Arne Slot has etched his name indelibly among the legendary “Rare Ones” of English football. Since the establishment of the English Football League First Division in 1888 only eight managers have ever won the league title in their very first season at a club. Slot is part of an even more exclusive group: just three managers who not only lifted the English title in their debut campaign but also arrived as reigning champions from their previous league. He now stands alongside José Mourinho, who won back-to-back Primeira Liga titles with Porto before guiding Chelsea to the Premier League crown in 2004–05, and Antonio Conte, who came to Chelsea as a Serie A winner and delivered the Premier League in 2016–17.

If Slot’s Liverpool side can defend their crown this season, he will match the remarkable feat of Mourinho—winning a domestic league before arriving in England, claiming the English title at the first attempt, and then retaining it the following year. Such an achievement would enshrine Slot’s legacy as one of the two “Really Rare Ones” in a league with a history stretching back 138 years.

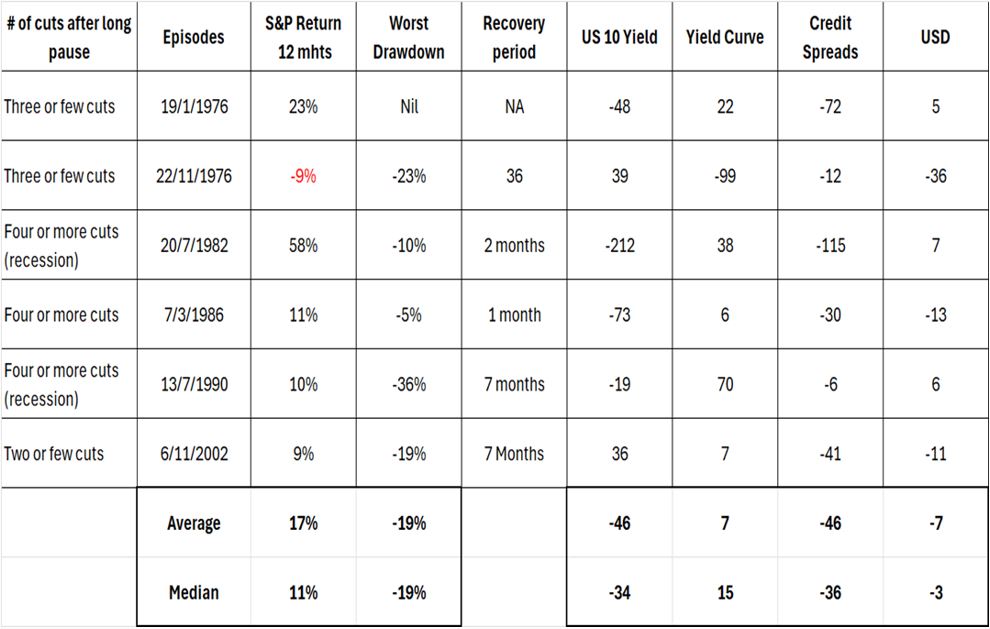

Rarity is not confined to sports. In the history of the Fed’s easing cycle dating back to World War 2, there has only been seven times that the Fed has halted for 6 months or more before commencing another round of easing. The 2024-25 easing cycle will be the eighth of such rare ones. Each episode was shaped not by the familiar rhythm of boom and bust alone, but by complex undercurrents that demanded constant policy recalibration. The 1976 pause, for example, provides an instructive parallel to the current one.

Back in 1971, US has just abandoned the Bretton-Woods Accord that has served in effect devaluing the USD and resulting in higher import prices amongst many other consequences. The prior decade of proxy wars against communism including the humiliating defeats in Korea and Vietnam coupled with enlarged social programs have also led to higher spending and eventually fiscal deficits in contrast to two decades fiscal discipline. Geopolitical miscalculations in the Middle East led to the oil embargo on the US in 1973 which further stoke inflation. The ensuing years saw inflation tripling to 12% by late 1974 and concomitantly, the Fed had to increase rates for much of 1972-1974 from a low of 3.50% to 13%. The economy crumbled and unemployment rate started to rise and by the middle of 1975 the unemployment ratio has more than doubled to 8%. The Fed had to reverse course slashing rates in late 1974 but by 1976, they had to pause their easing because inflation has re-emerged. Furthermore, there was politicizing of the Fed under Governor Arthur Burns as he was criticized for being too accommodative in his earlier tenure. The pause in easing of 1976 was also partly calibrated to demonstrate Fed’s independence.

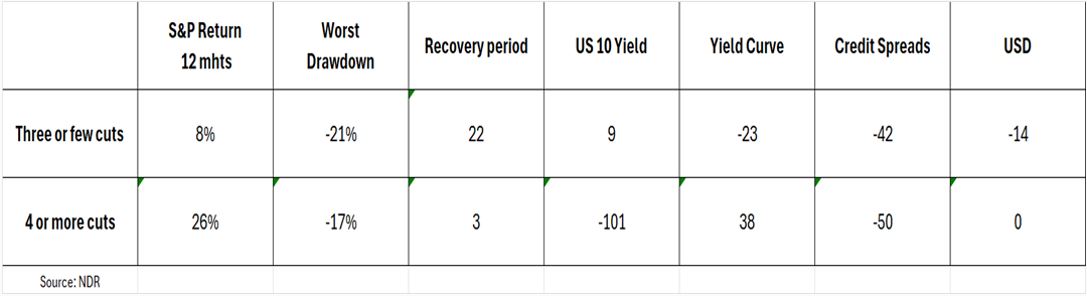

Our investment process is anchored by economic theories and empirical data. We need to glean from history what might happen next even more so when faced with such rare outcomes when Fed paused for so long before resuming another rate-cutting cycle:

Therefore, while the skew is for further upside in the next 12 months as Fed resumes its rate cuts, there are important features to note including risk of large drawdowns and the recoveries often took several months.

What about the other asset classes? How did they behave 12 months after a pause and a resumption of rates cut? 10-year yields mostly decline on average/median of -46 and -34 bps and only on two occasions it rose (1976 and 2002). Yield curve steepens by an average/median of 7 and 15bps and only in the 2nd episodes of 1976 yield curve inverted as stagflation took hold. Credit spreads always narrow on average/median of -46 and -36bps.

The outcome of the USD is less conclusive with 50% chance of rising or falling. The average/median decline are moderate at -7% and -3%. Again, it is the case of 1976 under the disastrous Fed governor Arthur Burns, USD experienced the largest decline of -36%.

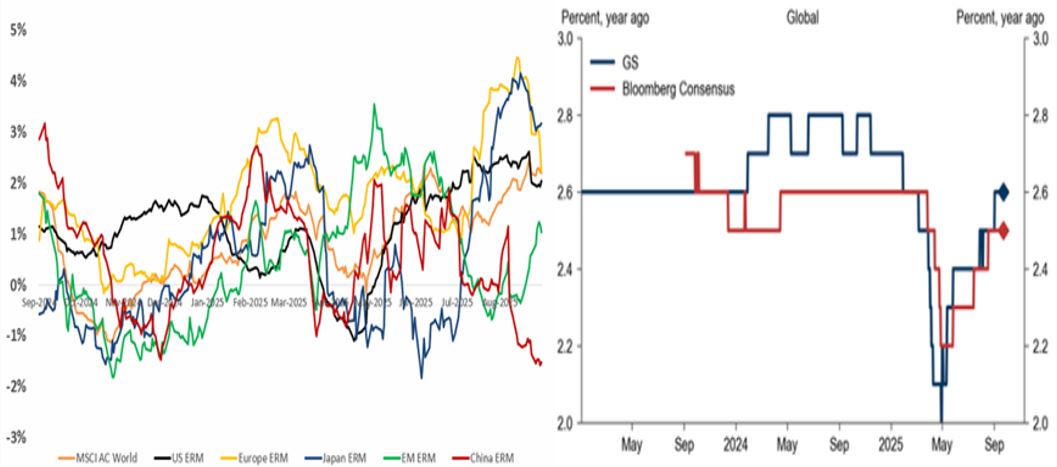

We started the year with the narrative of robust but uneven growth supported by strength in the US and recovery in China driven by their highly stimulative policy but stifled by fragility in Europe and Japan continues. While Trump’s 2025 agendas on immigration and tariffs are the biggest negative swing factors, his pro-business and deregulation stances can counteract the pernicious impact of tariff and mass deportation. Even as growth is strong and inflation is abating, the expected increase in tariffs kept us cautious in our positioning with Neutral in equities but with a view of neutralizing our underweight in US equities when opportunity presents. But we downgraded Fixed Income to underweight eschewing developed market government bonds particularly in the long-dated govies on concerns of their elevated level on indebtedness written in 3Q24 strategy, Now I know when I must retire. We instead opt to add more investment-grade credit and hedge funds instead in anticipation of volatility as tariffs noise amplifies. Gold featured prominently in our allocations due to expected increase in central banks’ buying as they look into ways to hedge their decades long overallocation into USD denominated assets.

By the second quarter, our worst-case tariff risks scenario outlined at the start of the year has now become our base case with the effective rates of 15–17% established as the new baseline. This higher tariff regime led to downward revisions in US growth forecasts, with GDP projected at 0.8–1.2% for 2025, while our dis-inflation trajectory was pushed out by two quarters into the end of 2025 instead. Still, we believe higher inflation pressures will be transitory, and the Fed should look pass this bump and resume its cuts to less restrictive monetary zone (sub 4%). Crucially, AI-led capex, data-centre buildouts, and grid upgrades emerged as powerful counterweights—supporting earnings revisions and allowing equities to advance even at fair valuations.

By the third quarter, the growth drag and price pressures from tariffs proved milder than feared, with upward revisions to earnings and GDP following Liberation Day.

We pivoted the portfolio to risk-on: We recalibrated with high beta, growth expressions added including more AI themes, China tech, and global financials which should benefit from our view of a steepening yield curve. The theme of curve steepening was also incorporated into our fixed allocation focusing on shorter duration mandates. We also added more EM credit as USD weakness is a tailwind for EM economies. The penultimate risk-on expression was our addition to Bitcoin ETF after months of consultation with our clients explaining the legitimacy this asset class has achieved post the establishment of clearer regulatory frameworks. It is also as an alternative to the prevailing view of USD losing its hegemonic status alongside our preference to hold Gold.

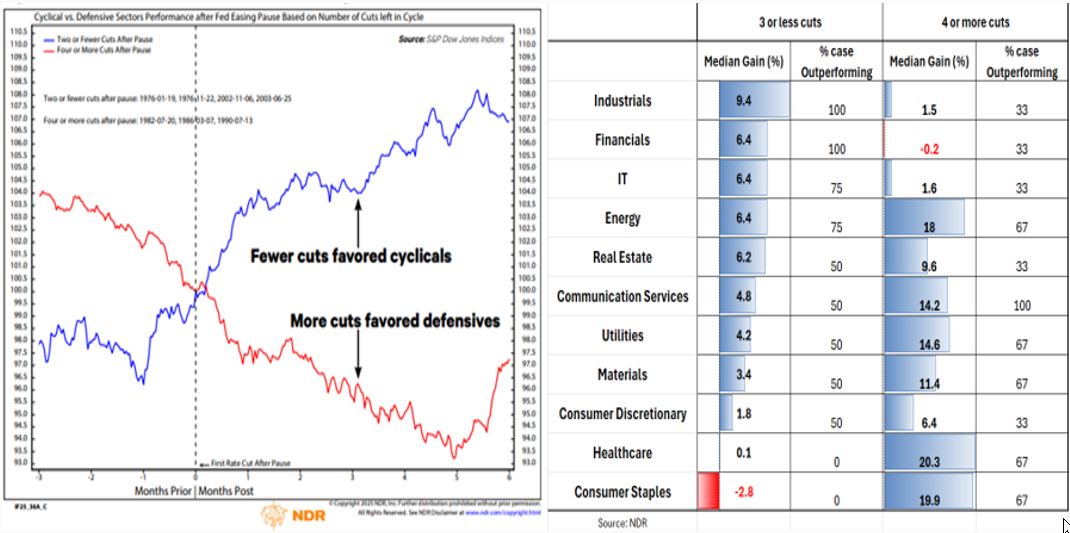

Equities: Upgrade to overweight. As detailed above, Equities has historically performed well when Fed resumes its easing cycle after an extended pause though leadership styles differ between shallow (defined as three or fewer cuts) versus more aggressive cuts (four or more). In a shallow easing cycle, cyclicals outperformed defensives, Industrials, Financials, and Tech outperformed the broader market and have high incidence of outperformance too.

We believe the market is too dovish in expecting the Fed Fund rate to reach 3% (i.e. 4 cuts) by 3Q26, and we will present that in our view in the fixed income segment. Our equities portfolio is positioned for a shallower cut outcome. 50% of our equities portfolio is positioned in tech, financials, and AI-related plays. Nonetheless, we are cognizant that those rare episodes often come with significant drawdowns averaging -19%, hence we have another 45% of our equities in core long/short, event-driven hedge funds and lower beta expressions. In terms of geographical views, we are overweight the US and China and Neutral in both Japan and European equities.

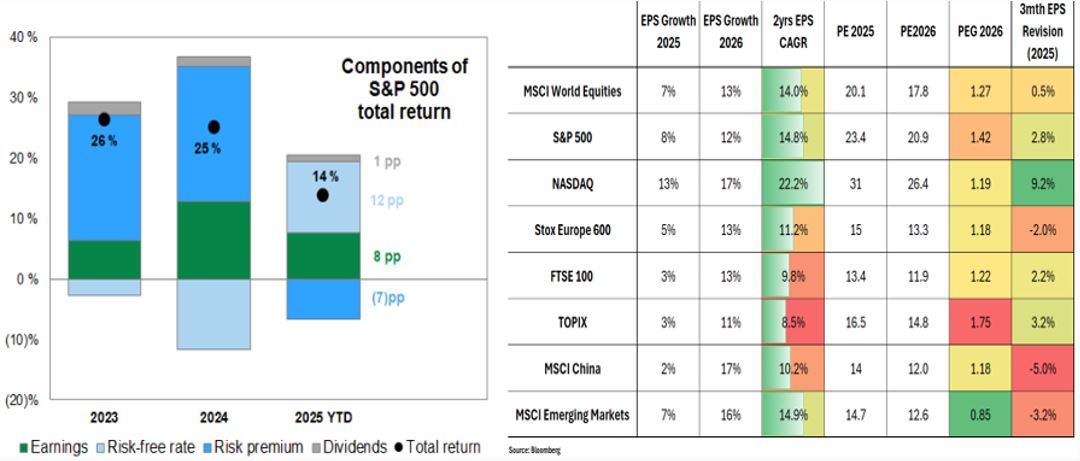

We have argued in T2025: I’ll be back – US equities are not expensive and instead are fairly valued. We commented the key condition for the market to generate positive returns hereon will be driven by earnings growth alongside positive earnings revision momentum. Year-to-date S&P performance of 14% has been driven by earnings growth which accounted for 44% of the advance, dividend 5%, multiple expansion 38% while rising equity risk premium subtracted 33%. S&P earnings for 2025 have been revised upwards by 3ppt since the start of the year. Looking forward, these positive catalysts should remain for the 1-2 quarters. Consensus estimates for S&P and Nasdaq are for EPS to grow by 8%/12% and 13/17% respectively in 2025-26 and there is no reason to expect negative revision momentum.

Fixed Income: Underweight. Shallow versus aggressive cutting cycles matter distinctly for bonds too. In shallow cycles, 10 year yields tend to be broadly unchanged, curves flatten, and credit spreads narrow modestly, leaving risk adjusted prospects more compelling in equities than owning bonds as the combined effect of yield and credit spread compression is expected to be mild, especially when considering credit spreads are near or at all-time lows across investment-grade and high yield bonds.

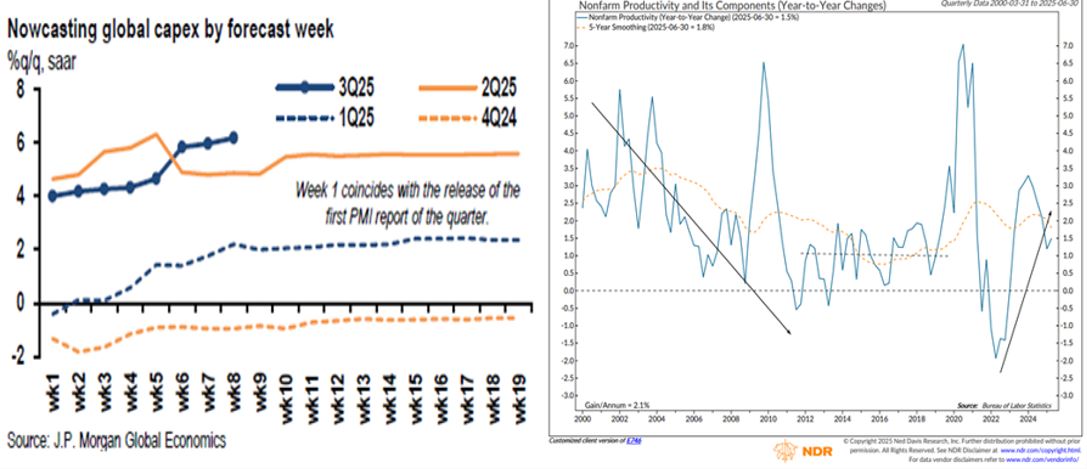

Our conviction that this cycle will be a shallower cut lies with assumptions that GDP growth will be resilient into 2026, while inflation will abate but is unlikely to retreat to the Fed’s level of 2% through a combination of stronger growth and residual effect of tariffs. The global GDP nowcasting model we tracked currently stands at 2.3%ar, which is not far behind its long-term growth potential. The latest PMI reading in Aug of 52.9 portends to trend-like growth of 2.1%ar in global GDP in the next two quarters. Much like the nowcasting model, global PMI has risen for four consecutive months. Looking further out, the consensus full year GDP growth forecast for 2025 and 2026 is for 2.9%; certainly not a stall-speed pace.

One of the main pushbacks to a benign growth outlook has been the stagnation in the labour market in the past few months. We believe the current conundrum between a weak job market, but a strong GDP can be explained by a combination of improvement in productivity and higher capex. As profits increase, we believe the current lag in employment will likely be reversed over the next few quarters. All these factors point to a measured response from the Fed. The current Fed dot-plot indicates three more cuts by 2026 while the market is expecting four more cuts by middle of next year. We will not be surprised if there are only two more cuts left; hence, we made no material changes to our fixed income strategies: keeping duration short, preferring Investment-grade and EM credits and staying with our private lending activity in trade finance.

Commodities: No changes, just keeping gold and bitcoin futures. Gold feels extended based on the positioning we have seen in Gold ETFs and future contracts and is already above our 2025 target price of $3,500. We introduce of our 2026 target price at $4,000 for Gold. Bitcoin medium term target price of $125k remains and fast money positioning is not as heavy as in Gold. So, from a risk-reward perspective, we prefer Bitcoin over Gold for this quarter.

Alternatives: No change with 30% allocation to hedge funds. Our fund-of-hedge-funds strategy (GARP) has shown its worth in providing low-correlated returns to bond and equities, while generating a 10.7% return since inception on volatility of less than 4%. Speak to our wealth advisor to find out more.

Cash/FX: Cash is kept at the minimum.

Featured Picture/Quote:

“Always take your job seriously, never yourself.” ― Dwight D Eisenhower

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.