By Edward Lim, Chief Investment Officer

Edward Lim, CFA January 2026 If you spent your childhood in the late 70s and early 80s like this writer did, you will likely remember this brand of bubble-gum, Bubblicious. It was marketed on one big difference from the competitors; it can be blown to a bigger bubble than the rest. For a few glorious […]

16 Raffles Quay, #41-02

Hong Leong Building

Singapore 048581

Covenant Capital is a Singapore-based independent wealth manager / multi family office.

We hold the Capital Markets Services License issued by the Monetary Authority of Singapore.

Our Firm operates on a fundamental bond between ourselves and the clients we serve. A bond built on professional and social ethics, expert knowledge and an unbiased stewardship towards holistic wealth accumulation and preservation.

Covenant Capital exists with a single-minded purpose to serve only the interests of our clients. We believe that such a covenant of trust, between clients and partners, is the only sustainable basis of long term wealth preservation, accumulation and partnership.

We earn predominantly via a fee based model, recognising that professionals are best aligned when clients are their paymasters. Yet we acknowledge that in Asia, both investors and wealth professionals need time to shift from a transactional model to a fee based model. The team-in-Covenant proactively supports RM teams in that shift towards the model where alignment is key.

We are not restricted to a single house view and instead have access to street-wide research to deliver an independent and unbiased prognosis for our clients in an increasingly challenging and changing world.

Every member of the founding team are stake owners of the firm which means we are intricately linked to our clients’ well-being, both financially and personally.

We pride ourselves to be different from other wealth managers. Our core team comprises largely investment-focused professionals.

The word S.E.R.V.E. embodies a heart of humility in the way we engage each other. The spirit of service, externally to our clients and families we serve, internally to each other within the firm.

Commitment to our clients and community.

Constant improvement to be at the forefront.

Respect is having the humility to listen

Collaboration & team spirit.

We are called to be stewards of our greatest assets — our team.

Edwin Lee CFA, CAIA

Chief Executive Officer

Some have asked me, ‘How big do you want to grow?’, ‘Where do you see the firm in 5 years?’, ‘What is your vision for the firm?’. In the world of wealth management, the common measures of success are ‘Assets Under Management’ (AUM), ‘revenue’, and other quantitative metrics. We look and plan ahead, with details on AUM growth, but sometimes it is important to look at the qualitative aspects of things as well.

Our long-term goal is to make an impact on the wealth management industry in Singapore and Asia. We want to drive investment professionals – private bankers, investment counsellors and other financial services professionals, back to the fundamental role that they are called to – the stewardship of clients’ assets.

In 2016, we launched with a team of seven in a cozy shophouse along Club Street. I firmly believe in finding and building the right team dynamics and synergies. As a firm today, we have a solid team of individuals with different gifts and skill sets but work towards the same goal of achieving stewardship of client assets.

While the temptation to grow bigger will always be there, without a deep foundation, the risk of failure when storms hit will be there. Covenant Capital is built on the foundation that strong values and a strong investment core is crucial to weather the ever-changing economic and market conditions. It is my hope and prayer that as we strive towards excellence in wealth management for our clients and grow over the years, the Covenant Capital team will always remember our how and why we first begun.

We offer unparalleled investment expertise with a core team comprising of highly experienced and disciplined investment-focused professionals with an average span of 18 years of experience in the financial services industry.

We align interests to clients and their heirs, and empower clients to be stewards of their assets by providing discretionary and advisory investment solutions throughout their life journey, from wealth accumulation to wealth preservation, and eventually to wealth transference.

We tap on an open architecture approach and have access to an ecosystem of platforms and products globally and in Asia, which enables the firm to provide sound investment recommendations and wealth management opportunities that are tailored to the clients’ best interests at the most efficient cost structure.

We offer unparalleled investment expertise with a core team comprising of highly experienced and disciplined investment-focused professionals with an average span of more than 25 years of experience in the financial services industry.

We offer unparalleled investment expertise with a core team comprising of highly experienced and disciplined investment-focused professionals with an average span of 18 years of experience in the financial services industry.

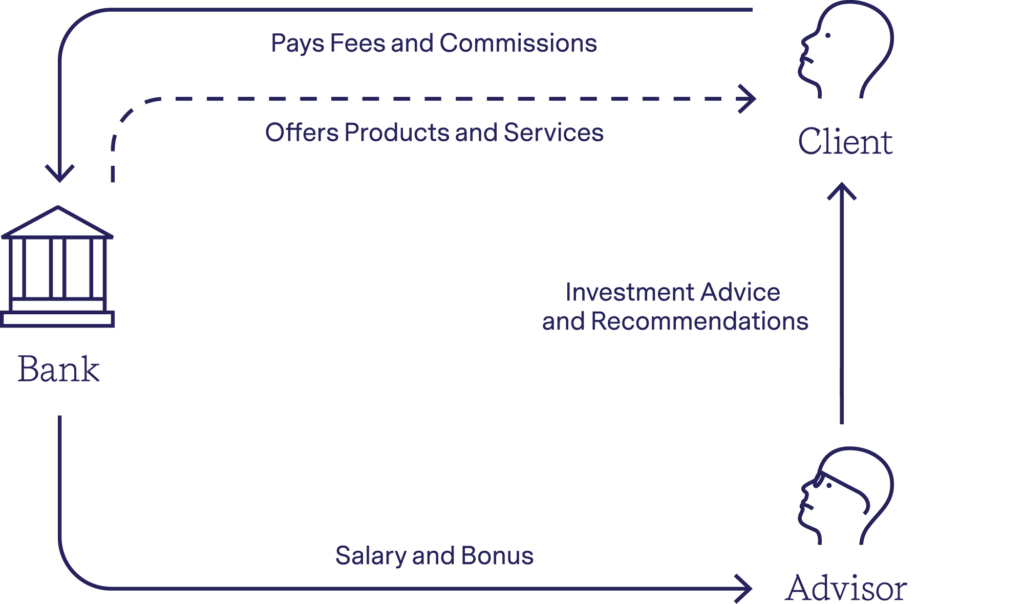

Investment professionals are called to be stewards of assets. They need a supportive ecosystem within which they can work for your best interests. The system can either empower them to perform their role as stewards or leave them feeling conflicted as sometimes sub-optimal solutions are delivered.

In the traditional wealth management model, significant conflicts of interest result in a less than ideal outcome both for investors and advisers.

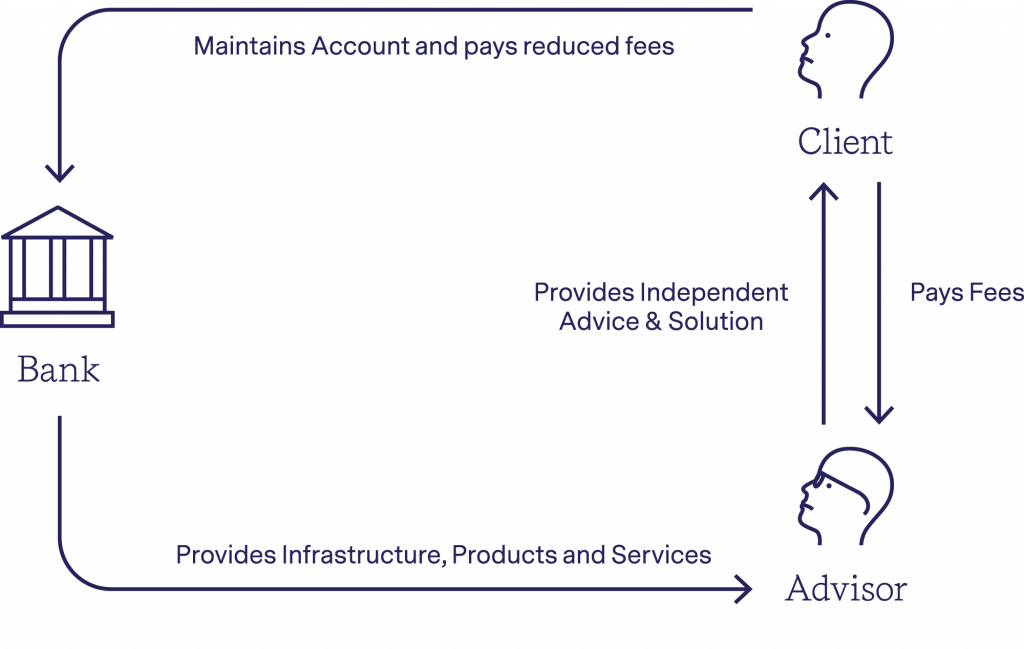

Our conviction is the key lies in the Independent Wealth Manager Model where clients and investment professionals interests are aligned.

Unlike most wealth managers, Covenant Capital has a dedicated investment team whose main focus is to conduct research, form in-house views, and manage our clients’ portfolios.

The value propositions of our dedicated investment team:

Often, the pressures faced by investment professionals are under appreciated. Striving to manage and meet the expectations of clients in the midst of volatile market conditions, coupled with firm and management demands, the forces around can indeed be overwhelming. It takes a strong heart and a stronger sense of conviction to stay on the course to be a good steward of our clients’ trust and their assets.

You might be exploring independence for the first time, or this might be 5th year since you first considered it, but in both cases, you still find the option daunting and find it difficult to muster up the courage to take the leap of faith.

The questions in your mind are multi-faceted:

It’s hard to put a price tag on the deep satisfaction that comes with knowing that we have done our job for our clients to the best of our ability.

We would be more than happy to chat through things over a cup of coffee, but here are a few key fundamental differences in the business model:

Through the fee-based model, our compensation (both investment professional and firm) are pegged to the value of the clients’ portfolio. By not receiving fees from the banks and fund managers, our interests are truly aligned with the clients’.

We recognize that some Asian clients prefer to pay a transaction fee rather than an ongoing management or adviser fee. Yet we can see that investor mentality is shifting, and they are seeing the risks associated with the transaction fee model (e.g. lack of post sales monitoring and due diligence.) and are willing to give the fee-based model a shot. Over time, we believe that this will be the dominant industry model.

One of the often-touted benefits of independence is that access to street-wide research and best of breeds products.

Yet in this day and age when one is swamped with information, this can be a daunting fact. Bankers and Investment Counsellors often have trouble keeping up with one firm’s research and investment ideas. Sifting through 5 firms’ research might not be the most appealing alternative.

Here’s where a key strength of Covenant Capital comes in. The thought leadership and depth of experience of the CIO’s office provides the much needed investment direction. The team provides the much-needed support to our bankers and investment counsellors by sifting through the wheat from the chaff and distilling key macroeconomic research to chart the way forward.

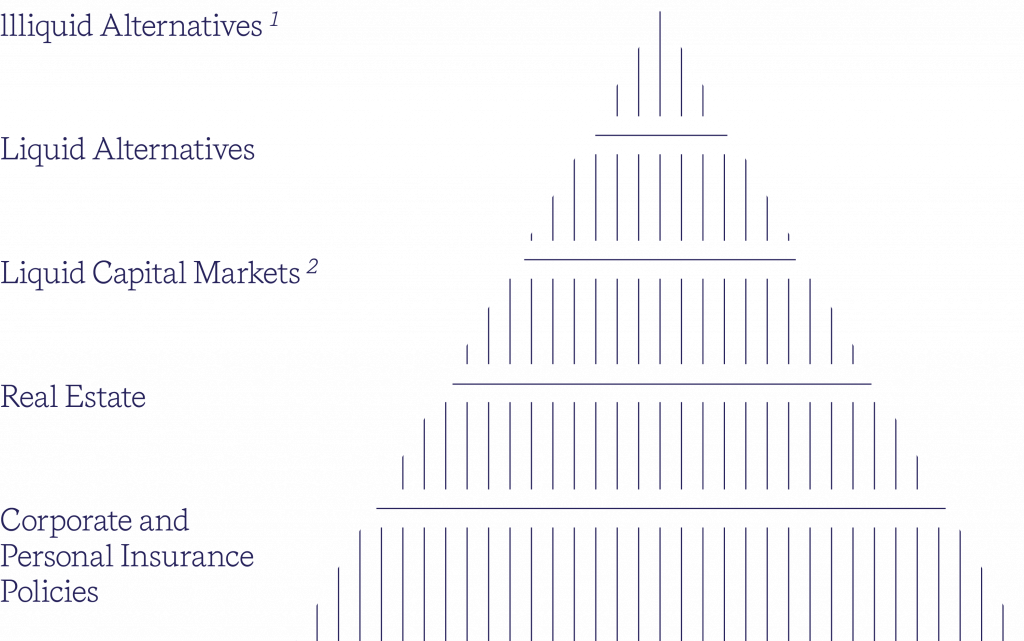

At each stage, we discuss with you your target return and risk tolerance to design a bespoke and unbiased wealth management plan to achieve these objectives. We employ an open architecture where both 3rd party services offerings and in-house expertise are utilized.

We deliver our services to you through a combination of discretionary and advisory model as we recognized there are differences in each client’s level of sophistication in the financial markets.

In the early stage of your wealth journey, our focus is to deliver capital appreciation with a total return objective in mind. Subsequently, income needs and capital preservation become more important in the next stage. Throughout our journey with you, we are constantly involved in your legacy, insurance and tax management needs.

In a discretionary mandate, you entrust your wealth to be managed by our team so that you can concentrate on your own business, family and charity work. We currently offer solutions across the objectives spectrum from our lower return/risk income generation mandate to higher return/risk capital appreciation global asset allocation mandate.

In our Advisory services, there is a symbiotic relationship between you and us when you engage the financial markets. By working with us, you will have access to our investment professionals expertise plus external research from the entire street. We help you distill from the myriad of views and information and formulate an action plan for you to profit from the markets. Given our fee-based revenue model, you will never be alone when you are invested in the market. Whilst you may have made the decision with inputs from us, we will be alongside you all the way, updating you and advising when to take profit or even cut loss.

As we are fully committed to providing the best-of-breed investment services and solutions, we are equally committed to work with you to find and select a network of qualified external service-provider partners to advise, select and implement solutions in the areas of risk management, tax planning and legacy planning.

In collaboration with you, we will work side by side with you and our panel of experts. Throughout the whole process, we can help you to crystallize your needs, decide on the best suited service-provider partner to work with, coordinate and monitor the implementation of the plans.

Insurance and risk management

Tax planning

Legacy planning

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Bloomberg

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Josh Le, Senior Vice President

By Edward Lim, Chief Investment Officer

By Bloomberg

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Robb Report Singapore

By Bloomberg

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Singapore Management University

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer and Gordon Ong, Investment Analyst

By Edward Lim, Chief Investment Officer

By Josh Le, CFA, MSc in FE

By TheEdge Singapore

By eFinancialCareers

By Edwin Lee, Committee Member (Education), Association of Independent Wealth Managers Singapore (AIWM)

By Bloomberg

By Edwin Lee, Committee Member (Education), Association of Independent Wealth Managers Singapore (AIWM)

By Edwin Lee, Committee Member (Education), Association of Independent Wealth Managers Singapore (AIWM)

By Edwin Lee, Committee Member (Education), Association of Independent Wealth Managers Singapore (AIWM)

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Josh Le, Senior Vice President

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer

By Edward Lim, Chief Investment Officer and Gordon Ong, Investment Analyst

By Edward Lim, Chief Investment Officer

By Josh Le, CFA, MSc in FE

By Edwin Lee, Committee Member (Education), Association of Independent Wealth Managers Singapore (AIWM)

By Edwin Lee, Committee Member (Education), Association of Independent Wealth Managers Singapore (AIWM)

By Edwin Lee, Committee Member (Education), Association of Independent Wealth Managers Singapore (AIWM)

By Edwin Lee, Committee Member (Education), Association of Independent Wealth Managers Singapore (AIWM)

By Bloomberg

By Bloomberg

By Robb Report Singapore

By Bloomberg

By Singapore Management University

By eFinancialCareers

By Bloomberg

16 Raffles Quay, #41-02

Hong Leong Building

Singapore 048581

By entering this site you agree to be bound by the Terms and Conditions of Use. COVENANT CAPITAL PTE LTD (“CCPL”) is a Capital Markets License (AI/II) holder and regulated by the Monetary Authority of Singapore (‘MAS’).

By using this site you represent and warrant that you are an accredited investor or institutional investor as defined in the Singapore Securities and Futures Act (Chapter 289). In using this site users represent that they are an accredited and/or Institutional investor and use this site for their own information purposes only.

The information provided on this website by Covenant Capital Pte Ltd (CCPL) is intended solely for informational purposes and should not be construed as investment advice. It does not constitute legal, tax, or other professional advice. CCPL strongly recommends consulting qualified professionals for personalized guidance. The website does not offer or solicit securities transactions, and users are expected to comply with local laws. Accredited and institutional investors in Singapore may access the information solely for informational purposes.

What types of Personal Data do Covenant Capital collect?

Personal data is any information that relates to an identifiable individual, and we may collect this information when you interact with our staffs:

1. Personal Particulars (e.g. name, address, date of birth)

2. Tax, Insurance and employment details

3. Banking information and financial details

4. Details of interactions with us (eg. Images, voice recordings, personal opinions)

5. Information obtained from mobile devices with your consent

How do we collect your Personal Data?

Below are the ways that we collect your data:

1. Investment Management Agreement forms, Risk Profile forms, Subscription forms;

2. Via emails, SMSes, Whatsapps, phone calls or any other digital means to the office or its’ staffs;

3. Photos and videos of you from our events; and

4. Information about your use of our services and website, including cookies and IP address

How do we use your Personal Data?

1. For General Support

Verify your identity before providing our services, or responding to any of your queries, feed-back and complaints.

2. For our Internal Operations

a. Aid our analysis so that the company can improve our services and products.

b. Manage the company’s day-to-day business operations.

c. Ensure that the information that the company have on you is current and up to date.

d. Conducting Due Diligence checks to reduce Money Laundering and Terrorist

3. Financing Schemes

e. Comply with all laws and obligations from any legal authorities.

f. Seek professional advice, including legal.

g. Provide updates to you.

4. Posting on LinkedIn and Website

We may post personal data, including pictures and videos, on our LinkedIn page and website for purposes such as:

Who do we share your Personal Data with?

1. Any officer or employee of the company and its related companies;

2. Third parties (and their sub-contractors if applicable) that works with us, such as Custodian Bank of choice, Fund Administrators for the Funds that we manage, any third party Fund’s Administrators, IT support who back up our database and other service providers;

3. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

4. Relevant authorities such as government or regulatory authorities, statutory bodies, law enforcement agencies.

5. We require all personnel of the company and third party to ensure that any of your data disclosed to them is kept confidential and secure

6. We do not sell your Personal Data to any third party, and we shall comply fully with any duty and obligation of confidentiality that governs our relationship with you

When the company discloses your personal data to third-parties, the company will, to the best of its abilities, exercise reasonable due diligence that they are contractually bound to protect your personal data in accordance with applicable laws and regulations, save in cases where by your personal data is publicly available.

Accessing and Correction Request and Withdrawal of Consent

Please contact your advisor/banker or alternatively you can contact ccops@covenant-capital.com should you have the following queries.

1. Regarding the company’s data protection policies and processes

2. Request access to and/or make corrections to your personal data in the company’s possession; or

3. Wish to withdraw your consent to our collection, use or disclosure of your personal data.

The company endeavours to respond to you within 30 days of the submission.

Should you choose to withdraw your consent to any or all use of your personal data, the company might not be able to continue to provide any further services or maintain further relationships. Such withdrawal may also result in the termination of any agreement or relationship that you have with us.

Complaints

If you wish to make a complaint with regards to the handling and treatment of your personal data, please contact the company’s Data Protection Officer, mentioned below, directly. The DPO shall contact you within 5 working days to provide you with an estimated timeframe for the investigation and resolution of your complaint.

Should the outcome of the resolution is not satisfactory, you may refer to the Personal Data Protection Commission (PDPC) for any further resolutions.

If you have any doubt, please contact Mr Tay Kian Ngiap, the PDPA Data Protection Officer for Covenant Capital Pte. Ltd. He can be reached at kntay@covenant-capital.com

By accessing this website, you hereby agree to the terms listed on the website, all applicable laws and regulations, and agree that you are responsible for compliance with any applicable local laws. Any claim relating to Covenant Capital’s website shall be governed by the laws of the Republic of Singapore without regard to its conflict of law provisions.

1. License to Use

Permission is granted to download information and materials on Covenant Capital’s website for personal, non-commercial viewing only. This is the grant of a license, not a transfer of title, and under this license you may not:

i) modify or copy the information and materials;

ii) use the information and materials for any commercial purpose, or for any public display (commercial or non- commercial);

iii) attempt to decompile or reverse engineer any software contained on Covenant Capital’s web site;

iv) remove any copyright or other proprietary notations from the materials; or

v) transfer the materials to another person or “mirror” the materials on any other server.

All content, including but not limited to logo, tagline, graphics, images, text contents, buttons, icons, design and structure are property of Covenant Capital. All content on this website is protected by copyright, patent and trademark laws.

The Covenant Capital logo should not be used for any purpose whatsoever beyond what is available on the website, unless you have obtained written approval from us.

2. Disclaimer

The materials on Covenant Capital’s website are provided “as is”. Covenant Capital makes no warranties, expressed or implied, and hereby disclaims and negates all other warranties, including without limitation, implied warranties or conditions of merchantability, fitness for a particular purpose, or non-infringement of intellectual property or other violation of rights. Further, Covenant Capital does not warrant or make any representations concerning the accuracy, likely results, or reliability of the use of the materials on its Internet web site or otherwise relating to such materials or on any sites linked to this site.

It is your responsibility to evaluate the accuracy, completeness, or usefulness of any information, advice and other content available through this website.

You should not solely rely on the information, advice and other contents available on our website for decisions on investment(s) or decision with respect to our company’s products and services. You are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

3. Limitations

In no event shall Covenant Capital or its suppliers be liable for any damages (including, without limitation, damages for loss of data or profit, or due to business interruption,) arising out of the use, inability to use or user’s reliance on the materials obtained through Covenant Capital’s web site, even if Covenant Capital or a Covenant Capital authorized representative has been notified orally or in writing of the possibility of such damage.

4. No Offer

Nothing in this website constitutes a solicitation, an offer, or a recommendation to buy or sell any investment instruments, to effect any transactions, or to conclude any legal act of any kind whatsoever. The information on this web site is subject to change (including, without limitation, modification, deletion or replacement thereof) without prior notice. When making decision on investments, you are advised to seek additional information required for you to make sound, well-informed and reasonable decision.

5. Revisions and Errata

The materials appearing on Covenant Capital’s website may include technical, typographical, or photographic errors. Covenant Capital does not warrant that any of the materials on its website are accurate, complete, or current. Covenant Capital may make changes to the materials contained on its website at any time without notice. Covenant Capital does not, however, make any commitment to update the materials.

6. Site Terms of Use Modifications

Covenant Capital may revise these terms of use for its web site at any time without notice. By using this website you are agreeing to be bound by the then current version of these Terms and Conditions of Use. If any of the term or change is deemed not acceptable to you, you should not continue to browse this site.

Your privacy is very important to us and we respect your online privacy. This Policy has been developed in order for you to understand how we collect, use, communicate and disclose and make use of personal information. We are committed to conducting our business in accordance with these principles in order to ensure that the confidentiality of personal information is protected and maintained.

1. Collection and Use of Information

We may collect personal identifiable information, such as names, postal addresses, email addresses, etc., when voluntarily submitted by visitors to our website. This information is only used to fulfill your specific request, unless further permission is provided to us to use it in any other manner or for any other purpose.

2. Web Cookies / Tracking Technology

A cookie is a small file which seeks permission to be placed on your computer’s hard drive. Once you are agreeable to the use of cookies, the file is added and the cookie helps analyse web traffic and tracks visits to a particular website. Cookies allow web applications to respond to you as an individual. The web application can tailor its operations to your needs, likes and dislikes by gathering and remembering information about your preferences.

We use traffic log cookies to identify which pages are being used. This helps us analyse data about website traffic and improve our website in order to tailor it to customer needs. We only use this information for statistical analysis purposes and then the data is removed from the system.

Overall, cookies help us provide you with a better website by enabling us to monitor which pages you find useful and which you do not. A cookie in no way gives us access to your computer or any information about you, other than the data you choose to share with us.

You can choose to accept or decline cookies. Most web browsers automatically accept cookies, but you can usually modify your browser setting to decline cookies if you prefer. This may prevent you from taking full advantage of the website.

3. Links to other websites

Our website may contain links to other websites of interest. However, once you have used these links to leave our site, you should note that we do not have any control over that other website. Therefore, we cannot be responsible for the protection and privacy of any information that you provide whilst visiting such sites, and this privacy statement does not govern such sites. You should exercise caution and review the privacy statement applicable to that particular website.

4. Distribution of Information

We will not sell, distribute or lease your personal information to third parties unless we have your permission or are required by law to do so. We may use your personal information to send you promotional information about third parties’ products or services, which we think you may find interesting if you tell us that you wish this to happen.

If you believe that any information we are holding on you is incorrect or incomplete, please write to or email us as soon as possible at the above address. We will promptly correct any information found to be incorrect.

When required by law, we may share information with governmental agencies or other companies assisting in the investigations. The information is not provided to these companies for marketing purposes.

5. Commitment to Data Security

To make sure your personal information is secured, we communicate our privacy and security guidelines to all Covenant Capital’s employees and strictly enforce privacy safeguards within the company.

Your personal identifiable information is kept secure. Only authorised employees, agents and contractors who have a direct need to access the information will be able to view this information.

We reserve the right to make changes to this policy. Any changes to this policy will be posted.