Singaporeans are not known for their good sense of humour. Let alone trying to put our brand of humour into the 30-second format of a TV commercial advertising for a state-sponsored radio station. But this commercial is an all-time classic, please click to watch before you read further. Gold 90.5: Hear only the good stuff. In our Navigator, we never shy away from telling our readers the bad stuff; call a spade a spade and in the case of this advertisement, call a dud a dud.

For a good part of the first half, our macroeconomic contours involve the global economy slowing down but do not fall into recession, therefore inflation moderates, and central bankers globally can commence their easing cycles. We also nuanced that even as the global economy slows, the impetus of growth shifts away from the US towards the rest of the world with Europe and Japan as the key drivers of this momentum while China economic activity stabilizes. Furthermore, we were expecting the transition of growth from the stalwart service sectors that have helmed global growth for much of the last two years to manufacturing sectors aided by state-sponsored investments in critical manufacturing and technological capabilities, as well as corporates with their strong profits plowing back to capex expansions. Even as the street has swung from extreme bull to bear on the path of inflation, we have been consistent and have argued for patience towards the path of disinflation, The Last Mile. The decline in inflation will therefore enable central banks to cut rates. This favourable macro setup bodes well for all asset classes particularly growth stories in equities.

Even when there is bad news about growth, participants have traded the market higher because they believe bad news is good news as it means Fed needs to cut early and cut hard. However, we believe that going into the next few quarters, bad news about the global economy will be regarded as bad news. While we are still in the camp the Fed has achieved the immaculate soft landing, we are humble enough to know this assumption needs to be continuously marked to market. We will also admit discerning a slowdown versus an impending recession requires clairvoyance we do not possess. We also humbly state we are wrong that US exceptionalism in the last two years gives way to a broader recovery by all actors nor have the manufacturing sector took over the growth baton.

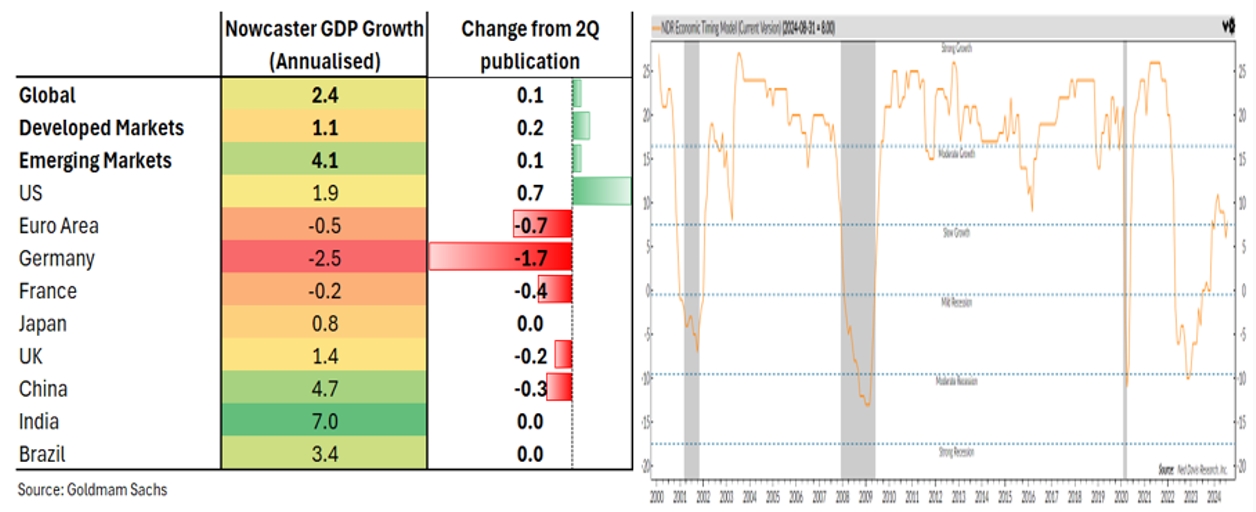

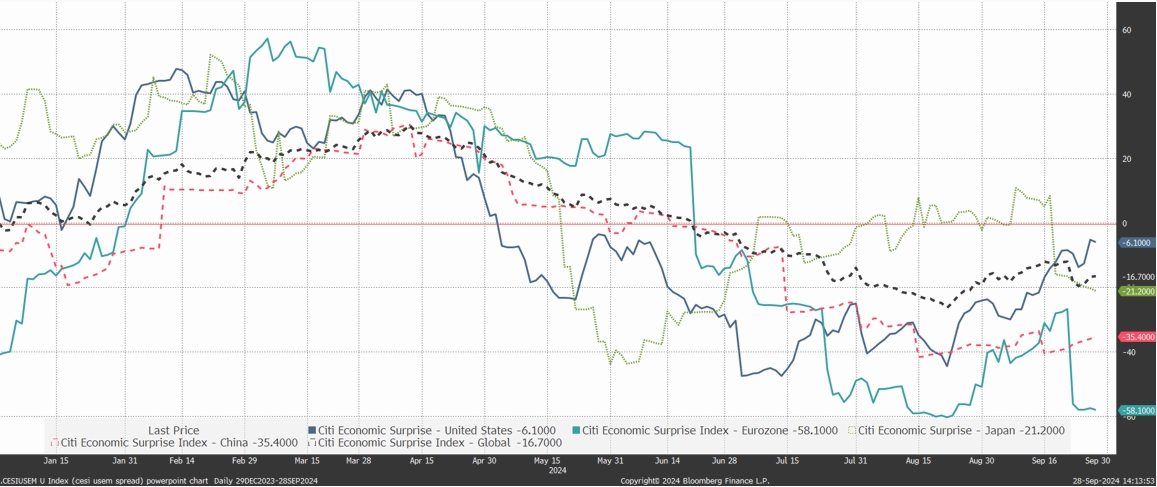

Working through our three-axis macro framework for asset allocation, on the growth axis, Nowcasting models such as Goldman’s shows the US economy has strengthen from our last publication, but weakness in Europe is pervasive outside of the bright-spot in UK. China growth is deteriorating, and Japan remains at its inconsequential torpid pace. Net Davis economic timing model has also dipped in the past few months falling from “Moderate Growth” phase back to “Slow growth.”

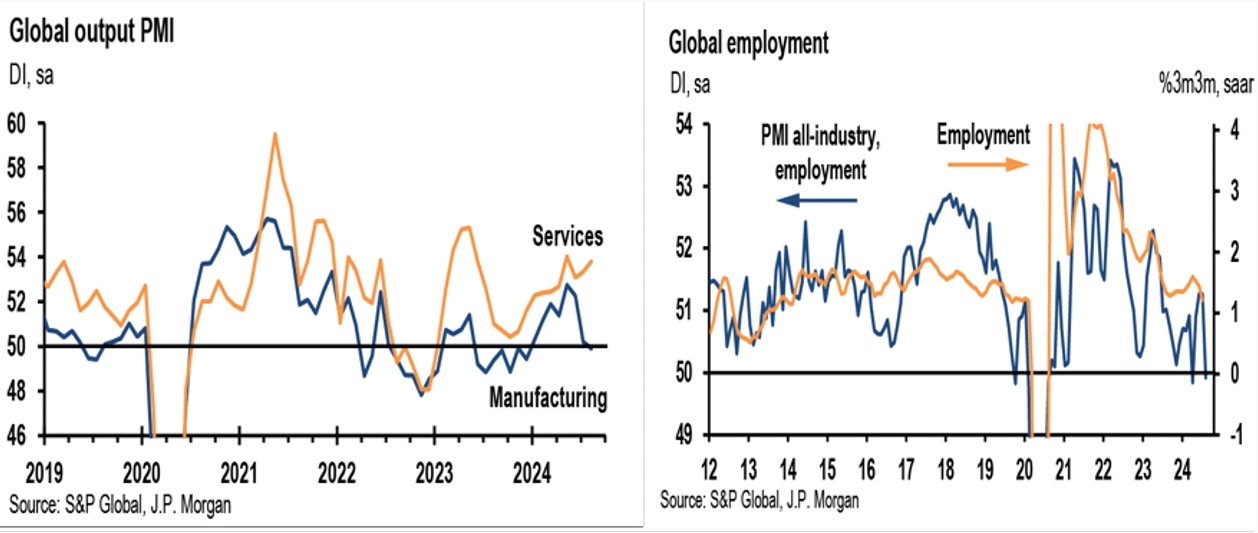

Forecasting tools like PMI shows service sector remains the key ballast of growth but the pickup in manufacturing and industrial production we saw in 2Q24 has now retraced in the last few months. A combination of fading fiscal impulses, automotive inventory overhang, China and Germany woes, and consumer pulling back as their saving has depleted have led to a reversal in PMI-Manufacturing dipping below 50 again. More worrisome is when we look at the forward-looking series on employment, employment prospects have now fallen below 50 and that does not bode well for vitality of the service sectors in the coming quarters.

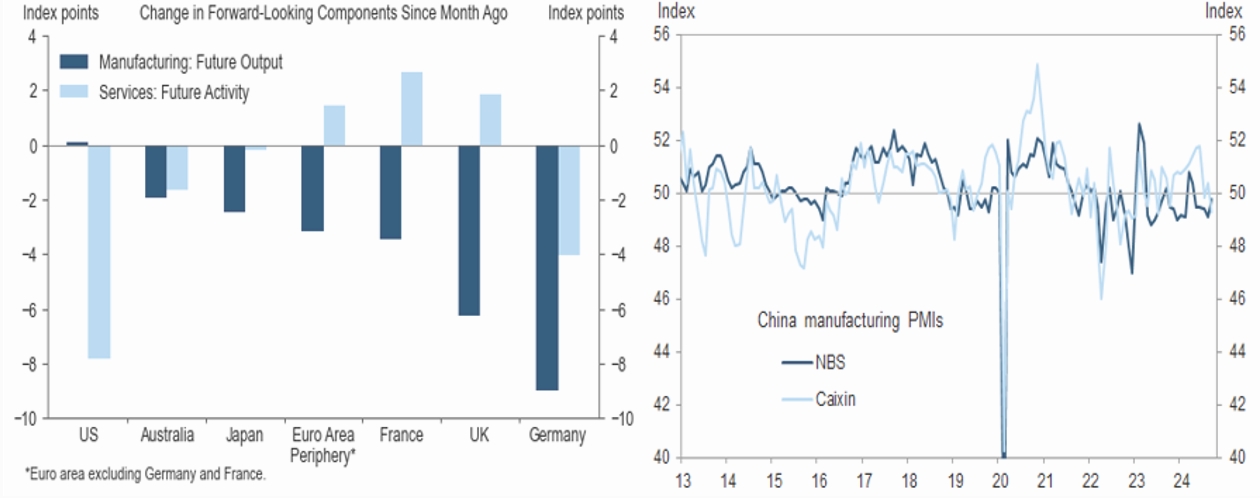

At the national level, the latest PMI data shows a greater swathe of economies posting lower forward-looking components from a month ago. For eg. the manufacturing PMIs for all major economic blocs have declined from few months ago. For services PMI, there is the sharp drop in future expectation in the US which needs careful monitoring and three of the six countries in the table have seen a deterioration in services. The US, Australia, and Germany services sector accounts for 24% of total global GDP.

Depending on which PMIs in China you want to use (NBS or Caixin), both underscored a weak manufacturing prospect. The NBS manufacturing index, which has larger SOE enterprises as their sample, has remained below 50 for five consecutive months. The Caixin manufacturing (skewed towards more private enterprises) has hovered around 50 for much of last 4 months too. Neither are the services PMI from both series exhibiting any strength over the last 5 months. The export sector has been a significant contributor of growth for China contributing more than half of its 1H 4.1% at 2.3ppt, but there are clear signs that is faltering now with New Export Orders falling to 47.5 from 48.7 in previous month and lead times are increasing and price deflation continues to persist.

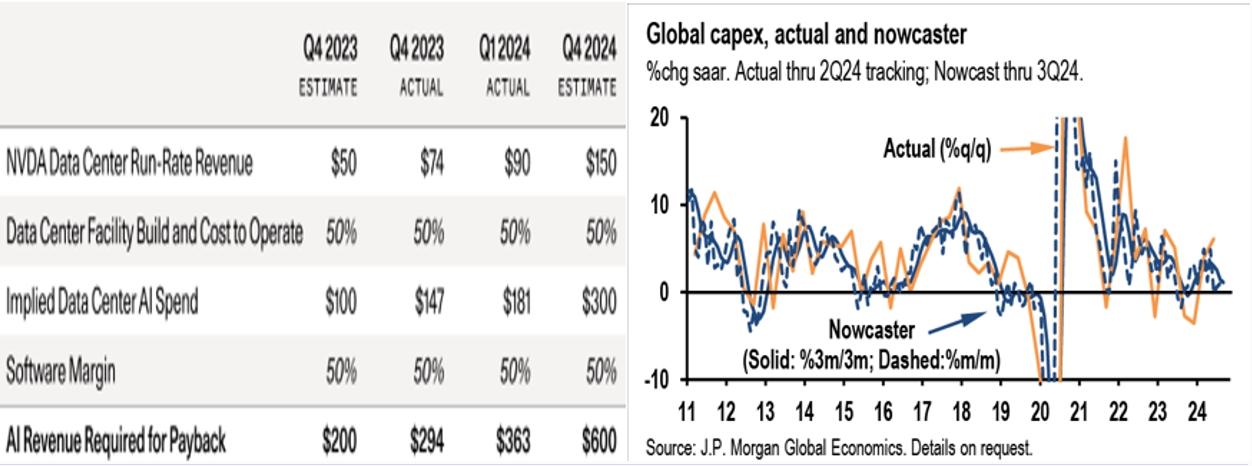

AI capex has been one of the bright spots and our global equities colleague remains optimistic about AI The 70/30 strategy and Gen AI. I am more skeptical in the short run doubting the hundreds of billions spend so far on AI can generate any meaningful return on investment for these companies in the medium term. It is estimate that over $400-500bn has already been spent on AI in the last 18 months and another budget of $500-600bn will be spend in the next two years. This stacks against what many believe revenue run-rate derived from AI adoption is only $10bn currently. Even if we generously extrapolate the cadence of AI-revenue which has jumped from less than a $1bn to $10bn in 12 months, AI revenue could be $100bn by 2025, the return of AI investment is less than 2.5% pa over the four years period. No technology spent can argue that a cumulative 10% ROI in four years is a great investment. You can only argue it is “Build and they will come” foray. Therefore, I expect the pace of AI capex investment should slow down in the coming quarters as the market calls time on these companies to show-me-the-money for the hardware investments that they have been made or is going to make. Do not take my word for it. Read the eminent VC expert, David Cahn of Sequoia Capital, commentaries about capex on AI, AI $600bn question and Game Theory of AI Capex or veteran tech analyst from Goldman Sach, Jim Covello, Generative AI: Too much spend, too little benefit?

The global capex renaissance we were expecting has also moderated in the last few months. Using JP Morgan Capex tracker, global capex is now merely annualizing 1% growth. Perhaps this softness in recent months is merely corporates delaying until US elections are over as there are significant ramifications between Trump versus Kamala economic policies.

However, we are not suggesting the economy is slipping into recession as the Nowcasting is still pointing to an annualized growth pace of 2.4% and global PMI level extrapolates to forward growth of 1.9%, but the drivers of growth are narrowly concentrated in fewer countries and segments and therefore is susceptible to shocks. We must remind readers investment is not just a matter of magnitude but more importantly it is a porous game of deducing the size, direction, and inflexion points. We are positing that in terms of magnitude of GDP growth it remains in a sweet spot, but the direction of change has started to turn negative.

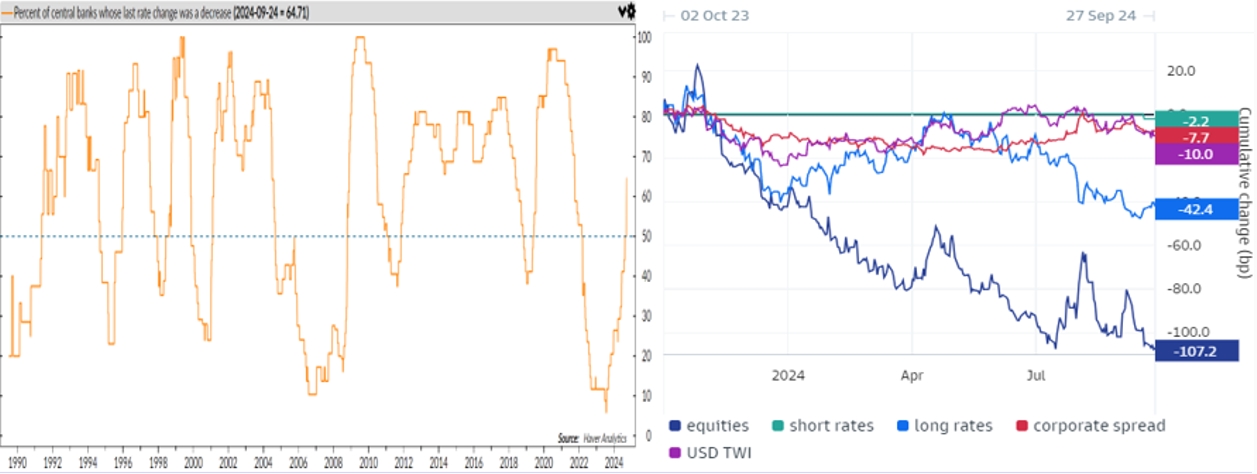

We shift now to our second axis of inflation and central banks’ reaction function to that. Inflation has come within developed market central banks threshold and the balance of risk for them to judge now has tilt towards growth concerns rather than sticky inflation. Hence, 65% of central banks have reduce their policy rates at their latest meetings and we expect more easing to come over the next 12 months and the most important of them all is the Fed. The resultant lower long-term yield, compression in credit spread, higher equities prices have pushed global Financial Conditions to the lowest level since the Feb 2022. It is worth mentioning that the Fed latest dot-plot is indicating another 50bps cut before the year ends and another 100bps into 2025. This would constitute an aggressive cutting cycle against our long-held view since end of last year of a shallow easing. We will be spending the remaining part of the strategy differentiating the outcomes of a shallow versus aggressive easing cycles.

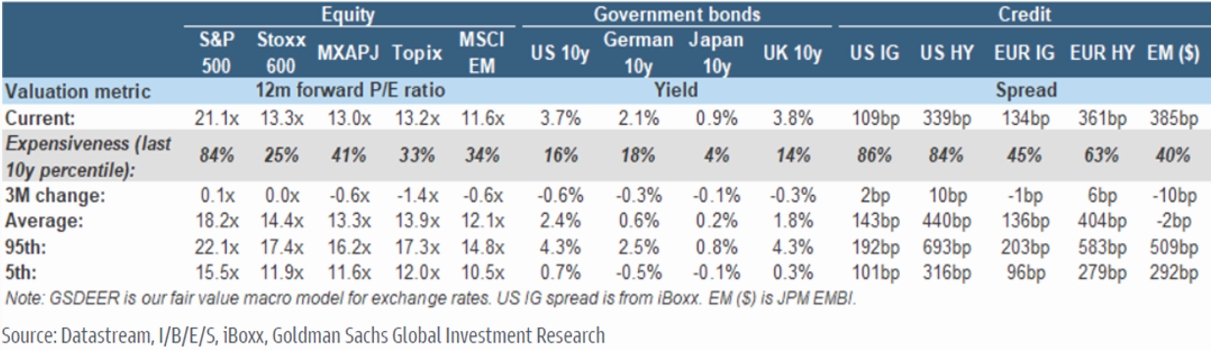

Which brings us to the last element of our macro-economic asset allocation framework which is valuations. Valuation of US equities and credit are not cheap by any definition and in an environment where bad news is treated as bad news, markets can be volatile. There has never been a calendar year when US equities returns are negative, and the rest of the world churn out positive outcomes.

This leads us to our portfolio construction. We are clearly in the anti-consensus call of a risk-on appetite. We are downgrading Equities to Neutral, for Fixed Income are Neutral and our exposures are in high-grade credit that should perform relatively well if the economy slows more than expected. We retain our position in Yen and Gold Yen given the differentiated path of monetary policy for the former and coincidentally both of them serve well as a risk off trades. We continue to favour hedge funds given they have demonstrated their ability to generate positive returns with low correlation to the broader equities and bonds markets.

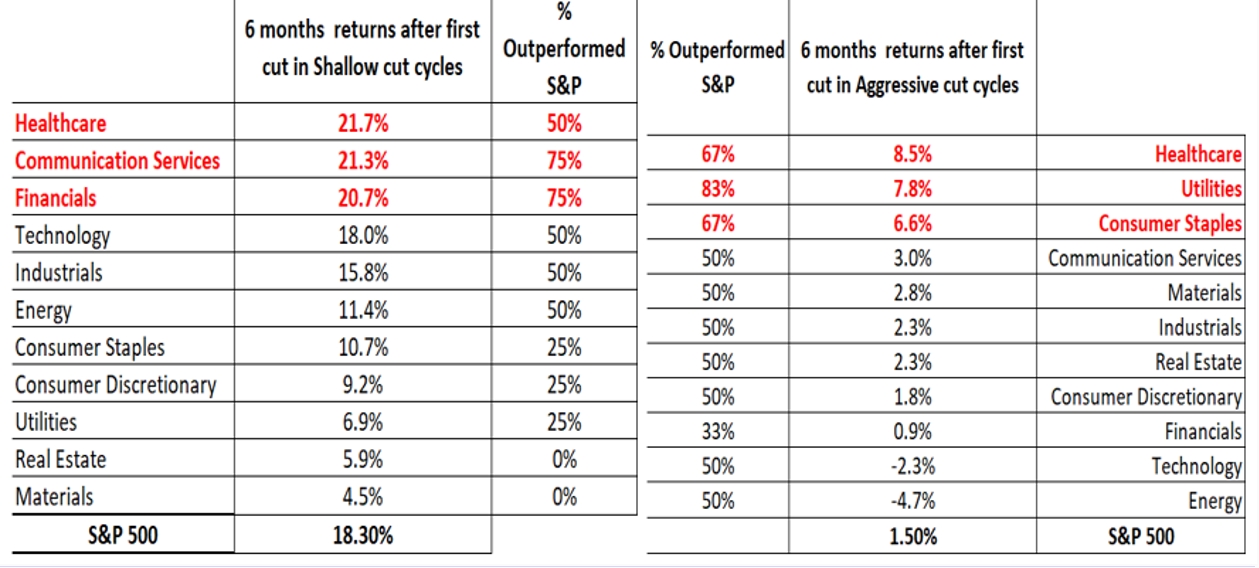

The differences in the path of returns and the probabilities of positive returns can vary significantly if the easing cycle was a shallow one (aka no recession) or an aggressive one (recession or a systemic risk occurred). For example, 12 months after the Fed first cut, the average return in a shallow cut cycle is 21% and all the time, the SPX returns were positive. However, in an aggressive cut, the average return turn to losses -1.4% and only 60% of the time the returns are positive, and the maximum losses can be material at -24%. US10 yield compressed 80% of the time in an aggressive cycle but credit spread widens most of the time. Risk off trade like Gold works returning 11% return on average and 80% of the time made positive return.

Equities: Downgrade from Overweight to Neutral. While we are still in the company of a US soft landing even as the rest of the world looks precarious or at the margin absent of growth catalyst, we note that can be significant dispersion from the average returns when the Fed commences its easing cycle. As we have detailed in last quarter Navigator, Now I know when I must retire, S&P delivered an impressive returns of 18.3% 6 months after a first cut if the follow-on easing is a shallow one (defined as four 25bps cuts of less). Healthcare, Communications Services, Financials outperformed the S&P, and Technology in-line. However, in an aggressive cutting cycle, it implies that the economy has deteriorated meaning fully, S&P only returned 1.5% and sector leaderships clearly shift toward defensive ones like Healthcare, Utilities and Consumer Staples of which we already own healthcare and utilities.

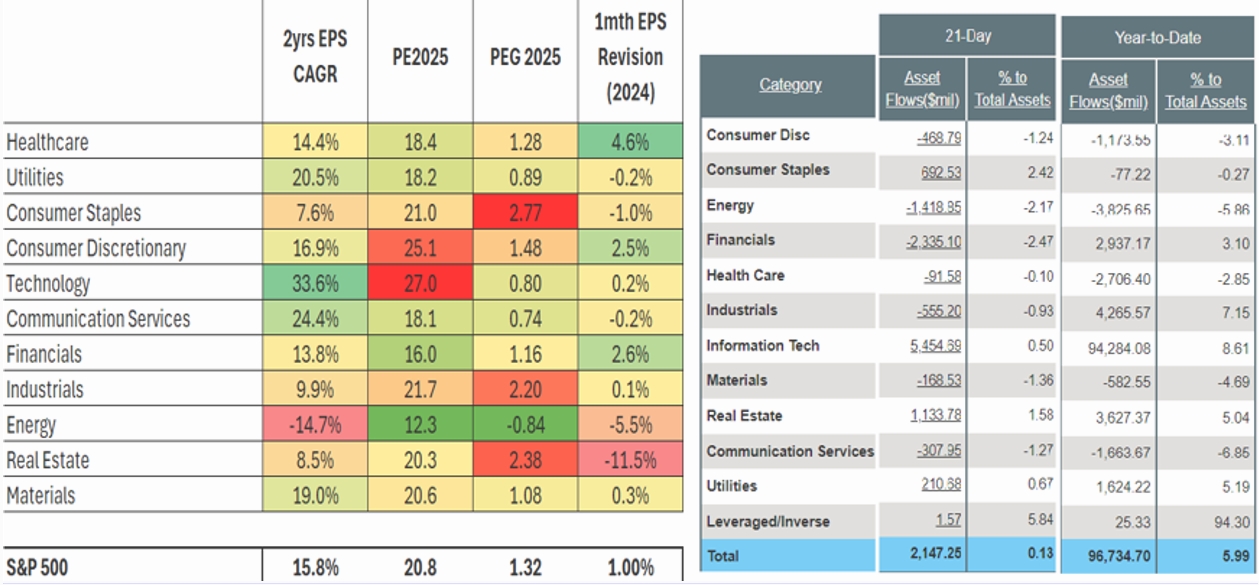

We exited our long-standing position on US Financials as our base-case economic scenario downshifts from our start of the year bullish calls. JPM CFO comments in the past few weeks are a negative harbinger for the sector. They downplayed consensus estimate of just low single digit growth in Net Interest Income as “overly optimistic” and warned that cost would increase more than market is estimating. The sector is trading at 1.52 PEG and is 15% more expensive than what is already an expensively valued S&P at 21x PE in 2025. On a P/B basis, financials trades at 2.3x far higher than its ten-year average of 1.7x and is at +2 sd. Instead, we swapped that position to consumer staples ETF in the US on grounds that it performs well during aggressive rate cut cycles delivering 6.6% return and outperforming S&P 67% of the time. The sector trades at 21x 2025 PE in-line with the broad market and is forecast to generate 2 years CAGR of 9%. In the last 3 months it has the biggest inflow of money into the ETF at 2.4% of its asset under management while we have seen outflows seven out of thirteen sector ETFs.

Outside of the US, we only made two trades. The first to switch out of our Stoxx 50 Europe to increase our exposure to MSCI Europe + UK ETF to gain exposure to the UK market. Economic momentum in the UK have surprised on the upside relative to their European cousins. The new UK Prime Minister’s economic doctrine of responsible fiscal restraint versus past governments’ years of profligacy could augur a new economic paradigm for UK versus the rest of Europe. UK constitute 22%% of the ETF while the switch also provided us a defensive bend with 21% in defensive sectors in contrast to Stoxx 50 ETF of 11%. Both ETFs trades at same level of 13x next year, but the ETF with UK blend has 4ppt higher EPS 2yrs CAGR.

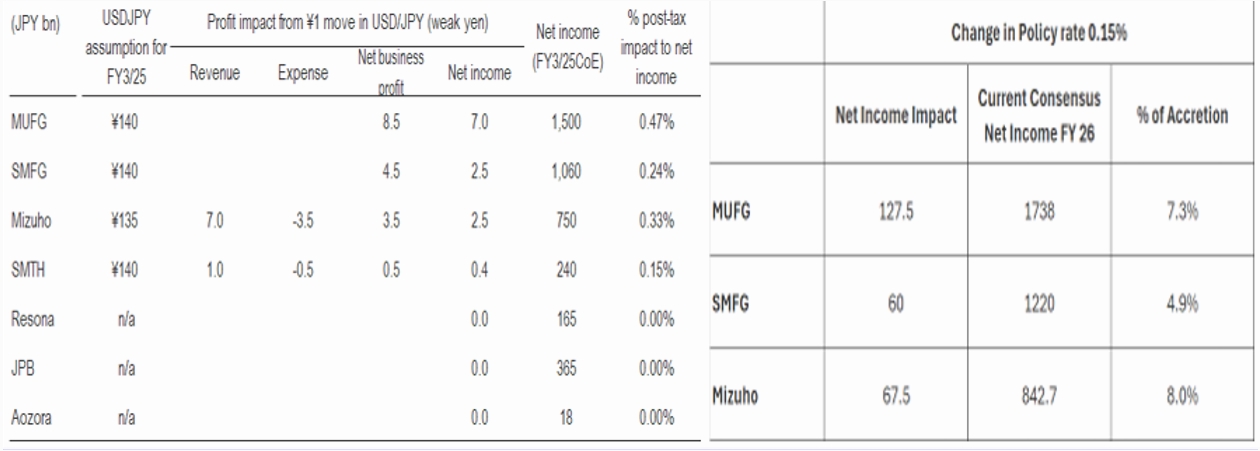

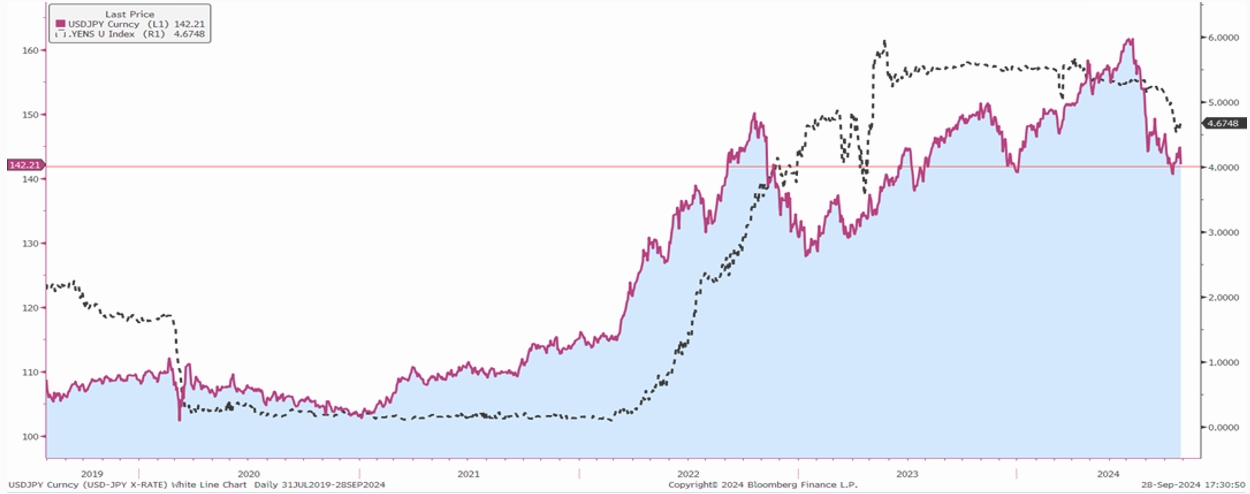

The other trade we did was to re-enter our Topix Banks ETF trade post the remarkable sell-down in late August when the Yen strengthen aggressively. But the fact is Japanese banks benefits from a stronger Yen because of their overseas lending activities which on average is about 30% of their total lending for the four major banks. Every 10 Yen appreciation adds 3% to their net income. Moreover, the banks have commented they are not sensitive to US rates as its net interest margin did not expand when US rates was going up simply because their USD lending are funded in USD too. In fact, they are key beneficiary of rising Japanese yield with every 15bps increase in local yields can add 6% to their net income.

The trade we avoided was to catch the bounce in China. We have written extensively in 2023 in High and Dry and in our Spotify podcast China Real Estate where we drew many similarities of Japan’s lost decades and China’s current moribund state of affairs. The latter part of the quarter easing by PBOC and all related financial bodies of China is not enough to get it out of its funk. China is in a balance sheet recession, no amount of cheap and more money will unhinged it. Japan has already provided them a template of what not to do and it befuddles me why the Chinese refused to learn from them, a misplaced nationalism? China needs a fiscal stimulus targeting not its export sectors but the domestic consumption.

Alternatives: Given our prescribed macro dynamics, hedge funds should form a large asset class in our portfolio, and it currently stand at 30% at the upper threshold of our limits. I have just completed a European trip visiting our hedge fund managers and speaking to other MFOs there. The skeptical view I have shared in the last Navigator on private equity and the advice I have given that one should have more hedge funds than private equity as their alternative assets were corroborated with the MFOs I have met. One large MFO told me they have 70% of their alternatives in hedge funds and 30% in private equity. He shared on average his experience has been PE managers do not deliver superior returns when adjusted for liquidity than their hedge funds managers or even public markets. Our multi-strategy and multi-manager hedge fund strategy continues its stellar performance generating good returns on low volatility and remains lowly correlated to equities and bonds. In the month of August where there has been violent unwind of Yen carry trade, growth equities, momentum strategies, only three of the twelve managers in GARP were down with the largest being our activism Japan manager that was down 2.6% only.

Fixed Income: Neutral. Current level of US 10 yield does not reflect our more cautious view of the US and global economy, and we will be looking to add to our current long-dated duration when it trades within our US10 yield ranges of 3.70-4.00% for the remainder part of 2024 and 2025 range of 3.30-3.70% in 2025 as we have successfully done so in the past. No change in views as we continue to like Developed Markets Treasuries and Investment-Grade debt in sync with our macro views. There is asymmetry of returns from current level of bond convexity, but quality of credit matters materially as the economic cycle slows. Speak to your wealth manager about our Global Investment-grade bond portfolio as well as our fixed-maturity global IG bond portfolio.

FX: No change holding long Yen for its under-valuation and risk-off characteristic. For Yen to move convincingly lower below 140, we will be monitoring the 1-month forward interest rate differential between US and Japan as it has often served as good barometer of direction. If it cracks below 4%, that trigger the next resistance level of Yen 130.It currently stands at 4.67%.

Commodities: No change holding Gold as debasement of fiat currencies trade, the slow demise of USD hegemony, and risk off trade. We will be reassessing our 2025 gold target towards the year end and would be happy to ride it past our 2024 target of $2,700.

Cash: Cash has increased meaningfully to 10-15%.

Featured Picture/Quote:

Me in the loo in Amsterdam. “I wondered if they come with a complimentary ladder?”

Edward Lim, CFA

Chief Investment Officer

edwardlim@covenant-capital.com

Risk Disclosure

Investors should consider this report as only a single factor in making their investment decision. Covenant Capital (“CC”) may not have taken any steps to ensure that the securities or financial instruments referred to in this report are suitable for any particular investor. CC will not treat recipients as its customers by their receiving the report. The investments or services contained or referred to in this report may not be suitable for you and it is recommended that you consult an independent investment advisor if you are in doubt about such investments or investment services. Nothing in this report constitutes investment, legal, accounting, or tax advice or a representation that any investment or strategy is suitable or appropriate to your circumstances or otherwise constitutes a personal recommendation to you. The price, value of, and income from any of the securities or financial instruments mentioned in this report can fall as well as rise. The value of securities and financial instruments is affected by changes in a spot or forward interest and exchange rates, economic indicators, the financial standing of any issuer or reference issuer, etc., that may have a positive or adverse effect on the income from or the price of such securities or financial instruments. By purchasing securities or financial instruments, you may incur above the principal as a result of fluctuations in market prices or other financial indices, etc. Investors in securities such as ADRs, the values of which are influenced by currency volatility, effectively assume this risk.

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.