Before every race, I have a standing appointment with my cardiologist, thanks to the strict regulations imposed by the household’s chief health officer—the wife. The doctor will always give me the same spiel: the last mile is where most amateurs bite the dust. He advises against any last-minute heroics or a mad dash to the finish line, reminding me that after 5 to 6 hours of pushing my limits, my body isn’t exactly craving for more punishment. Plus, trying to outpace my shadow in the final stretch won’t exactly rewrite the race’s result, certainly not for this amateur athlete. It is the same wisdom of pacing and patience that I am advocating to our readers as we navigate towards the 2% inflation target in the US.

We sent our key assumptions in our January 2024 strategy, How difficult is it to sink a US aircraft carrier?, expecting a Goldilocks period of trend-like growth and the continuation of disinflation leading to a set-up for rates to be lowered across many economies. While valuations across many asset classes are not cheap and at best fair, we countered that positive revisions in GDP and earnings will drive price appreciation. We also note that market concentration in “Magnificent 7” (perhaps should be renamed Magnificent 4 since Apple, Tesla, and Google are down for the year) is a risk, but the broadening of earnings profile across more sectors alongside significant money on the sidelines do recommend a risk-on posture. We have dived deep into the reasons why the global and the US economy escaped a recession in 2023 and concluded those drivers of strength should prevail in 2024. There are ambient risks that may temper this constructive view such as the US election and transnational conflicts that might affect oil prices, but the biggest risk we believe would be a resurgence in inflation more than a recession.

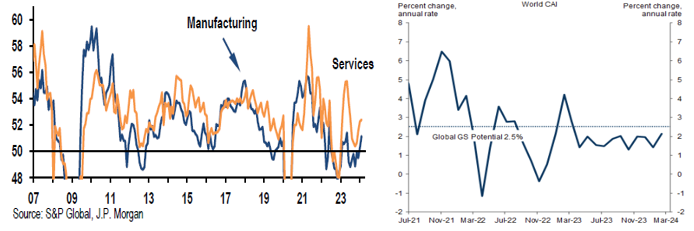

The global economy, including the US, is finding its equilibrium, neither too hot nor too cold, with the service sector continuing to drive growth. The resilience of the service sector is evident in the Global Purchasing Managers’ Index (PMI) for services. Both the Output and New Orders for Services indices remain in an expansionary phase, marked by readings of 52.4 and 52.0, respectively. These figures have shown consistency over recent months, underlining the sector’s steady contribution to economic activity. A recent noteworthy development comes from the manufacturing sector, which after enduring several quarters of contraction (indicated by PMI readings below 50), is showing signs of revitalization. In February, the New Orders for Manufacturing climbed to a 50.4 reading, crossing the threshold into expansion. This rebound has been complemented by the sustained expansionary levels in Manufacturing Output and Future Outputs, while Output Prices have turned, hinting at a recovery in demand and pricing power within the segment of the economy.

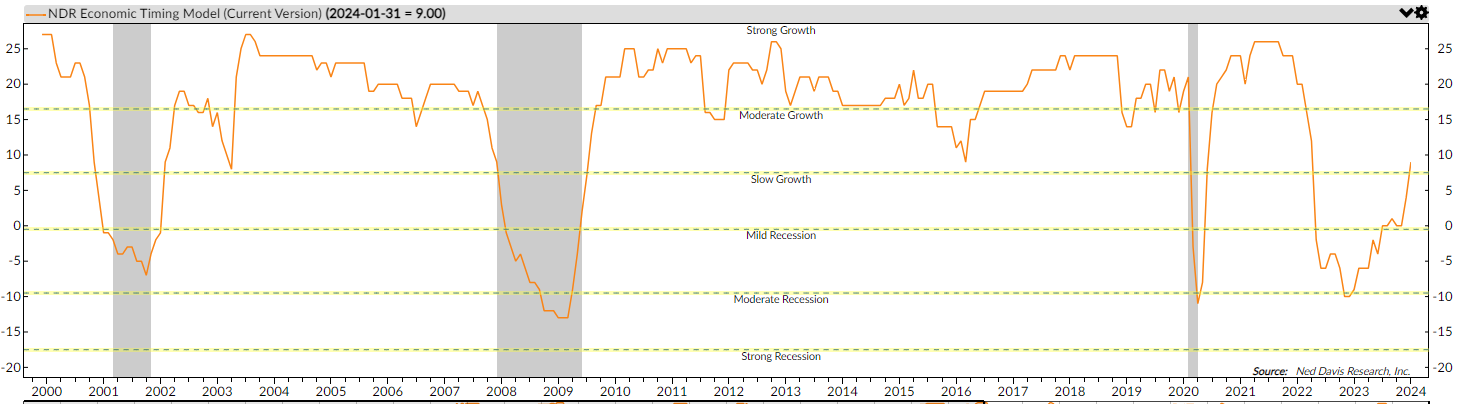

The consecutive improvements in the global PMI over the past four months reinforce our assumption of a trend-like growth and one of avoiding a recession, as this data extrapolates to an annualized global GDP growth rate of approximately 2.9%. Goldman Sachs’ nowcasting model projects a slightly more conservative growth rate of 2.1%. Furthermore, the Net Davis Research economic timing model suggests a transition out of “Mild Recession” into the “Slow Growth” phase, implying the risk of recession has abated further.

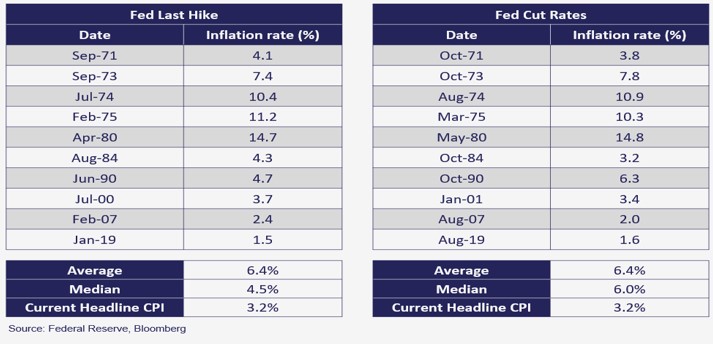

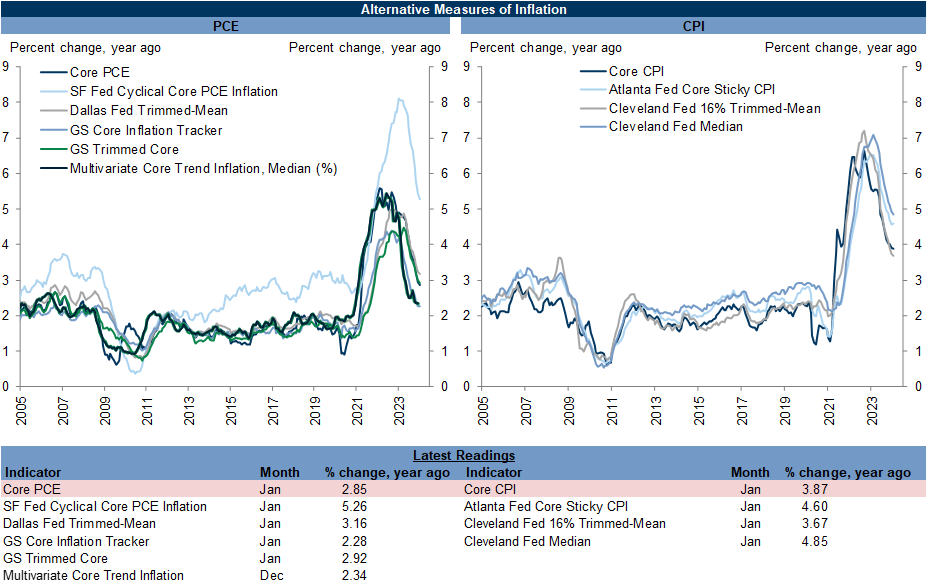

While the recent two months of higher-than-expected inflation prints challenge one of our key views, we caution against the consensus view that disinflation has stalled. The correlation between inflation and growth is a well-established fundamental. Robust growth fuels inflationary pressures, and conversely, a slowdown tempers them. Given the anticipation of global growth slowing down to its long-term trajectory post the exceptional surge in 2023, the prospect of a sustained inflationary resurgence seems improbable. The post-pandemic landscape had many unique challenges—supply chain disruptions, labor market imbalances, and housing supply mismatches— some of which continue to exert episodic pressure on inflation but should reflect fundamentals of demand and supply over time. Keeping a restrictive monetary policy stance for too long can have detrimental effects on the economy and expose unintended and hidden vulnerabilities that can be systemic. We already have two recent examples from last year; the bankruptcies of five regional banks in the US and the near collapses of many UK pension funds as they suffered significant mark-to-market losses on their government bond holdings. History has shown the Fed cut rates even before their inflation target is achieved as recession looms and unknown systemic appears. Lastly, the latest Fed dot reaffirms their view that the long-term neutral rate should be 2.6% not 5.5% currently.

After stronger than expected inflation prints in the US in January and February, market expectations shifted significantly, scaling back from predicting five to six interest rate cuts down to just three, and delaying the anticipated first cut from March to June. Contrary to market sentiment, we stated in our 2024 global macro outlook podcast in January on Spotify, How difficult is it to sink a US aircraft carrier? that is too aggressive and expects a 75-100bps cut over 12 months commencing sometime in 2Q24. Inflation in the US rose notably at 0.3% month-on-month increase in February’s Core CPI, following January’s 0.39% rise. However, we dismissed January’s stronger-than-expected print as annual start-of-the-year price adjustments, while the Feb strength was driven largely by energy and housing.

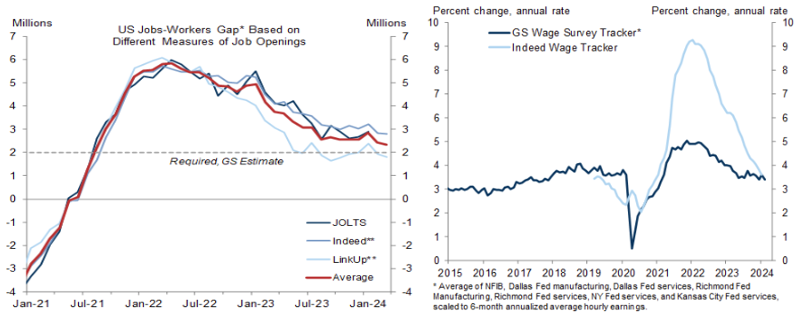

We fade the oil impact for now, moreover it is core inflation that the Fed will focus on. We have mentioned before among the various key drivers of inflation, wages, and house prices are the most important to monitor. We expressed confidence that wages will slow towards trend growth by 2H24 and are monitoring the gap between job openings versus availability of workers, jobless claims, and wage surveys. According to Goldman Sachs, the jobs-workers gap needs to fall to 2mn to be consistent with a 3.5% wage growth, which translates into a 2% inflation print. The gap is very close to that level now. The surge in immigration has also eased the workers shortage in blue-collar jobs and this segment was responsible for the largest increase in the wage composite. The latest wage surveys corroborate this view as wages have moderated to 3.5% in February.

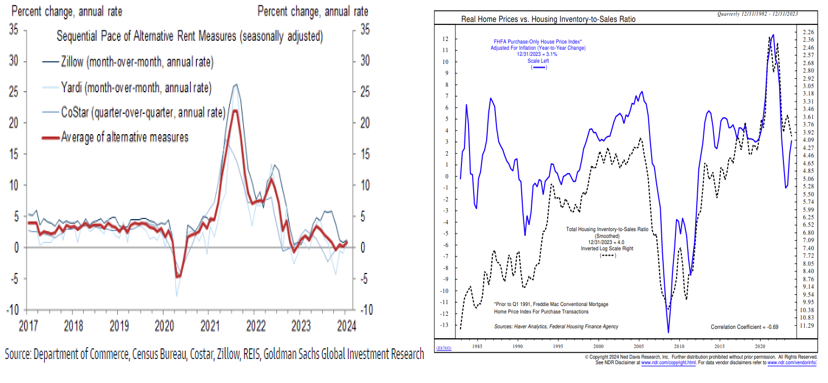

As we have communicated in our bond webinar held in October 2023 (please ask your wealth manager if you like to listen to that recording) we believe housing represents the greater risk to our disinflation call. Furthermore, house inflation is by far the largest weight in both PCE and CPI calculations. The latest high-frequency indicators of rents continue to support the view of housing inflation will moderate in the coming months. But on the other hand, the chronic shortage of housing, especially at the localized levels, does present an upside risk in the longer term.

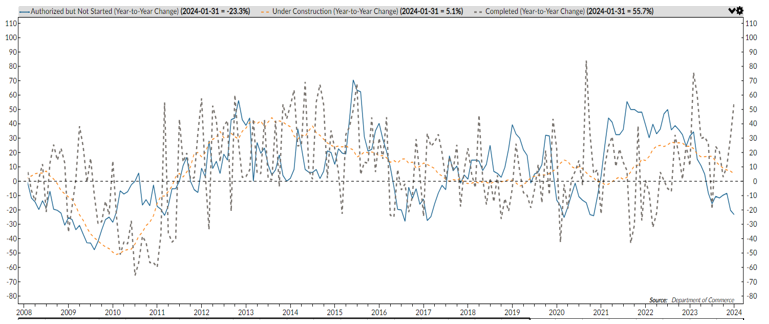

At the national level, the US needs a sales-inventory ratio of 6 months to ease price pressure. Currently, it stands at 2 months short and that has not changed post-GFC aftershocks to developers’ psyche. Recent construction data presents a mixed picture. On a positive note, there has been a significant year-over-year increase of 55.7% in completed housing projects, yet this optimism is tempered by a noticeable slow and declining in the volume of ongoing constructions (only growing +5% yoy) since the start of 2023. This downturn is further exacerbated by a worrying -23% year-over-year drop in the initiation of new projects, as indicated by the permits for yet-to-be-started constructions. Such trends portend a prolonged undersupply of housing. Housing is not within the remit of the Fed’s policy tools, so for now, we cautioned against the current view that inflation is sticky and about to surge and reiterate our view for patience and for inflation to reach the Fed’s last mile by late 2H24 with a caveat to watch housing sales and construction data.

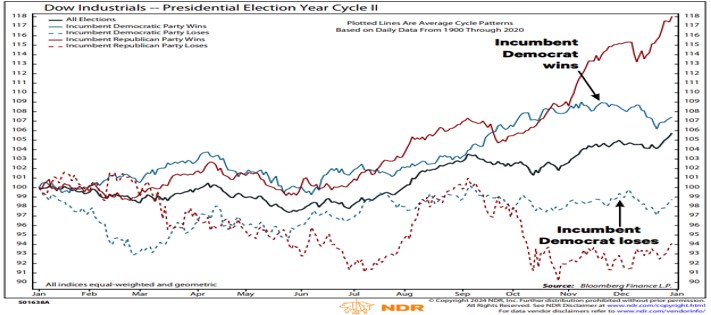

Even though we are not experts in US politics and often find it more entertaining than enlightening, it’s hard to ignore discussions about the US elections. What we can do is to look at data with regard to this risk. Looking at data since 1928, we note that market tends to be choppy in the first half of an election year. We also note that when a Democrat incumbent President wins, the market performance is the best rallying ahead and post-election. However, if a Democrat incumbent loses it is 2nd worst outcome after the loss of a Republican incumbent, chopping around negative returns throughout most of the election year. These are fun facts, but they could also be spurious and ultimately as they said during Bill Clinton’s campaign against senior George Bush. “It is the economy, stupid.”

While the macro set-up continues to be constructive, the debate has shifted from aggressive cuts to slower cuts. We looked at the difference in asset price performances in an environment where rate cuts are shallower, which has been our base-case scenario since the start of the year anyway.

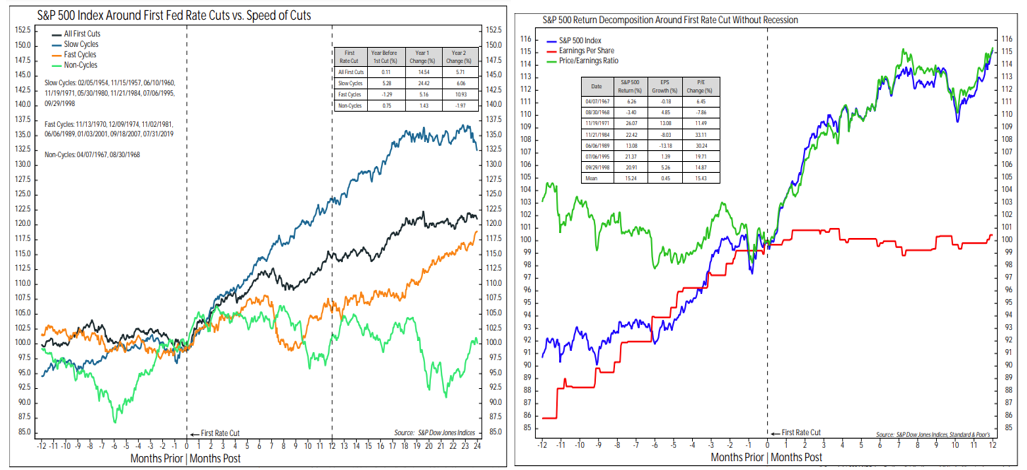

Equities: Overweight. For equities, a slower rate cut cycle (defined as 4 cuts or less within a year of the first cut), is better than an aggressive one. Using data since 1954, it shows that in a slower rate cutting scenario, S&P rose 5x more than in an aggressive cutting cycle returning 24% a year after the first cut. The logic is simple. If a rate cut is shallower, it therefore implies the economy is resilient and avoids a recession. In this scenario of a shallower rate cut, the driver of price appreciation comes from the dual combination of PE multiple expansion (15% increase in PE ratio in a year out) and stable EPS growth. In contrast, if the Fed must cut rates aggressively it would mean a recession has occurred and/or a systemic risk has risen. Return drivers rest solely on PE multiple expansion which increased by 37% during this period while EPS collapsed on average of -16%.

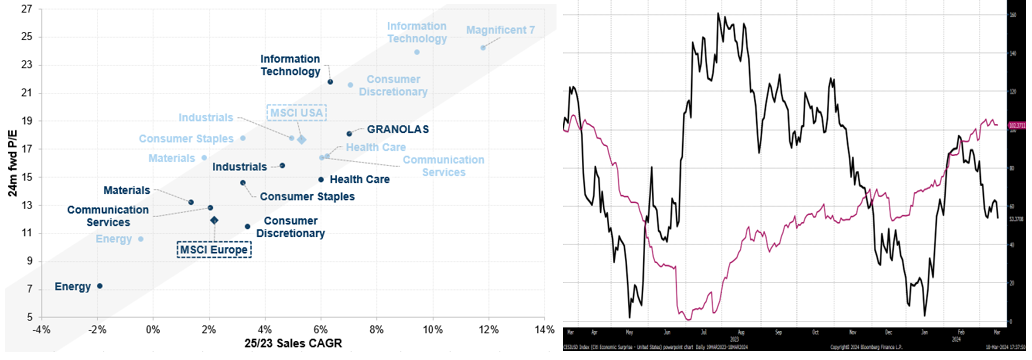

However, we note that since Oct last year, the S&P500 has risen by 25% and its PE has rerated by 32% to 21x forward earnings (23% if we consider EPS growth). This expansion has already exceeded history when rate cuts were shallow. It makes sense to lighten some positioning in the US and in tech where valuations are steep and to look for cheaper quality growth alternatives.

We fancy European equities. European equities are highly leveraged to global economic momentum, particularly in manufacturing, which plays well to our view that global growth for 2024 broadens out. We also have higher confidence that the ECB will cut rates earlier and more than the Fed, while its Chair has already provided a timeline for the first cut in June. In the last few months, the delta of surprises in economic data has also been better for Europe than in the US. On valuation, MSCI Europe equities trade at a cheaper multiple with a 12x forward PE and EPS growth of 8% while MSCI US equities trade at 37x PE with 10% EPS growth. Europe is still trading below its long-term PE of 15x, but the US is trading close to its +1sd average. On a relative PE basis and even after adjusting for ROE differences, the US is trading at its highest over Europe in the last 20 years.

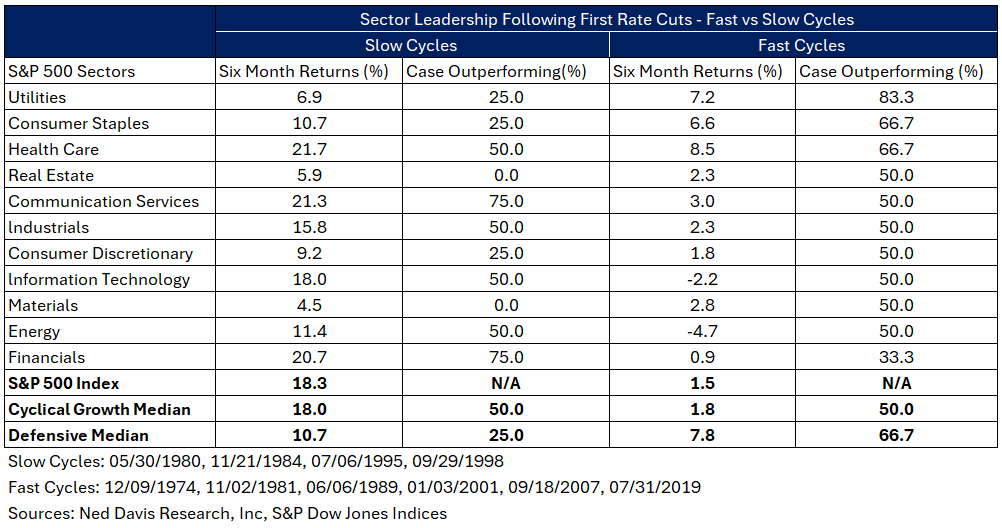

In scenarios of shallower rate cuts, the S&P 500 delivers a better performance with an 18.3% rise, whereas sharper cuts lead to meagre gains. The US small caps often outperform large caps a year post-cut by 5%. Within sectors, performances also vary by the depth of rate cuts. Post a shallow cut, sectors like Healthcare, Communication Services, Financials, and Industrials perform better with returns of 21.7%, 21.3%, 20.7%, and 15.7% respectively in six months. In contrast, aggressive cuts favor defensive sectors like Utilities and Consumer Staples. We are reducing our Tech exposure due to high valuations and aligning our US equities portfolio with these anticipated market shifts through newly established exposures in Healthcare and Industrials ETFs while keeping our Financials investments unchanged. The communication services sector is excluded due to the high concentration of Meta and Google, where we have a neutral view, and its valuation is not attractive as well.

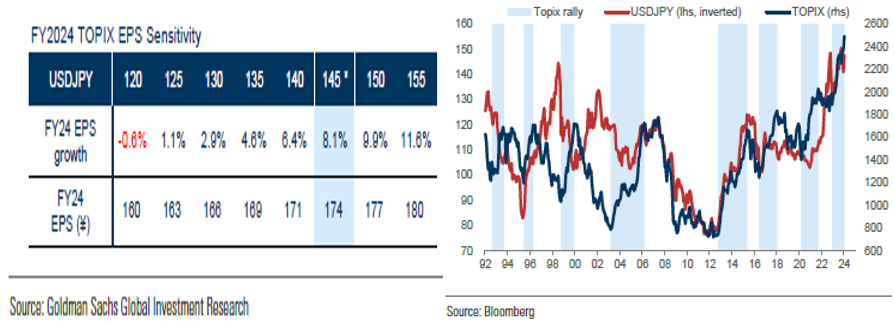

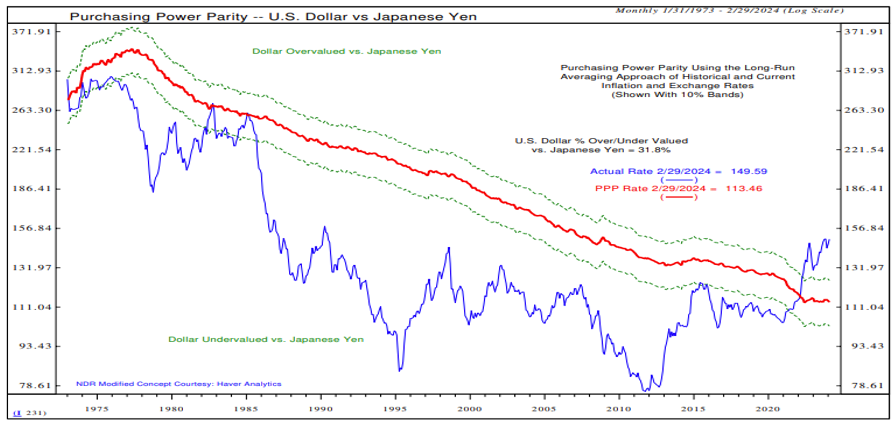

The current consensus view is that an exit by the Bank of Japan from the world of NIRP is positive for Japanese equities. We do not think it is so simple. Back in April last year, we contented the mother of all QE is by the BOJ, Everything, everywhere all at once, and the ramifications of their unwinding are multi-folds and complicated. There is the impact of higher rates on the fiscal position of the government coffers when it already has the distinction of having the highest debt-GDP of 218% amongst OECD countries. Financial institutions’ balance sheets will be adversely impacted by mark-to-market loss similar to what happened to Silicon Valley Bank and UK Pension funds debacle but can be counterbalanced by higher profitability in their loan books. Another big unknown is the impact on the global economy and stock markets when domestic investors start to sell down their overseas holdings and repatriate back onshore as the Yen appreciates. It is the largest foreign holder of US treasuries (4% of total US treasury stock) and many other countries such as Australia (15% of stock), Sweden (13%), New Zealand (10%), and France (8%). Japan is also consistently the biggest FDI investor in this region. Furthermore, the appreciation of Yen is negative for Japanese earnings. For every 10 Yen appreciation, earnings will be cut by half. Lest we forget, there is a carry trade unwind making the domestic equities negatively correlated when the Yen appreciates.

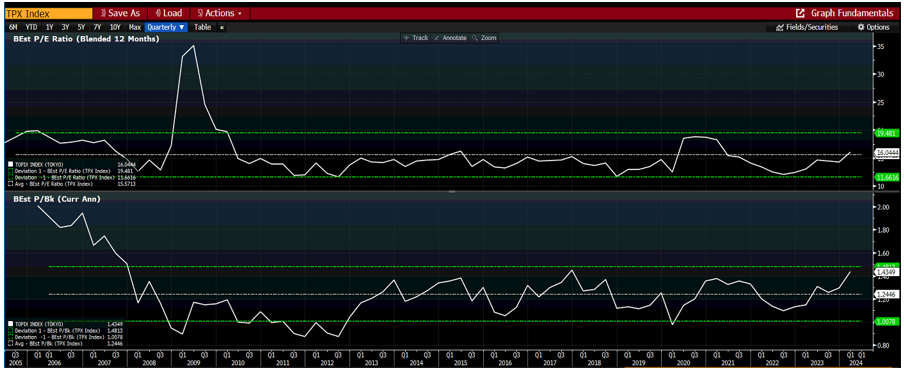

Valuations are no longer cheap. Topix now trades at 16x forward Price/Earnings, in-line with its 25-year average, and 1.41x Price/Book it is above its 25-year average. We have been early advocate of the improvement in corporate governance and ensuing restructuring themes in Japan but that will take time to improve its ROE of 8%, which is much lower than Europe’s 14% and the US 20%. Reducing beta in Japan and retaining our expressions in activism and ROE enhancement themes.

Fixed Income overweight in US Treasuries and Investment Grade. No change as we are expecting 75-100bps cuts in the next 12 months in the US Fed fund rates. Working off this 75-100bps cuts, we use our four-prong approach of using market participants forecast, forecast from economists, history as a guide, and theory as an anchor, we believe US10 yield should trade with the range of 3.70% to 4.20% in 2024. With bond convexity working in our favour now that yields are high, a 50bps move lower in US10 yield can generate a total return on investment-grade bonds in excess of 7%. But should yield rise by 50bps against our expectation, our sensitivity shows our bond portfolio can still generate a total return of 2%.

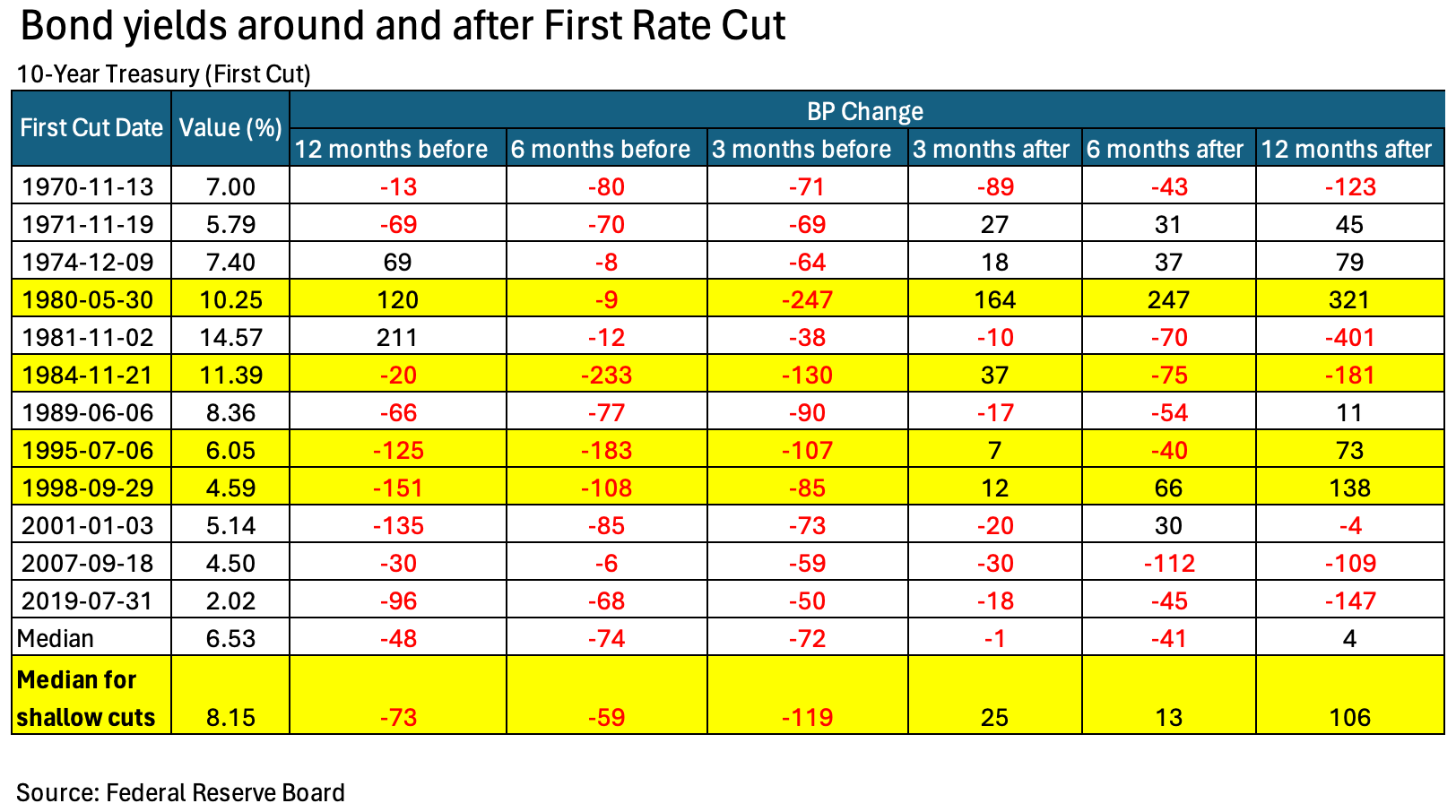

Regardless of the depth of cuts, US 10 years Treasury yields fall ahead of the first cut, though it tends to fall more in a shallower cut scenario. Post-cut and in shallow cut episodes, US10 yields are largely unchanged for the first 6 months but rose by the 12th month as investors comes to grip that the economy is strong. However, the yield curve always steepens post cuts and steepens more when the cuts are shallow. Hence, we are positioned in the front end of the curve rather than the back end. Happy to clip attractive 5+% coupons with the possibility of generating capital gains with low volatility from this allocation even as valuations are at best fair.

Alternatives: No change with 25% to 30% of the budget allocated to our multi-strategy and multi-manager hedge fund strategy. It has demonstrated the ability to generate high-single digit return with a volatility budget that is less than one-third of equities and half of bonds. Its returns are also less correlated and have a low beta relative to the traditional stocks and bonds asset classes. If you would like to find out more about this mandate, please also reach out to your wealth managers.

FX: The rather dour price reactions after BOJ announced the end of its decades long unconventional monetary policy did not sway our bullish stance on the Yen for this year. BOJ provided no clear signal for an immediate policy lift-off and rightfully should adopt a cautious and data-driven strategy given the complexities we have raised above. Nonetheless, we believe the Yen is poised to appreciate as the interest rate differentials between the US and Euro versus the Yen are expected to narrow, largely due to diverging policy directions from their central banks. While the Fed and ECB are anticipated to initiate rate cuts in June, with projections of a 100bps reduction by the end of 2024, the BOJ is likely to tighten with a potential 20bps hike in either October or December. This contrast in monetary approaches underpins our optimism for the Yen to strengthen.

Commodities: We continue to favour Gold. It has several investment theses running for it. A play on the long-term risk of de-dollarization, it is inversely correlated to bond yields and the USD. There is a need for emerging market economies to diversify their USD holdings and increase their gold reserves. Gold as a percentage of central banks’ reserve is still very low even excluding the early tumultuous decade post Bretton-Woods exit.

Cash: Rasing some cash from equities but mostly fully allocated to high-grade debt, alternatives and gold.

Featured Picture/Quote: Watching the Bank of Japan pivot from NIRP is as exciting as watching an AMSR of trimming a bonsai plant. Enjoy.

Breathtaking and exhilarating video of trimming a bonsai tree. A must watch. Click to watch video

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.