I have asked ChatGPT to rank the greatest football transfers of all time and it responded with Cristiano Ronaldo’s transfer from Manchester United to Real Madrid back in 2009 as the greatest. Back then, it was a world record transfer and in his tenure in the Bernabeu, he scored a prodigious 450 goals in 438 matches. Simplistic math equates to one goal per game. He also won two league titles, four Champions League titles, while picking up the Ballon d’Or on four occasions. It is a hard fact for a rival team supporter to accept but if I apply my investment acumen while suppressing my inherent bias as a fan of his rival team, the title of the greatest transfer will still be Mr CR7. Adjusted for inflation, Ronaldo will cost £113m in 2023 terms ranking him only the 10th most expensive transfer of all time. His success far eclipsed that of Neymar’s move from Barcelona to Paris Saint-Germain for £229 million (inflation-adjusted), or Mbappe’s transfer from Monaco to PSG for £185 million. During Neymar and Mbappe time together in PSG, they only won some trophies in the minor league of world football.

Back in the 2020 strategy piece, The Four Horsemen of the Apocalypse, we delineated the challenges government will face in the coming decades, especially in the developed world. An aging demographics, the end of neoliberalism economics, the rise of state-sponsored enterprises, the ascendance of the vox populi, and the emergence of a new world order. These developments portend significant complexities and threats to both the financial system and the system of governance. Four years on, and we have indeed witnessed the intensification of these issues. The opprobrium generated by the woke culture contributed somewhat to the rise of the Far-right movement. The redux of Trump versus Biden, and the bipolar schism between Western style system of governance and all other forms of governance against a plethora of issues from wars to climate challenges. A good example is how the state has sponsored the success of China’s EV cars and the ensuing trade barriers enacted against them are a microcosm of the trends we have raised in 2020.

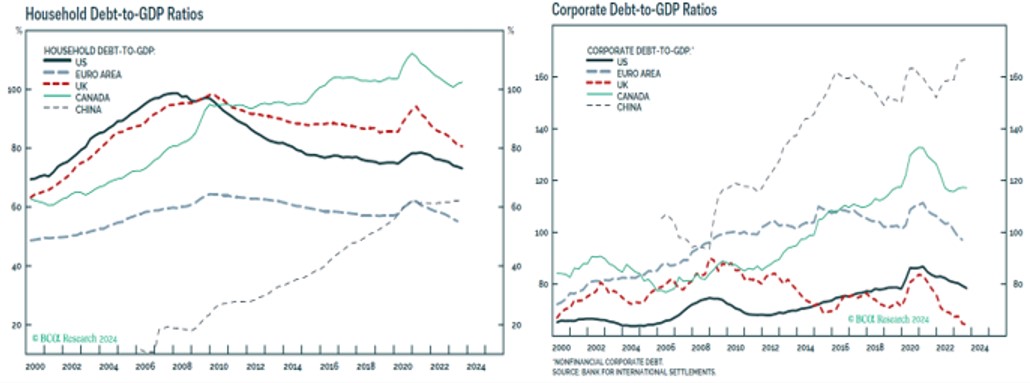

The most salient encapsulation of all these issues is the greatest transfer of debt from the consumer and the corporate sectors to the government. In the US, Federal debt-GDP rose from just under 59% pre-2008 to more than 100% now. At $34trn of debt, it is a peacetime high and only 6ppt lower than its record high right after the end of World War 2. According to the US Congressional Budget Office, in the absence of any major policy changes, US federal debt-GDP will reach 170% by 2050. Already the US is spending $870 billion in net interest servicing which is equal to their defense budget and will soon surpass it.

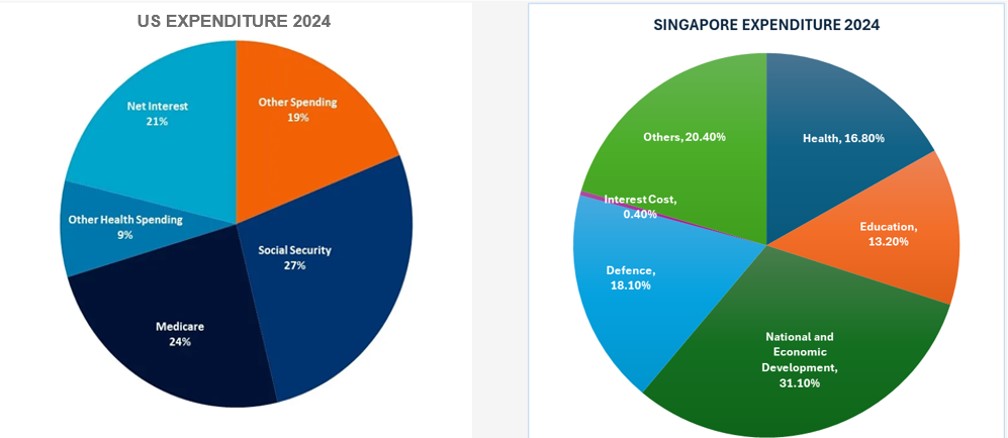

Government incurring debt is not inherently deleterious. If the debt is use for productive purposes, it propels future growth and keep the debt ratio at bay. However, if the debt is to finance consumption rather than investment, it is borrowing from the future to fund the present and that is exactly what is happening in many developed countries. Take the US for example, social security (27% of fiscal budget), Medicare/Mediaid (24%), and net interest payments (21%) constitute the three largest parts of its budgetary allocations, and they are all consumption-related spending. In contrast, Singapore investments-related expenditure such as healthcare, education, and various national and economic development programs account for 58.1% of the national budget, and interest cost is only 0.4% of our budget.

As detailed below, the ballooning of government is not just a US occurrence. It is prevalent in all the major economic blocs, even in China, which is late in the development cycle, has seen their government debt risen rapidly.

Conversely, the US private sector debt-GDP (which includes both household and corporate) fell from a high of 170% pre-2008 to less than 150% now. Aside from China and Canada, household debt to GDP has either stablised or trend lower post 2008. Corporate debt- GDP has also fallen steadily in countries like US, UK and the Euro Area post covid.

While the transfer of debt from the consumers to corporates does reduce the risk of the next recession originating from these segments, it means the next global recession could be triggered by bond vigilantes revolting against further funding of profligate governments. In a classic private sector recession fuelled by intolerable debt levels, defaults rise, lenders suffer, and a destructive cycle of retrenchment in profits, employment, and GDP growth ensues until sufficient resets are achieved. However, in a public debt default scenario, yields spike, dragging down capital markets, financial institutions that are large holders of government debt go under, and currency devaluation occurs. This pushes inflation up as growth struggles and the country moves into the dreaded stagflation. If it is Argentina that we are talking about, the world brushes that aside. If it is the US, I think it is time to retire.

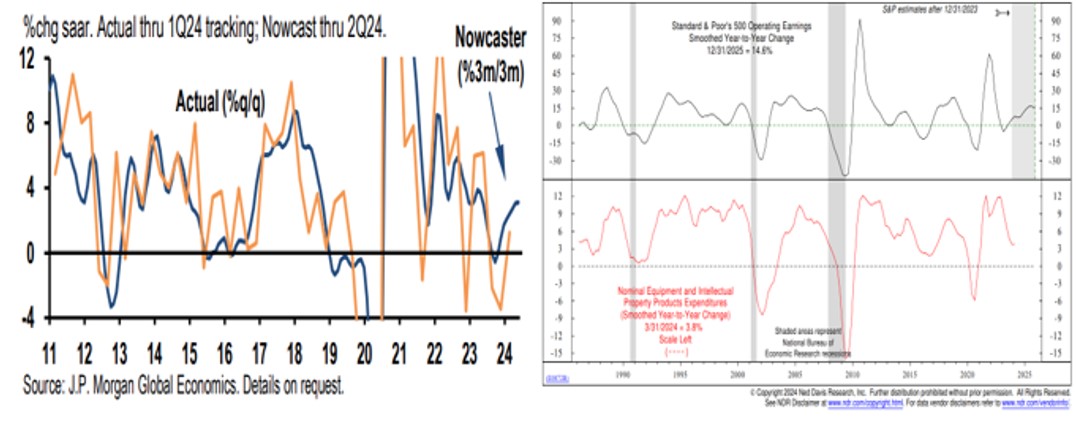

In our 2024 outlook, “How difficult is it to sink a US aircraft carrier?”, we moderated our concerns about an imminent recession in the US. Our analysis of the strength of US consumer and corporate balance sheets led us to conclude that both are remarkably healthy, supporting our view that a recession is not on the horizon. We anticipate a deceleration in global GDP, driven by a moderate slowdown in the US but mitigated by growth in other regions, thus preventing the risk of a synchronized global recession. We are also expecting the driver of growth to transition from the services sector, a post-Covid bulwark, to the manufacturing sector. The latest global output PMI, which rose for the seventh consecutive month in May, is collaborating with this view. Furthermore, we give considerable importance to the sectoral and regional details, and those sets of data point to a global expansion that is increasingly independent of the US demand.

Another promising facet of the current economic cycle is the resurgence of capital expenditure (capex) fueled by robust earnings and the promising applications of artificial intelligence (AI). The latest high-frequency data points to an acceleration in Capex with the nowcasting model suggesting sustained momentum in the coming few quarters. Critically, the pick-up in intermediate goods reinforces the trend. We can link this resurgence in capex to the virtuous cycle of better-than-expected corporate profits that is inspiring greater confidence to further invest. Such an up-cycle in capex has historically been accretive to GDP and earnings growth. As we wrote in 2017, Melt-up, capex cycles have been pivotal for equities performance as they typically yielded higher returns driven by positive earnings revisions and multiple expansions.

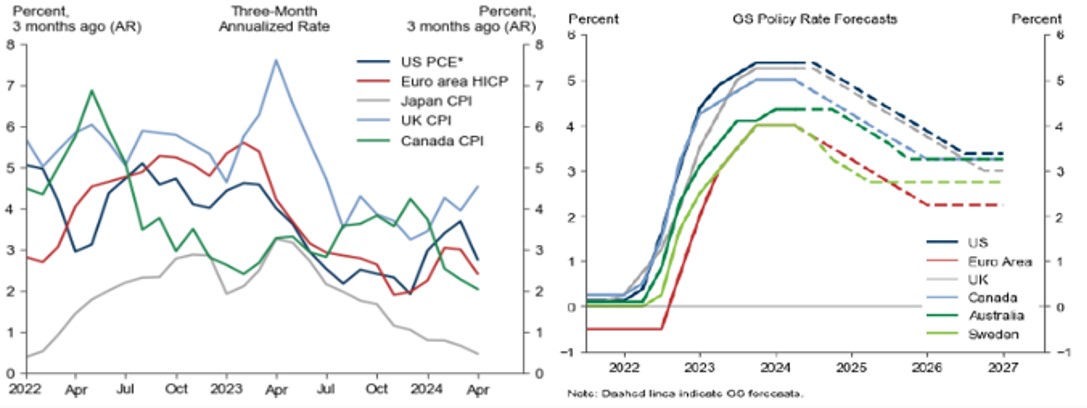

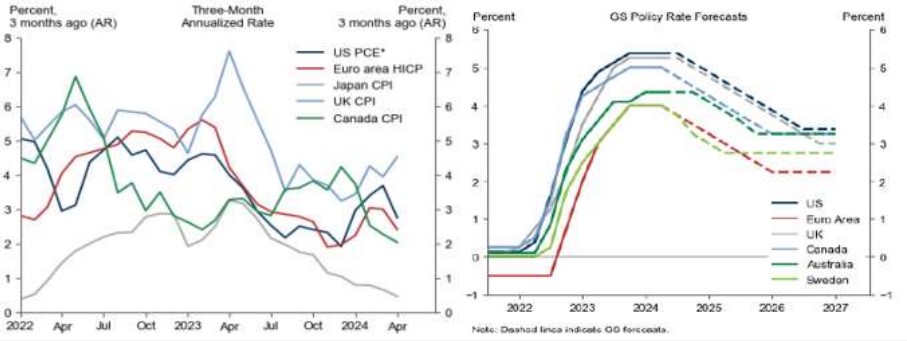

At the same time, we cautioned against the widespread belief of substantial central bank rate cuts arising from a smooth disinflationary trend. In our 2Q24 outlook, The Last Mile, we counsel patience for inflation in the US to fall to the Fed’s target and cited the biggest risk on our disinflation call has less to do with oil nor wages but with housing, which the US is suffering from a chronic shortage post-2008 trauma. Given that inflation prints since our 2Q24 publication have only edged slightly lower and our main concern, housing disinflation has fallen slower than we have anticipated, we move our first rate cut to 3Q-4Q24, with the earliest possibility being in September and the latest by November. Nevertheless, we retained the view that the Fed will execute 3-4 cuts over the following 12 months after the first cut.

There are nuances in our inflation and rates view as well where we expect the ECB to cut ahead of the Fed and they did (For the data geek, this is the first time the ECB has ever cut its rates ahead of the Fed), followed by BOE in 3Q24. Since the start of the year, we have already seen the central banks of China, Brazil, Mexico, and Switzerland reducing their policy rates, hence, we remain confident we are at the start of a global easing cycle, not one of higher for longer rates. But we are suspending our view that BOJ will be raising theirs in the near term and has written extensively about the dilemma Governor Ueda faces in raising rates, Everything, Everywhere, All At Once. We believe BOJ could wait for Fed to cut first before they increase theirs as that would have a more pronounced impact to arrest the “excessive” depreciation of the Yen that they so detest.

It is important to highlight our portfolio strategy is assuming that the forthcoming easing cycle will be a shallow one, with four or fewer reductions, akin to those seen in 1980, 1984, 1995, and 1998.

Equities: Overweight. When we triangulate the three aspects of valuation, growth and positioning, Europe stands out on cheaper valuation, and lower positioning, while both the US and Japanese equities are expensive on valuation and already well-favored. We have further reduced our weights in the US equities in favour of Europe and Japan as Neutral after significantly trimming positions in the last two quarters. The lift in global manufacturing bodes favourably for Europe more than for the US as well as its economy and stock market constituents are more geared to global momentum. China is cheap on all three measures, but we remained cautious as we do not believe the current policy actions are enough to stem the multi-dimensional and multi-year restructuring process it must address as stated in this Navigator, High and Dry.

Instead, we are quite happy to represent our views in EM Equities via our key long/short managers and they have continued to deliver. Many of our core managers and ETF expressions have continued to generate better risk-adjusted returns than their respective indexes.

For the active component of our US equities allocation, we have constructed around two intersecting characteristics. We like sectors that will outperform in a shallow-cut cycle such as healthcare, financials, and communication services as shown below. We also want to be in sectors that will exhibit higher growth potential, have better valuations, and are not overly crowded, such as Utilities and Technology sectors.

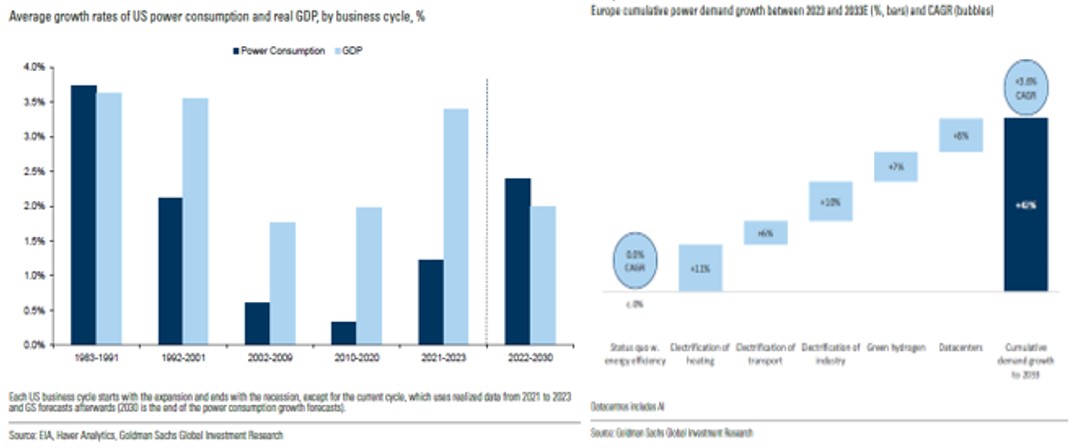

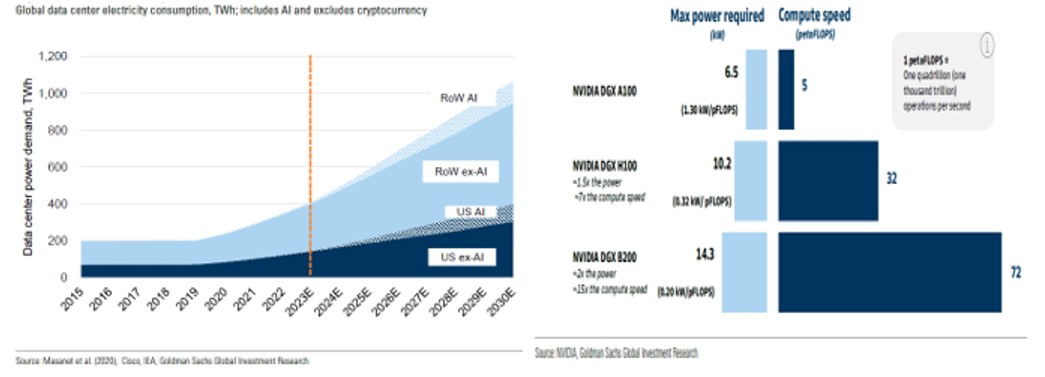

Take the Utilities sector for example. We call it the 2nd derivative of AI play aside from the semiconductor and software plays we have in the portfolio as the underlying, and data centres as the 1st derivative. According to a study by Goldman Sachs, it will be the first time in three decades that power demand in the US will outpace GDP growth. It is estimated power demand in the US will grow at 2.4% CAGR up until 2030 in contrast to the past 2 decades’ growth of less than 0.5% pa. The proliferation of data centres is expected to drive 650 TWh of incremental power or at 15% CAGR during this period. It is expected to account for 8% of total power demand by 2030 up from only 3% currently. At least $95bn of annual capital investments will be needed just to deliver power to data centre in the US.

Over in Europe, the demand surge is even more pronounced. Electricity demand in Europe since 2008 has declined cumulatively by nearly 10% through a combination of exogenous financial shocks and ongoing greening of their economy. But Goldman Sachs forecast power demand from Europe will reverse this trend rising 3.6% CAGR over the next decade. In Europe, in addition to supporting data centres, there is also the added impetus coming from the electrification of their household and transport systems. The power demand for data centres is forecast to grow 8% CAGR in the next 10 years or addition of 150 TWh of extra power needed. Furthermore, it is estimated that Europe needs $800bn of spending on transmission and distribution especially given that their grid is the oldest in the world with an average grid life span of 45-50 years versus North America’s 35-40 and China’s 15-20 years.

Globally, the power for data centre is expected to accelerate significantly from 2023 onwards from 200 TWh of power to more than 1000 TWh by 2030. This is driven not only by the increase in demand for AI data centres but also by the difference in power intensity between traditional hyperscalers and AI data centres. For example, ChatGPT itself requires 10x more power than a normal Google search. The upcoming Nvidia Blackwell chip will require 2.2x more than the first GPU used in AI data centre and 40% more than the current chip that is being used.

Distilling all of these factors, the EPS for Utilities ETF in the US is forecast to grow 21% CAGR over the next 2 years, outpacing S&P by 3ppt. The last time this industry grew at such healthy clips is way back in 2004-2007. It currently trades at a discount to S&P on a PEG basis and at 15.7x 2025 earnings is just trading at a slight premium to its long-term PE. Between 2004-2007 when it exhibited double-digit growth, the sector traded at an average of 17x PE to a high of 21x. Moreover, for the first time since the GFC of 2007, the sector is forecast to generate ROE above 11%. This sector is also sensitive to interest rates given utilities are highly leveraged companies, which should also benefit from our view of an easing cycle in the coming months.

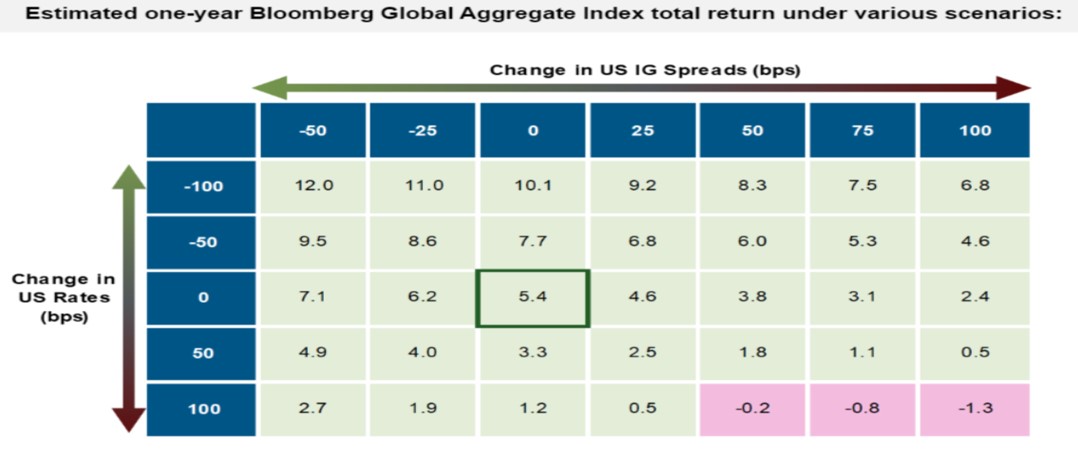

Fixed Income downgrading to Neutral. We are in the camp the easing cycle will commence this year and our range of US 10 yield has not changed looking for a fair value trading band of 3.70-4.20% in 2024 and 3.30-3.70% in 2025 versus the current level of 4.32%. However, we are downgrading Fixed Income to Neutral as we believe better returns could be generated by allocating to equities and hedge funds. We continue to like Developed Markets Treasuries and Investment-Grade debt as they can generate asymmetric returns given the current level of bond convexity. Furthermore, as past analysis shows that fixed deposit rates always fall 6 months before the first cut and 12 months after, we believe there will be a hunt for carry shifting flows from fixed deposits to other relatively safer assets such as higher yielding Treasuries and investment-grade debt. Speak to your wealth managers if you want to find out more about our Fixed Maturity Investment-grade offering that is currently yielding more than 5.5%

Alternatives: We have never agreed with the consensus view that Private Equity is a great diversification strategy that should warrant anything more than 15% of your portfolio. This asset class has hidden behind a flood of cheap money and away from the realism of mark-to-market profit and loss. Even when they are mark-to-market, the vagaries of how they are valued and the inherent conflict of the auditor marking a client’s book is just too obfuscating.

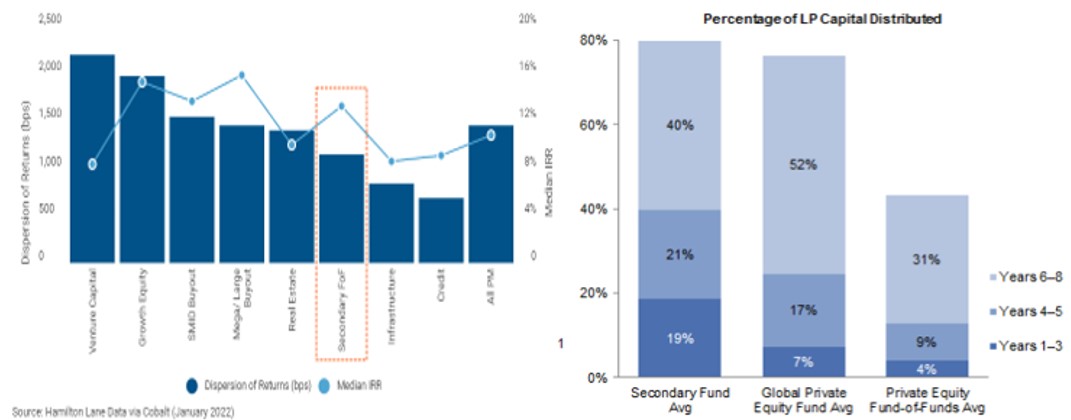

Our skepticism towards private equity has been validated, as noted in the Financial Times article, “FT: Private Equity bosses warn of further losses”. However, in the realm of investments, everything has its price—whether in periods of euphoric pandemonium or manic depression. We believe that in the coming quarters, the reset in private equity valuations will become more pronounced, potentially presenting an opportune moment to acquire PE secondaries. Historically, returns from PE secondaries have closely matched those from venture capital seeding and growth equity but with lower return dispersion. More importantly, given our firm’s emphasis on liquidity, PE secondaries typically return capital much earlier than other private equity formats.

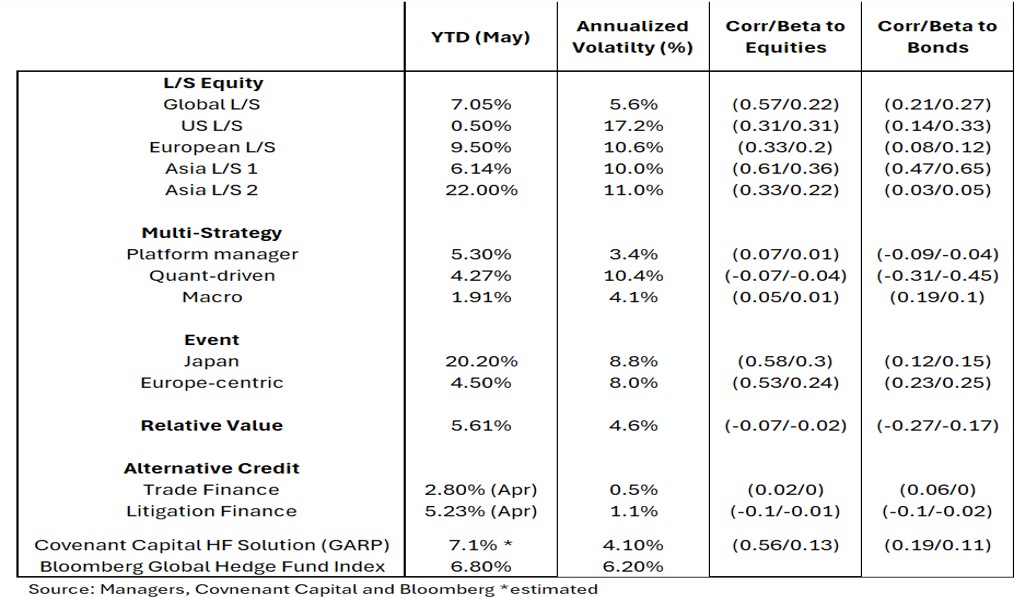

Instead, we have advised clients to allocate a larger chunk of their alternative bucket to hedge funds. They have far better liquidity (typically within 6 months you will get your money back) and if the hedge funds are dealing with the public markets, valuations are easily discoverable. Our multi-strategy and multi-manager hedge fund strategy continues its stellar performance generating good returns on low volatility and remains lowly correlated to equities and bonds. If you would like to find out more about this mandate, please also reach out to our wealth managers.

FX: We expect the Yen to appreciate as the interest rate differentials between the US and Euro versus the Yen are expected to narrow, largely due to diverging policy directions from their central banks. ECB has already cut, and we expect the Fed to ease sometime between August-November this year. However, we think it is more likely that BOJ will initiate their hike after the Fed has eased theirs. The contrast in monetary approaches underpins our optimism for the Yen to strengthen, albeit gradually.

Commodities: We continue to favour Gold within the commodities space. It has several investment theses running for it. In the short term, gold is inversely correlated to bond yields and the USD. Seasonality is also favourable for gold heading into the second half of the year.

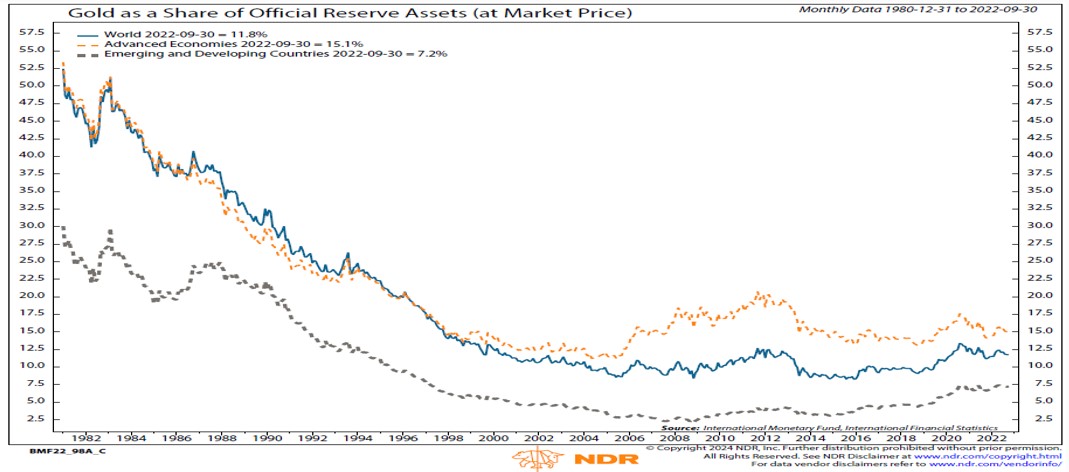

In the longer term, the dollar hegemony we have known since post-WW2 is increasingly being called into question. The blunt force of locking Russia out of the international financial system is as brute as Russia’s attack on Ukraine. The multi-national move to cut off Russia has caused consternation amongst many governments, especially among emerging market economies. Compounding their concern is that US is on a path of unsustainable fiscal profligacy and the day of reckoning when foreigner buyers’ revolt will have serious repercussions to the status of the USD.

How much more can these central banks be substituting US Treasuries for Gold? Currently, emerging and developing countries hold 7.2% of their reserves in gold, which is more than 3x they held at the bottom in 2008. Post 2008, when the developed market central banks threw away conventional monetary policies and opted for an unorthodox world of QE and helicopter money, there has been a perceptible increase in their holdings in Gold. If we look at their gold reserves back in the 1980s, they averaged 22% of their reserves and between 1990-2007, the average was approximately 11-12%. The same trends can also be seen for advanced economies; a noticeable pick up in Gold post-2008 and gold reserves that were substantially higher back in the 1980 right up to 1999 when the other reserve asset, the Euro, debuted. In other words, there is still room for them to add more gold and diversify away from USD. We can also slide copper as the 3rd derivative of AI data centre boom.

Cash: Cash 3 to 5%

Featured Picture/Quote: ChatGPT dating gone wrong. Thank God I am married.

https://www.tiktok.com/@thechattinghour/video/7371150343163350305

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.