield spreads have reacted in synchrony to equities concern on the economy increasing by 40bps to 300bps which is still insignificant if indeed we are heading into a recession.

Within fixed income, we believe high yield debt is most vulnerable to a slowdown. While the leverage ratios in low relative to its long-term history, it has been increasing in the last eight quarters to 3.98x. The common adage is you do not go broke because you are highly leveraged, you go broke when you cannot pay off the debt and declining coverage ratio since 1Q22 is a concern. As illustrated in the chart above, the current yield of high-yield credit of 7.5% can wiped out if spread widen by another 784bps in a recession. Whereas for investment-grade debt, the yield can fall by 40-50% in a recession but will still be positive. We initiated a short on US high-yield debt but kept an exposure to investment-grade debt which typically has far lower default incidence and much higher recovery ratios than high-yield.

Commodities: Gold has surpassed our near-term target of 2800 on the back Trump’s induced uncertainty. Our long-term target of $3500 remains but in the near-term we believe there is too much fast money there and have trimmed our position when it traded above $3000. Gold futures are near its highest ever open positions worth $770mn while GOLD ETF inflows are the largest on record since Russian invasion. Any peace dividend from Trump’s inspired diplomacy could see the metal trade back to our near-term range of $2600-$2800.

We have been exploring Bitcoin as an investment option for our multi-asset allocation strategy. The recent policy changes under the Trump administration, such as the repeal of SAB 121 and the establishment of a national digital assets stockpile, could encourage institutional adoption. The launch of Bitcoin ETF is another impetus as it significantly enhances investor access, attracting a net USD 39 billion inflow so far making it the fastest launch of over $10bn of any ETF on record. Additionally, with more derivatives products expected to launch as this asset class becomes more institutionalized will reduce Bitcoin’s volatility, making it more attractive as a stable investment.

Alternatives: No change with 30% allocation to hedge funds to improve our risk-reward because of their less correlated returns streams versus traditional stocks and bonds.

Cash/FX: Cash is reduced as opportunities arose in the US market and macro-shorts in high-yield credit presented in the quarter. We remain bullish on our long Yen/USD trade not just on a diverging monetary path but also as a risk-off hedge.

Featured Picture/Quote:

My anti-consensus wish list

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.