At the start of the year, I was invited to a roundtable organised by one of the premier fund managers in the world, presided over by their chief US political analyst. The prevailing wisdom in that gathering revolved predictably around the second Trump presidency. I was encouraged that many of my seasoned peers have already thought through Trump’s machinations ranging from tariff, immigration, climate hoax, political witch-hunt, and his grandiose saviour complex that he will end to the wars in Ukraine and Palestine and of course, in record time. If everyone is so well-versed in what will happen in his second presidency, I infer that there will be less surprises and hence less volatility. Alas, were we so wrong but to be fair, who really knows?

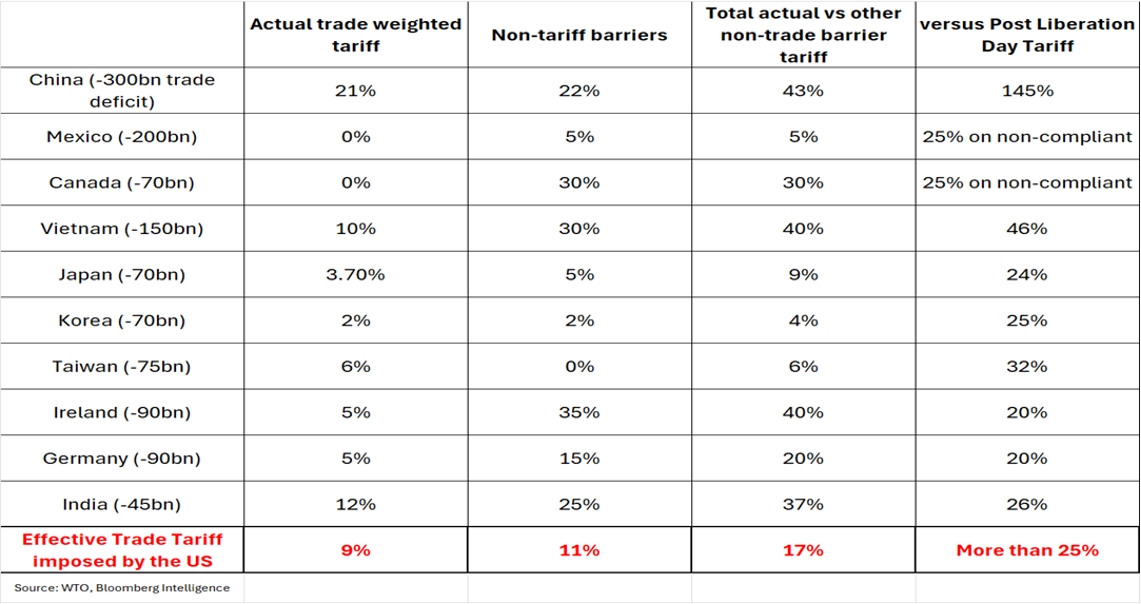

Is the US headed for a recession in the next year? Once more, who really knows? Trump’s capricious trade agenda has made what is an already difficult question to answer in normal times harder. How much of its trade war will increase inflation, reduce employment and result in a recession? Much of that will depend on where the eventual effective tariff will settle at, how long will the current partial détente last, and which sectors will be most impacted in the final iteration. Our initial forecast of a punitive 15% effective tariff, outlined in our previous Navigator, To tariff or not to tariff? Navigating the Trumpian maze, has swiftly shifted from worst-case scenario to our new normal. A cocktail of tariffs and non-tariff barriers could cumulatively push the effective tariff rate to around 15-17%.

Back-of-the-envelope first-order calculations suggest that for every 5% increase in tariffs, US GDP could be shaved by about 0.50-0.65%. This arithmetic nudge our forecast downwards, with growth landing at 0.8%-1.2% for 2025 and remaining tepid at around 1.3%-1.4% in 2026. Yet, this scenario, thankfully, dodges an outright recession, though growth limps along at a pedestrian pace with its weakest quarterly growth in the period of 2H25.

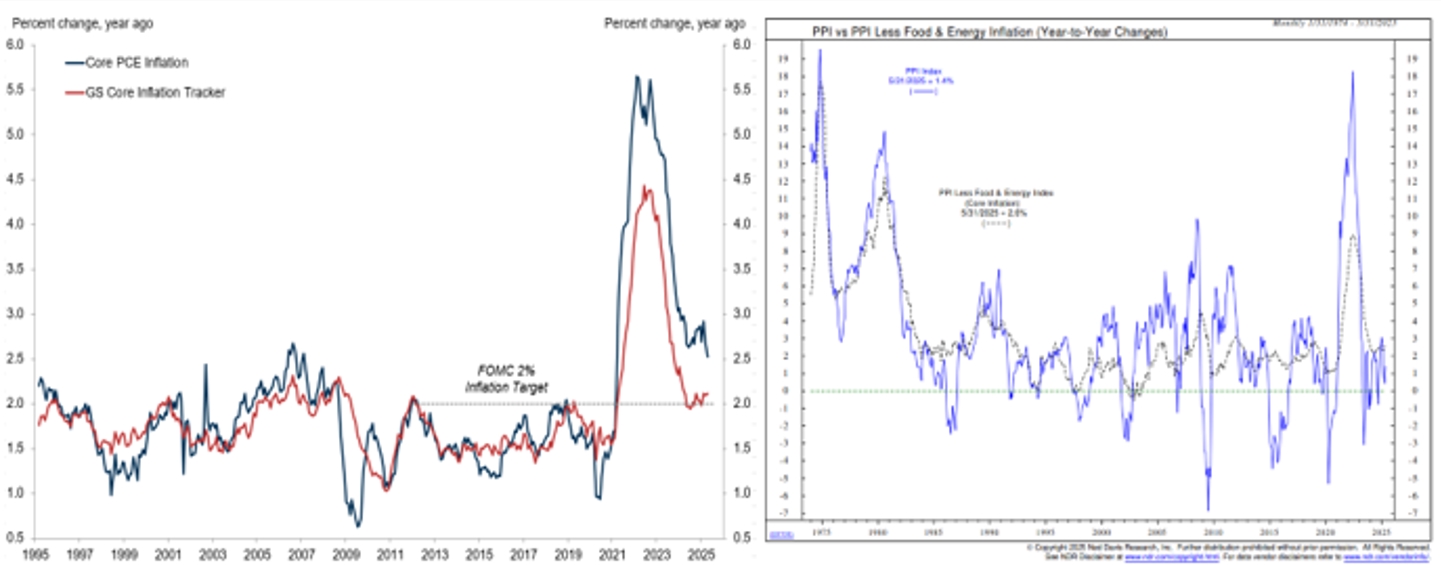

At 15% effective tariff, Core PCE may start rising from June onwards deviating from the path towards 2.0% by end of the year that we have previously envisaged. But the view on inflation remains unchanged from our previous assessment in the sense that it is a one-off increase and is likely to be transitory. Moreover, we are encouraged that inflation remains subdued so far with May Core CPI only rising 0.1% mom and Core PCE tracking at 2.5% yoy. The key components of stickier inflation such as rent and services continue to moderate lower even as prices of goods rebounded from their past quarters of deflation. Similarly, there is scant trace of tariff impacting producer price index yet (+0.1% mom and 2.6% yoy) despite the US collecting $72bn in tariff since April.

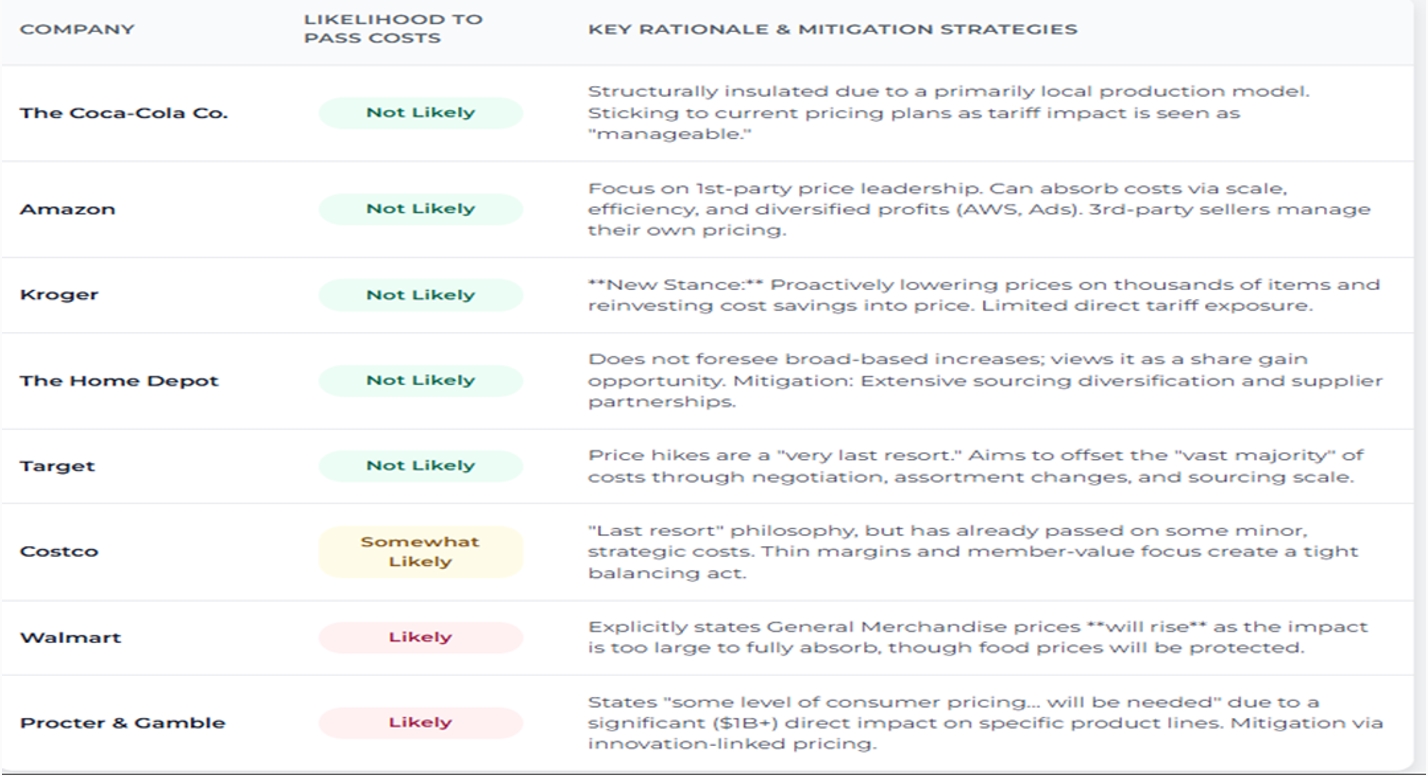

The significant stockpile that firms have accumulated in the past months heading into April coupled with some easing on consumption are probably the reasons why firms have been less willing or unable to pass on costs to end consumers. May’s consumer inflation survey also reported a slower month-month increase, while the 5/5yrs inflation expectation by market participants have been well anchored at 2.30 to 2.45% in the past 2 months in contrast to the start of year print of 2.6%. The heatmap we gathered from the leading US retailers post their 1Q25 earnings call is substantiating the view it is harder to pass through tariffs to consumers.

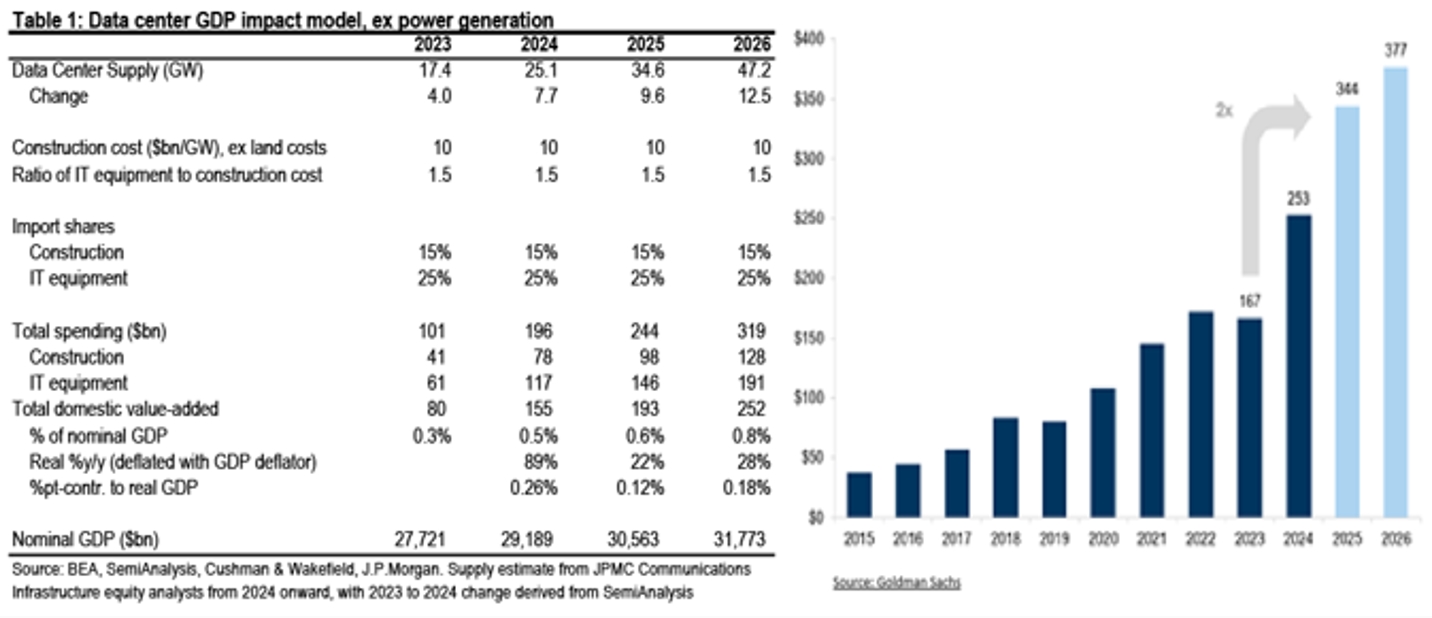

Regular readers of our strategy piece might notice the shift from our usually convicted language to cautious pragmatism. Afterall, who really knows? Part of our hesitant to subscribe to a more maligned US economy due to higher tariff is because much has changed in the world of AI in the last 6 months. Consider this: $225 billion annual investment in US data centres, an additional $280 billion yearly upgrading America’s antiquated electricity grid, and consensus revenue projections for semiconductor demand in 2025 has increased by $200 billion since the start of the year. The AI-inspired capex sojourns could perhaps offset tariff-induced drags on consumption.

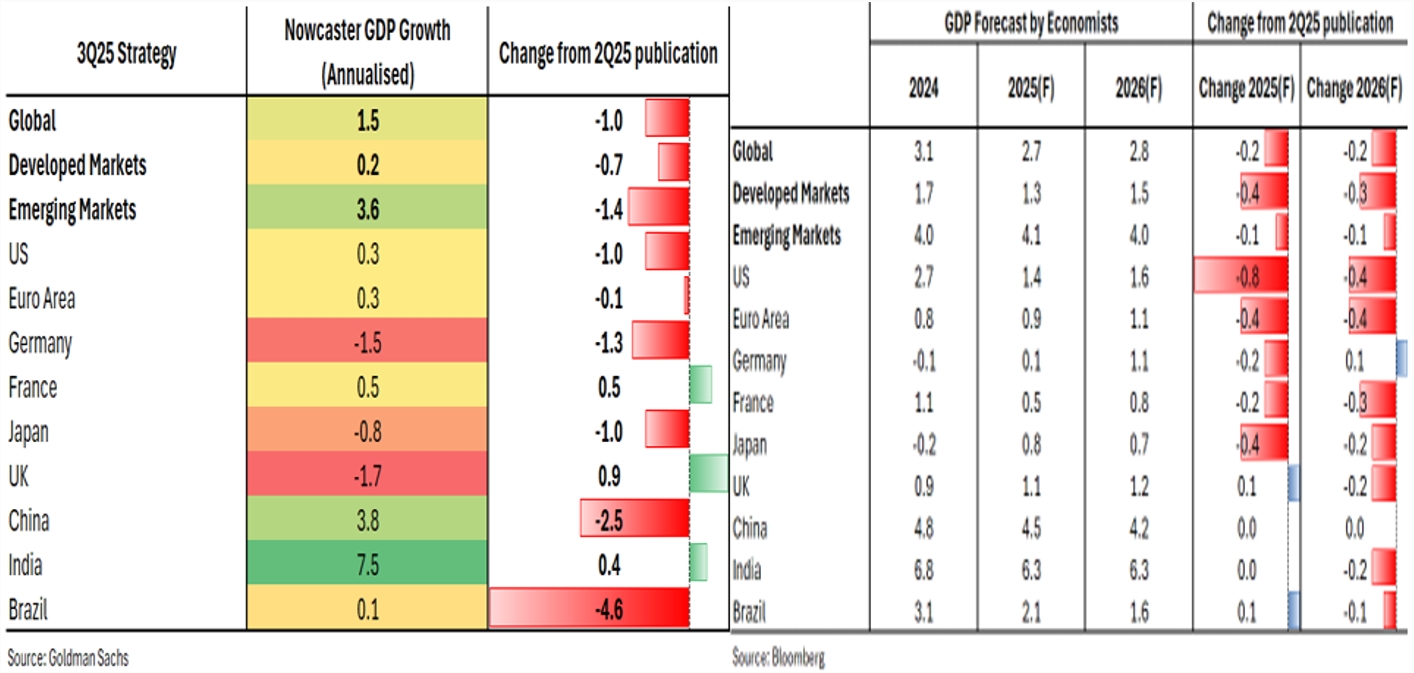

Falling back to our data-backed methodology of incorporating nowcast, forecast and recession watch monitor, it is not conclusive that a recession is inevitable even as data has deteriorated from our last quarter data. The Nowcasting model we track shows global growth at sub-par level of 1.5% with the US slowing to 0.3% yoy and is a drop from 1.0 ppt from 2Q25. Consensus forecasts for global growth for the full year of 2025 and 2025 have been nudged lower but still at respectable growth of 2.7% and 2.8% respectively. The US has seen the largest downgrade by 0.8 and 0.4 ppt for 2025 and 2026 respectively but avoids a recession with growth of 1.4% this year and growing just above its long-term potential of 1.6% for 2026.

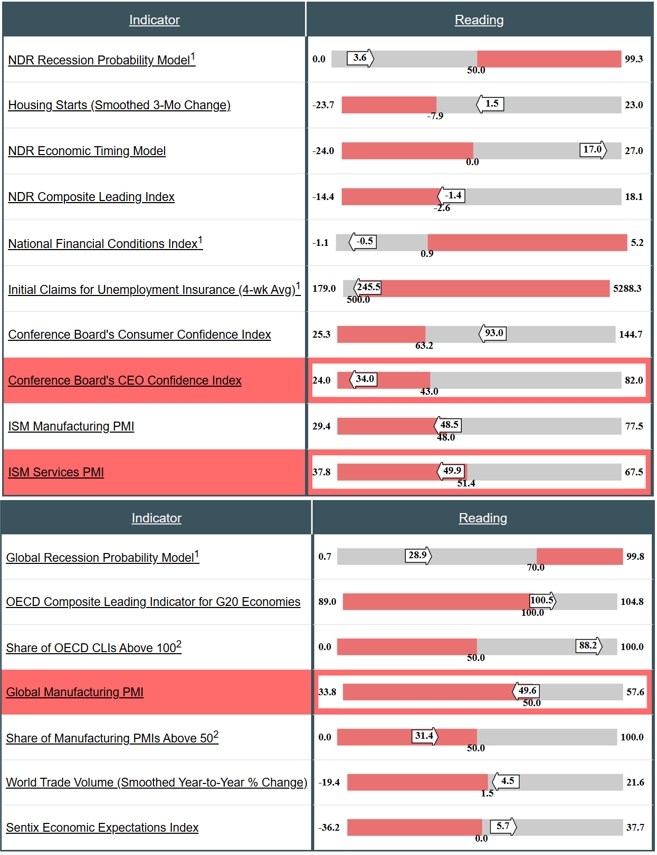

Our US recession watch list remains benign with only 2 of ten indicators are in past recession territory (CEO Confidence Index and ISM PMI-Services). It is worth noting the CEO Confidence Index and the ISM Services are one of the worst leading indicators of a recession with 25- and 16-months lead time till. Similarly, only 1 of the 7 indicators in the global recession watch list we track are flashing red. They are the Global Manufacturing PMI, but it has given many false alarms of an impending recession ever since post Covid.

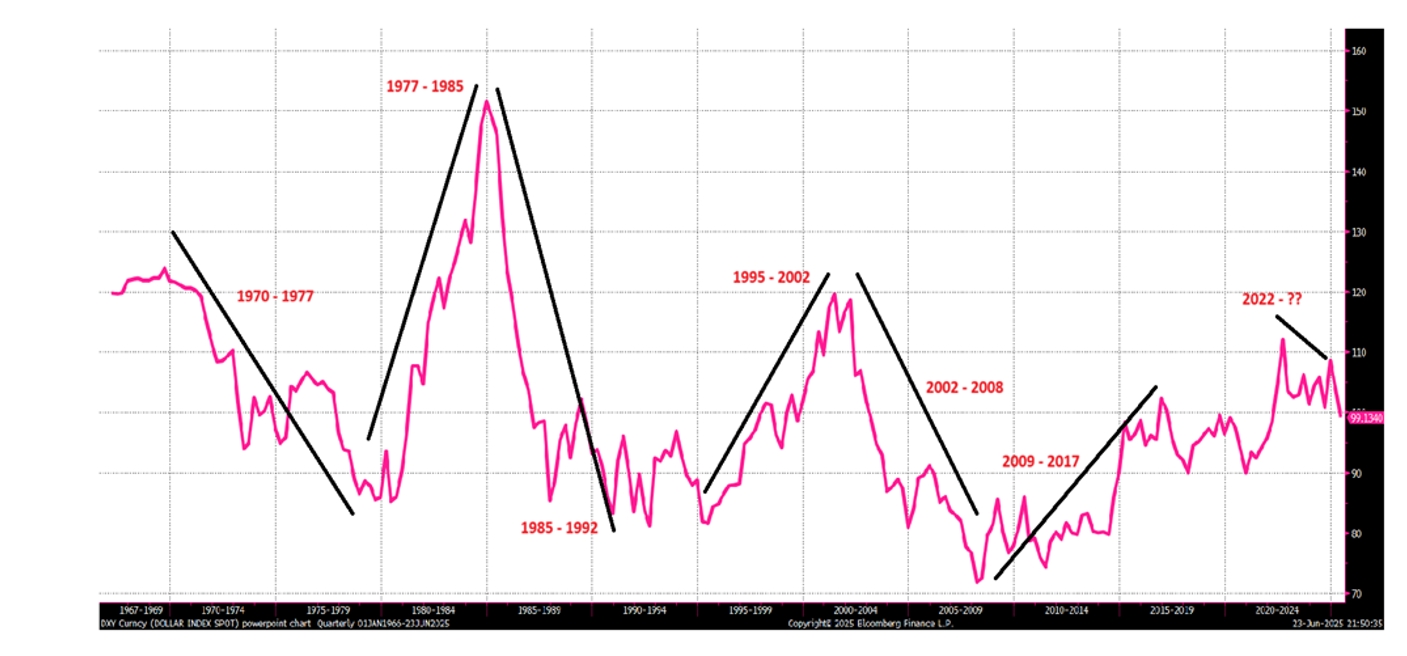

Has the USD hegemony finally capitulated? The truth again is who really knows? Of late, many newly minted FX experts are commenting we are seeing the beginning of the USD demise as the reserve currency of the world. It also does not help President Trump’s twaddle on unilateralism is alienating both friends and foes. We wrote many years ago about the curious case of USD 7 years itch (7 to 9 years actually). Since its abandonment of the Bretton-Woods accord in 1970, the USD exhibits an interesting trend of 7 years up followed by 7 years down cycle. Are we at the cusp of another down cycle?

Each of the USD down cycle since then was accompanied by its own endogenous economic shocks. The early 1970s was the abandonment of the peg to Gold, followed by a series of unintended consequences that led to the Middle East embargoing oil to the US. The 1985 decline was on the back of the Plaza Accord and subsequently the Louvre Accord (1987) that saw its US major trading partners agreeing to depreciate the USD on the same issue we are facing now; a strong USD eroded US industrial base that led to the widening of its trade deficit with its trading partners. During this cycle, it was made worse with the Savings and Loan Crisis in 1985. The 2000 downcycle was the unwinding of the infamous Dotcom bust. Since peaking in 3Q22, the DXY Index has fallen 10% (6% were from this year alone) raising the convenient prediction the next 7 years downcycle has begun, or the more insidious, the end of the mighty Greenback as the reserve currency.

However, it must be emphasized. Unlike owning a stock say Nivida, which is a singular argument do you like NVDA or not, FX isn’t. It is always a relative game. If you don’t like the USD, sell it, and buy what? In each of down cycles, there was also an exogenous alternative developing. In the 1970s downcycle, it was Deutsche Mark (The emerging economic powerhouse) and Swiss Franc (safe haven). In the 1980s, it was the Yen that dominated (the next economic powerhouse challenging the US). Then in the 2000, it was the birth of EUR (someone’s wild dream) that became the alternative to the USD and then there was the China de-pegging in 2005. But with each downcycle, the USD recovered to engineer another prolonged upcycle as its economy adjust, recalibrate, and often pivot to another source of growth.

Then there is the TINA (There Is No Alternative) question? Which other countries can absorb all the selling of the USD that you can buy into? China? It has a closed capital accounts even though as early as 2010, they have explored opening, but ideology changes, domestic tumults, and fear of massive outflows have all put a halt to this initiative. The EUR? An economic bloc flawed with political landmines, imperfect policy coordination, and rapidly ageing demographics? Yen? A country which has even worse demographics and anaemic long-term growth potential than Europe and has the distinction of the highest Debt/GDP ratio in the world. SGD? You ought to be joking. The US economy is $30trn and the Singapore is a 1/40th size of the US. Gold? Sure, we do own it, but it is most easily fungible for trade settlements and is a negative carry asset. Bitcoin? Sure, but it is in limited supply and try convincing the public to transact in BTC.

To add to the mix of if not USD who else, there is also the issue of settlements systems. Right now, more than half of the FX flows are traded via the SWIFT system. The weaponization of SWIFT onto the Russian have added impetus to alternatives such as CIPS (China backed system) or block-chain networks, but both networks are still in its infancy and volumes through them are incomparable to SWIFT. E.g., SWIFT handles over $2trillion of volume compares to CIPS of only $50-100bn a day. We are witnessing plenty of newly created stablecoins but even those are still tethered to a currency.

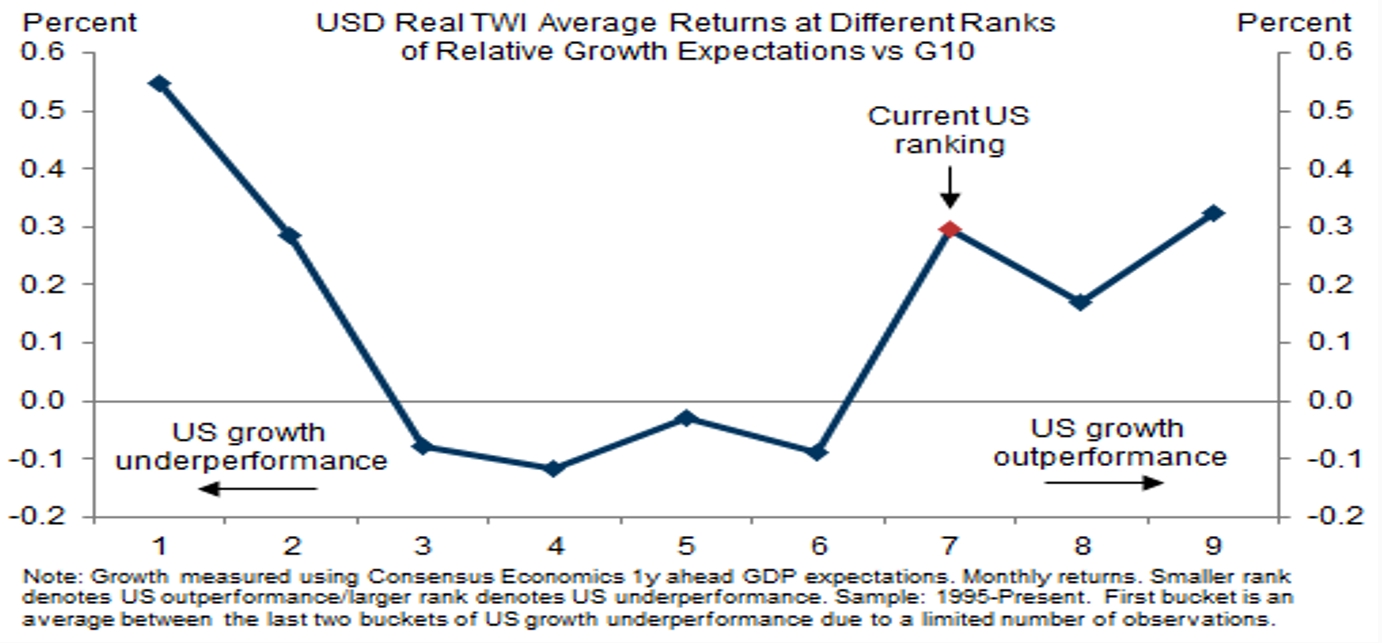

Could the USD weakness in recent months simply be a case of its over-valuation correction rather than a tectonic shift away from it? We disagree with consensus view that US exceptionalism is permanently impaired. Even after post-liberation day tirades and downgrades, US growth is forecast to be higher than the Euro Zone and Japan. Granted the delta of change often matters more in the repricing of risks and clobbered with self-inflicted policy uncertainty risk, we still think it’s premature to call for the end of USD as a reserve currency. If one subscribes to AI as the game changer for decades to come, nowhere in the developed world aside from the US, and to some extent China, has dominated this frontier technology. Nobody has ever heard of a OpenAi, Grok, Gemini, LLaMa equivalent from Europe, Japan or UK!

It has been a while since we revisited the Dollar Smile concept which posit the USD will rise in two circumstances. When the US outpaces global peers, or conversely, when global crises ignite flight-to-safety instincts, the dollar strengthens. In between these two circumstances of exceptionalism, the USD can depreciate if its growth is lower than the rest of its major trading partners on both relative and absolute basis. Currently languishing between these extremes, we believe the narrowing US growth differential explains the dollar’s recent softness. A global downturn, however, could swiftly reignite dollar strength.

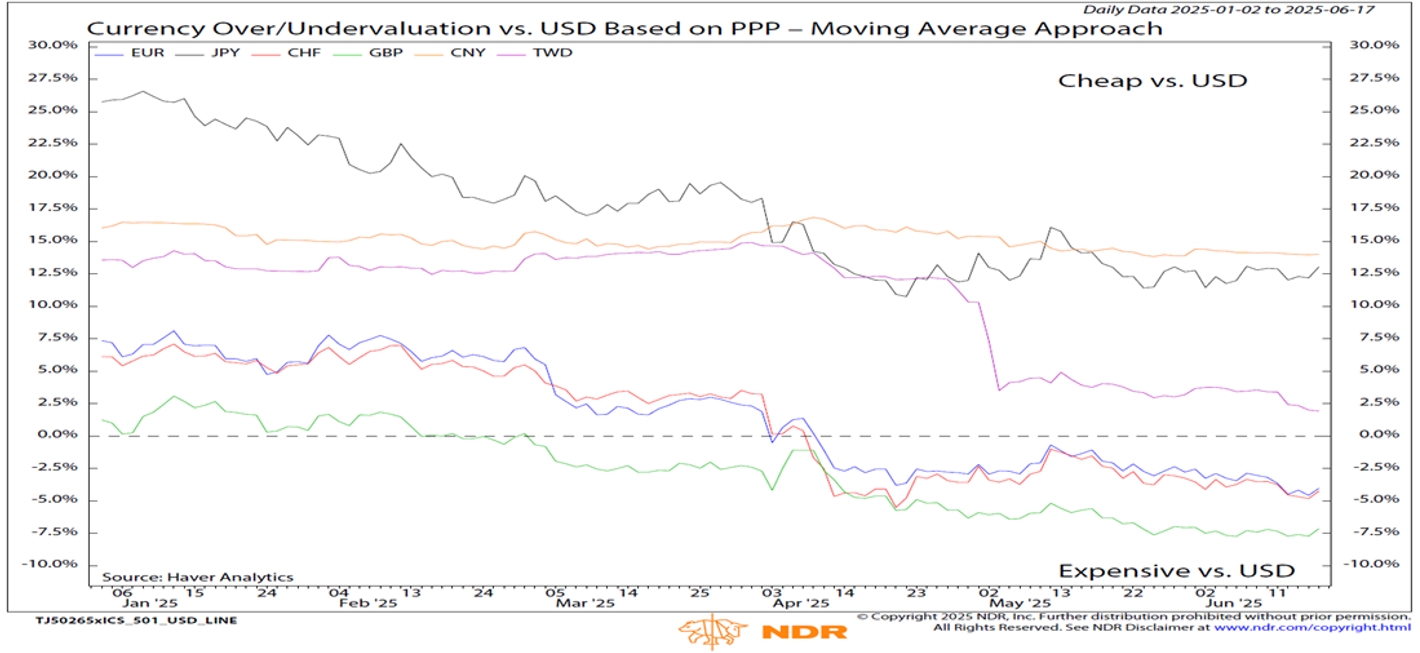

If we based on textbook Purchasing Power Parity fundamentals, the USD is no longer expensive relative to EUR, Swiss Franc and Pound as compared to the start of the year. In fact, they are now 5 to 7.5% more expensive against the USD, whereas the at start of the year all of them were under-valued by 3 to 7.5%. The USD is only expensive against the Yen and CNY (still more than 10% expensive to these pairs) and TWD (narrowed to less than 2.5% from 12% at the start of the year).

Our longstanding caution over America’s and many developed economies fiscal irresponsibility remains which wrote in this edition of the Navigator Now I know when I must retire. Trump’s recent “Big, Beautiful Bill” reignites this concern again. A rebellion by bond vigilantes against relentless US fiscal profligacy could precipitate a crisis far graver than the conventional recessionary script.

“The next global recession could be triggered by bond vigilantes revolting against further funding of profligate governments. In a classic private sector recession fuelled by intolerable debt levels, defaults rise, lenders suffer, and a destructive cycle of retrenchment in profits, employment, and GDP growth ensues until sufficient resets are achieved. However, in a public debt default scenario, yields spike, dragging down capital markets, financial institutions that are large holders of government debt go under, and currency devaluation occurs. This pushes inflation up as growth struggles and the country moves into dreaded stagflation. If it is Argentina that we are talking about, the world brushes that aside. If it is the US, I think it is time to retire.”

However, as we always confess, predicting such outcomes is a perilous game.

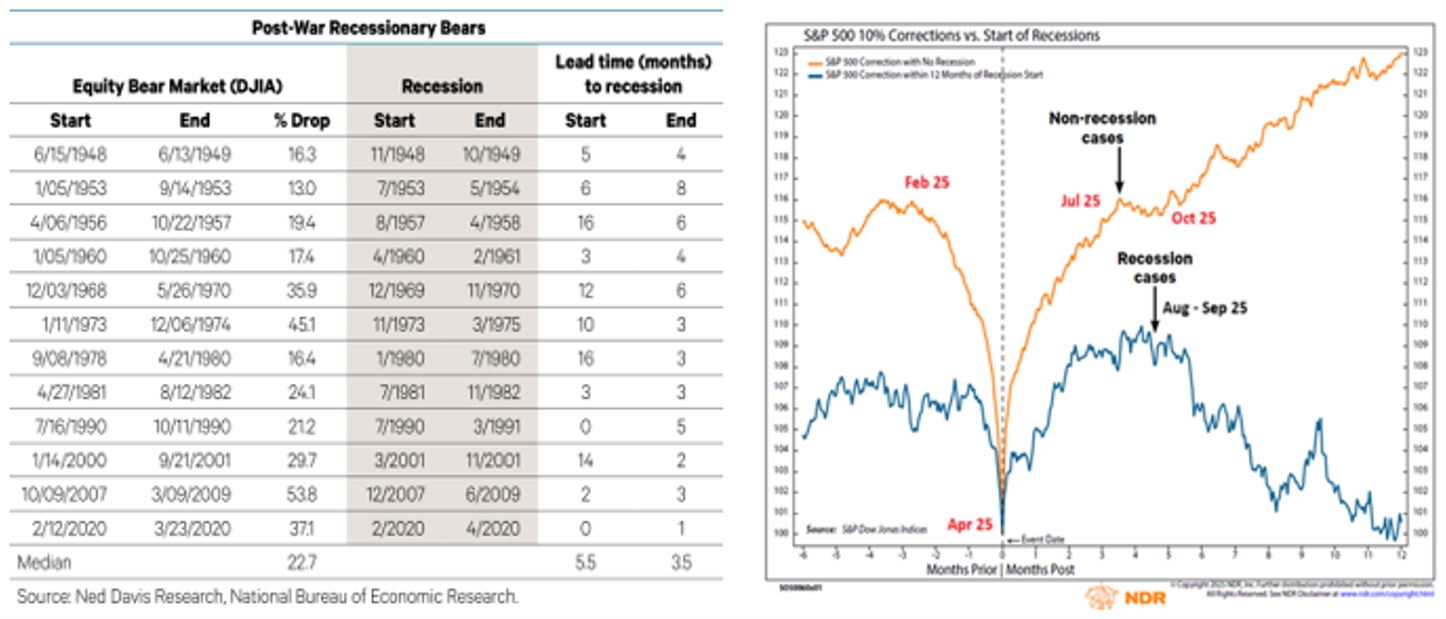

Equities: Remain Neutral and balanced. On average, equity bear markets lead 5.5 months before a recession is officially declared and end 3.5 months ahead of the end of a recession. There has never been a case when the bear market ended before a recession starts. Based on this empirical data and the fact that the market is just 5% shy from the high post DeepSeek and Liberation Day selloffs, a recession would be needed for the market to hit a new low. Even though nobody really knows with certainty a recession is imminent, our analysis suggests it is unlikely for now.

We have studied past bear market corrections 1928 till now. In a non-recessionary bear market correction, the S&P500 typically corrects 15 to 16%, but recoups much of its losses within 3 months of the trough. It then consolidates for another 3 months before staging a higher move. It is uncanny that the recent market moves parallel to this history. Markets peaked in Feb 2025, then corrected by 21% post liberation in April, it has since recovered an over the next 2 months and is 3% shy from the Feb high. If history does repeat, we should expect the market to consolidate from Jul to Sep as we assess the confluence of tariff and two ongoing wars.

Combining our latest mark-to-market assessment of macroeconomics and with the empirical data quoted above, we remain constructive on equities and the only reason we have not upgraded our view to Overweight is our cognizance that a great dose of humility is required. We have been reducing our underweight in US equities in the past few months and increasing our positions across the AI opportunity set while retaining our overweight in Japan and China and underweight in Europe. We have made no changes to our key fund manager and ETFs expressions aside from adding in the low-beta ETFs in US utilities and healthcare. On balance, we would categorize our equity positioning as 45%/55% in low-beta ETFs or managers versus high-beta positions.

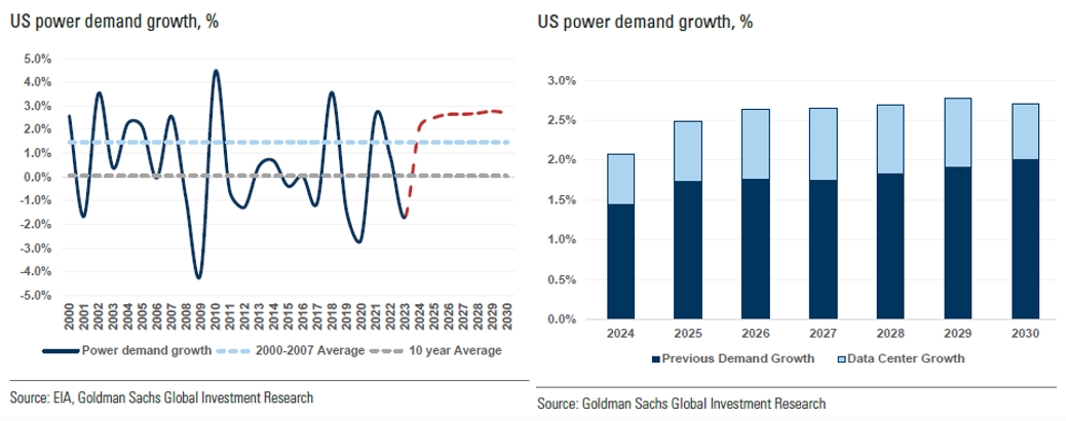

Back in July 2024, we wrote in our Navigator Now I know when I must retire, we advocated for the Utilities sector ETF as a 2nd derivative of the AI play. Power is a major bottleneck for the US to achieve its AI supremacy. It is estimated an additional 50GW of incremental power is needed just to support US data centre demand into 2030, translating to over $100bn capital investment per year. The advent of DeepSeek has further galvanised US tech companies to spend more in data centre build out. The DeepSeek moment has also speed up the transition from LLM to inference computing. We believe all these two factors will accelerate the Jevons Paradox and will be beneficial for the utilities. Hence, power demand is forecast to grow 2.4% CAGR for next decade versus two decades of near zero growth. Over the next two-years, the utilities EPS is forecast to grow 19% CAGR in-line with S&P500 but trades at lower valuation relative to S&P and its own long-term historical average. There is also dividend support of 3.4%, doubling that of S&P.

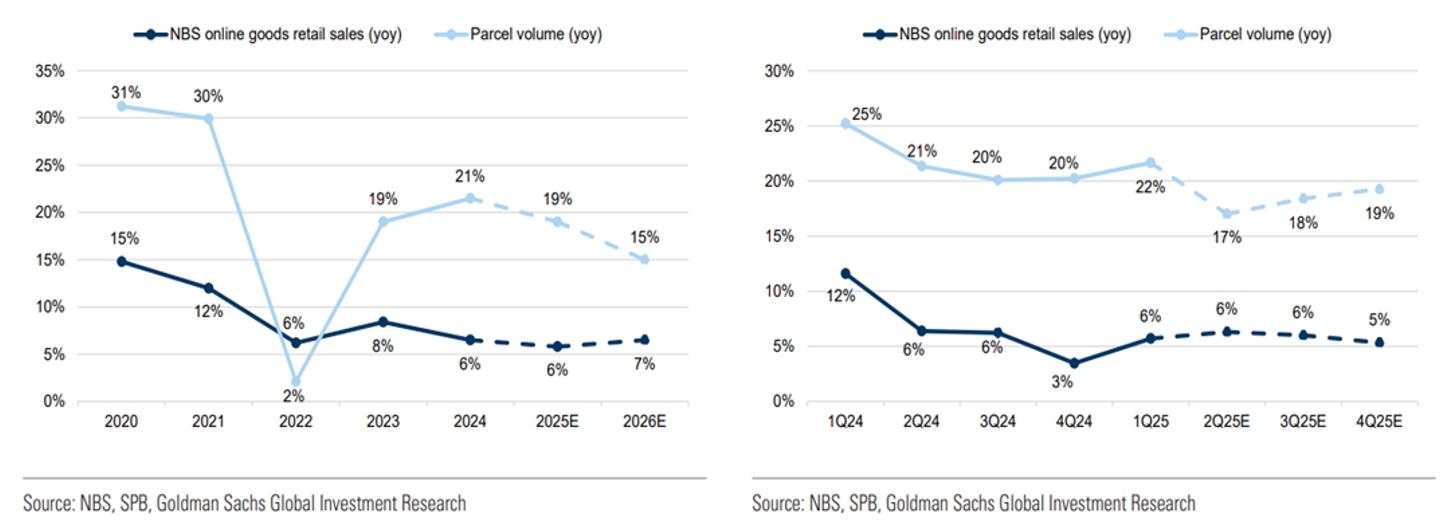

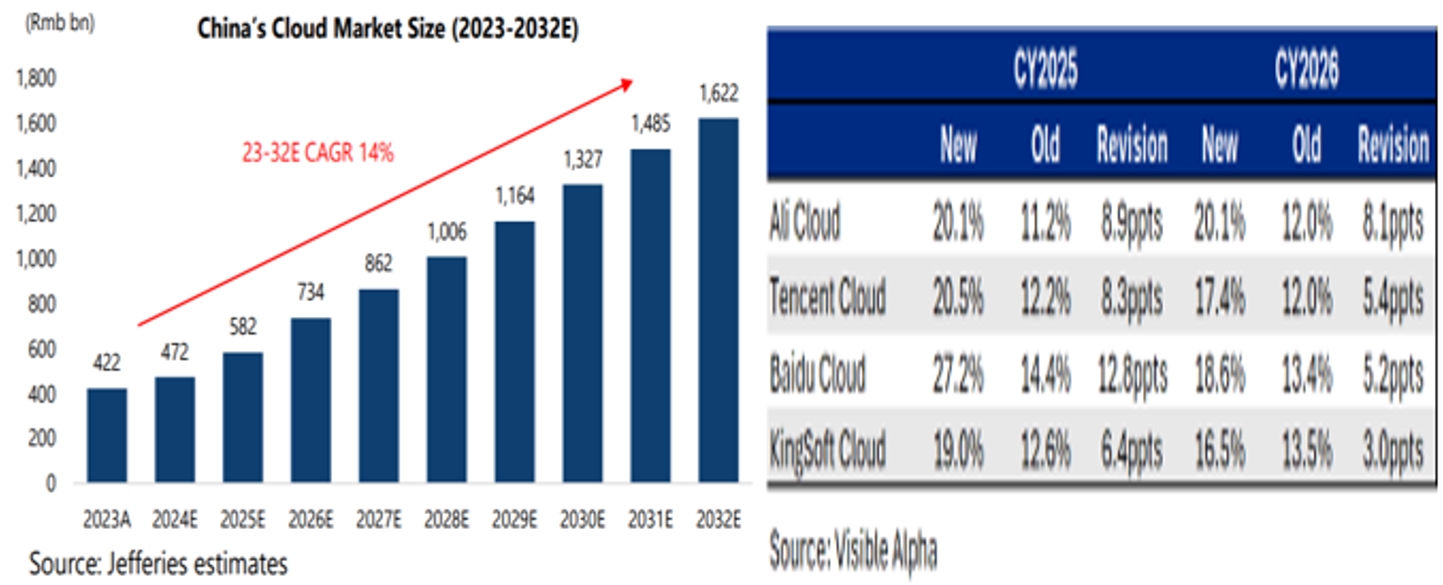

We have been adding China AI, e-commerce, technology, and robotics ETFs throughout the first half. There are three drivers underpinning this bullish view. First, their e-commerce business, which remains the biggest earnings contributor, is stabilizing. Second, AI adoption is re-invigorating the demand for their cloud business. Lastly, there has been a seismic shift in the authorities’ attitude towards promoting private enterprise and particularly in the technology space.

After a couple of volatile years and declining trend, China e-commerce growth is projected to grow at CAGR of 5%. NBS online goods retail sales and parcel volume growth in the next two years is projected to stabilise at 6% and 17% respectively. This is in comparison to last 3 years where we see volatile spikes in NBS online goods retail sales from 12% to 6% and parcel volume growth from 30% to 2%.

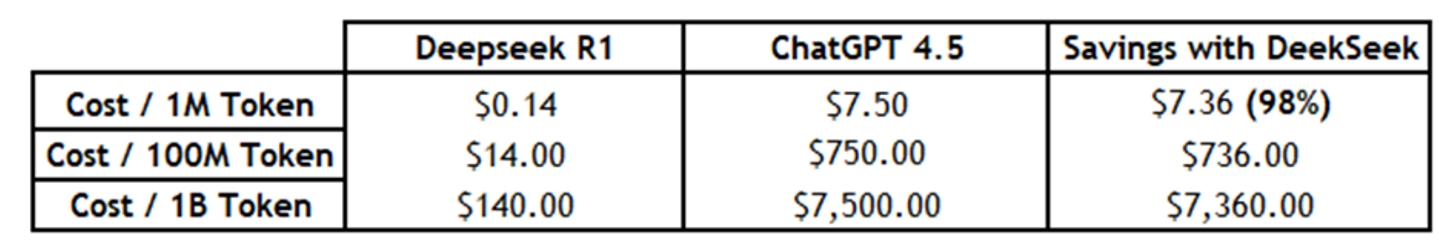

The China’s cloud market is forecast to grow at a 14% CAGR, reaching RMB 1 trillion by 2028. The launch of DeepSeek in February marks a seminal inflection for China AI ambition. As shown in the chart below, amid tightening US export bans on Nvidia’ advanced Blackwell chip, DeepSeek illustrated China can train competitive models without 5nm GPUs. DeepSeek latest model, DeepSeek R1, which computes at just $0.14 per million tokens, while GPT 4.5 remains at $7.50. The latest news of Huawei’s Ascent chip is another important development that suggests the bifurcation of AI technology between the East and the West is a given. At present, the 98% cost advantage in China’s Gen Ai is already yielding results. 83% of Chinese organizations have adopted GenAI versus 65% in the US (Source: Coleman Parkes Research)

Evidently earning revisions across China’s tech sector have been broad based since the start of the year. Cloud infrastructure providers are the biggest beneficiaries, reflecting growing investor conviction in the long-term value of China’s own iteration of the AI revolution.

Fixed Income: Will be reducing the Underweight. Even with a whippy US10 yield and an over-compensatory 30-year yield, our fixed income positions have managed to generate net returns ranging from 3 to 5% in the first half of the year. Focusing on owning excellent quality credits, active duration management, and investing outside of US debt markets were the reasons for their decent performances. Furthermore, the current high coupon rate compensates for convexity in bond pricing relative to the movement in rates. The schism between Powell and is supposed successor Chris Waller will shape Fed’s move from hereon till Powell’s end of term in 2026. There is sympathy for Governor’s Waller dovish views. Europe’s trimmed core inflation has fallen from its high of 5.8% 2Q23 to 2.2% as of May this year. In that time, ECB had cut rates by 235bps. In the US, Core PCE has fallen from a high of 5.65% to 2.5% currently but the Fed has only cut by only 100bps. Our analysis on inflation and growth intersect does indicate Fed is behind the curve or worse the Fed has become political choosing to engrain its independence than following the modus operandi of following the data.

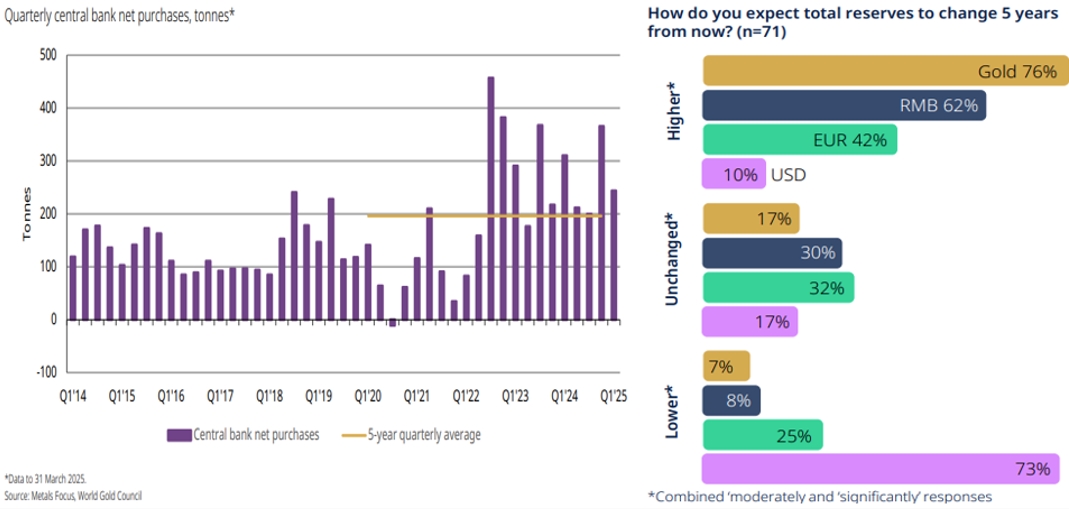

Commodities: Global tensions have escalated and that have provided bids for USD alternatives such as Gold and Bitcoin. We adjust our full-year target of Gold towards $3300 to $3800 as we are surprised by central banks’ lack of price sensitivities in adding to their gold stockpile. The latest World Council of Gold survey from central bankers indicates 95% of the respondents expect their gold reserves will increase over the next 12 months. They cited gold’s performance during times of crisis, portfolio diversification and inflation hedging as the key themes underpinning their intentions. Interestingly, majority of respondents expect to see a moderate to significant lowering of their US dollar holdings over the next five years with Gold and RMB taking precedents.

Over the past three months, we have seen two important developments in crypto space. First, the passage of the GENIUS Act is widely seen as a watershed moment and major milestone for the digital asset industry. By crafting federal rules, Congress is effectively acknowledging that crypto assets have a place in the U.S. financial system rather than existing in a legal gray zone. This regulatory recognition indirectly benefits Bitcoin’s legitimacy. The second is the slew of MNCs like JP Morgan, Walmart and Amazon issuing or considering issuing their own stablecoins. Big institutions adopting stablecoins implicitly endorse the underlying blockchain technology that also powers Bitcoin. Both are significant signalling events. We need to further study the interplay with great stablecoins adoption versus the price of Bitcoin. On one hand, the increase in adoption of crypto assets including stablecoins by major institutions should promote greater interest in Bitcoin. But because stablecoins are tethered to a major currency, their price fluctuation should be less volatile than Bitcoin. This characteristic could also divert the flows away from Bitcoin to stablecoins. Or it could be a two-tier system where stablecoins serve as transaction layer to global finance while Bitcoin act as a “digital gold” proxy.

Asset | Current Market Cap | High-end estimate | Share of Crypto Market |

Stablecoins | $250–260 bn | $2.0 trn | ~8–9 % of overall crypto |

Bitcoin | $2.03–2.05 trn |

| ~62–63 % of total crypto |

Separately, if stable coins ecosystem should grow to $2trn as some experts have estimated, this could mint a phenomenal new buyer of US Treasury Bills. As stablecoins are required to be backed by “high quality liquid assets” and is likely to be short duration, a 70% allocation of this market to T-Bills would mean an incremental buyer of $1.4trn or 22% of the current US T-Bill stock and perhaps this could drive down US borrowing cost too!

On oil, we need to remind readers before the recent Israel-Iran hostilities, oil price has retreated from $71 at the start of the year to as low as $57 in May. This is due largely to a surplus of oil in excess of more than 2million barrels per day. The surplus is entirely driven by higher oil supply from OPEC, not because of lower demand which has increased yoy. Iran’s seaborne exports 2.1mn bpd (or less than 2% of global oil production) and 70% of that demand is going to China. Even if Iran’s entire oil export is taken out, China will be worst hit as Iran accounts for under 10% of China’s oil import. Moreover, Saudi, UAE and Kuwait has excess of 3.5mn bpd of spare capacity it can readily turn on more than offsetting the unlikelihood of total embargo on Iranian oil export. Furthermore, the US is expected to add 1.1mn bpd of production over the next 2 years. Hence, unless the Stratis of Hormuz is shut for months, we do not believe oil prices will rise above $80 and if based on current demand and supply fundamentals, a $60-65 oil is more likely in the coming 12 months. It is also noteworthy Iran exports 58% of its oil and 90% of that export is routed through the Straits of Hormuz. So does Saudi at 75%, UAE 83% and Kuwait 54%. Any attempted closure by Iran will be suicidal and incite even more hostilities from their Sunni neighbours.

Alternatives: No change with 30% allocation to hedge funds. This fund of hedge fund strategy (GARP) has shown its worth in providing low-correlated returns to bond and equities while generating 9.8% return in the last 12 months on volatility of less than 3%.

Cash/FX: Cash is reduced as opportunities arose in the US equities, USD alternatives and fixed income.

Featured Picture/Quote:

“The most familiar arrangement of human civilizations is that of the Westphalian system as conventionally understood. The idea of the sovereign nation-state, however, is only a few centuries old, having emerged from treaties that are collectively known as the Peace of Westphalia in the mid-seventeenth century. It is not the preordained unit of social organization, and it may not be suited for the age of AI. Indeed, as mass disinformation and automated discrimination trigger a loss of faith in that arrangement, AI may pose an inherent challenge to the power of national governments.”

― Henry A. Kissinger, Genesis: Artificial Intelligence, Hope, and the Human Spirit

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.